As meme coins fight for relevance, Maxi Doge is breaking through with a futures-driven twist – blending trader culture with on-chain utility as its presale surges past $3.6 million amid volatile markets.

After a year packed with launches and relaunches, a genuine breakout among dog-themed tokens has been hard to find. The niche is saturated and many projects lean on memes without offering lasting engagement or reasons to hold.

That backdrop helps explain why a newcomer – Maxi Doge ($MAXI) – is drawing attention. It borrows the cultural cachet of Dogecoin and Shiba Inu yet positions itself differently: not as a “pure” joke token, but as a meme coin that embraces the culture of high-octane trading during periods of market volatility.

The pitch is simple enough: capture the energy of retail traders who live on the edge of 1,000x leverage and leaderboard bragging rights, then wrap that into an on-chain token with utilities designed for that audience. Whether or not the project ultimately delivers on a long roadmap, the timing and framing have resonated.

Why a “Gym-Bro” Meme Coin is Getting Serious Attention

Maxi Doge’s branding is intentionally loud. The mascot is a shredded Shiba with a wink to degen culture. The tagline – “trades on 1,000x leverage, no stop loss” – is satirical by design.

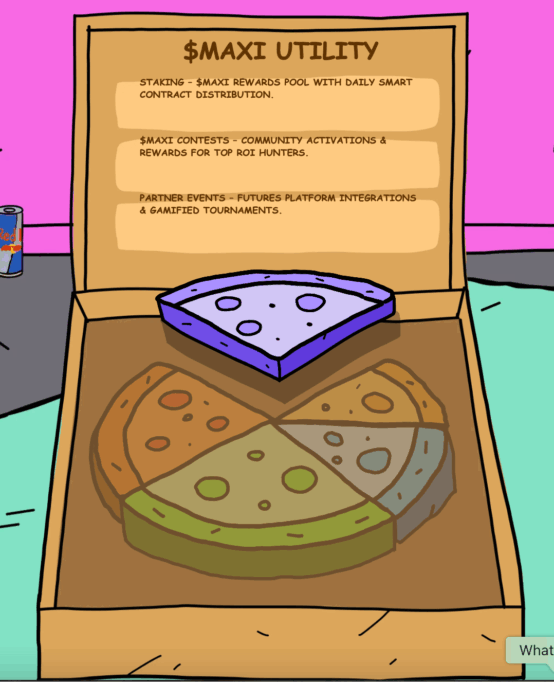

Underneath the meme veneer, the team has outlined features meant to translate that identity into activity: integrating MAXI with perpetuals venues, running weekly trading competitions that pay out in MAXI and USDT and offering 84% staking to keep participants engaged between events.

That combination – meme familiarity plus a futures-centric hook – differentiates MAXI from most dog coins that rely almost entirely on social buzz. The project has also cleared two smart-contract audits (SolidProof and Coinsult), which, while not a guarantee of success, removes some basic contract-level risks that often dog early meme launches.

Tokenomics skew heavily toward go-to-market: of the 150.2 billion total supply, a large slice is earmarked for marketing and a dedicated “Maxi Fund,” signaling an intent to pay for distribution, listings and visibility rather than rely on purely organic spread.

Social Proof Meets Presale Momentum

Presales aren’t the same as product-market fit, but they do reflect sentiment. MAXI’s staged pricing model – incrementally lifting the token price as tranches sell – has created a rolling meter of demand that’s accelerated in recent weeks.

After some initial whale-sized buys, influencer exposure added fuel: a video from Crypto June predicted Maxi Doge could see 100x gains. As of this week, MAXI’s social accounts have been growing steadily, with X (Twitter) crossing the multi-thousand follower mark and Telegram activity rising as markets rebounded.

For traders triaging where to place risk after an intense drawdown, that mix – audits, explicit go-to-market budget and visible social lift – can be enough to warrant closer monitoring. It doesn’t make MAXI the best meme coin to buy for every profile, but it helps explain why the project is surfacing on more watchlists during renewed market volatility.

Macro Whiplash, Micro Rotations

The setup for MAXI’s emergence is the market’s own instability. The recent selloff – driven by tariff headlines, cross-asset risk-off and a cascade of liquidations – was a case study in how quickly market volatility reprices leverage.

Bitcoin and Ether recovered some losses, but the shock reset positioning across altcoins and meme tokens. Historically, these periods spur rotations: liquidity can migrate from larger caps (after a bounce) into smaller, higher-beta names perceived to have asymmetric upside.

Context matters here. While larger names like BNB printed a fresh all-time high and Dogecoin notched a double-digit daily gain, analysts noted a second, quieter current: flows into micro-caps with distinct angles.

MAXI’s angle – futures-trading utility – arrives as perp DEX volumes have been setting records and as discussions about risk management and capital efficiency dominate crypto trading feeds. That alignment between narrative and product plan is a big part of why MAXI is earning mentions alongside established meme brands.

