After one of crypto’s biggest shakeouts – a $19B liquidation that wiped out overleveraged positions across the market – traders are looking for smarter, more adaptive strategies. With volatility returning, Snorter’s AI trading bot is drawing attention from risk-tolerant investors eager to turn chaos into opportunity.

The cryptocurrency world was rattled last Friday after a dramatic market crash wiped out nearly $19 billion in leveraged positions within hours – one of the largest liquidation events in crypto’s history. Triggered by President Donald Trump’s threat to impose new tariffs on Chinese imports, the sell-off cascaded through risky assets, hitting both tech stocks and digital currencies simultaneously.

Bitcoin plunged from around $122,500 to a low near $104,600, while Ethereum dropped over 20%. Meme coins and speculative tokens suffered even worse: Dogecoin fell more than 50% and the Trump-themed coin collapsed by 63% before rebounding slightly. Analysts described the event as a textbook example of overleveraged traders being forced to unwind their positions.

“Friday’s move was a textbook example of how leverage can amplify short-term volatility in a 24/7 market,” said Samir Kerbage, CIO at Hashdex. “As prices started falling, margin calls and forced liquidations cascaded across venues.”

In total, 1.6 million traders saw their positions forcibly closed, according to data from CoinGlass and The Kobeissi Letter. For those who borrowed heavily to amplify their bets, the damage was swift and severe.

From Panic to Perspective

While the scale of liquidations was alarming, analysts say such wipeouts often serve as a healthy reset. They remove excessive leverage from the market, allowing prices to stabilise at more sustainable levels. As the saying goes: “Be fearful when others are greedy and greedy when others are fearful.”

That perspective is beginning to take hold among opportunistic investors. With Bitcoin stabilising near $112,000 and Ether back above $4,000, many traders view this as a temporary correction rather than the start of a prolonged downturn.

“Structural forces – ETF adoption, institutional inflows and clearer regulations – still support long-term growth,” said Kerbage. “This type of volatility, while painful, tends to separate short-term speculation from genuine innovation.”

Among the projects gaining traction during this post-crash reset is Snorter ($SNORT) – a new AI trading bot built on Solana that promises to give retail traders the same kind of precision and speed that institutional players have long enjoyed.

Snorter’s Timing: Launching During Volatility

For most, a market crash is a time to pull back. For some, it’s a time to build. Snorter fits the latter mold. The project, which recently surpassed $4.5 million raised in its token presale, is entering the market at a moment when volatility – the lifeblood of active trading – is soaring.

Snorter’s premise is simple yet powerful: it uses AI to automate and optimise crypto trading decisions, helping users buy or sell tokens based on real-time signals, price action and liquidity shifts. Think of it as a personal trading assistant that never sleeps – only it’s running on Solana’s high-speed blockchain for minimal fees and instant execution.

The project’s developers are marketing Snorter as a tool that levels the playing field between average traders and “smart money.” By blending algorithmic decision-making with user-friendly features, it aims to reduce emotional bias – one of the main reasons individual traders lose during volatile markets.

As the presale nears its close, investors are watching closely. If market sentiment improves and retail trading volumes rise again, Snorter’s AI trading bot could debut just as traders are seeking smarter ways to capture post-crash rebounds.

Why Analysts See Opportunity After the Market Crash

Market cycles often create two types of projects: those that crumble when liquidity dries up and those that adapt to new conditions. Snorter appears to fall into the latter category.

Its timing, according to analysts like Alessandro de Crypto, could be serendipitous. The crash flushed out speculative excess, setting a cleaner stage for fundamentally stronger protocols to grow. “If this recovery takes hold organically – not through borrowed leverage – Snorter could launch at precisely the right moment,” de Crypto noted.

With a relatively modest presale raise of around $4 million, the project’s valuation remains low compared to inflated tokens that have already peaked. That gives it more room for growth once listed. “It hasn’t had a pump yet,” de Crypto said, “so there’s less immediate sell pressure – which could mean steadier price discovery post-listing.”

A smaller outcome – say, achieving a $250 million market cap similar to mid-tier meme coins – would represent a 10x return from presale levels for Snorter Token.

What Sets Snorter Apart: Utility Over Hype

Unlike many speculative tokens that rely purely on community memes or celebrity endorsements, Snorter has a clear use case: making crypto trading smarter and faster.

