Bitcoin’s sharp fall below $104,000 has triggered widespread panic across the crypto market, but one project – Bitcoin Hyper – is moving in the opposite direction. As the presale surpasses $26 million, many traders believe this new Layer-2 token could be the best crypto to buy now amid the chaos.

The cryptocurrency sector endured one of its toughest weeks of 2025 as a sudden Bitcoin crash rattled markets and wiped out billions in value. Bitcoin’s price has plunged to $101,661, marking a 7.21% drop over the past 5 days and its lowest level since June. The slide has erased around 17.5% from the digital asset’s October highs, reinforcing investor fears that the bull cycle might be losing steam.

The selloff quickly spread to the wider crypto market. Ethereum dropped nearly 13% and XRP lost 11%. Solana and other major altcoins followed suit, tumbling between 5% and 9%. Within 24 hours on Tuesday, liquidation trackers showed that $1.37 billion in leveraged positions were wiped out, one of the largest single-day washouts since the early 2024 correction.

Market sentiment, once firmly bullish, has turned fragile. The Fear and Greed Index slipped to extreme fear as futures premiums collapsed and funding rates flipped negative. Prediction markets indicate that 71% of traders now expect Bitcoin to revisit $100,000 before rebounding toward $120,000 – a complete reversal from early November expectations.

The Causes Behind Bitcoin’s Sudden Decline

The roots of this Bitcoin crash go beyond technical corrections. A cascade of factors converged to create the perfect storm. A DeFi sector shock was the initial spark: Stream Finance disclosed a $93 million loss on Monday, pushing fears of contagion across lending and stablecoin markets. Total bad debt within DeFi has now swelled beyond $280 million, while multiple vaults are facing forced redemptions.

This on-chain stress collided with worsening macro conditions. Weak U.S. employment data and renewed hawkish sentiment from the Federal Reserve triggered a broader risk-off mood, while volatility in the bond market compounded the unease. By the time Bitcoin broke its $106,000 support, heavy leverage in derivatives markets made a liquidation spiral almost inevitable.

Funding rates had climbed to +0.0026%, showing that bullish traders were overextended. When the price slipped, $1.22 billion in long positions were automatically liquidated, amplifying the crash. Adding to the pain, US-based spot Bitcoin ETFs reported $1.15 billion in outflows in just three days – a signal that even institutional investors were exiting to the sidelines.

Amid Panic, Bitcoin Hyper Defies the Downtrend

While most digital assets are bleeding, Bitcoin Hyper ($HYPER) has become an unlikely bright spot. The project’s presale has surged past $25.7 million, nearing the $26 million mark even as markets tremble. Its resilience has caught traders’ attention and led many to label it the best crypto to buy now during the downturn.

Unlike the speculative altcoins hit hardest by the crash, Bitcoin Hyper offers a more structural proposition. It’s a Layer-2 network built on the Bitcoin blockchain, designed to fix the one thing Bitcoin has never managed to solve: scalability. By enabling faster transactions and smart contracts, Bitcoin Hyper bridges the gap between Bitcoin’s unmatched security and the performance of modern blockchains, such as Solana and Avalanche.

What Bitcoin Hyper Does and Why It Matters Now

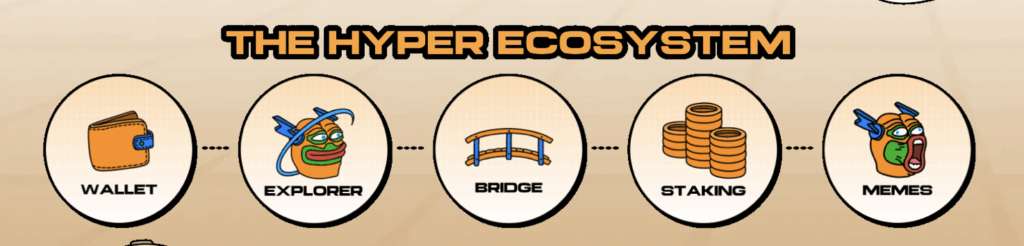

At its core, Bitcoin Hyper uses the Solana Virtual Machine (SVM) to achieve transaction speeds of over 65,000 TPS, compared to Bitcoin’s modest 3–4 TPS. This allows users to bridge BTC onto the Hyper network, wrap it into a tokenised version, and access decentralised applications, staking, and even DeFi trading – all while keeping their assets secured by Bitcoin’s base layer.