What “Futures Utility” Could Actually Look Like

Cutting through the meme fog, the practical claim is that MAXI aims to be listed on venues that allow leveraged exposure to the token itself while also rewarding ecosystem participation. In concept, that does two things.

First, it offers traders optionality: the ability to hedge, express directional views with less capital and participate in contests that map onto their existing behaviors. Second, it may help bootstrap liquidity via incentives tied to volume and performance. If weekly competitions and fee discounts are structured well, they can create a feedback loop of usage rather than a pure airdrop chase.

There’s risk in tying identity so tightly to leverage: it can amplify swings and attract short-term behavior over long-horizon holding, but as a pure product-market fit question, building for high-engagement, futures-oriented participants – rather than a general audience – could make the community more cohesive. That’s especially relevant if the goal is to be the best meme coin to buy for traders who already spend most of their screen time in perp terminals.

Token Design, Listings and the Execution Gap

Two audits and clear token allocations are table stakes; they don’t resolve the core challenges ahead. Integrations with third-party perp venues are competitive and “1,000x leverage” is more meme than market standard. Exchanges also weigh liquidity, compliance and risk before turning on high-multiplier products for new micro-caps.

In practice, MAXI will need to prove sustained depth on spot markets, demonstrate organic participation in its competitions and maintain transparent communications around treasury, emissions and any changes to staking terms.

On the distribution front, a sizable marketing allocation can be a double-edged sword. It can accelerate listings and campaigns, but it must be deployed with discipline to avoid short-lived spikes that end in post-listing fatigue. Investors watching MAXI closely will likely focus on the quality of partnerships, the credibility of trading venues that list the token and the cadence of real feature releases versus purely cosmetic milestones.

Can MAXI Outperform Dogecoin in Q4?

It’s tempting to default to binary comparisons: “next Dogecoin” or not. A more useful frame is correlation and beta. If DOGE extends its recovery toward historical resistance, spillover liquidity typically lifts smaller dog coins with tighter floats

In that environment, a project with a differentiated hook like MAXI’s could, in theory, outperform on a percentage basis even if DOGE commands the narrative. That’s the essence of the “100x” chatter: not a base case, but a statement that asymmetric upside lives at the long tail when conditions line up.

Still, it’s important to ground expectations. A 100x requires a confluence of factors: favorable market structure, sustained retail inflows, credible listings and no execution missteps. After the latest spike in market volatility, the bar for durable appreciation is higher. Projects need more than memes; they need mechanisms that convert attention into ongoing participation.

Signals to Watch Next

For readers tracking whether Maxi Doge can transition from a hot presale to a durable listing, several practical indicators can help cut through the noise.

The first is listing quality and depth. Where MAXI ends up being listed will matter a great deal, but so will the strength of its order books and the presence of credible market makers. Deep liquidity and stable pricing are often signs that a project has genuine backing rather than temporary hype.

Another key factor is competition engagement. The weekly trading contests will reveal whether the community is truly active or simply chasing quick rewards. Sustained participation and well-balanced prize structures can help prevent short-term, mercenary behavior and foster long-term loyalty.

Then there’s the question of futures integrations. Concrete partnerships or listings on reputable perpetual trading platforms will serve as the ultimate test of Maxi Doge’s “leverage utility” narrative. Without these integrations, the project’s unique selling point could lose its weight.

Staking dynamics will also be worth watching. As more users join and the headline APY compresses, it will be important to see whether staking lock ratios remain healthy without relying on excessive token emissions to prop up returns.

Finally, transparency may be the deciding factor. Regular communication about treasury holdings, liquidity provisioning and vesting unlocks will either strengthen or undermine investor confidence. Projects that maintain open, verifiable updates tend to weather volatility far better than those that leave their communities guessing.

INVEST IN DOGECOIN’S COUSIN, MAXI DOGE, BEFORE IT EXPLODES

Memes move fast, but utility sustains. Maxi Doge has positioned itself at the intersection of culture and perps at a moment when market volatility has traders rethinking risk and reach. Strong presale reception, security audits and an unapologetically targeted roadmap have earned MAXI an unusual amount of early mindshare for a dog coin.

Whether it becomes the best meme coin to buy for this phase of the cycle depends on execution: the credibility of futures integrations, the staying power of its competitions and the team’s discipline in converting hype into habit.

For now, MAXI is more than another canine ticker. It’s a test of whether a meme coin can build a community around behaviour – trading – rather than just around a logo. If the team delivers, Maxi Doge could be one of the cycle’s more interesting case studies in how narrative plus utility can coexist in the meme economy.

Disclaimer: This article is for information only and does not constitute investment advice. Cryptocurrency is highly volatile and you should do your own research before investing.