There has been a significant surge in the attention and accolade given to technology startup ecosystem in Nigeria. With a vibrant and growing tech sector that cuts across healthcare, agriculture, finance, e-commerce, etc., Nigeria ranks first in African startups. While it can boast of the largest number of startups in the African tech ecosystem, Nigeria lags in other important metrics, with funding being the biggest challenge.

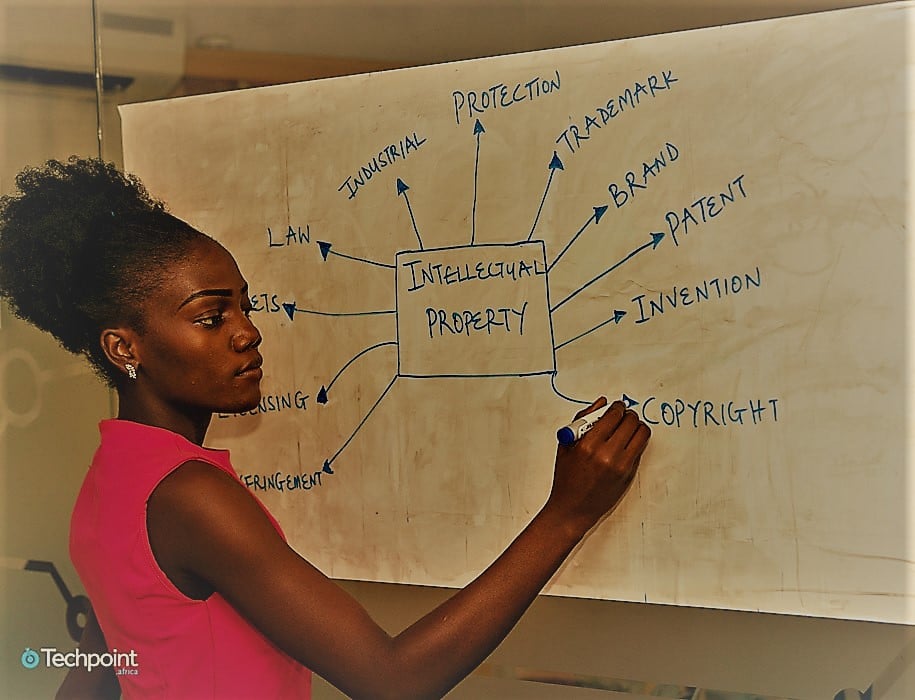

While securities created over tangible assets still hold prominence in lending activities in Nigeria, intangible assets like intellectual property rights (IPRs) are increasingly being given global prominence in asset-based lending activities.

Businesses are turning towards their intangible assets, specifically their intellectual property (IP) to finance their growth and further innovation. Using IP as collateral in a loan agreement or the rights over future cash flows from the IP are options available in IP-backed financing.

This article examines the present state of the law on creation, perfection, and enforcement of security interests in IP pursuant to the Secured Transaction in Movable Assets Act (the “Act”, “STMA Act”). It x-rays the context in which the creation of security interests in IP assets can be leveraged upon in Nigeria.

The Secured Transaction in Moveable Assets Act (STMA) of 2017

The STMA Act (pdf) provides a broad framework for creating security interests in moveable assets, enforcing security agreements, perfecting security interests in moveable assets, creating a national collateral registry, and determining the priority of competing interests in secured assets. The overall objective of the Act includes ensuring that micro, small and medium scale enterprises (MSMEs) can use movable assets to create security for debt finance.

The Act provides a broad definition of movable assets which serve as the object of a security interest, to include tangible or intangible property other than real property, but is silent on what constitutes “intangible property”. However, the elastic provision of the term, allows for broad interpretation and by implication, embraces all categories of IP.

The Creation of Security Interest over IP

A security interest is a property right in collateral created by agreement that secures the payment or other performance of an obligation regardless of whether parties have denominated it as a security interest. Under the STMA Act, the creation of a security interest over movable assets requires the fulfillment of certain requirements which once fulfilled, attaches the security interest, making it enforceable by the secured creditor against the debtor and third-parties.

A security interest can be created over future assets if the asset falls under the collateral description in the security agreement and if the agreement provides for the extension of the security interests to the grantor’s future assets. Similarly, IPRs that come into existence after the execution of the agreement can be included as collateral.

A security interest is effective according to the extent of the rights the grantor has in the collateral. For example, copyright in a work creates a bundle of exclusive rights which are divisible and may be dealt with by the copyright owner independently of one another. A grantor may have the right to publish a literary work (e.g., novel) but may not have the right to adapt the same work as a film. Consequently, part of any lender’s due diligence is to ensure that the grantor has rights in the collateral.