Smart contracts written in Rust execute almost instantly and at near-zero fees. That gives developers the tools to build scalable applications while maintaining trust in Bitcoin’s underlying network – a combination that the market has been waiting for since Bitcoin’s inception.

The timing couldn’t be more striking. With trust in centralized exchanges and DeFi protocols shaken by the recent wave of losses, traders are seeking infrastructure-level innovation rather than short-term speculation. Bitcoin Hyper fits that narrative perfectly – offering real functionality rather than hype.

Inside the Bitcoin Hyper Presale: $26M and Counting

The HYPER token presale has become one of the largest of 2025, attracting retail and institutional investors alike. Structured in pricing tiers, the token currently sells at $0.013225, with each round’s price incrementally rising. Early participants can buy using ETH, USDT, BNB, SOL, or even debit and credit cards, and all transactions occur through a fully transparent smart-contract process.

More than 1.15 billion tokens are already locked in staking, with rewards as high as 46% APY, a figure that continues to draw attention as traditional yields remain low. No tokens circulate until the Token Generation Event (TGE), reducing the risk of pre-launch dumps that often undermine early-stage projects.

Once the presale concludes, Bitcoin Hyper will be listed on leading decentralized exchanges, likely starting with Uniswap. The project has also confirmed that liquidity provisioning will be handled internally, ensuring a stable post-launch environment.

Why Traders See Bitcoin Hyper as the Best Crypto to Buy Now

Traders are treating Bitcoin Hyper as a rare refuge in a volatile market and for good reason. The project builds on Bitcoin’s brand trust while solving its most persistent weakness: slow transaction speeds. Unlike speculative meme coins, Bitcoin Hyper offers a tangible infrastructure utility that can support future applications, ranging from tokenized real-world assets to high-frequency trading platforms.

Ethereum’s own growth story offers a telling comparison. The success of Layer-2 networks like Arbitrum and Optimism has already proven that scalability solutions can outperform their base chains in transaction count and adoption. Bitcoin Hyper aims to replicate that success within the Bitcoin ecosystem, potentially unlocking the next wave of innovation and capital inflow – for the world’s largest blockchain.

As analyst reports note, Layer-2 solutions tend to outperform during recovery cycles. When market volatility subsides, capital often shifts from blue chips like Bitcoin into higher-beta plays with technical merit. That rotation could benefit Bitcoin Hyper if it becomes the go-to platform for developers seeking both performance and the Bitcoin security model.

What the Bitcoin Crash Reveals

The ongoing Bitcoin crash highlights a crucial truth about the current market: leverage and sentiment remain the biggest vulnerabilities. Yet, it also reveals where investors are turning when fear takes over. Projects like Bitcoin Hyper, which offer structural improvements, clear roadmaps, and transparent tokenomics, tend to attract capital even when others falter.

This shift reflects a more mature investor mindset. Instead of chasing short-term gains, traders are now hunting for tokens that strengthen the ecosystem itself. In this environment, Bitcoin Hyper’s technical foundation and alignment with Bitcoin’s long-term security ethos make it an appealing candidate for both developers and holders seeking stable growth prospects.

Can Bitcoin Hyper Drive the Next Layer-2 Wave?

For all its volatility, Bitcoin remains the anchor of digital finance and its ecosystem’s evolution is inevitable. If Bitcoin Hyper succeeds in executing its roadmap, it could become the first widely adopted Bitcoin Layer-2 to support decentralised finance, smart contracts, and high-speed payments at scale.

Such an achievement could trigger a new phase of capital rotation within the cryptocurrency sector, similar to Ethereum’s Layer 2 boom in 2023. While no project is immune to risk, Bitcoin Hyper’s timing and execution give it a significant head start.

Building During the Storm

The Bitcoin crash has exposed fragility across the market, from overleveraged traders to vulnerabilities in DeFi protocols. Yet, it has also highlighted where innovation persists. As panic grips speculative assets, projects offering real technological advancement – like Bitcoin Hyper – continue to gain traction.

INVEST IN BITCOIN HYPER BEFORE THE PRICE RISES

With over $25 million raised, transparent governance, and a clear utility model, Bitcoin Hyper exemplifies how innovation can still thrive amid turmoil. Whether it becomes the best crypto to buy now or simply the first step in Bitcoin’s Layer-2 expansion, one thing is clear: the next wave of blockchain progress may be born from this very crash.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Cryptocurrency markets are volatile and speculative. Always conduct your own research before investing.