As Bitcoin hovers near $110,000 and DeFi momentum builds, Q4 2025 could mark the start of crypto’s next major rally. But unlike past cycles, capital is moving with precision. Here are five standout projects – Bitcoin Hyper, Maxi Doge, Pepenode, Best Wallet, and SUBBD – that are capturing investor attention ahead of the next bull run.

The question hanging over the entire crypto market as we head deeper into Q4 2025 is simple: Are we still in a bull run, or has that run ended?

Bitcoin briefly reached a new all-time high of around $126,000 in October 2021 before cooling to the $110K–$115K range. Ethereum is still holding above $4,000 on hopes that the Fusaka hard fork expected in November 2025 will improve network performance.

Spot Bitcoin ETFs continue to drive demand from traditional capital, and institutional exposure to ETH is expanding through spot Ethereum ETFs. Total crypto market cap is back near $3.8 trillion after bouncing off support, and the Relative Strength Index (RSI) for the total market has recovered to neutral-bullish territory. Altcoins are lagging, but selective narratives – AI, DeFi, scaling – are quietly rotating higher.

In other words, conditions for a broader bull run are still intact, but capital is more selective than in previous cycles. Instead of blindly buying anything with a ticker, investors are mapping narratives to utility.

That’s where five specific projects – Bitcoin Hyper, Maxi Doge, Pepenode, Best Wallet, and SUBBD – are getting attention. Each touches a different structural theme emerging in late 2025: Bitcoin scaling, community-led memecoins, gamified mining, crypto infrastructure, and AI-powered creator monetisation.

Below, we break down the 5 best crypto projects to watch before the next major leg up and why they matter in the context of the current market structure.

1. Bitcoin Hyper – A Bitcoin Layer 2 Built for Throughput

Bitcoin dominance has climbed back toward 59% and remains the gravitational centre of crypto. ETFs, corporate treasury buys, and macro positioning around rate cuts have made BTC behave more like “digital gold” than a tech stock. The problem for builders has always been: Bitcoin is secure, but it’s slow. Around 7 transactions per second is not workable for payments, DeFi, or on-chain commerce at a global scale.

Bitcoin Hyper is aiming at that exact pressure point. It positions itself as a Bitcoin Layer 2 that uses the Solana Virtual Machine (SVM) for execution while anchoring final settlement to Bitcoin. In practice, that means sub-second confirmation speeds and thousands of transactions per second, while still leaning on Bitcoin’s security guarantees. The design uses ZK-rollup style batching to aggregate high-throughput activity and route finality back to Bitcoin’s base layer. That gives developers Solana-like speed but with Bitcoin’s liquidity.

Why this matters as we enter a possible 2025 bull run: Liquidity tends to flow to infrastructure when adoption accelerates. Suppose Bitcoin Hyper can realistically push fast settlement, smart contract support, and DeFi rails around BTC without trying to hard-fork Bitcoin itself. In that case, it becomes part of the scaling story rather than the “replace Bitcoin” story. That positioning is attractive to institutions that view Bitcoin as the safest asset in crypto, yet still seek yield, lending, tokenization, and programmable money.

The early signal here is funding. Bitcoin Hyper’s presale has reportedly attracted around $25 million. That’s not proof of long-term viability, but it is proof of attention in a market where capital is becoming more discerning. Speculation about a rate cut, along with a renewed appetite for Bitcoin-linked products, adds a tailwind.

INVEST IN $HYPER NOW BEFORE THE PRICE BUMPS

Key themes to watch:

· Can Bitcoin Hyper attract builders who would otherwise deploy to Solana or Base?

· Does it actually route meaningful activity back to BTC, or does it become another isolated sidechain?

· Will it ship audited bridges and keep security assumptions transparent?

2. Maxi Doge – The Next High-Beta Meme or Just Another Meme?

Memecoins reliably reappear at the edge of every bull cycle. That’s not an accident. Narrative coins serve as a liquidity release valve: when majors like BTC and ETH consolidate, traders seek volatility. In late 2025, one of the names pulling attention is Maxi Doge ($MAXI).

Maxi Doge leans into memetics in a very self-aware way. The character – a degenerate “gym bro” cousin of Doge who only buys green candles and never uses stop-loss – isn’t just branding; it’s identity-building. The project openly markets itself to traders who see risk as part of the lifestyle, not something to be hedged away. That cultural clarity matters in meme ecosystems. It creates cohesion.

