Since Chinese-backed and consumer Internet company, Opera, launched OPay in 2018, it has aggressively disrupted the Nigerian technology space, launching an array of consumer-focused services with enticing incentives.

These include transportation verticals ORide, OCar, and OTrike; food service, OFood; marketing and advertising service, OLeads; and lending feature, OKash, among others.

But as of this morning, users can no longer access the loan feature because OPay has removed it. The company has also removed its loan description as part of the features it offers on the Google Playstore.

The most likely explanation for this might be the recent findings made by Hindenburg Research.

Recently, Opera, the parent company of OPay, has come under immense scrutiny for its post-IPO and browser market share performances. From a report by the investigative publication, Opera is reportedly said to be cashflow negative and its browser margins have seriously declined since going public.

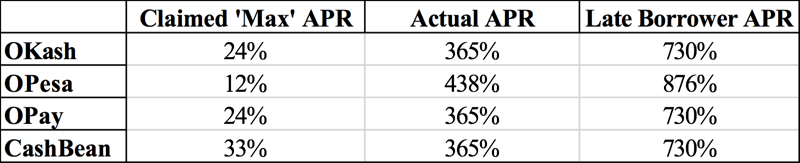

To mitigate these losses and boost revenue, Opera launched a series of short-term lending businesses — OKash, OPesa, OPay, CashBean — in Kenya, Nigeria, and India, which the Hindenburg Research found to be rather exploitative in nature.

In Nigeria, through its OPay mobile application, the company claims to offer loans between ₦2,500 to ₦60,000 with a loan term of 91 to 356 days and a maximum interest rate of 24%. However, this report shows that OPay hasn’t been true to its words and has violated major Google Playstore short-term lending policies by providing an inaccurate description of its loan businesses.

Hindenburg Research says the company has adopted a 3-step pattern of ‘bait and switch’ to lure users with low rates and long loan length terms and, unlike the above representations on OPay’s app description, users typically have 7 to 15 days to repay a loan with interests reaching 365% in most cases.

The report goes on to highlight that this predatory practise is specifically targeted at Nigeria’s poorest population and this is borderline disturbing.

With this development, what happens to users who have borrowed and are yet to pay, and also users that were in the process of borrowing before the feature was removed? These are questions that might need to be answered, however, all efforts to reach OPay’s Lagos office or its staff for comments have failed.

This is still a developing story.

Also Read

- Allegations against OPay’s parent company, Opera, and its other lending platforms are perhaps geared towards short-selling the company’s stock

- Beyond OPay, money lending apps may be at risk for alleged violation of Google’s policies

UPDATE [JANUARY 22, 2020]: OPay has responded with an official statement. It reads:

As communicated in our statement, available on our investor website, we believe that the report contains numerous errors, unsubstantiated statements, and misleading conclusions and interpretations regarding the business of and events relating to us.

Also, OPay is a different company and the app is a product of Paycom Nigeria Limited, a CBN licensed Mobile Money Operator. As a financial services product in Nigeria, it operates with Nigeria’s financial laws as regulated by the central bank of Nigeria.

The decision for OKash to be hosted on the OPay App was based on a partnership with BlueRidge Microfinance Bank (OKash) as a form of value-added service to our customers and also as a market entry strategy. As part of our beginning of year business evaluation period, we are reviewing the business impact of our partners to know if the partnership has impacted on our business goals that’s why it is not available on the App for now.

Currently to access the services of OKash, you can get the OKash App on Google Playstore. OKash is fully operational and available today for Android devices. OKash is fully compliant with the policies for the Google Play store and partner networks we rely on. Specifically, we continue to provide more than 60 days repayment options for users, as required.