A couple of months back, I was trying to get some items from a nearby supermarket. I presented my debit card at the counter as I didn’t have any cash on me, but I was asked to use the ATM next door because there was a connectivity issue with all their Point of Sale (PoS) terminals.

A situation like the above is not encouraging for the cashless initiative of the Central Bank of Nigeria. There are other channels through which merchants can accept payment from their customers but PoS seems to be the one with the highest penetration in the country aside cash.

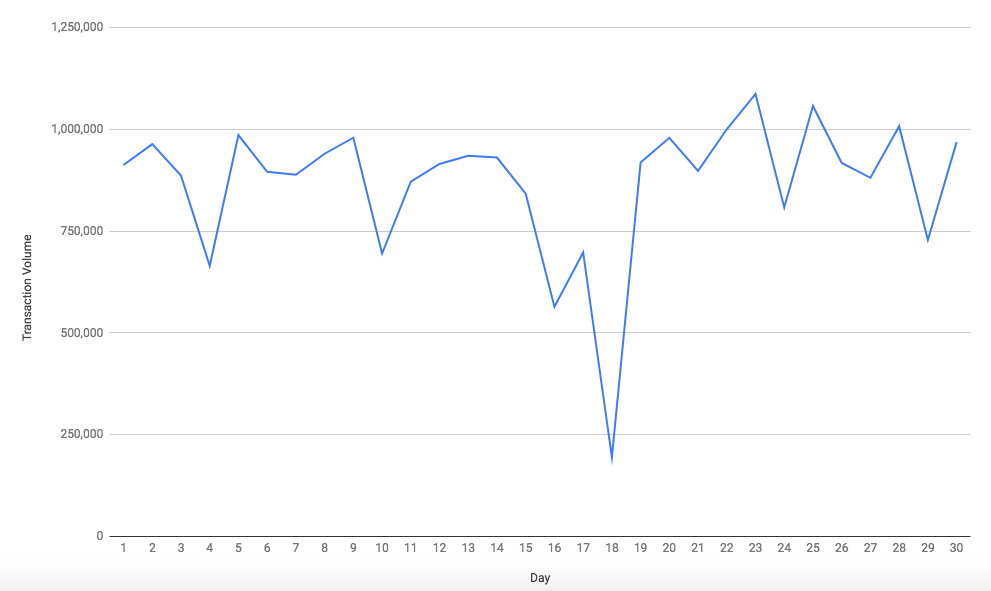

I studied the figures of PoS transaction details provided by the Nigeria Inter-Bank Settlement System (NIBSS), taking record of the live data between 11:59 pm and 12:00 am for a period of 30 days starting from October 10, 2018.

During the 30-day period, the average daily transaction count was 866,877. This translates to about 4.36 daily transactions for every PoS terminal (189,802 as at September 2018) across the country.

Although the penetration of PoS over the past is growing, the population of debit card holders in Nigeria that use PoS terminals is really low, considering that as of December 2017, there were approximately 84.37 million active cards in the Nigerian banking system. Even if we assume two debit cards per user (with daily usage), that could mean much less than 2% of Nigerians use PoS terminals on a daily basis.

On the bright side, this is still a remarkable improvement from 2017, where the average daily transaction for the year was 400,732 via 155,462 terminals; less than half of the daily average of the period under review.

