The crypto market is entering one of its most critical phases of 2025. While Bitcoin ETFs have dominated financial headlines for most of the year, the latest data shows that institutional enthusiasm might finally be cooling. Yet, amid the turbulence, new innovation could hold the key to the next bull run, and it might come not from Wall Street, but from the code powering Bitcoin itself – Bitcoin Hyper.

Late last month, cryptocurrency ETFs posted their largest outflows in weeks. BlackRock, the world’s biggest asset manager and one of the central forces behind Bitcoin’s institutional adoption, sold 2,724 BTC – worth over $292 million – in a single day.

According to data from HeyApollo, BlackRock’s total holdings still stand at 802,810 BTC, valued at approximately $87.4 billion. However, after losing roughly $519 million in assets under management this week, questions are emerging about whether Bitcoin ETFs can continue to sustain market momentum.

The sell-off coincided with a $500 million fraud scandal involving BlackRock’s HPS division, discovered just days after the firm completed a $12 billion buyout. The controversy, which included allegations of fake invoices and forged contracts, sent shockwaves through the financial community and raised concerns about oversight at a time when digital-asset regulation is already under scrutiny.

Despite these negative headlines, the broader picture remains mixed. While the daily chart showed outflows totaling 4,559 BTC (approximately $490 million), the monthly figures were still positive, up 30,904 BTC, worth over $3.5 billion. This contradiction highlights a market in transition: institutional adoption continues to expand, yet short-term sentiment remains fragile.

Bitcoin itself has dropped below the $110,000 mark, a sign that long-term fundamentals remain intact. As ETF enthusiasm wavers and scandals shake confidence, investors are looking elsewhere for signs of sustainable growth, and that’s where Bitcoin Hyper ($HYPER) enters the conversation.

Why the Next Bull Run Might Be Built on Infrastructure, Not ETFs

The approval of spot Bitcoin ETFs in late 2024 marked a historic milestone, but it also revealed a deeper truth about the growth cycle of crypto. ETFs make Bitcoin accessible to traditional investors, yet they don’t expand Bitcoin’s underlying utility. They’re a financial wrapper, not a technological advancement.

That’s why the next bull run may be sparked by innovation at the protocol level – new infrastructure that enhances Bitcoin’s capabilities rather than simply monetising its price.

Enter Bitcoin Hyper, a project that seeks to transform Bitcoin from a slow, store-of-value network into a scalable, DeFi-ready platform.

While Bitcoin’s price action below $110,000 grabs headlines, the real innovation is happening beneath the surface. Bitcoin Hyper’s emergence has captured the attention of developers and investors who believe Bitcoin’s next growth phase depends on solving its scalability bottleneck.

Tackling Bitcoin’s Long-Standing Limitations

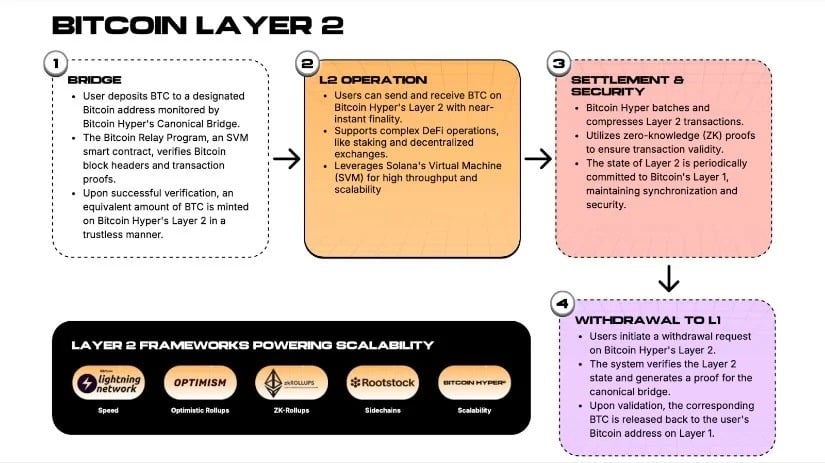

Bitcoin currently processes roughly seven transactions per second (TPS). That speed was acceptable in 2011, but it’s unworkable for modern use cases, such as gaming, lending, or decentralized finance. Bitcoin Hyper introduces a Layer-2 solution that uses ZK-rollups and the Solana Virtual Machine (SVM) to achieve transaction speeds similar to Solana – thousands per second – while maintaining Bitcoin’s security by anchoring final settlement to the main chain.