But Maxi Doge is trying to move beyond pure meme and into recurring engagement. Instead of “buy and hope,” the roadmap references trading contests, leaderboard rewards, and eventually even integration with leveraged trading environments that might allow extreme leverage (the marketing line pushes “1000x”). The idea is to gamify speculation itself, then distribute rewards in MAXI and USDT to sustain activity.

Here’s where the link to bull run conditions comes in. If Bitcoin stabilizes at six-figure territory and institutions continue to flow into ETFs, liquidity tends to trickle down. Historically, when large caps like XRP and DOGE start to run, microcaps (primarily narrative coins) can move violently because they’re cheaper to rotate into. Analysts pitching Maxi Doge argue that MAXI’s still-small market cap gives it far more theoretical upside than already established multi-billion-dollar meme coins. That logic is standard in every cycle, but it’s still relevant: structurally, small caps move faster.

Of course, high upside also means high wipeout risk. That’s the honest framing. For traders, Maxi Doge is not about stability. It’s about exposure to early-stage community coordination that could accelerate if we get an altcoin rotation in Q4 2025 or early 2026.

JOIN THE $MAXI PRESALE BEFORE IT GOES LIVE

Key themes to watch:

· Does MAXI actually deliver its competitive trading product and reward loops, or does it stall at vibes?

· How transparent are token allocations, unlock schedules, and treasury control?

· Can it retain holders during periods when BTC is rallying and sucking oxygen out of the room?

3. Pepenode – Mining for the People, Not the Warehouses

One under-reported shift going into this potential bull run is the evolution of “participation” products. Traditional Bitcoin mining is now industrial. Hashrate is at record highs, public miners are on NASDAQ, and the entry cost for a serious ASIC rig can run into the thousands of dollars, plus ongoing power costs. For regular users, mining is basically dead.

Pepenode ($PEPENODE) goes straight at that pain point. It bills itself as the first “mine-to-earn” crypto where players build virtual mining rigs in a gamified environment. Instead of physically plugging in hardware, you create and upgrade a digital server room using PEPENODE tokens. Your layout and node choices determine yield. In return, you earn not just PEPENODE, but potentially other meme coins like PEPE and FARTCOIN.

Under the hood, Pepenode is merging GameFi-era mechanics (customisation, upgrades, leaderboards) with deflationary tokenomics. The design says that 70% of tokens spent on upgrades are permanently burned. That’s intended to create long-term scarcity and reward people who keep reinvesting in their “rigs,” rather than exit immediately after buying.

This model sits nicely inside the current market structure. Retail wants yield, but doesn’t want to spin up industrial-scale infrastructure. Retail wants memes, but is clearly getting tired of memecoins with no function. Retail wants to feel early, but also wants some game-like loop instead of passive staking.

Another signal: Pepenode’s presale pricing (reported at around $0.0011227) and multi-million-dollar interest indicate that the team is hitting the overlap of “fun plus tokenomics plus upside.” Whether it can sustain engagement post-launch is a different question, but it’s undeniably aligned with how grassroots crypto participation has evolved this cycle.

HAVE FUN WHILE MINING WITH $PEPENODE

Key themes to watch:

· Will Pepenode’s mine-to-earn loop actually be engaging after month one, or does it become a dashboard you forget about?

· Can it avoid the inflation traps that killed most play-to-earn projects after 2021?

· How transparent is the burn, and can players independently verify it on-chain?

4. Best Wallet – Infrastructure for the Next Wave of Users

Every bull run has an “infrastructure winner.” In 2017, it was exchanges. In 2021, it was MetaMask and low-friction on-ramps. In 2025, the pitch is that we’re moving into a stablecoin-and-multichain world and whoever controls the gateway experience controls enormous value.

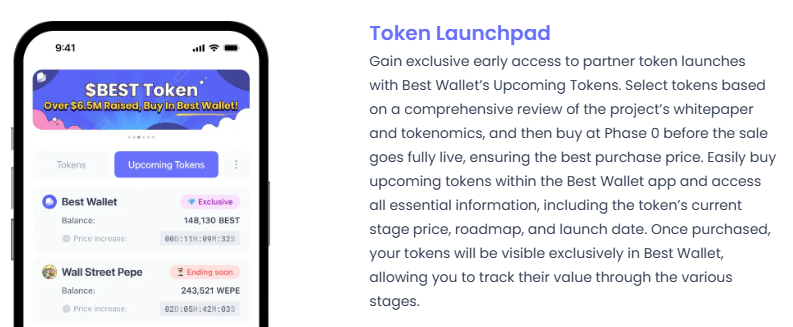

Best Wallet is angling to be that gateway. It’s a non-custodial mobile wallet that supports Bitcoin, Ethereum, Solana, BNB Chain, Base, and dozens of other networks with a stated roadmap to exceed 60 chains. The app integrates fiat on-ramps (card, bank, Apple Pay / Google Pay), swaps, portfolio tracking, staking aggregation, presale access through its “Upcoming Tokens” tab, and even early governance hooks via its own $BEST token.

