The largest crypto liquidation in history sent Bitcoin below $110K, but amid the chaos, a new Layer-2 contender – Bitcoin Hyper – is quietly rising. Could it be the best crypto to buy as markets recover?

Friday’s market meltdown marked the crypto industry’s biggest liquidation event to date, wiping out nearly $19 billion in leveraged positions and briefly pushing Bitcoin (BTC) below $110,000. While that figure doesn’t represent direct investor losses, it reflects the forced closure of excessive leverage across exchanges.

The broader market capitalisation dropped by $450 billion, sliding from $4.24 trillion to $3.79 trillion before stabilising above $4 trillion. Bitcoin’s swift rebound shows that this was less a systemic failure and more a structural reset – a forced cooling-off after months of speculative build-up.

A mix of macroeconomic pressure and on-chain vulnerabilities combined to create this perfect storm. US President Trump’s announcement of a potential 100% tariff on Chinese imports sent global markets into panic.

Meanwhile, a technical glitch on Binance’s price oracle worsened crypto’s decline, triggering widespread liquidations across DeFi platforms and perpetual futures markets.

When Macro Meets Code: Binance’s Oracle Glitch Amplifies the Crash

While traditional finance suffered losses from tariff fears, crypto faced a unique complication. On Binance, Ethena’s synthetic dollar USDe appeared to depeg to $0.65, despite trading near parity on other exchanges. Analysts later confirmed it was a data-feed error, not a fundamental collapse.

Delphi Digital’s Trevor King described it as a “first-principles error,” where Binance priced collateral like wBETH, BNSOL and USDe using its own spot markets rather than redemption values. This mispricing rapidly cascaded across linked venues, liquidating positions that were otherwise solvent.

Binance has since updated its oracle mechanism and distributed $283 million in compensation to impacted traders. Yet the incident reignited debate around over-reliance on centralised oracles in decentralised systems – a tension that continues to define crypto infrastructure.

Hyperliquid and the 19-Billion Question

As the chaos unfolded, Hyperliquid, a leading decentralised derivatives exchange, became a focal point. More than half of Friday’s total liquidations occurred on its platform. CEO Jeff Yan defended Hyperliquid’s performance, claiming 100% uptime and “zero bad debt” throughout the event.

Yan emphasised that the liquidations reflected market behavior, not system failure: excessive leverage met sudden volatility. Nonetheless, one mysterious whale drew scrutiny after opening a $163-million Bitcoin short just before the crash – earning nearly $200 million in profit.

While regulators and analysts dissect timing and transparency, one message is clear: the infrastructure around Bitcoin is evolving rapidly and in that evolution, Layer-2 scalability is emerging as the next major battleground.

Bitcoin Hyper: The Layer-2 Turning Volatility Into Opportunity

In the aftermath of the crash, Bitcoin Hyper ($HYPER) is standing out as a project that represents forward motion rather than fallout. Built as a Layer-2 solution for Bitcoin, it combines the security of BTC with the Solana Virtual Machine (SVM) – unlocking sub-second transactions, near-zero fees and full support for DeFi and dApps.

While Bitcoin remains unmatched as a store of value, it still handles only 14 transactions per second, compared to Solana’s 956. This 98.5% performance gap underscores why scalability remains Bitcoin’s biggest constraint. Bitcoin Hyper directly addresses that issue by creating a fast, trustless Layer-2 that can turn Bitcoin into a real utility network – not just a vault.

How Bitcoin Hyper’s Layer-2 Architecture Works

Bitcoin Hyper functions as a bridge-based Layer-2 protocol that locks BTC on the main chain and mints mirrored assets on its SVM-powered network. Transactions happen instantly on Hyper and are then settled back to Bitcoin via zero-knowledge proofs, maintaining full transparency and trust.

Once bridged, users can send, stake, or trade BTC with sub-second speed and minimal cost. Builders can deploy DeFi apps, NFTs and meme coins, leveraging Bitcoin’s security and Solana’s throughput in one ecosystem.

The $HYPER token fuels every interaction: it pays transaction fees, powers staking rewards and enables governance. This hybrid model turns Bitcoin into an active base layer for programmable finance, something the Lightning Network and other sidechains never fully achieved.

