South Africa’s FSCA is cracking down on unlicensed crypto operators as consumer losses mount, pushing investors toward safer self-custody platforms like Best Wallet that prioritise transparency, control, and regulatory compliance.

South Africa’s rapidly expanding cryptocurrency market has entered a critical turning point. A surge has unfortunately matched growing investor interest in alleged scams, platform collapses, and unauthorised financial services posing as legitimate Web3 businesses. Now, the Financial Sector Conduct Authority (FSCA) is sending a clear message: regulatory oversight is here, and the industry must adapt.

The warning comes at a decisive moment, following the high-profile provisional liquidation of NTC Global Trade Fund. While the company promised automated crypto arbitrage returns of up to 4% per trade, provisional investigations suggest that none of the R492 million contributed by nearly 2,000 South Africans ever reached a licensed trading platform.

Instead, more than R233 million reportedly flowed to accounts linked to company directors. The NTC case underscores a growing reality: if crypto platforms operating in South Africa do not hold valid Crypto Asset Service Provider (CASP) licences, the risk falls directly on consumers – often with devastating consequences.

FSCA Tightens Oversight as Crypto Scams Grow

Legal scrutiny around NTC intensified following the murder of its legal adviser, Bouwer van Niekerk, who had been investigating the possibility of pyramid-style structures within the company’s business model. Though the court has yet to rule definitively, the FSCA has confirmed that neither NTC nor its wallet interface – Arbitrawallet – has authorisation to provide financial services.

The regulator’s stance is unambiguous: “The investigated parties are not authorised to render any financial services under any financial law. To avoid unnecessary risk, the public should not accept any financial advice, assistance or investment offers from persons who are not authorised by the FSCA.”

This enforcement push follows the FSCA’s landmark decision to classify crypto assets as financial products in 2023, meaning all crypto businesses must register or apply for CASP licences. Companies that failed to apply by the November 2023 deadline are now operating illegally, even if they began operations beforehand.

This crackdown is significant for a country that has previously seen billions lost to alleged schemes like Mirror Trading International, which also advertised an AI-driven trading bot and promised unsustainable returns. For the FSCA, market regulation is not about hindering innovation. It is about ensuring that crypto does not become a playground for bad actors who exploit retail investors with promises of effortless profits.

South Africans Shift to Self-Custody as Trust in Platforms Erodes

The core issue goes beyond licensing – it centres on custody. Many investors still store assets inside centralised exchanges or service providers that can disappear overnight, leaving users locked out of their funds with little legal recourse. This shift in risk perception is driving more South Africans toward self-custody solutions. When users control their private keys, they control their assets entirely – removing reliance on intermediaries that may later be found operating unlawfully or incompetently.

Self-custody aligns with the FSCA’s guidance and with modern consumer expectations. It represents a move toward transparency, accountability, and ownership as the foundation for long-term crypto adoption in the country.