That last point matters. Best Wallet isn’t just a wallet; it’s an ecosystem play. Holders of $BEST (currently in presale and said to have raised over $16.7M so far) get fee discounts, privileged access to new launches, and even perks tied to iGaming partners like lootboxes and bonus multipliers. The wallet is aiming to become the consumer interface layer for not just buying crypto, but also using crypto on a daily basis.

This matters for the broader market because the bull run narrative for 2025 isn’t only “number go up.” It’s “can normal people move money, stake and access opportunities without needing to understand RPC endpoints?” Wallet-level UX, especially across chains, will determine how much of the $3.8T total market cap becomes active liquidity versus idle speculation.

SECURE AND PROTECT YOUR CRYPTO WITH THE BEST WALLET

Key themes to watch:

· Can Best Wallet deliver on security claims (e.g., MPC custody features) while staying user-friendly?

· Will regulators tolerate deeply integrated presale access inside consumer wallets?

· Can it retain users against incumbents once MetaMask and Coinbase Wallet inevitably copy similar features?

5. SUBBD – AI, Creators and Tokenised Fan Economies

Suppose Bitcoin Hyper is about scaling, and Pepenode is about participation. In that case, SUBBD is about creator monetization and specifically how that ties into tokenized fandom as it enters the next stage of the bull run.

SUBBD is positioning itself as a decentralised creator platform powered by the $SUBBD token. The pitch: let creators monetise directly, accept crypto payments seamlessly, and build AI-driven experiences for fans without ceding control to Web2 platforms. The team reports that it has already connected with over 2,000 creators, boasting a combined reach of more than 250 million followers. That scale, if accurate and if those creators stay active, matters.

Where SUBBD really leans forward is its AI layer. The roadmap includes AI-generated creator personas, automated assistants, and even synthetic livestreams, allowing audiences to interact 24/7.

That sounds sci-fi, but it’s precisely where a lot of Web3 plus AI capital is rotating right now. Fans pay in crypto for access, custom content, behind-the-scenes drops, and VIP interactions. Creators keep more of the revenue. $SUBBD becomes the access key, staking asset (with a quoted 20% APY), and discount mechanism inside that economy.

Why does this matter for a potential 2025/2026 bull run? One of the most resilient secular trends in crypto is the tokenization of attention. If SUBBD can convert followers into recurring, on-chain commerce, and do it with lower platform fees and instant settlement, it aligns directly with where consumer crypto is heading. That’s especially relevant in Africa and emerging markets, where creators often struggle to monetise across borders due to payment friction.

Of course, SUBBD is still in presale, and early-stage risk is high. Its success will depend on whether those creators actively onboard fans, not just sign MOUs, but also align with AI-driven media and decentralized payouts, which are on trend.

JOIN SUBBD AND ENJOY THE BENEFITS OF THE CREATOR ECONOMY

Key themes to watch:

· Will fans actually pay in $SUBBD, or will they stick to stablecoins and fiat rails?

· Can SUBBD deliver a reliable payout infrastructure without banking partners cutting them off?

· Will regulators treat AI “personas” as protected IP or something closer to synthetic adult content, with all the policy friction that implies?

Positioning for the Next Leg of the Bull Run

The broader market setup heading into late 2025 remains constructive. Bitcoin’s ETF-fuelled legitimacy, Ethereum’s institutionalisation, and the $3.8T total market cap recovery are all signals that risk appetite hasn’t left – it’s just more targeted. We’re in a phase where the bull run isn’t just about price discovery; it’s about infrastructure, scalability, utility, and culture.

Bitcoin Hyper addresses scalability issues related to Bitcoin. Maxi Doge speaks to culture and speculative energy. Pepenode speaks to accessible participation. Best Wallet speaks to infrastructure. SUBBD addresses creator monetization in a Web3 economy.

If liquidity rotates out of majors and into higher-risk assets – something that tends to happen once Bitcoin calms down – these are the kinds of projects traders will be watching. None of them is guaranteed to win. All of them carry meaningful downsides, but together, they outline where crypto appears to be heading as the next phase of the bull run takes shape.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrencies, including Pepenode, are highly volatile and speculative assets. Readers should conduct independent research and consult licensed professionals before making financial decisions.