A bipartisan US bill aimed at clarifying crypto regulation could finally unlock the long-awaited Web3 expansion in America. As policymakers bring structure to digital assets, new projects like Pepenode are reimagining mining – turning it from an industrial pursuit into an accessible, gamified experience for everyday players.

The US Senate Agriculture Committee has completed an updated draft of the long-anticipated Crypto Market Structure Bill, which seeks to provide long-overdue clarity in how digital assets are regulated. The committee is expected to publish the bill within days, marking a significant step forward for the United States’ role in the evolving Web3 economy.

This bipartisan legislation establishes a dual regulatory framework, assigning the Commodity Futures Trading Commission (CFTC) oversight of digital commodities. At the same time, the Securities and Exchange Commission (SEC) will continue to oversee assets that are deemed securities. The framework introduces three key asset classifications: digital commodities, investment contract assets, and permitted payment stablecoins. This provides both developers and investors with a clearer understanding of where their projects fall under federal law.

For years, uncertainty over crypto regulation has been one of the biggest obstacles to Web3 innovation in the United States. The new bill’s structure aims to strike a balance between innovation and investor protection, a combination that has eluded policymakers for much of the last decade.

A critical change in the latest draft was the removal of automatic securities classifications for staking, DePIN, and airdrop mechanisms – all critical elements of emerging Web3 ecosystems. This amendment, industry observers say, signals that lawmakers are beginning to appreciate the diversity of blockchain use cases beyond speculative trading.

Bipartisan Progress After Years of Division

After months of political deadlock, the Crypto Market Structure Bill is gaining rare bipartisan traction. Lawmakers from both sides of the aisle now appear motivated to reach consensus, particularly after recent roundtables featuring executives from Coinbase and Ripple.

Senate staff involved in the process report that they are “90% aligned” on key frameworks. Coinbase CEO Brian Armstrong echoed this sentiment, calling the bill “a significant leap forward for innovation in the US.” Analysts expect the legislation could be finalised before year’s end – a timeline that, if met, would provide long-needed clarity to Web3 businesses currently operating in regulatory grey areas.

The bill’s dual-agency model is seen as a pragmatic compromise. Defining more precise jurisdictional boundaries reduces the tug-of-war between the SEC and CFTC that has frustrated the crypto industry for years. More importantly, it gives entrepreneurs a map – a predictable compliance route to build applications, networks, and services in the United States without fear of shifting interpretations.

The outcome is not just regulatory relief; it’s a potential catalyst for growth in the broader Web3 movement. As innovation migrates toward clear frameworks, retail participation and infrastructure development could follow suit.

Why Clear Rules Could Reignite Web3 Innovation

For developers and investors alike, regulatory clarity represents confidence. The Crypto Market Structure Bill effectively sets the stage for Web3 to expand beyond speculative trading and into scalable, real-world applications.

Web3’s promise – decentralized identity, gaming economies, and tokenized assets – has often clashed with outdated financial laws. This bill could bridge that gap by providing both startups and institutions with the legal certainty they need to operate within the system rather than around it.

Projects like Pepenode ($PEPENODE) exemplify this next phase of innovation. As the industry shifts from complex, capital-intensive operations toward gamified and community-based ecosystems, Pepenode’s approach captures the core ethos of Web3 – participation without barriers.

Pepenode’s Web3 Vision

Large institutional players have long dominated traditional crypto mining. The days when individuals could profitably mine Bitcoin on a home computer are long gone. Today, with the Bitcoin network’s hashrate hitting a record 1.36 ZH/s, mining requires enterprise-grade ASICs and enormous energy reserves.

A single high-end rig, such as an Antminer S21, can cost up to $7,000 and consume over 3,500 watts of electricity. Unsurprisingly, mining has become an institutional arms race – 16 mining companies are now listed on NASDAQ, according to ChainUp data. Retail miners, squeezed out by cost and competition, have been mainly relegated to spectatorship.

Pepenode wants to change that. The project’s mine-to-earn model brings the mechanics of mining into a virtual environment, allowing anyone to participate – not with expensive hardware, but through gameplay. Users can build and upgrade virtual mining rigs, earning real rewards in $PEPENODE tokens and other popular meme coins like PEPE and FARTCOIN.

This approach democratises mining while preserving the competitive spirit that once defined early crypto culture. It’s a fusion of strategy, gaming, and token economics – all aligned with Web3’s vision of decentralised participation.