Best Wallet Meets the Moment

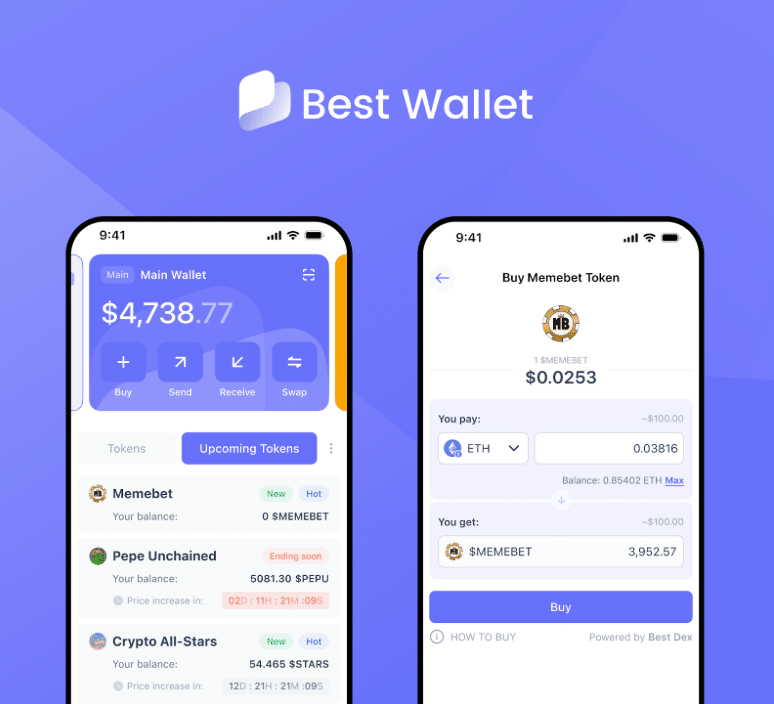

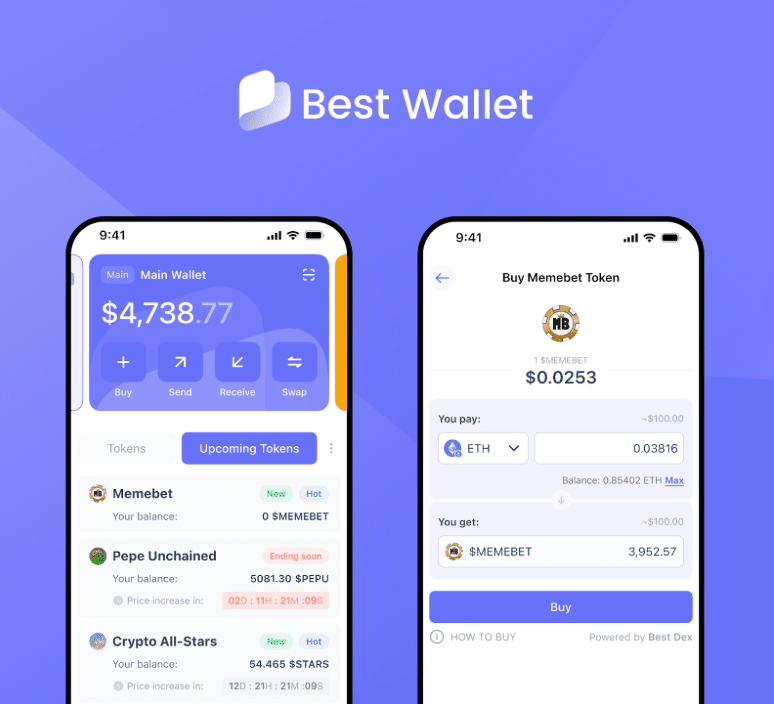

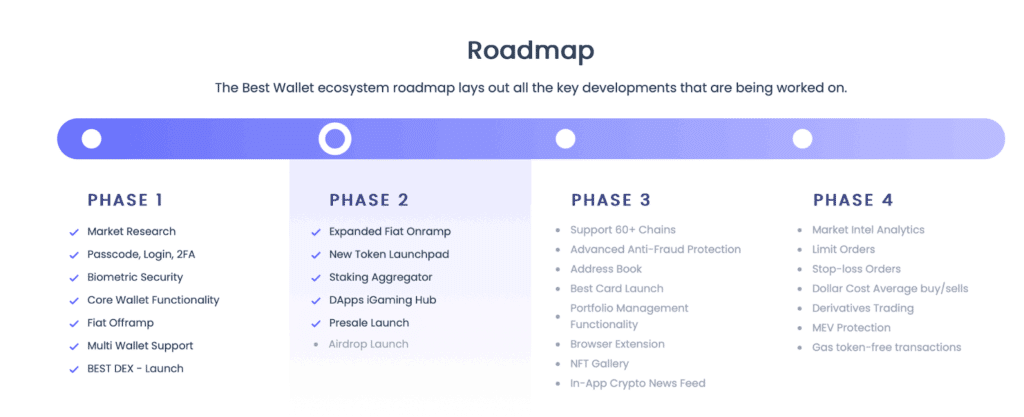

One of the most notable self-custody platforms gaining traction in this environment is Best Wallet Token ($BEST), which powers a rapidly growing ecosystem designed for asset security, multi-chain flexibility, and intuitive mobile access. The Best Wallet app uses Fireblocks MPC-CMP cryptographic infrastructure – technology trusted by major custodial institutions – meaning it is built not just for retail portfolios but for treasury-level risk management as well.

While many legacy wallets offer basic functionality, Best Wallet supports more than 60 blockchains and thousands of digital assets, enabling users to buy, swap, and stake without depending on centralised exchanges. Its focus on clean, mobile-friendly design speaks directly to South Africa’s mobile-centric user base.

With a reported monthly active user count surpassing 250,000, the platform is scaling rapidly, and at the same time, the FSCA is closing in on unauthorised operators. In effect, Best Wallet is becoming part of the solution as government oversight tightens.

Why the $BEST Token Matters

The wallet runs without a token, but holding $BEST unlocks deeper integration with the platform’s expanding services. Token holders receive reduced swap fees, enhanced staking yields, governance voting on ecosystem development, and early access to vetted token presales via the in-app “Upcoming Tokens” portal.

This presale access feature addresses a major consumer protection issue: thousands of South Africans have been misled into sending funds to fake project websites or impersonation scams. By handling access through the wallet’s secure interface, the model reduces exposure to malicious links and phishing risks.

With more than $16.6 million raised in its ongoing token presale and community metrics accelerating, $BEST is positioning itself as a tool that not only enables crypto participation but safeguards it in line with the regulatory direction of South Africa’s financial watchdog.

Regulation Is Coming, but Investors Must Protect Themselves First

While regulators pursue enforcement and licensing frameworks, the burden of responsibility still largely falls on investors to ensure they are transacting safely. Avoiding platforms that guarantee profits, verifying FSCA authorisations, and storing assets in secured, self-managed environments are becoming essential steps for anyone entering the crypto economy.

South Africa remains one of the continent’s largest adopters of Bitcoin and digital assets, and innovation is set to continue. Still, in the aftermath of the NTC investigation and similar cases, the future will belong to infrastructure that supports accountability. Best Wallet is one such example – representing a broader industry evolution from hype-driven offerings to tools that prioritise protection and regulatory alignment.

PROTECT WHAT’S YOURS. OWN YOUR CRYPTO WITH THE BEST WALLET

As the FSCA’s warning highlights, the difference between financial opportunity and financial loss now depends heavily on where South Africans choose to store and manage their crypto.

Disclaimer: This article is for informational purposes only and should not be considered financial, legal, or investment advice. Cryptocurrency carries risk. Always perform due diligence and consult a licensed professional where appropriate.