Institutional Bitcoin lending is accelerating, with Bitcoin Treasury and JPMorgan now embracing BTC-backed loans. As Bitcoin becomes a mainstream collateral asset, Bitcoin Hyper is emerging as a high-speed Layer-2 contender positioned to capitalise on the next wave of crypto adoption.

The once-niche idea of Bitcoin loans is rapidly becoming a mainstream financial service. This week, Bitcoin Treasury Corporation announced its first institutional loan denominated in Bitcoin – a landmark step toward making crypto lending an institutional norm. The company’s aim is clear: to increase shareholder value by deploying Bitcoin as a productive asset, not just a store of value.

“As Bitcoin evolves from a niche asset to a foundational element of global finance, the opportunity set for institutional Bitcoin services continues to expand,” said Elliot Johnson, CEO of Bitcoin Treasury Corporation. The company’s two-pronged approach – Bitcoin lending and capital markets operations – underscores its ambition to maximise Bitcoin per share (BPS), creating measurable returns through direct asset utilisation.

The loan program follows Bitcoin Treasury’s registration as a Money Services Business (MSB) and its partnership with FRNT, signaling a push toward regulatory compliance and institutional credibility. For the company, it’s not just about lending Bitcoin – it’s about positioning the asset as collateral within the global credit system.

Wall Street’s Bitcoin Conversion: From “Pet Rock” to Loan Collateral

The private-sector shift toward crypto lending doesn’t end there. JPMorgan Chase & Co., the world’s largest bank by market capitalisation, has announced plans to allow clients to borrow against Bitcoin and Ether holdings by year’s end. This initiative, offered globally, will utilize third-party custodians to safeguard pledged tokens, marking a symbolic turning point in Wall Street’s relationship with digital assets.

This is the same JPMorgan whose CEO, Jamie Dimon, once famously called Bitcoin a “fraud”. Yet, as crypto integration deepens, Dimon’s stance has softened. “I defend your right to buy Bitcoin – go at it,” he said earlier this year, hinting at a reluctant acceptance of crypto’s staying power.

The decision to accept Bitcoin as loan collateral places it alongside traditional assets like gold, equities, and bonds. For investors, this means that Bitcoin is now seen not only as a speculative tool but also as a legitimate financial instrument – one that can support lending, liquidity, and structured products.

Other financial giants are following suit. Morgan Stanley, State Street, Fidelity, and BNY Mellon are expanding their crypto services, while BlackRock now allows investors to swap Bitcoin for ETF shares. With the Trump administration’s pro-crypto policies easing regulatory constraints, the institutional barriers that once kept Bitcoin on the sidelines are fading fast.

Why Bitcoin Loans Mark a Structural Shift in the Market

Bitcoin loans represent more than just a financial product – they signify Bitcoin’s evolution into a yield-bearing, capital-efficient asset class.

For years, Bitcoin was defined by its passive “HODL” culture. Now, with financial products like lending, staking, and tokenised derivatives, Bitcoin is beginning to circulate within the global economy in ways that were previously limited to fiat or equities. The implications are profound: the more Bitcoin is used as collateral or credit, the more integrated it becomes with the financial system’s core architecture.

This trend could spur demand for complementary technologies that expand Bitcoin’s functionality – Layer-2 solutions, smart contract integration, and faster transaction settlement. That’s where Bitcoin Hyper ($HYPER) enters the conversation.

Bitcoin Hyper: The Layer-2 Network Designed for the Next Financial Phase

As institutional players adopt Bitcoin for lending, scalability and transaction speed are becoming crucial. Traditional Bitcoin transactions, while secure, remain slow and costly – a bottleneck for financial institutions that require efficiency and throughput.

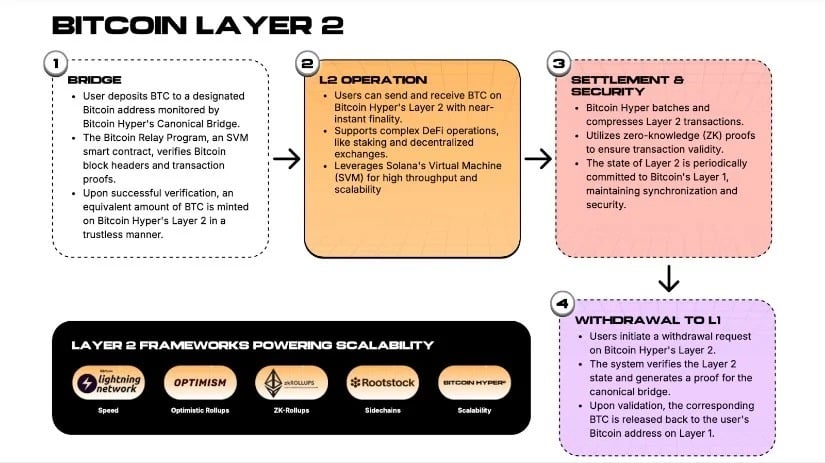

Bitcoin Hyper ($HYPER) is emerging as a powerful solution. Rather than competing with Bitcoin, the project enhances it by creating a fast, scalable Layer-2 network anchored to Bitcoin’s security. Through a canonical bridge that verifies block headers and mints wrapped BTC, users can transact with near-instant finality and minimal fees.

