Bitcoin dominance is slipping and TOTAL3’s multi-year chart pattern hints that Altseason could be forming. Amid this rotation, Pepenode’s $1.7M presale is drawing attention with its gamified mine-to-earn model that turns crypto mining into a community-driven game.

The market’s risk dial is edging higher. On a weekly view of TOTAL3 – crypto’s aggregate market cap minus Bitcoin and Ethereum – analysts are highlighting a textbook Cup & Handle formation that has taken shape over multiple years. The “cup” spans from a 2021 peak around $1.13 trillion, through a 2023 bear-market low near $0.287 trillion, back to a 2024 recovery peak close to $1.16 trillion.

In 2025, a compact “handle” has been carving out just beneath resistance, the spot where breakouts often begin. Read that literally and Altseason may be nearer than many think: a confirmed move could target approximately $4.37 trillion – nearly a 290% expansion from current levels if momentum holds.

Macro context backs the pattern. Bitcoin remains firm above $120,000, but its market dominance has slipped below 59%. Historically, that inflection is one of the cleanest signals that capital is rotating into altcoins. When dominance fades while prices stay elevated, liquidity tends to cascade down the risk curve into smaller caps, where performance dispersion widens and narratives matter.

In other words, the preconditions for Altseason – breadth, rotation and story-driven leadership – are present.

Why the Setup Looks Different This Time

Classic crypto cycles have seen meme coins lead sentiment while infrastructure follows. This cycle’s early innings are more nuanced. Yes, speculative assets are perking up, but investors are also rewarding projects that map to practical participation, not just price charts.

It’s visible in how quickly communities are coalescing around models that blend engagement with transparent mechanics. That’s the thread connecting the market’s top-down picture to one of the cycle’s more talked-about newcomers: Pepenode.

Altseason, after all, isn’t just a number on an index; it’s the sum of thousands of individual decisions to deploy into themes that feel timely and scalable. When patterns like the Cup & Handle appear alongside a visible drift from BTC into smaller names, the door opens for projects with a clear, accessible entry point. Pepenode is being discussed in that context – not as a guaranteed winner, but as a case study in how a theme can capture the mood of a rotation.

Pepenode’s Mine-to-Earn: Turning Participation Into a Loop

At its core, Pepenode is trying to simplify crypto mining for the broadest possible audience. Instead of asking users to buy hardware and power real rigs, it drops them into an empty virtual server room and lets them assemble Miner Nodes – each with properties that influence simulated hashpower.

The mechanics are deliberately familiar: you acquire nodes using Pepenode’s token, arrange and upgrade them and test combinations to improve output. The system rewards configuration skill and persistence, not specialised equipment.

That loop matters in an Altseason. When volatility rises and liquidity spreads out, projects that translate complex ideas into intuitive participation often grab mindshare. Pepenode’s approach keeps the essence of mining – hashrate, energy, output – without the barriers that wall off most retail users from the practice.

The early advantage is explicit too: the most powerful Miner Nodes are slated to be sold first, meaning early entrants can secure setups with outsized virtual efficiency, echoing the “first movers mine more” dynamic of early Bitcoin.

Built on Ethereum with ERC-20 smart contracts, Pepenode uses on-chain rails for transparency while anchoring most of the gameplay logic in a dashboard that surfaces the metrics users care about. Rewards track the mining power you generate. A live leaderboard adds the social flywheel that’s propelled countless crypto communities and top performers can become eligible for additional meme-coin rewards, including Pepe and Fartcoin.

That cross-pollination aligns Pepenode with two of crypto’s largest, loudest audiences and gives the game a path to sustained attention beyond its own token.

