As charts flash red and traders brace for deeper declines, meme coin culture is once again proving its resilience. Amid a potential crypto market crash, Maxi Doge ($MAXI) is drawing social buzz, on-chain traction, and millions in presale inflows – suggesting retail traders still have an appetite for high-risk, high-reward plays even in bearish conditions.

The cryptocurrency market is on edge after a brutal week that erased over 20% of global digital asset value. Following a strong summer run, both Bitcoin and major altcoins are now struggling to hold key support levels, signaling a possible deeper correction.

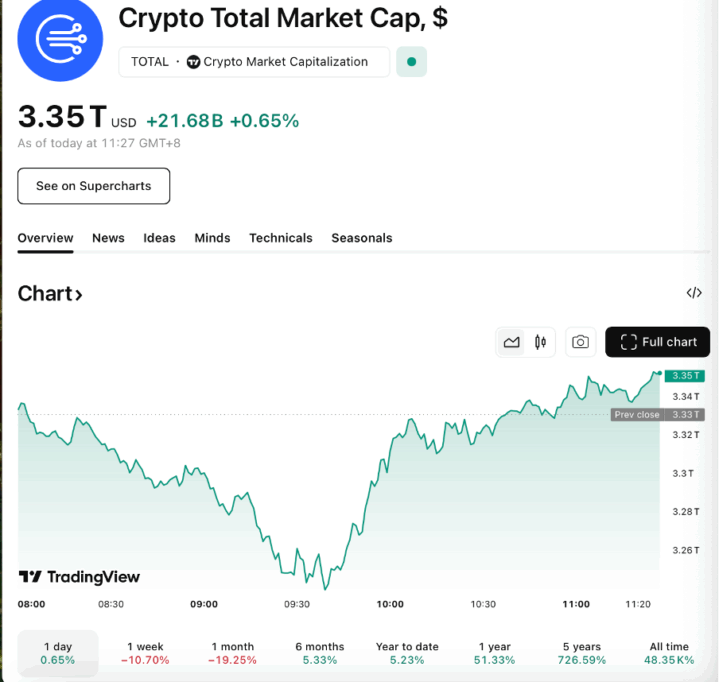

The total crypto market capitalization has fallen from its all-time high of $4.27 trillion to around $3.35 trillion, with bearish divergences in the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) indicators serving as precursors to this decline.

On October 10, markets attempted a relief rally – a sharp bounce that briefly stabilised sentiment, but the move has since faded. The TOTALCAP chart broke below the critical $3.55 trillion support area, confirming the breakdown. Technical analysts warn that this loss could trigger further declines, especially given the absence of strong historical support below current levels.

Source: TradingView

For Bitcoin, the pattern looks equally grim. The leading cryptocurrency trades below the $106,000 support zone, a line that has historically separated consolidation from panic. If BTC closes the week beneath it, analysts predict a drop toward $94,400 or even $85,700, hitting deeper Fibonacci support zones that could mark the end of this bull phase.

Altcoins are showing no immunity. The ALTCAP index, which measures non-Bitcoin market capitalisation, has also broken its uptrend channel. RSI and MACD signals confirm the reversal, and the next major support sits near $1.20 trillion – about 25% below current levels.

With Bitcoin dominance rising once again, liquidity is consolidating around blue-chip assets, leaving smaller tokens vulnerable. Yet paradoxically, this same liquidity rotation is fueling selective rallies – particularly in speculative meme coins that thrive on volatility and social hype.

Market Crash Creates Contrarian Openings for Retail Traders

While institutional investors are retreating from risk, retail traders are seeking alternative opportunities for action. As volatility surges, meme coins are becoming a magnet for short-term speculation, often outperforming larger tokens in times of uncertainty.

The reason is simple: meme coins move on social momentum, not macro data. When fear grips the broader market, online communities often double down – chasing the next viral token as a cultural statement rather than a macro bet. That dynamic is playing out again in late 2025, with one coin in particular standing out from the crowd: Maxi Doge ($MAXI).

Maxi Doge Emerges as a Breakout Story in a Bleeding Market

While most traders are tightening positions amid the market crash, Maxi Doge ($MAXI) has defied the bearish tide. Built around meme-driven energy and community culture, the project’s presale continues to attract heavy inflows – with whale wallets and retail participants alike showing surprising conviction.

Maxi Doge has become a trending topic in the cryptocurrency community. Influencer mentions, meme campaigns, and curated trader lists are pushing MAXI into conversation alongside broader discussions of “best altcoins for November 2025”.

