Nigeria’s Securities and Exchange Commission (SEC) has warned unregistered investment-tech platforms to desist from offering foreign securities to Nigerians.

The regulator made this in a statement on Thursday, April 8, 2021, maintaining that only registered exchanges may issue, or sell foreign securities to the Nigerian public.

In recent years, Nigeria has witnessed the emergence of technology companies that are easing access to foreign and local stock markets for the average Nigerian.

Although we’re yet to independently verify, well-informed insider sources maintain that some Nigerian corporate giants have long been offering foreign securities to the wealthy few.

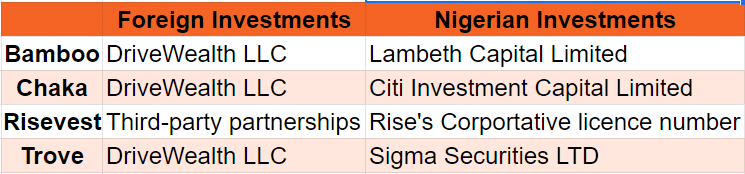

Tech companies like Bamboo, Trove, and Chaka came into the game through strategic partnerships with existing Capital Market Operators (CMOs) in the US and Nigeria.

However, the SEC has warned such CMOs to desist from such partnership following its statement.

This development follows the recent dispute between the SEC and Nigerian investment tech platform, Chaka Investment Technologies.

Its been on the way

Recall that in December 2020, the SEC published a surprising memo which stated that Chaka would be restricted from offering stocks to the public.

The wording of the memo highlighted that regulations would soon be coming for other investment-tech platforms. At the time, Tosin Osibidu, CEO of Chaka echoed this sentiment and called for everyone to be prepared and meaningfully engage.

On February 11, 2021, the regulator confirmed its intent to place regulations on online platforms offering securities to the average Nigerian.

Interestingly, on March 26, 2021, Chaka announced that it has taken the necessary steps to register with the SEC for a newly created licence for online investment companies. A statement from the company’s blog reads thus:

“We are pleased to inform our stakeholders and the general public that Chaka has taken the necessary steps to register with the Securities & Exchange Commission of Nigeria (SEC) for a newly created license, as SEC continues to maintain its avowed intention to encourage innovation within the market space.”

The implication

The SEC’s decision to prevent investment tech platforms from leveraging partnerships with the likes of Lambeth, Drivewealth, and Citi Investment Capital Limited seems instructive.

Since the SEC has declared the partnership void, other platforms like Trove, Risevest, or Bamboo may need to secure the licence which Chaka has reportedly begun the process for.

For now, it appears Chaka is ahead of the development due to the SEC’s fateful statement in December 2020. But it begs the question as to why only Chaka was singled out then, and other parties were seemingly ignored.

Thankfully, all platforms have assured investors of the safety of their funds, and have promised to engage with the SEC on the recent development.

Why is the SEC doing this?

While it may seem strange that Nigeria’s Securities regulator is placing restriction on startups offering foreign stocks, it actually falls within its powers.

Interestingly, specific provisions were already part of the law from the Investment and Securities Act, 2007, the SEC rules of 2013. Rule 414 of the SEC Rule reads thus:

“A foreign government or a company incorporated in a foreign country may issue, sell or offer for sale or subscription its securities to the public through the Nigerian Capital Market; Such securities may be denominated in naira or any convertible foreign currency.”

While Rule 415 states that such securities should be registered, it gives rooms for exemptions that online investment platforms could leverage. The existence of this rule makes it plausible that large corporations have been offering foreign stock options for years.

Also, as explained by Enyioma Madubuike, Lead Partner at Lawrathon in this piece, the SEC has a duty to protect the investors who, in this case, are the Nigerian public.

While we can’t draw concrete conclusions yet, we can expect the SEC to come up with a draft regulatory framework for registering investment-tech platforms.