Harvard’s decision to triple its Bitcoin ETF holdings signals deepening institutional conviction in BTC, but as Bitcoin nears cycle highs, many investors are turning to emerging networks like Bitcoin Hyper for higher growth potential.

Harvard University’s latest 13F filing revealed one of the most significant institutional moves of the year: a 280% increase in its allocation to BlackRock’s iShares Bitcoin Trust (IBIT). The position now totals $443 million, representing 6.8 million shares and becoming the single largest holding in the university’s public portfolio. In doing so, Harvard joins a growing cohort of leading institutions that are reinforcing the legitimacy of the Bitcoin ETF market amid volatility.

Harvard now sits among the top 20 holders of IBIT, the world’s largest spot Bitcoin ETF with nearly $75 billion in net assets. For Bloomberg ETF analyst Eric Balchunas, this marks rare validation from one of the most conservative financial stewards in the U.S. endowment ecosystem. “It’s extremely rare and difficult to get an endowment to join an ETF, especially Harvard or Yale,” he noted, calling the allocation the strongest endorsement an ETF product can receive.

Why Harvard’s Move Matters in an Uneasy Market

The timing of Harvard’s expanded Bitcoin ETF position is notable. Bitcoin itself has seen increased turbulence, with major buyers, ETF allocators, and corporate treasuries slowing purchases in recent weeks. Although Bitcoin’s long-term thesis remains intact, near-term uncertainty persists, especially as macroeconomic conditions shift and ETF flow momentum cools.

Still, the move highlights a broader institutional trend: Bitcoin is no longer viewed merely as a speculative asset. Instead, it is increasingly recognised as a treasury component and portfolio diversifier. Asian fintech firms and SMEs are already adjusting their operations in response, reorganising around crypto-treasury management tools and regulated ETF exposure routes.

These adjustments reflect a changing global landscape in which regulatory clarity, ETF accessibility, and institutional accumulation are slowly reshaping the digital-asset economy.

Retail Investors Respond Differently – Seeking Higher Upside Than ETFs Provide

While demand for Bitcoin ETFs grows among large institutions, retail investors face a different reality. Bitcoin trades near the upper end of its multi-year cycle, limiting the potential upside. For investors hoping to replicate past-cycle returns, exposure to an ETF or spot BTC involves accepting lower expected returns.

This dynamic is driving capital rotation into younger, higher-beta ecosystems. Recent breakouts such as Zcash, Firo, and Telcoin show that the market continues to reward undercrowded narratives that offer strong fundamentals or narrative tailwinds. Each of these assets saw explosive moves despite Bitcoin’s lacklustre performance. The pattern is clear: investors still seek opportunities with asymmetric return profiles – especially during periods of consolidation.

Enter Bitcoin Hyper: A High-Upside Bet Built on Bitcoin’s Limitations

This is where Bitcoin Hyper enters the conversation. While Harvard increases its Bitcoin ETF allocation for long-term stability, more nimble investors are evaluating newer networks explicitly designed to overcome Bitcoin’s technical constraints.

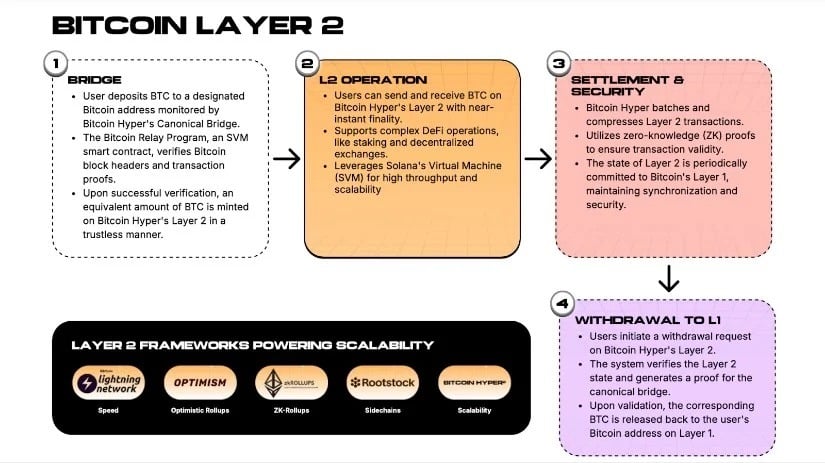

Bitcoin Hyper positions itself as a Bitcoin Layer-2 network built on the Solana Virtual Machine (SVM), enabling thousands of transactions per second and smart-contract functionality. This addresses two of Bitcoin’s core limitations – speed and programmability – while retaining the security guarantees of the underlying L1 chain through zk-rollups and a canonical bridge design.

This hybrid approach transforms Bitcoin from a relatively static asset into a programmable economic base layer. It opens the door to DeFi, stablecoins, tokenisation, and meme-asset experimentation on top of the world’s most secure blockchain – capabilities that BTC alone cannot natively support.

Why Bitcoin Hyper Is Attracting Capital Despite the Market Downturn

The Bitcoin Hyper presale has now raised $27.8 million, approaching the $30 million mark even as broader market sentiment remains fragile. Unlike Bitcoin ETFs, which appeal to large allocators seeking regulated exposure, Bitcoin Hyper appeals to investors looking for higher-risk, higher-reward opportunities.

While Bitcoin ETF flows slowed during recent turbulence, HYPER’s presale continued accelerating – mirroring the same rotation seen in Zcash, Firo, and Telcoin. Investors appear to be redistributing profits and hedging against Bitcoin stagnation by seeking earlier-stage projects with narrative alignment.

With Bitcoin Hyper’s architecture reflecting sector themes that analysts expect to dominate 2025 – scaling, bridging security, and programmable Bitcoin – its early traction is not entirely surprising.

The Broader Market Is Searching for Asymmetric Opportunities

Market history shows that late-cycle Bitcoin performance often drives capital toward alternative assets. The 2022–2025 period illustrates this clearly. Those who added to positions during the November 2022 capitulation saw 8x returns on Bitcoin and similar performance from Ethereum, Solana, and XRP.

But many assets never had a 2023–2025 bull run at all. Zcash, Firo, and Telcoin effectively traded sideways for three years before exploding in recent weeks. This is precisely why analysts argue that rotation into discounted, infrastructure-focused tokens may continue – even as Bitcoin ETFs attract institutional capital.

For many investors, the search is not for stability but for untapped growth. Bitcoin Hyper fits that thesis by extending Bitcoin’s utility while remaining early enough in its lifecycle to offer non-linear upside potential.

Presale Window Tightens as Price Steps Increase

The final presale tranche offers $HYPER at $0.013285 before the next price increase, with staking options at up to 41% APY. The staged presale structure has been central to maintaining steady inflows, particularly during volatile market periods.

EXPLORE THE BITCOIN HYPER PRESALE BEFORE THE NEXT PRICE INCREASE GOES LIVE

For now, the timing appears favourable for risk-tolerant investors. With Bitcoin facing consolidation and institutions turning to ETFs for defensive accumulation, emerging narratives may attract greater attention in the coming weeks.

Disclaimer: Cryptocurrencies are volatile and high-risk. This content is for informational purposes only and is not financial advice.