A security interest in an account-receivable is valid between the grantor and secured creditor, and against the account-debtor of the account receivable and a third-party with no perfected interest in the account-receivable. An account-receivable is defined as a right to receive value arising from an obligation owed by an account-debtor to the grantor including book debts but excluding negotiable instruments. Accordingly, transactions involving the right to receive payments or royalties under a license arrangement may fall within the scope of security interest in an account-receivable. section 4(2) of the Act.

Section 5 of the Act makes a mandatory provision with regards to the content of a security agreement which once fully met, creates a valid security interest.

Perfection of Security Interest

Perfection of a security interest under the STMA Act is accomplished by filing a financing statement with the National Collateral Registry (NCR). This acts as notice to the world of the potential or actual existence of a security right in a collateral or category of a borrower’s collateral.

In Nigeria, like most countries, there are specialised registries for filing transactions related to IPRs. The question therefore, is to what extent do these specialist registries interface with NCR? Section 2(1)(c) of the STMA Act mandates every public registry established by any Act of the National Assembly to coordinate or warehouse or oversee transactions in movable assets in Nigeria to be operated in a manner that creates automated interface between that registry and NCR, thereby ensuring that the registry is made accessible from NCR.

Accordingly, NCR should not operate in isolation from other registries that record interests in moveable assets, including the registries for IPRs. This will ensure harmonisation of all existing registries for movable assets in Nigeria and make NCR the central registry.

In practice, however, the laws regulating IPRs are federal statutes that creates an autonomous registry for security interests over IPRs. To achieve the intention of section 2(1)(1) of the Act, these laws should be amended to recognise NCR as the central registry of interests in IPRs.

Currently, there is no evidence that an interface has commenced between the existing IPR registries and NCR, thus, it is advisable that a secured creditor taking security in IPRs should, in addition to filing in the NCR, file in the relevant IPR registry to be effective against competing lien holders.

Priority of a Security Interest

Under the STMA Act, priority between competing security interests is determined by order of registration. Accordingly, priority is rooted in perfection and is based on the time in which the secured creditors registered the security interests at the registry. Any interest arising after a competing unregistered security interest will be superior if it is recorded first.

There is no obligation on a secured creditor who has a perfected security interest in a collateral to register a separate security interest in respect of the proceeds realised from that collateral, for which a security interest has already been perfected.

A secured creditor may transfer a secured obligation without obtaining the debtor’s consent even if such right or ability has been limited in the security agreement.

Section 26(1) of the Act allows a creditor to enter into an agreement to subordinate its priority in favor of another claimant. Such agreement is effective without having to register an amendment to the financing statement.

Enforcement of Security

Once the requirements for the creation of a security interest is achieved, attachment is said to have occurred, thus enforceable. It is only once a security agreement is enforceable that one can be concerned about perfection and priority. Enforcement is usually triggered by default of the borrower to repay its debt.

The general rule is that following default, a secured party has rights under the Act and in the security agreement, including judicial remedy. For companies, in addition to the remedies available under the Act, they are entitled to remedies under the Companies and Allied Matters Act, including the right to appoint a receiver.

The Act gives a secured party the right to take possession of the collateral after default by giving the debtor a 10 days’ notice of default and intention to repossess the collateral.

As with any intangible, enforcing a security interest in IP presents some practical complexities. It is impossible to take possession or assemble intangible IP collateral. Similarly, the Act provides for non-judicial disposition of collateral.

There are no regular markets for the sale of patents, trademarks, and copyrights, however, the Act makes an innovative provision for the disposal of a collateral through licensing. In this circumstance, the secured creditor will look primarily to the proceeds of the license for satisfaction of the debt, rather than to the asset itself.

Conclusion

A recent report by the Central Bank of Nigeria, quoted by Vanguard Newspaper shows that the number of MSMEs that have used their movable assets to obtain loans from financial institutions through the NCR steadily rose with an increase of 54 percent, between 2017 and December 19, 2018. Most of these were individuals, micro-businesses, and medium-businesses. The number of movable assets used by MSMEs to obtain loans also rose to 118 percent.

Top on the list of the movable assets used to secure loans are: Documents of title/Negotiable Instruments-(17,105); Vehicles-(11, 725); Consumer/Household goods-(9,029); All assets-(6,427); Electronics-(3,5740); Other intangibles-(2,573); Inventory-(2,531); Farm products-(1,580); Deposit Accounts-(1,141); and Equipment-(537).

The data is indicative of a gradual shift in recognition of the asset value of intangibles, however, the umbrella approach in the classification of ‘intangibles’ and the failure to properly consider the status of IPRs within the ambit of secured transaction may create uncertainties until tested by the courts.