The crypto market crash has left many altcoins bleeding, but one project – Pepenode – is defying the trend. Its innovative “mine-to-earn” model and fast-growing community have drawn investor attention, helping the presale surpass $2 million while broader sentiment remains cautious.

The cryptocurrency market has entered one of its toughest phases in recent months. While Bitcoin has shown relative resilience, the altcoin sector has been hit by sharp declines, leaving traders to question when the pain will end.

Analyst Michaël van de Poppe points to low tradable supply as one of the key reasons behind the crash. In a thinly liquid market, when only around 10% of an altcoin’s total supply is available for trading, even a single large sell order can trigger a sharp drop. That’s exactly what’s happening now. As leveraged positions get flushed out, smaller tokens are struggling to absorb the shock.

Van de Poppe notes that this imbalance makes altcoins inherently more volatile: “If you’re holding altcoins, be patient. The cycle hasn’t peaked yet.” The implication is that while drawdowns are painful, they can also reset valuations and pave the way for new leaders when the next wave of capital arrives.

Bitcoin Dominance and Liquidity Pressures Deepen the Decline

Adding to the market strain, Bitcoin dominance – the measure of BTC’s share of the total crypto market – continues to climb. The ratio recently broke above the 60% level, indicating that capital is shifting from smaller coins to the relative safety of Bitcoin. This kind of dominance spike typically marks the late stages of a correction, as traders consolidate around the most liquid asset.

Meanwhile, macro forces are worsening the liquidity crunch. The ongoing US government shutdown has frozen Treasury spending, locking up more than $1 trillion in the Treasury General Account (TGA). That cash vacuum is pulling liquidity out of risk assets, including crypto.

US Federal Reserve Chair Jerome Powell’s recent comments have only added to the defensive tone. The prospect of delayed rate cuts pushed Bitcoin below $102,000, while altcoin trading volumes dropped by 20–40% since mid-October.

Yet, history shows that such periods often mark the turning point for opportunistic investors. When liquidity tightens and sentiment collapses, early movers start looking for overlooked opportunities – especially in the presale and microcap sectors.

Why Smart Money Is Rotating Toward New Narratives

For those who have seen multiple cycles, the pattern is familiar: Bitcoin dominance peaks, altcoins capitulate, and then the next wave of capital chases fresh narratives. This time, the focus appears to be on gamified meme tokens – a new breed of projects that mix entertainment, community, and on-chain utility.

That’s where Pepenode comes in. As the broader market contracts, Pepenode is expanding – both in user engagement and presale momentum. In just a few weeks, the project has crossed $2 million in early funding, drawing the attention of retail traders and analysts alike.

Pepenode’s “Mine-to-Earn” Model: A Fresh Take on Meme Coins

Unlike traditional meme coins that rely solely on viral marketing, Pepenode ($PEPENODE) introduces an inventive “mine-to-earn” system. Users can set up virtual mining nodes to generate rewards without expensive hardware or high electricity costs.

The idea is simple but effective: by purchasing PEPENODE tokens, users gain access to a dashboard where they can build and upgrade digital mining rigs. Each upgrade boosts virtual hash power, while around 70% of the tokens used in upgrades are burned, creating scarcity and long-term deflationary pressure.

Mining rewards are distributed in PEPENODE, but the twist is that players also earn bonus meme tokens, such as PEPE and Fartcoin. This multi-reward setup turns participation into an interactive experience – part game, part investment ecosystem.

In essence, Pepenode merges play-to-earn mechanics with meme culture, creating a hybrid system that captures both the community energy of Dogecoin and the user engagement of GameFi.

Strong Early Demand Despite Market Volatility

Despite the broader market crash, Pepenode’s presale has been a standout performer. Priced near $0.0011317, the initial offering quickly raised over $2 million before accelerating toward its current $2 million milestone.

Part of this success lies in how the project aligns with the shifting psychology of traders. In a bearish environment, investors look for tokens that combine upside potential with tangible mechanics. Pepenode’s gamified structure delivers both deflationary economics and interactive engagement.

With a modest market cap of around $95,000, Pepenode remains a high-risk, high-reward play, but that’s precisely what attracts investors during periods of low liquidity. When most of the market is frozen, small-cap presales offer the chance to front-run future narratives.

Community Energy and Deflationary Tokenomics

Another reason Pepenode is gaining traction is its community-first design. The project encourages participation by making mining fun, social, and potentially lucrative. Users can collaborate through shared dashboards, form groups to compete for leaderboard rewards, and even stake their tokens for an annualised yield exceeding 628% APY.

