It appears the efforts of Rocket Internet to cash out on Jumia will finally pay off as the eCommerce giant is planning to launch its Initial Public Offering (IPO) this year on the New York Stock Exchange (NYSE).

As reported by Bloomberg, the planned listing could value the company at $1.5 billion. The move to have the company listed on the NYSE raises a couple of questions, one of which is about the choice of New York and not any of the African countries Jumia operates in.

MTN Group — the major stakeholder of the company — is looking forward to raising $600 million from the offering, having revealed plans to sell its 40% stake in the company last year.

Evidently, MTN is pulling out. And as it is, Rocket Internet is also probably giving its exit ambition another shot.

The earliest move towards Rocket’s exit was bringing all its companies in Africa under the Jumia umbrella.

Suggested Read: So Jumia wants to completely take over?

In 2017, the company sold Jumia House Nigeria — its real estate and property arm — to ToLet.com.ng, now PropertyPro. The Ghanaian unit was acquired by MeQasa.

In the same year, Jumia recorded a negative figure for its adjusted Earnings Before Interest, Tax, Depreciation and Amortisation (EBITDA) at €120.1m (about $144.12m), which is higher than that of 2016 at €91.3m. Worthy of note is that Jumia is not the only Rocket Internet company that recorded negative figures in those two years.

For MTN Group, with a reported debt of ZAR 69.8 billion (about $5.07 billion), the sale of its stake in the eCommerce giant has the potential of reducing its debt burden. This is considering that Jumia hasn’t recorded a profit since the telecom group alongside other investors invested hundreds of millions of dollars.

Evidently, the MTN Group is selling off stakes in businesses that are not bringing in profits. When it eventually lists its Nigerian unit on the nation’s stock exchange, it would also reduce its stake in the unit translating to a further reduced risk.

On the choice of the NYSE, as against the Nigerian Stock Exchange, where Jumia has seven of its business units that are operational, Ibi Cookey, an investment officer, believes the former is a better option since the company doesn’t have to operate in New York to be listed on its stock exchange.

According to the World Federal of Exchanges, the NYSE has the highest market capitalisation in the world with $20.1 trillion as of December 2018. In contrast, the market capitalisation of the Nigerian Stock Exchange as of December last year was $30.2 billion. No doubt, being on the NYSE translates to unparalleled opportunities for the company, in terms of more visibility among others, as it is a more structured market and ranks number one in the world.

Should the owners of Jumia eventually settle for an African alternative, the Johannesburg Stock Exchange (JSE) would be the most preferable, in terms of market capitalisation. The JSE’s market capitalisation was $865 billion as of December 2018.

Cookey explains that getting listed on the NYSE means Jumia has to put its house in order which will, in turn, instil confidence in potential investors. He believes that the rigorous process of getting listed on the market would serve as proof that the company is investment worthy.

He also points out the issue around over-regulation of the Nigerian market which doesn’t encourage investments in the nation’s stock exchange.

Beyond the above reasons, there’s a higher probability that Jumia’s shares would sell faster on NYSE than on the Nigerian Stock Exchange.

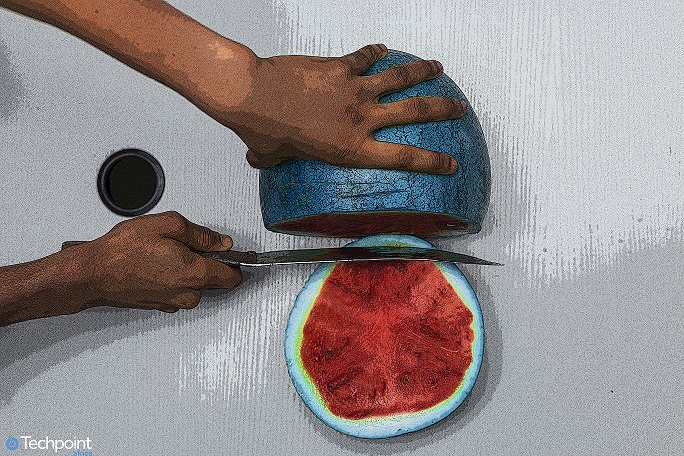

There is, no doubt, a great potential for Jumia if it gets listed on the top-ranked exchange in the world, but this does not allay concerns around profitability which the company is yet to attain even after over half a decade of its establishment.

Since profitability is the measure of business success, the planned listing may not have the expected market acceptance. Especially as it’s more of a pull-out move by key investors of the company.

In the event that Jumia gets listed on the stock market, how likely are you to invest in it?