When Ferrari auctions its 499P hypercar exclusively via blockchain tokens and cryptocurrency payments, it highlights how luxury markets are embracing next-gen finance. Meanwhile, Bitcoin Hyper is positioning itself as the technical counterpart – the fastest Bitcoin Layer-2 chain designed to support the kind of tokenised economy Ferrari just tapped.

Ferrari has taken a bold step into the world of blockchain by announcing the first crypto-only auction for its 499P hypercar. Reserved for its ultra-exclusive “Hyperclub” of just 100 endurance-racing enthusiasts, bidders will acquire a dedicated digital token – the “Token Ferrari 499P” – created in collaboration with Italian fintech firm Conio.

Payments will be accepted in Bitcoin, Ethereum or USDC, then automatically converted into fiat to complete the transaction. The event, scheduled for the 2027 World Endurance Championship, integrates artificial intelligence for fraud detection, trend analysis, and a seamless crypto bidding experience.

Ferrari is clearly targeting a new generation of crypto-rich buyers – tech-native investors, blockchain entrepreneurs, and digital asset collectors. It’s a high-profile demonstration that crypto payments are not only legitimate but increasingly desirable among luxury brands seeking fresh relevance and deeper digital integration.

By blending its racing heritage with technical innovation, Ferrari is signalling a future in which auctions for elite assets are not hosted behind closed doors, but secured via blockchain to provide transparency, immediacy, and verified provenance for every bid.

Bitcoin Hyper: Building the Rails for Tokenised Premium Assets

As Ferrari experiments with tokenised ownership and blockchain settlement, the infrastructure required to support real-world crypto transactions becomes critical. This is where Bitcoin Hyper ($HYPER) comes into play.