Token Mechanics: Deflation and the Scarcity Feedback Loop

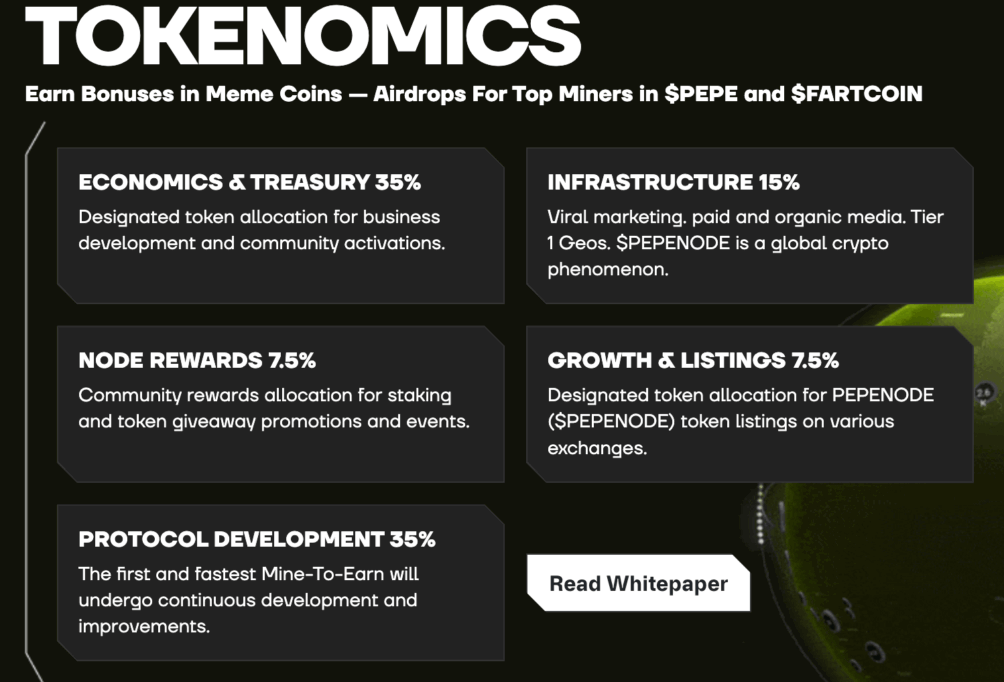

Any tokenised system lives or dies by its incentives. Here, Pepenode’s token is the universal currency: you buy and upgrade Miner Nodes with it, you stake it and you receive it as part of the base reward stream. The design adds a strong deflationary counterweight.

According to project details, 70% of tokens spent in the in-game store are burned. If the user base grows and activity stays healthy, that continuous burn shrinks circulating supply while the game itself channels demand back into upgrades.

This is the piece fueling talk of asymmetric upside. The deflationary design, paired with early momentum, could compress available supply quickly. Commentary from the community even speculates about 100x outcomes, while noting that performance will hinge on delivery and sustained engagement. The presale’s reception – more than $1.7 million raised to date – suggests the theme has resonance with early adopters.

Mine-to-Earn vs. Legacy Passive Models

Passive rewards aren’t new in crypto. Bitcoin offers them through proof-of-work mining; Shiba Inu and others offer them via staking. Pepenode tries to position itself between those poles: it borrows the progression and merit dynamics of mining – your actions change your output – while preserving the low barrier to entry of staking. Start with a wallet and tokens, not a warehouse and power contract. That middle ground is where many retail users want to be – engaged, but not overwhelmed; guided, but not gated.

In Altseason terms, that matters. When capital rotates rapidly, passive models alone can struggle to hold attention. Gamified progression and visible leaderboards can keep communities active through the inevitable pullbacks that punctuate every rally. Pepenode’s “mine-to-earn” aims to build that persistence into the product itself.

Early Momentum and the Rotation Narrative

Presales are a familiar feature of every cycle, but not all presales align tightly with the dominant market story. Pepenode’s does. With Bitcoin’s dominance slipping and TOTAL3 telegraphing the possibility of a structural breakout, investors are scouting for themes that could expand with the tide.

A low-cap, frog-themed project that welds meme-coin culture to a mining-inspired reward loop is exactly the kind of speculative vehicle that tends to find an audience in these windows. The fact that this one is framed around participation, not just price, helps it stand out.

That’s not a prediction; it’s a connection. Altseason favors projects that give their communities something to do, not just something to hold. By building a system where the “work” is configuring and upgrading virtual rigs for measurable output and where upgrades burn supply – Pepenode ties engagement to economics in a way that fits the moment.

Risks and Realities to Keep in View

None of the structural features eliminate risk. A Cup & Handle is suggestive, not deterministic. Bitcoin’s dominance can whip back higher on a single macro headline, choking off alt liquidity.

Within Pepenode, the deflationary burn only tightens supply if users keep spending in the store; if engagement fades, the mechanism’s impact fades with it. Early-buyer advantages can encourage rapid uptake, but they can also concentrate influence if distribution isn’t broad.

Staking rates, which are drawing attention now, are also dynamic by nature. Elevated APYs typically compress as more tokens lock and as systems seek equilibrium and while the leaderboard and multi-asset rewards could deepen the moat, they also raise the bar for ongoing content and feature development. A leaderboard is only sticky if it reflects a game worth winning.

Where Altseason Meets Product-Market Fit

Even with those caveats, the through-line is clear. The market is flashing signals that Altseason is forming: a multi-year bullish pattern on TOTAL3, a visible drift in dominance and a backdrop of investors re-risking into smaller themes.

Pepenode’s early traction – over $1.7 million raised in its presale – sits neatly inside that rotation narrative, offering a way to express appetite for meme-culture upside while anchoring it in an activity loop most retail users can understand.

If the handle on TOTAL3 resolves higher and dominance remains south of 59%, breadth should continue to improve. In that environment, projects that convert attention into action tend to compound faster.

Pepenode won’t be the only beneficiary if Altseason accelerates, but its mine-to-earn blueprint shows why it’s among the names early adopters are watching: it’s simple to start, designed to reward iteration and structurally wired to create scarcity as people play.

Altseason’s Evolving Storyline

Markets move in stories as much as in numbers. The story today is a familiar one – the possibility of Altseason – told with new accents: patterns that took years to form, dominance that is finally bending and communities that want participation with their positions.

MINE-TO-EARN WITH PEPENODE NOW

Pepenode enters that story with a proposition tailored to the moment. Whether it becomes a breakout or simply a bellwether, its $1.7 million presale and mine-to-earn architecture help illustrate how this phase of Altseason may differ from the last: less about hype alone, more about systems that keep people playing.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and speculative. Readers should conduct independent research and consult a licensed financial advisor before making any investment decisions.