This high-yield model has drawn comparisons to early DeFi farming, but with a lighter, meme-driven twist. The combination of staking incentives and deflationary token burns creates an ecosystem that rewards activity rather than speculation alone.

If executed well, this could help Pepenode avoid the fate of many meme coins that fade once the hype cools. Sustained engagement – through upgrades, burns, and node expansions – could generate consistent token demand even in bearish conditions.

What the Rotation Into Pepenode Means for the Market

For many traders, the move into Pepenode reflects a broader shift in post-crash behavior. Instead of abandoning the market altogether, investors are reallocating into smaller, more creative ecosystems where upside remains possible.

This rotation is both psychological and structural. The market crash flushed excess leverage and speculative froth from larger caps, creating space for new themes to emerge. Meme-based innovation – once dismissed as unserious – has become one of the most resilient categories, powered by grassroots participation.

In that sense, Pepenode’s success is not just a meme story but a sign of evolving investor logic. Retail traders are experimenting with projects that combine humor, utility, and deflationary economics, signaling a maturing approach to risk in speculative markets.

Cautious Optimism as Investors Hunt for the Next Narrative

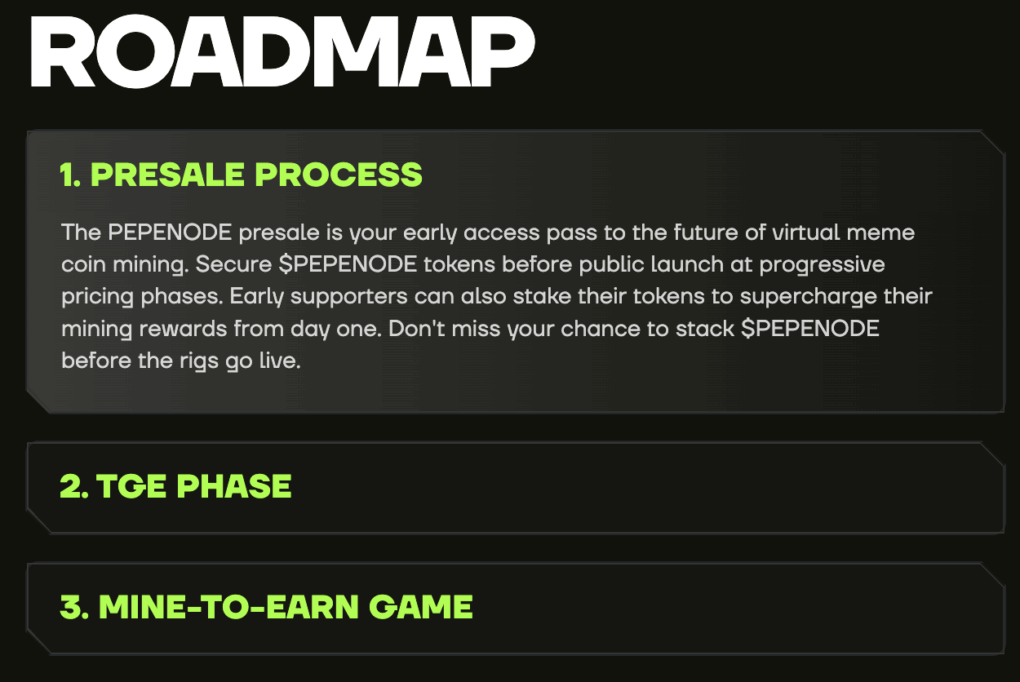

Still, even as Pepenode gains traction, analysts urge caution. Its success depends on maintaining engagement and delivering on the roadmap beyond the presale. Gamified ecosystems can proliferate but burn out just as fast if updates lag or token incentives falter.

That said, early presale metrics and community momentum indicate that Pepenode may have struck the right balance between playability and profitability. With $2 million raised and strong participation despite the crypto downturn, it’s proving that innovation can thrive even when markets stumble.

If the project sustains this pace through its upcoming phases, it could emerge as one of the few post-market crash winners and possibly a new template for how meme coins evolve in 2025 and beyond.

A Bright Spot in a Bleak Market

The recent market crash has tested investor patience, liquidated overleveraged positions, and drained liquidity from the crypto sector. Yet, amid the red charts and declining sentiment, Pepenode stands out as a project that’s rewriting the narrative.

EARN BY MINING WITH PEPENODE NOW

By gamifying mining, introducing deflationary mechanics, and anchoring value in community engagement, Pepenode has turned a bear market into an opportunity. Whether it ultimately becomes a breakout success will depend on long-term execution, but for now, it’s clear that smart investors are paying attention.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency markets are highly volatile, and investors should conduct their own due diligence before participating in any presale or token purchase.