With Bitcoin’s next bull run already brewing, ChatGPT forecasts that Bitcoin Hyper could become a defining Layer 2 project for BTC scalability. Yet analysts caution that hype may be outrunning proof as transparency questions grow.

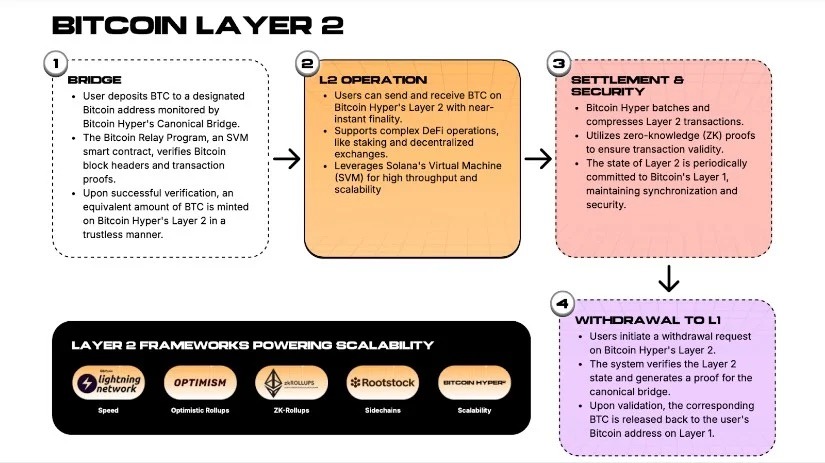

Artificial intelligence has joined the growing chorus of market watchers weighing in on crypto’s next bull run. According to a recent simulation by ChatGPT, Bitcoin Hyper ($HYPER) could emerge as a major breakout token over the coming quarters. The project’s ambition is bold: build a fully fledged Layer 2 network for Bitcoin that uses the Solana Virtual Machine (SVM) and ZK-rollups to process transactions in near-real time while keeping fees almost negligible.

The prediction hinges on execution. ChatGPT’s analysis suggests that if Bitcoin maintains its bullish trajectory and capital rotates from memecoins into infrastructure plays, HYPER could be positioned for outsized upside, but the model also flags four critical conditions: successful token listing, a functioning network, verified audits and observable liquidity. Without these, the projection remains speculative – a reflection of both potential and uncertainty.

For now, market interest appears genuine. The Bitcoin Hyper presale has already raised $24.6M, signalling notable retail participation ahead of its planned network rollout. The token’s pitch – blending Bitcoin’s security with Solana-level speed – has found traction with investors chasing exposure to the next structural narrative in crypto: Bitcoin scalability.

The Promise: A Faster Bitcoin for a Faster Market

Bitcoin’s original design prioritised decentralisation and security, not speed. The main chain still processes only a handful of transactions per second, often at high cost during network congestion.

That bottleneck has spurred a wave of Layer 2 experimentation, from Lightning to Stacks. Bitcoin Hyper enters that race promising something new – not incremental improvement but a “hyper-speed” upgrade that uses SVM integration to process thousands of transactions per second while anchoring settlements to the Bitcoin mainnet.

If realised, this could enable on-chain DeFi protocols, micro-transactions and gaming applications denominated in BTC – use-cases long imagined but rarely feasible. It’s this potential that underpins ChatGPT’s bull run thesis: when infrastructure projects deliver meaningful user utility, they can outperform meme-driven rallies. The challenge, however, lies in distinguishing true engineering from marketing gloss.

The Reality Check: Transparency Gaps and Missing Proof

Behind the ambitious branding, several analysts have urged caution. Investigations into Bitcoin Hyper’s public materials reveal a concerning lack of verifiable technical documentation. The project’s official website leans heavily on buzzwords – scalability, staking, meme integration – yet no open-source code, white paper, or independently validated testnet has been released.

