After being in the works for some time, Nigeria’s President, Muhammadu Buhari, has signed the much-vaunted Finance Bill into law.

The president made this announcement today, January 13, 2020, on his Twitter handle, as the Bill was signed and submitted alongside the 2020 budget to the National Assembly.

The bill — now tagged the Finance Act 2019 — is meant to reform the country’s tax laws, aligning them with global best practices, support MSMEs, encourage investments in infrastructure and capital markets, and increase revenue for the government.

With the president’s assent given, this means that the provisions of the Finance Act would now be in effect, having varying effects for the tech ecosystem.

Recall that last week; we pointed out that once the Finance Bill is signed, early-stage startups with revenues of ₦25 million ($68,900), would no longer have to pay the required company income tax (CIT).

For medium scale businesses with revenues between ₦25 million and ₦100 million, a 20% CIT will be required, instead of the standard 30% which will now only be for large scale companies with revenues above ₦100 million ($277,000).

Suggested Read: If passed into law, Nigeria’s Finance Bill will exempt small and early-stage startups from paying taxes

In line with the aim of the Act to incentivise investments, shareholders may be encouraged to invest more in small and early-stage startups, knowing that there would be enough wriggle room for taxes in the growth period.

Also, startup/SME employees who have managed to avoid paying taxes may soon find it difficult to escape as a result of the new Act.

Victoria Fakiya – Senior Writer

Techpoint Digest

Make your startup impossible to overlook

Discover the proven system to pitch your startup to the media, and finally get noticed.

Besides the changes to company income tax, the Act will also implement changes to the personal income tax as a tax identification number (TIN) will now be compulsory for anyone to operate a bank account.

Last year, the FIRS revealed plans to begin charging 5% Value-added Tax (VAT) on online transactions for VATable items starting from 2020. With the change in the FIRS chairman, the fate of that plan remains up in the air.

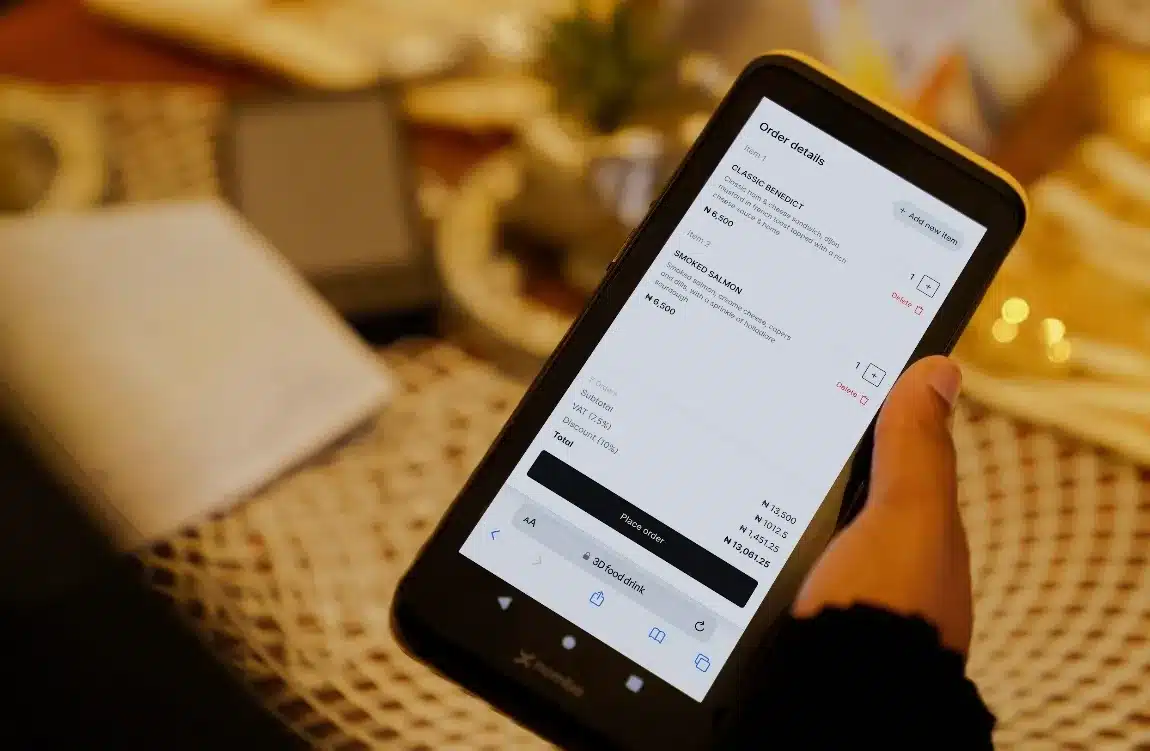

However, if it is implemented, it could change the face of e-commerce in Nigeria, since according to the Finance Act, the said VAT would no longer be 5% but 7.5% on all VATable items for online transactions.