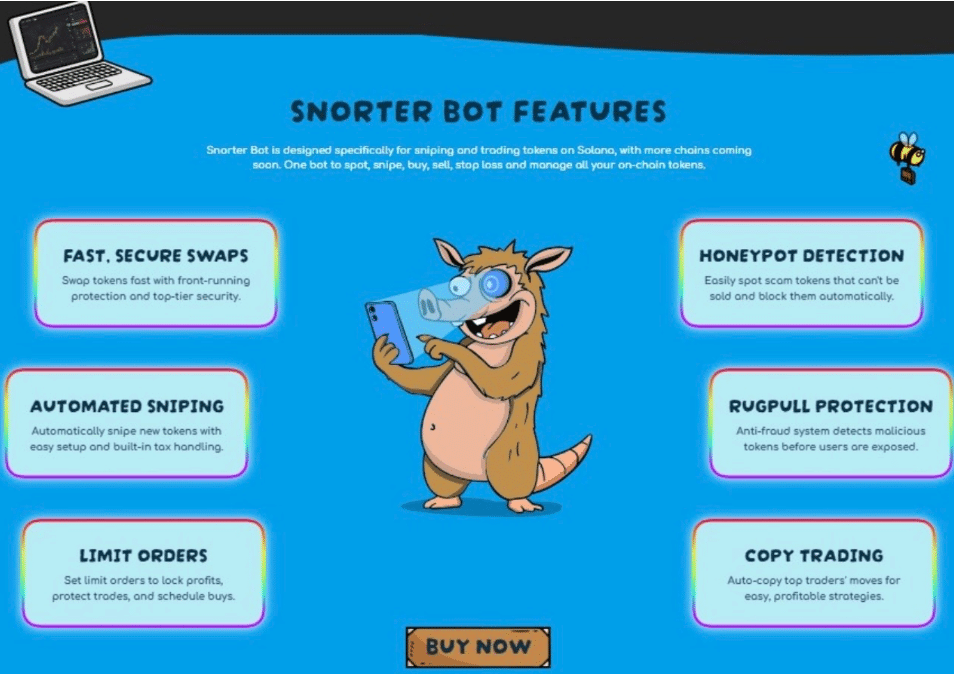

The platform integrates several advanced features, including:

· Automated Token Sniping: Quickly identifies and executes trades on newly launched tokens before wider adoption.

· Copy Trading: Allows users to mirror the strategies of top-performing wallets in real time.

· Rug Pull Detection: Flags suspicious contracts or liquidity patterns before execution.

· Dynamic Stop-Losses: Adjusts protective orders automatically based on live volatility.

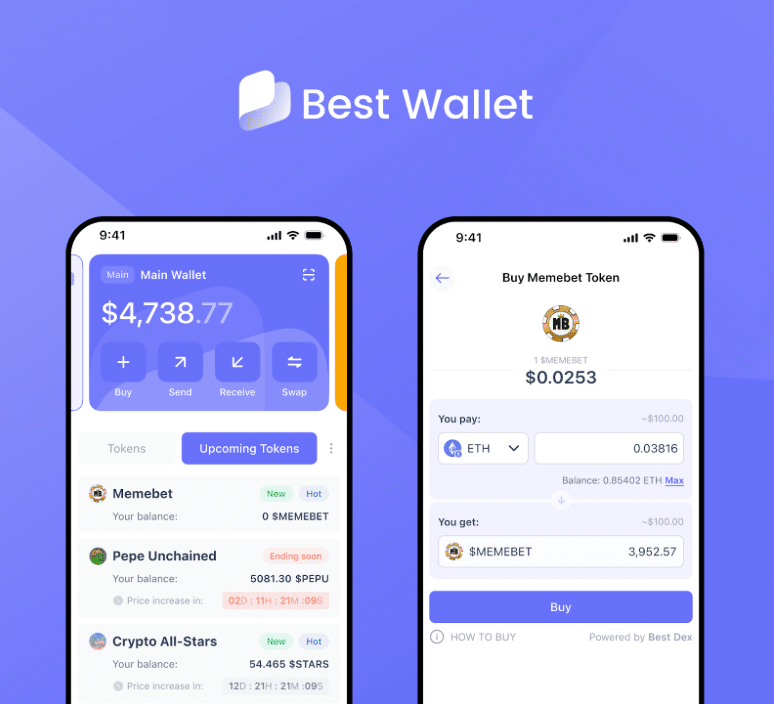

Snorter’s fee structure further strengthens its appeal. Holders of the SNORT token pay just 0.85% trading fees, compared to the 1% charged by competitors such as Trojan and Bonk Bot. That 15% discount can make a tangible difference for active traders over hundreds of transactions.

Moreover, Snorter users can stake their tokens for additional rewards and participate in governance votes, giving holders both utility and voice in shaping the platform’s roadmap.

Filling a Gap in Solana’s Trading Ecosystem

One intriguing factor working in Snorter’s favor is the gap it’s filling within the Solana ecosystem. The leading Solana trading bots, Trojan and Bonk Bot, currently have no native tokens – meaning they lack a direct way for users to invest in their growth.

Snorter’s introduction of the SNORT token changes that. It provides a tangible investment vehicle for those bullish on the Solana DeFi trading infrastructure. If the bot gains adoption, the token’s built-in utility – from staking to fee reductions – could translate into real demand.

The project’s long-term roadmap also hints at expansion beyond Solana. Developers have signaled plans to integrate with Ethereum Virtual Machine (EVM) networks in future updates, potentially broadening Snorter’s reach across major blockchain ecosystems.

From Leverage to Logic: The Future of Smarter Trading

If last week’s market crash underscored one thing, it’s the peril of unchecked leverage and emotional trading. As exchanges automatically liquidated billions in positions, traders were reminded how fast gains can vanish in crypto’s 24/7 markets.

Snorter’s pitch – automation, logic and AI-driven discipline – directly addresses that weakness. By providing tools that act instantly and without emotion, the AI trading bot aligns with the industry’s gradual shift toward algorithmic efficiency and risk management.

This is not about eliminating risk – it’s about understanding it and in a market that just saw its biggest shakeout in years, that message is likely to resonate.

Opportunity in the Aftermath

The $19 billion liquidation event left scars on the crypto landscape, but it also cleared the field for projects built on sturdier ground. As volatility persists and traders search for new edges, Snorter’s AI trading bot offers an intriguing solution – combining real utility, measurable advantages and market timing that could prove pivotal.

Whether Snorter becomes the next major Solana success story remains to be seen, but its emergence highlights a broader shift: in post-crash markets, intelligence, automation and efficiency increasingly trump hype.

SNIPE NEW CRYPTO COINS WITH SNORTER NOW

For now, as the dust settles from the latest market crash, projects like Snorter may define what the next wave of crypto innovation looks like – faster, smarter and built to thrive where others falter.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are volatile and risky. Always do your own research before investing.