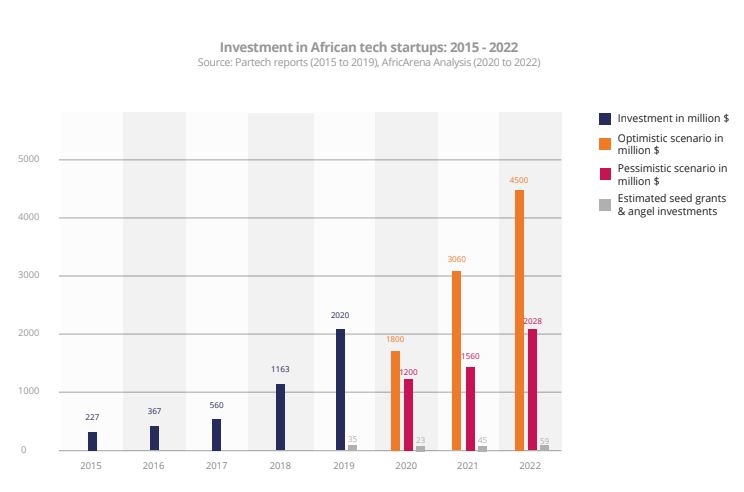

Last year, Partech Africa reported that 234 African tech companies raised a total of $2.02 billion in 250 equity rounds. This signalled a 74% increase from 2018’s figure of $1.163 billion raised by 146 startups in 164 rounds.

With fintech giants, OPay and Interswitch, raising $120 million and $200 million respectively in November, this year promised to be one the African tech ecosystem would not forget in a hurry.

At first, it looked like it was going to be so. Deals from other fintech players, Flutterwave and JUMO in January and February ushered us into 2020 with the pair raising $90 million.

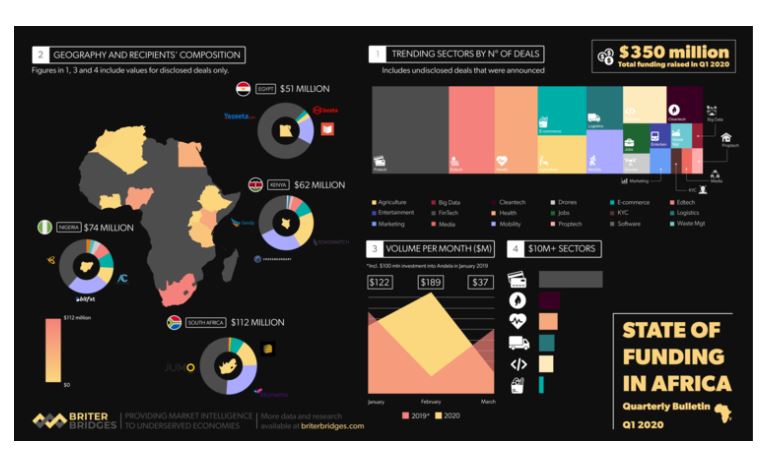

By the end of the first quarter, Techpoint Africa reported that Nigerian startups had raised a total of $55.37 million, a 313% increase from Q1 2019 figures while Briter Bridges reported that African startups raised approximately $350 million.

However, according to AfricArena, an African tech ecosystem accelerator, via its State of Tech Innovation and Investment in Africa report, venture capital will decrease in the remaining quarters of the year.

Venture capital to African startups to reduce by 40%

The accelerator is basing its findings on the impact of the coronavirus pandemic on African startups and their respective ecosystems.

“Whilst until early 2020 the trend seemed to be relatively clear in terms of the growth of investment in the continent’s tech ecosystem, the COVID-19 crisis has put a high level of uncertainty and poses many challenges,” an excerpt from the report reads.

AfricArena used data from Partech Africa’s 2019 Africa Tech Venture Capital report and Greentech Capital’s Maxime Bayen to narrate its findings.

Despite the continent bringing in approximately $350 million in the first quarter of 2020, AfricArena believes a sharp fall will occur in the second and third quarters.

Due to the impact of the pandemic, the report says African startups will receive 40% less venture capital than they did last year.

Painting a worst-case scenario of no pickup deals throughout the year, the report pegs African deals to be around $1.2 billion while pegging a best-case scenario with an uptake in the last quarter at $1.8 billion.

“We expect deal activity to fall sharply in Q2 and Q3 2020, primarily fuelled by VC investors doing refinancing deals on their portfolio. In spite of valuation metrics likely down by a 20 to 30% factor, new deals will be limited until the broad economy restarts.”

However, if the pandemic spirals until the first quarter of 2021, the report predicts venture deals totalling $1.6 billion but if there’s a gradual return to pre-coronavirus life, it’s holding an optimistic view of $3 billion.

The report also made a two-year forecast saying African venture deals will range from $2 billion to $5 billion.

In addition, it expects a lot of pre-seed to Series A startups to have shut down their businesses before the year runs out.

“One critical factor is the risk that a large chunk of early-stage clusters (from pre-seed to Series A) will be largely wiped out in the coming 3 to 9 months destroying much of the future pipeline of investors.

“We do not expect angel investment or seed funds to be able to perform well in the current context and therefore the continuous lack of early-stage investors on the continent might prove particularly problematic at this juncture,” the report said.

In spite of its forecasts, the accelerator is banking on the resilience and frugality of founders and startups to sail through this period despite the imminent cutback on venture capital investment in the coming months.