This hybrid design bridges two worlds: Bitcoin’s unmatched liquidity and trust and Solana’s speed and programmability. It could make Bitcoin compatible with the same types of decentralised applications (dApps) that thrive on Ethereum and other high-performance blockchains.

Introducing Programmability to Bitcoin

The integration of the Solana Virtual Machine enables smart contracts to operate natively within Bitcoin’s ecosystem – something previously considered impossible without compromising decentralization. Through Bitcoin Hyper, developers can build DeFi protocols, NFT platforms, and Web3 games using Bitcoin as the base layer of value.

To connect these systems, Bitcoin Hyper will deploy a Canonical Bridge, allowing users to convert BTC into wrapped tokens that interact with the Layer-2 network. This creates liquidity for activities such as staking, lending, and governance, effectively transforming Bitcoin from a passive asset into a productive one.

The Bitcoin Hyper Token: Central to the New Ecosystem

At the center of this ambitious framework is the Bitcoin Hyper token ($HYPER), the native asset that powers transactions, governance, and staking on the network. HYPER holders gain access to lower fees, exclusive staking rewards, and the ability to vote on ecosystem upgrades.

While the project is still in its presale phase, momentum has been staggering. More than $25.6 million has already been raised, with whales actively accumulating. On-chain data shows one investor recently purchased $93,000 worth of HYPER, while another added over $12,000. This activity mirrors the early-cycle accumulation patterns observed during previous bull runs.

Crypto analyst Crypto June described Bitcoin Hyper as a “technological inflection point” for Bitcoin – the kind of upgrade that could “power BTC’s next era.” His view aligns with a broader market sentiment that real growth now depends on extending Bitcoin’s utility, not just its price.

From ETFs to Innovation: A Shift in Market Leadership

The timing of Bitcoin Hyper’s rise is no coincidence. As ETF inflows cool and Wall Street narratives falter, retail and crypto-native investors are rotating toward infrastructure plays – projects that can expand blockchain usability. This shift mirrors earlier cycles, where Ethereum’s DeFi boom followed Bitcoin’s ETF hype and Solana’s rise came after institutional consolidation.

In this context, Bitcoin Hyper isn’t competing with ETFs; it’s complementing them. ETFs invite capital into Bitcoin; Hyper gives that capital a productive outlet.

Moreover, with rate cuts anticipated in 2026 and liquidity expected to rise, the appetite for innovative Layer-2 solutions could grow rapidly. History shows that when Bitcoin stabilizes, attention shifts to ecosystems built around it, and HYPER is positioning itself to capture that momentum.

Staking and Community Growth: Early Signs of Confidence

One of Bitcoin Hyper’s strongest indicators of early confidence is its staking activity. Over 1.1 billion HYPER tokens have already been locked into the project’s staking pools, offering a reported 46% annual yield. While high APYs should always be approached cautiously, such participation suggests genuine engagement from the community, not just speculative trading.

The presale’s dynamic pricing model – currently at $0.013205 per token – also creates urgency among early adopters. Prices rise incrementally with each phase, aligning long-term incentives with project milestones.

The Broader Picture: Bitcoin’s Evolution Beyond ETFs

Even as BlackRock and Fidelity dominate ETF headlines, the underlying narrative is shifting from investment vehicles to infrastructure development. For the crypto economy to sustain another bull run, it needs more than inflows; it needs utility, scalability, and real-world integration.

Projects like Bitcoin Hyper are part of that next wave – bringing Bitcoin into the world of programmable money and setting the stage for an era where BTC can compete directly with Ethereum, Solana, and other smart-contract ecosystems.

Innovation May Outlast Financial Hype

While Bitcoin ETFs remain important for legitimising crypto in traditional finance, they may not be the spark that ignites the next bull run. Institutional outflows, fraud concerns, and regulatory fatigue are symptoms of a maturing market – one that now looks beyond price exposure toward tangible technological progress.

The Bitcoin Hyper token represents that progress. Its Layer-2 vision aligns with where blockchain adoption is heading: faster, cheaper, and more useful. If successful, Bitcoin Hyper could do for Bitcoin what Layer-2s did for Ethereum – turn a store of value into a living economy.

BE PART OF BITCOIN’S FUTURE WITH BITCOIN HYPER

Whether or not it becomes the ultimate bull-run trigger remains to be seen, but one thing is certain: as ETFs lose their luster, innovation is back in the driver’s seat and Bitcoin Hyper is firmly in the spotlight.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile. Always conduct your own research before investing in digital assets.