Compared with credible Layer 2 frameworks such as Lightning or Stacks, which maintain active GitHub repositories and peer-reviewed documentation, Bitcoin Hyper’s deliverables remain mostly graphical mock-ups. Its explorer, bridge and staking dashboard are marketing placeholders rather than functioning products.

Adding to the unease are questions around audits and governance. While Bitcoin Hyper frequently references audits by Coinsult and SpyWolf, no full reports are publicly accessible. The team’s identities are also anonymous, with no verified developer profiles linked to the project. In an ecosystem still recovering from high-profile collapses, that opacity is a red flag.

Marketing Momentum Without Technical Foundation

Despite these concerns, the campaign continues to gather momentum. The Bitcoin Hyper presale has now raised over $24.6 million, nearing its stated hard cap of $25 million. The site employs a high-pressure marketing cadence – countdown timers, “limited spots” notifications and repeated reminders of imminent price hikes. Industry watchers recognise the pattern: a playbook that prioritises fear of missing out over demonstrable progress.

The bull run narrative amplifies this effect. As Bitcoin’s price grinds higher, retail investors often seek cheaper proxies for exposure and projects that claim direct affiliation with Bitcoin – especially “Layer 2” labels – can attract disproportionate attention.

ChatGPT’s Forecast Meets Analyst Skepticism

The divergence between ChatGPT’s optimistic model and human analysts’ caution encapsulates a wider tension in the crypto market: the gap between theoretical potential and real-world execution. While AI-driven forecasts extrapolate from patterns of previous innovation cycles – where early Layer 2 solutions delivered massive returns – they cannot account for undisclosed risks or fraudulent behaviour.

Bitcoin Hyper’s anonymity and lack of technical evidence place it closer to speculative marketing than engineering, which means caution is still warranted.

This caution does not negate the macro trend. The Layer 2 revolution is real – and accelerating. Projects like Lightning, Stacks and Rootstock have proven that Bitcoin can support scaling layers, but each success has relied on transparency, open collaboration and time-tested codebases. Until Bitcoin Hyper demonstrates the same, its inclusion in the “next bull run leaders” list remains hypothetical.

The Broader Context: Why Layer 2 Still Matters

Regardless of Bitcoin Hyper’s legitimacy, the attention it draws highlights how central Layer 2 technology has become to crypto’s future. Ethereum’s scaling boom through Optimism, Arbitrum and zkSync has set a precedent: throughput and low fees are now table stakes for mainstream adoption. Bitcoin’s ecosystem has lagged, constrained by design choices that prioritised immutability over flexibility.

If any Layer 2 truly bridges Bitcoin’s security with modern blockchain speed, it could unlock trillions in dormant liquidity. For that reason alone, investors are willing to take early risks – a dynamic that fuels presales like HYPER’s. Yet such enthusiasm also makes the market fertile ground for imitation and over-promotion.

Investor Takeaway: Between Opportunity and Overreach

As the crypto bull run narrative builds momentum heading into 2026, Bitcoin-branded Layer 2 projects will continue to multiply. Some will advance genuine technical breakthroughs; others will replicate marketing hype without substance. ChatGPT’s prediction that Bitcoin Hyper could lead the charge underscores both possibilities: the promise of scalable Bitcoin infrastructure and the perils of unchecked optimism.

For investors, the prudent path is due diligence. Transparent teams, open code, verifiable audits and realistic timelines separate viable ventures from speculative mirages. In that respect, Bitcoin Hyper’s current opacity makes it a high-risk, high-volatility play rather than a cornerstone of Bitcoin’s next chapter.

INVEST IN BITCOIN HYPER BEFORE THE PRICE RISES

Bitcoin’s evolution beyond a store of value will depend on how effectively it scales without sacrificing trust. The coming bull run may indeed be defined by Layer 2 breakthroughs, but whether Bitcoin Hyper leads that revolution or fades as another cautionary tale will depend on what it delivers after the presale lights dim.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are volatile and can result in total capital loss. Readers should conduct independent research and seek professional guidance before investing.