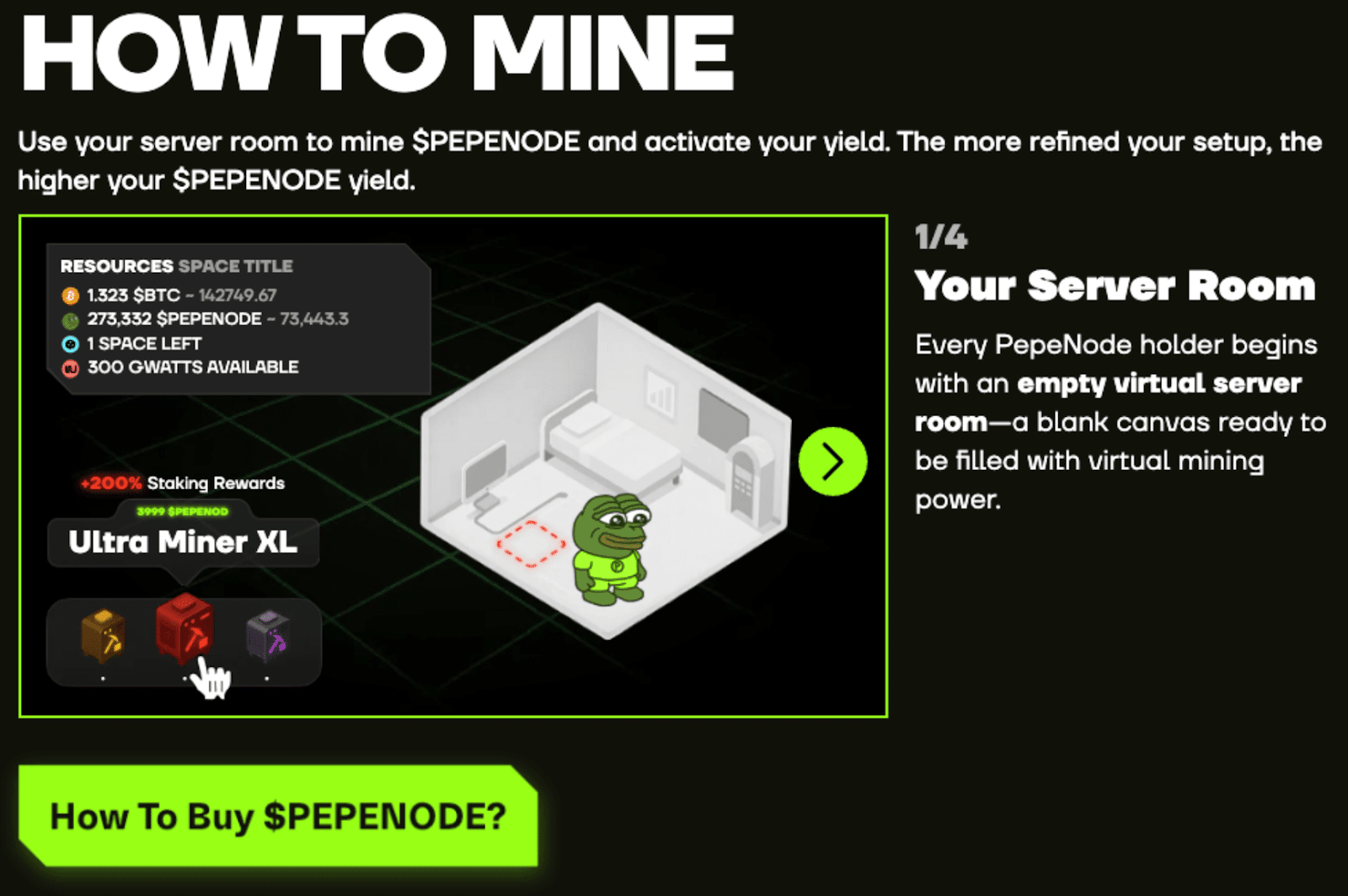

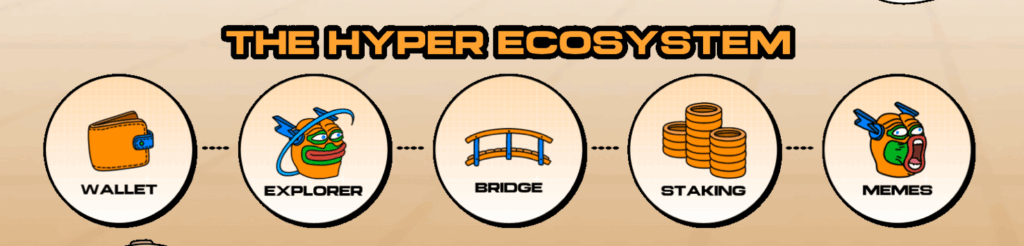

Bitcoin Hyper presents itself as the fastest Bitcoin Layer-2 to date—a full execution network where payments, DeFi, dApps, and even meme coins operate seamlessly. Instead of behaving like a conventional sidechain, it uses the Solana Virtual Machine (SVM) to deliver sub-second transaction speeds and near-zero gas fees within a Bitcoin-anchored environment, addressing the throughput limitations that have historically restricted Bitcoin’s usability.

Bitcoin remains the base-layer store of value, while Bitcoin Hyper positions itself as the layer where value actually moves. Developers get scalable infrastructure; traders and everyday users get a Bitcoin network that is spending-ready, cross-chain compatible, and fast enough to support modern financial activity.

The $HYPER token powers payments, governance, staking, and exclusive access to launches, embedding the token at the heart of the project’s economic model.

The presale has raised around $24.8 million so far, driven by investor interest in extending Bitcoin’s functionality and preparing for broader utility in retail, digital ownership, and tokenized real-world asset models – all areas highlighted by Ferrari’s auction vision.

Where Ferrari Meets the Layer-2 Narrative

Ferrari’s hypercar auction does more than disrupt the culture of automotive luxury – it validates core use cases that infrastructure projects like Bitcoin Hyper aim to enable. Tokenised luxury assets require speedy, low-fee settlement, while buyers demand transparency and cross-chain liquidity for the capital they deploy.

Ferrari’s adoption of crypto in a premium setting demonstrates that blockchain is no longer merely an alternative finance system – it is becoming embedded in the purchasing behaviours of elite consumers. Bitcoin Hyper’s mission is to ensure that this kind of token-driven interaction can scale efficiently and affordably across multiple chains that participate in global commerce.

At the same time, the emergence of exclusive community tokens, such as Ferrari’s 499P Token, points to new models where ownership, fan access, and purchasing power coexist within blockchain environments. Infrastructure capable of hosting these models rapidly gains relevance.

Skepticism Still Has a Place

Bold experiments invite scrutiny. Ferrari’s crypto auction represents a symbolic leap, but it must navigate the realities of crypto volatility, shifting regulation, and digital asset taxation. Wealth preservation and compliance still matter deeply to high-net-worth individuals, and crypto must demonstrate it can meet those expectations reliably.

Similarly, Bitcoin Hyper faces demands for transparency that go beyond marketing claims. Investors expect a working testnet, visible development progress, and verified audits before relying on the network for high-value execution.

As luxury and decentralised finance converge, credibility will determine which experiments become industry standards and which fade after the hype.

A Premium Test Case for Crypto and What Comes Next

Ferrari is providing a high-profile glimpse into the future of exclusive transactions: seamless verification, instant settlement, and token-based access that transforms buying into participation.

Meanwhile, the Bitcoin Layer-2 sector is rapidly evolving as builders work to address the scalability challenges that have kept Bitcoin relegated to a passive role in global payments. Bitcoin Hyper’s narrative suggests that Bitcoin’s next decade is about movement – fast, borderless, and functional.

Luxury, tokenisation, and infrastructure create a powerful triangle. Ferrari is showing potential at the top of the market. Bitcoin Hyper is racing to build the rails beneath that potential.

INVEST IN BITCOIN HYPER TO BE PART OF THE FUTURE OF CRYPTO

There is symbolic poetry in a hypercar driving blockchain forward: a pinnacle of speed entering a world built for frictionless value transfer. Ferrari’s 499P auction shows luxury doesn’t fear crypto – it embraces it, and if Bitcoin is digital gold, then Bitcoin Hyper is an attempt to give that gold gears, wheels, and acceleration.

Luxury markets have entered the blockchain age. The question now is which technologies will keep pace with the world’s fastest ideas and which will be lapped.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency and digital assets carry significant risk. Always conduct your own research before investing.