Built on the Solana Virtual Machine (SVM), Bitcoin Hyper combines speed with composability, enabling decentralised applications (dApps) to operate seamlessly within the Bitcoin ecosystem. Transactions are batched and validated using zero-knowledge proofs, ensuring scalability without compromising trust.

The project’s tagline – “One vision, one chain, one upgrade” – reflects a focused mission: to make Bitcoin faster, cheaper, and more usable in both institutional and retail environments.

$27 Million Raised in Presale Funding

In a market where most altcoins are struggling for relevance, Bitcoin Hyper’s funding success tells a different story. The project has raised over $27 million in its ongoing presale, a clear sign of investor confidence. A recent whale purchase of 16 million HYPER tokens, worth approximately $227,000, has further validated this growing belief in the project’s trajectory.

These funds are being strategically deployed: around $2.7 million is reserved for Tier-1 exchange listings, ensuring liquidity and market visibility upon launch. Analysts note that such forward planning distinguishes HYPER from other presale projects that often falter post-launch due to limited access or volume.

The presale also features a staking program offering a competitive 42% APY, with over 1.2 billion tokens already locked. This early community participation helps stabilise the circulating supply while incentivising long-term commitment.

Why Bitcoin Hyper Fits the Bitcoin Loan Narrative

As Bitcoin becomes collateral in global lending markets, its Layer-2 ecosystems will likely become critical for speed, interoperability, and efficiency. Institutional players deploying Bitcoin in high-frequency environments will demand networks that can handle near-instant settlement and programmable functionality – attributes Bitcoin Hyper is designed to deliver.

In essence, Bitcoin Hyper serves as the technological complement to Bitcoin’s financial evolution. Where JPMorgan and Bitcoin Treasury focus on unlocking liquidity, HYPER builds the infrastructure to make those transactions smoother, faster, and more scalable.

This symbiotic relationship between financial innovation and technical scalability is what positions Bitcoin Hyper as a credible contender for massive growth. In an era where traditional and decentralised finance increasingly overlap, such hybrid solutions are what bridge the gap between theory and execution.

Tokenomics and Long-Term Potential

Bitcoin Hyper’s architecture revolves around three key pillars: scalability, transparency, and participation. Its tokenomics are designed to reward holders through staking, governance, and ecosystem engagement while maintaining scarcity through fixed supply mechanics.

The network’s staking model encourages participants to validate transactions and contribute to liquidity, fostering both stability and decentralisation. Combined with active community engagement, these dynamics create a feedback loop of participation and trust – critical factors for sustainable token value.

At a current price of $0.013275, Bitcoin Hyper offers a relatively low barrier to entry for retail investors while attracting institutional observers intrigued by its scalability potential. Layer-2 networks with strong funding, credible teams, and measurable utility could outperform traditional altcoins in the next cycle.

Risks and Considerations

As with all emerging projects, Bitcoin Hyper faces challenges. Market volatility, evolving regulation, and technical execution risks remain central concerns. Additionally, the rapid institutionalisation of Bitcoin may shift focus toward compliance-heavy frameworks that slow down grassroots innovation.

However, HYPER’s advantage lies in its alignment with macro trends. As Bitcoin loans and institutional adoption accelerate, demand for scalable Bitcoin infrastructure will inevitably rise. If Bitcoin Hyper delivers on its roadmap, it could become a cornerstone for this new phase of the Bitcoin economy.

The Convergence of Finance and Innovation

The rise of Bitcoin loans through institutions like JPMorgan and Bitcoin Treasury signifies Bitcoin’s entry into the mainstream of financial services. At the same time, the emergence of Bitcoin Hyper highlights the next frontier – building the technology that will sustain this integration at scale.

Where traditional finance is learning to leverage Bitcoin as collateral, Bitcoin Hyper is ensuring that the network itself can handle that future. Together, they represent two sides of the same coin: one financial, one technological.

BUY BITCOIN HYPER NOW – POWER THE FUTURE OF BITCOIN SCALABILITY

For investors and observers alike, this convergence offers a glimpse of what the next phase of crypto might look like – a world where Bitcoin isn’t just held, but used, scaled, and multiplied.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk. Readers should conduct independent research and consult a qualified advisor before making investment decisions.