Market Confidence Grows

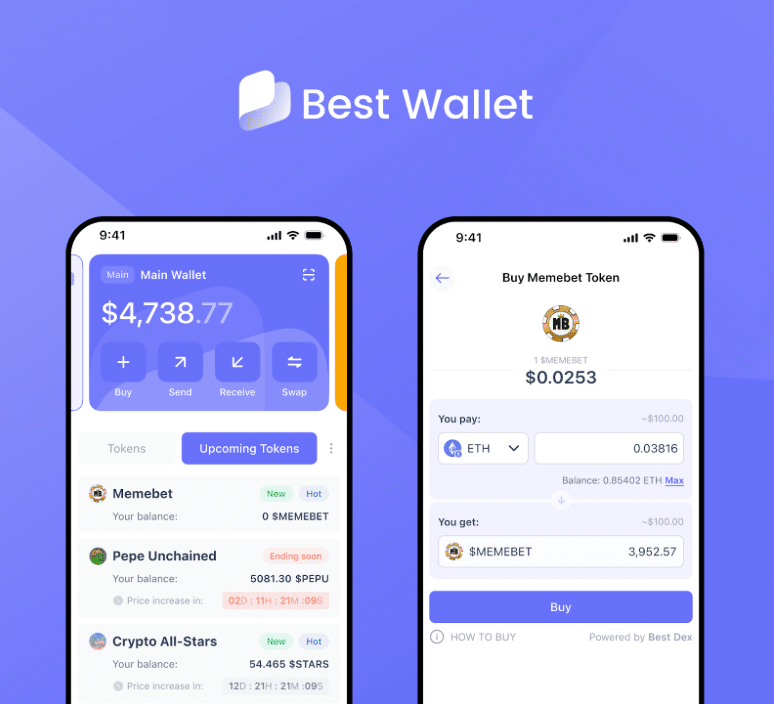

Despite the chaos across exchanges, investors are betting heavily on Bitcoin Hyper. The project’s presale has surpassed $23.5 million, including a $28.2K whale buy, highlighting sustained conviction in the Layer-2 narrative.

Early adopters are also rewarded with 50% staking APY, plus priority access to governance, airdrops and upcoming launchpad events. The token’s current presale price of $0.013105 may rise soon as the project moves toward its mainnet phase.

Funds raised are being directed toward cross-chain integration, developer tooling and user-friendly infrastructure to make Hyper a frictionless extension of Bitcoin’s network.

Why Bitcoin Hyper Could Be the Best Crypto to Buy After the Market Crash

Market resets often separate speculation from substance. In that context, Bitcoin Hyper offers a tangible value proposition – speed, scalability and real utility – backed by Bitcoin’s proven base layer.

During this month’s crash, overleveraged projects without strong fundamentals struggled. Yet Bitcoin Hyper’s continued presale growth amid extreme volatility suggests it’s being recognised as a long-term play, not just a speculative token.

By bridging Solana’s execution layer with Bitcoin’s settlement strength, it has the potential to reshape how Bitcoin participates in decentralised finance. Analysts now consider Layer-2 scalability projects as one of the few sectors likely to outperform in the next market cycle.

From Liquidation to Innovation

The $19-billion liquidation may have rattled traders, but it also revealed a deeper truth: crypto’s next leap won’t come from leverage, but from infrastructure.

As volatility cools and liquidity returns, the question isn’t just which coins will recover fastest – it’s which networks will build the foundation for the next cycle. Bitcoin Hyper represents that shift, merging Bitcoin’s reliability with modern blockchain speed.

The market’s message is clear: security alone is no longer enough. Scalability, usability and composability now define the best cryptos to buy in a maturing ecosystem.

INVEST IN BITCOIN’S LAYER-2, BITCOIN HYPER NOW

From Trump’s tariff shock to Binance’s oracle glitch, the $19-billion market crash exposed just how fragile over-leveraged systems can be. Yet amid the chaos, the Layer-2 revolution keeps moving forward.

Bitcoin Hyper stands at the intersection of that change – a project that transforms Bitcoin from a passive store of value into a high-speed engine for global finance. With a $23.4M presale and rapidly expanding interest, it may well be one of the best cryptos to buy as the market rebuilds.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research before investing.