How Pepenode Makes Mining Simple

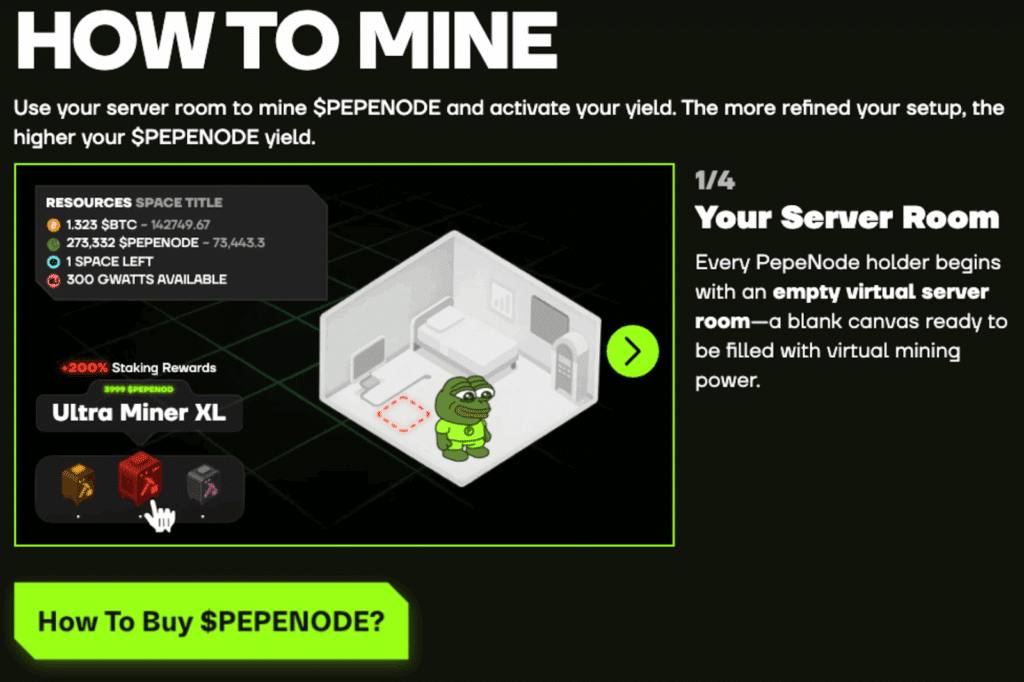

Inside Pepenode’s ecosystem, players start with an empty digital server room. Using PEPENODE tokens purchased during the presale, they can buy and upgrade miner nodes, expand facilities, and enhance performance. Each upgrade boosts yield efficiency, simulating real-world mining dynamics but without the overhead or energy demands.

Unlike the static dashboards of traditional staking platforms, Pepenode’s interface is interactive and immersive. As users invest more time and strategy into building their mining operations, their earnings potential grows.

The tokenomics are designed to reward sustained participation. Each transaction within the game burns 70% of the tokens used, introducing a deflationary mechanic that supports long-term value stability. Players can also earn other meme coins through their activity – tying community engagement directly to economic incentives.

This blend of play and productivity embodies what many consider the heart of Web3: active contribution and transparent reward mechanisms.

Why Projects Like Pepenode Matter in the Web3 Era

Web3 isn’t just about decentralisation; it’s about empowerment. Projects like Pepenode lower the barriers to entry by making blockchain participation tangible and enjoyable. By transforming mining into a game, it reconnects users to the underlying value-creation process – something that institutional mining has largely abstracted away.

Moreover, Pepenode’s fully audited smart contract and early integration with tools like Best Wallet add a layer of credibility often missing in early-stage GameFi projects. The project’s upcoming token claim feature, built into Best Wallet’s “Upcoming Tokens” dashboard, further streamlines access for everyday users, making onboarding simpler and safer.

In many ways, Pepenode’s model illustrates how regulation and innovation can complement each other. As the United States prepares to formalise crypto oversight, projects that focus on accessibility and transparency are likely to thrive. A clear legal framework reduces risk, while gamified platforms like Pepenode make participation appealing – a dynamic combination for Web3 adoption.

Regulation Meets Reinvention

If the Crypto Market Structure Bill achieves what its drafters intend, it could mark the beginning of a more inclusive digital economy. More precise boundaries between commodities and securities will help innovators design compliant systems from the outset, fostering growth in areas such as decentralized finance, NFTs, and digital gaming economies.

At the same time, accessible projects like Pepenode are shaping what the next generation of Web3 experiences could look like – participatory, gamified, and community-driven. For many retail investors who missed early crypto booms, initiatives like this represent a fresh entry point into an increasingly complex ecosystem.

As lawmakers debate policy on Capitol Hill, the market continues to evolve on-chain. Pepenode’s mine-to-earn model may be just one example. Still, it encapsulates a broader shift toward making blockchain usable, fun, and rewarding – precisely the kind of innovation that clearer US regulation could empower on a national scale.

MINE-TO-EARN WITH PEPENODE NOW

The US Senate’s forthcoming Crypto Market Structure Bill could provide the clarity needed for Web3 to mature into a mainstream digital economy. Defining the lines between securities, commodities, and payment tokens sets a stable foundation for innovation to flourish.

Meanwhile, projects like Pepenode are already demonstrating what that innovation looks like in practice: open access, gamified participation, and shared value creation. Together, regulation and reinvention may form the twin pillars that propel Web3 into its next growth phase – one where participation is no longer exclusive to institutions but open to everyone.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrencies, including Pepenode, are highly volatile and speculative assets. Readers should conduct independent research and consult licensed professionals before making financial decisions.