The appeal lies in its hybrid model: MAXI blends traditional meme coin humor with on-chain fundamentals, including audited contracts, staking rewards, and transparent tokenomics. These features give it structural durability, helping it stand out in a sector that often moves purely on sentiment.

Even as Bitcoin tests multi-month lows, on-chain activity around MAXI is climbing. Wallet data shows increasing transaction counts and holder growth, indicating that traders are buying dips in anticipation of exchange listings. Social signals – hashtag surges, engagement metrics, and influencer interactions – are mirroring the patterns seen before prior meme coin rallies.

Social and Technical Signals Behind MAXI’s Momentum

To understand why Maxi Doge continues to gain traction, analysts attribute its success to a combination of on-chain resilience and off-chain virality.

· On-chain activity: Rising transaction counts and wallet creation show steady accumulation, even as other assets see outflows. This suggests conviction among holders rather than pure speculative churn.

· Exchange catalysts: Rumors of upcoming listings on decentralised exchanges like Uniswap and PancakeSwap are circulating in trader groups. Historically, confirmed listings act as price catalysts in the meme coin sector.

· Community acceleration: Telegram groups and influencer channels tracking MAXI have seen surging membership, with followers reporting double-digit daily growth in engagement.

· Market narrative alignment: As traders search for the next crypto to explode, Maxi Doge benefits from timing – arriving when sentiment is low but appetite for recovery plays remains strong.

In short, MAXI’s rise amid a market crash speaks to crypto’s cultural resilience. Even when charts imply panic, social capital – memes, momentum, and FOMO – remains a potent force.

Fundamentals, Not Just Frenzy: Why MAXI Is More Than a Meme

While social buzz drives near-term attention, MAXI’s underlying structure offers it longer-term potential. Tokenomics include a capped supply, transparent vesting schedules, and liquidity locks to deter rug-pull fears. Staking rewards and community governance features further align incentives for holders.

More importantly, Maxi Doge’s roadmap emphasises decentralised participation. Future milestones include NFT integrations, creator partnerships, and interactive campaigns designed to sustain engagement beyond initial hype cycles.

These fundamentals matter because they anchor speculative energy in measurable frameworks. In prior cycles, meme coins without real use cases often collapsed when sentiment faded. By contrast, MAXI’s transparent audit, verified token data, and public roadmap offer some insulation from purely emotional trading.

That mix of transparency and culture has made Maxi Doge one of the few meme coins to gain traction even as the wider market retreats.

Lessons From the Market Crash: Speculation Still Finds a Way

The juxtaposition is striking. On one side, Bitcoin and altcoins are teetering near major breakdown levels, with bearish divergences and macro uncertainty dominating technical charts. On the other hand, retail traders are pouring into new meme coins that appear unaffected by macro fear.

This pattern isn’t new. During past crypto downturns, community-driven tokens have often rallied against the trend – Dogecoin in 2019 and Shiba Inu in 2021 – showing that retail energy thrives precisely when institutional sentiment wanes.

In 2025, Maxi Doge may be replaying that script. Its presale success and expanding community indicate that speculative capital hasn’t left crypto – it’s simply rotating into smaller, faster-moving ecosystems. For risk-tolerant traders, these tokens act as short-term volatility hedges or early-stage bets in a stagnant market.

Still, caution is warranted. Meme coins remain highly speculative, and price reversals can be swift. It is important to track verified contract data, check liquidity pools, and confirm exchange listings before allocating capital.

Meme Coins Defy the Fear, But Risk Never Disappears

The current market crash highlights crypto’s extremes: institutional outflows and technical breakdowns on one side and relentless retail enthusiasm on the other. While Bitcoin hovers near critical support at $106,000, Maxi Doge continues to trend upward in both presale momentum and social visibility.

Whether this resilience lasts depends on execution. If the team delivers on its listings, maintains transparent liquidity, and sustains community engagement, MAXI could extend its gains even as broader markets recover.

Yet, history reminds traders that meme coin rallies often burn out quickly once liquidity dissipates. Prudent risk management – position sizing, stop-loss strategies, and fundamental verification – remains essential.

JOIN THE MAXI DOGE PRESALE NOW

Still, one takeaway is clear: even in downturns, crypto’s culture finds new outlets for speculation and creativity. The ongoing success of Maxi Doge shows that in a world obsessed with charts and corrections, community-driven innovation may remain the one asset class that refuses to crash.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk and volatility. Always perform your own research before participating in any presale or trading activity.