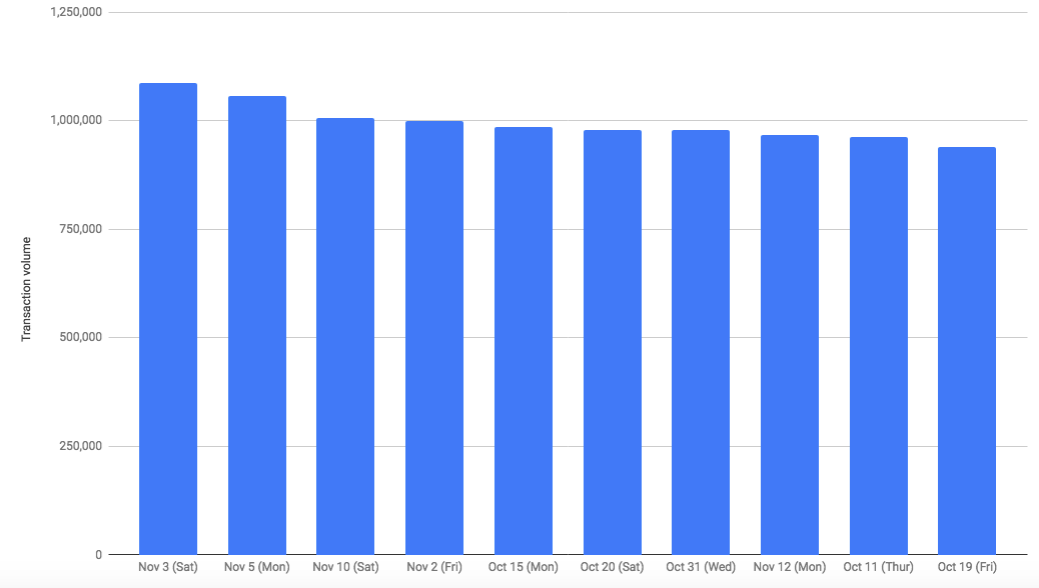

During the period under review, there were three days that recorded more than a million transactions. Two of those days were Saturdays. However, on the average, transactions over PoS during weekdays are higher than that of weekends.

As alluded to in my experience above, transaction failure is still prevalent with PoS transactions in Nigeria. During the 30-day period, the day with the least failure rate had 8.69% of the total transactions fail; the highest was 18.18%.

While average failure rate might not be that impressive, the average processing time is quite the opposite. The lowest average processing time was 1.7 seconds and the highest was 70.16 seconds, which is just a minute and 10 seconds. Although the highest average processing time is more than a minute, 90% of the days studied had their average processing time less than 20 seconds.

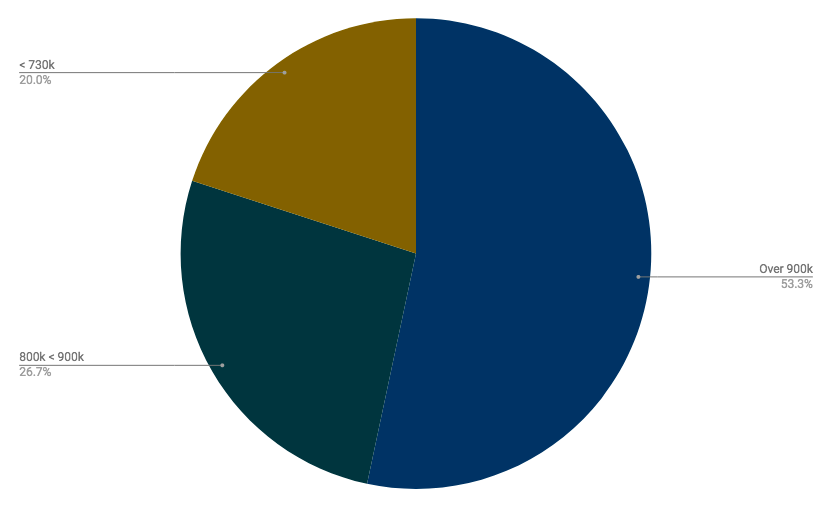

Sixteen of the 30 days had PoS transaction count of over 900k, 8 had more than 800k with the remaining 6 recording less than 730k transactions. October 29, 2018 was a Monday and it recorded the lowest transaction count within the period under review with 194,666.

As stated above, the average volume of transactions over PoS during weekdays is relatively higher than that of weekends. But there seems to be no correlation between the failure rate and transaction volume of weekdays and weekends.

A deeper look at the figures shows that the days with the highest transaction volume were Tuesdays, Wednesdays and Thursdays. What is driving the spike in these three days is a question that begs an answer.

Most Nigerians regard weekends as a period for relaxation to see movies at the cinemas, visit relaxation sites or go partying. This questions the lower transaction volume recorded during the weekend as against the one recorded during the weekdays when people are supposedly busy at work. A possible explanation is that higher traffic on weekends could affect network quality; average processing time for the period under review was higher during the weekends than on weekdays.

Perhaps a large percentage of people using PoS terminals regularly have noticed a trend with poor connectivity during the weekends, which makes them go for the cash option instead. It could also be that merchants with PoS terminals encourage more cash transactions during weekends due to connectivity.

Sundays had the lowest transaction volumes, which is relatable on the account that most shops don’t open for business on Sunday, and the ones that open do so towards the latter end of the day.

Overall, there’s a significant increase in the value of PoS transactions of the year so far over 2017, as at September 2018, the value of PoS transactions had passed that of the entire year of 2017 by ₦200 billion which was ₦1.41 trillion.