Almost two years ago, I got the opportunity to contribute my quota to the adoption of Open Banking in the Nigerian financial industry; I did this from my corner at GTBank by helping to re-position the Bank’s corporate payment solutions as democratised APIs for consumption by fintechs and MSMEs.

It was a challenging experience — from convincing senior management to embrace long-term, win-win partnerships with fintechs as enablers and not solely as competition; to getting the right support from the Bank’s technology team for go-to-market (timeliness & readiness).

Integrating the bank’s payment APIs with these fintechs also threw up a myriad of technical issues; and in analysing these issues, one of the biggest contributing factors was found to be in the way NUBAN was implemented in Nigeria.

There were cases of the same NUBANs existing in different banks; with increasing occurrences as more NUBANs are generated. This defeats the purpose of NUBAN as a unique bank account identifier in Nigeria. As it stands, NUBAN’s uniqueness depends on the customer or user’s conscious usage of bank codes / bank names with the NUBAN, even at API level (requiring the inclusion of an interface to identify bank code or bank name mapped to the bank code).

When uniqueness of an identifier depends on user input, it loses the potency for uniqueness. There was also the implicit problem of the character length and how quickly the unique combination of the (10 digits) of NUBAN will be used up, given the rise in MFBs and OFIs.

Given these challenges, in March, 2018 I published an article titled “Did We Score an Own Goal with NUBAN?”

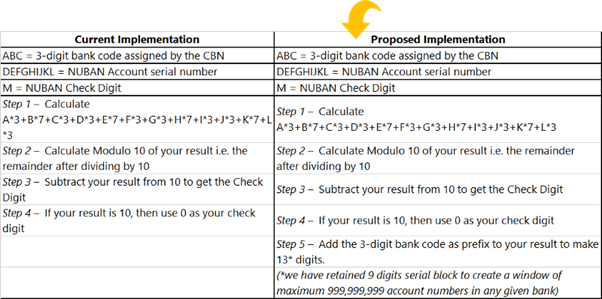

In the article, I recommended a practical solution; include the 3-digit unique bank code to the current implementation dynamics. This way, we arrive at a 13 digit NUBAN that will truly be unique, and vastly expandable to accommodate an exponentially larger instances of NUBAN. Below is a snapshot of the proposal:

Eight months later, the CBN has not only considered this proposition, it has issued a draft of how it plans to revise the implementation architecture of NUBAN in alignment with this recommendation.

The apex bank has gone further to introduce 3 extra digits taking the tally to 16 digits (i.e. from Step 5 above, the CBN is introducing three preceding zeros as a buffer for when more Banks, MFBs and OFIs are incorporated for business). This implementation will further ease integrations between banks, OFIs, fintechs and the many MSMEs that will embrace open banking for innovative developments and implementations to deliver quality financial services to Nigerians.

Also, CBN is doing this to rubber-stamp its strategy to open up NUBAN issuance to more non-DMBs, implying that you may not need to hold a bank account before you have a NUBAN number. However, funds (value) transactions will happen across issuers and providers within the ecosystem. This is good news for wallet-based fintechs.

One of the expected criticism to this new approach is the shift from remembering your 10 digits NUBAN to 16 digits; this is anticipated and highlighted in the initial article, with the comfort being that in the days before NUBAN, Nigerians were provided with 12 – 15 digits account numbers by their banks based on differing account numbering nomenclatures unique to each bank. (In those days, banks’ account number system depended hugely on the architecture of their core banking applications).

I believe the CBN considered critical feedback and recommendations on how to reposition NUBAN to achieve it’s intended aim of unifying account number nomenclature in Nigeria; and this highlights the importance of independent contribution to the general body of knowledge for the advancement of underlying infrastructure (standards, policies and procedures) that power financial service delivery in Nigeria.

If implemented right, I believe this will position NUBAN as the truly unique, unified account numbering system that will be the bedrock for the CBN National Financial Inclusion strategy outlined in its CBN-funded Shared Agent Network Expansion Facility (SANEF) initiative.

About the Author

Adewale Otolorin is experienced in positioning banking & payment APIs for integration with MSMEs while giving utmost consideration to data security. He has recently focused on API security management for FS clients. You can follow him on Instagram/Twitter @authorwales.

Adewale Otolorin is experienced in positioning banking & payment APIs for integration with MSMEs while giving utmost consideration to data security. He has recently focused on API security management for FS clients. You can follow him on Instagram/Twitter @authorwales.