Passive income is back in focus as crypto risk appetite improves. One emerging idea is Pepenode’s “mine-to-earn” model: a gamified, virtual mining setup that aims to turn strategy and staking into on-chain rewards – without buying hardware or paying power bills.

At its simplest, passive income is money that continues to arrive after the upfront work is done. It isn’t a salary or a fee you earn by the hour; it’s income that continues to flow from something you set up – an asset you bought, a product you published, equity you hold, or a mechanism that runs without your constant involvement.

Different tax authorities define slices in their own way, but the general idea is universal: diversify away from a single paycheck and reduce the time-to-money grind.

Traditionally, people have pursued the best passive income through rental properties, dividend stocks, high-yield savings accounts, term deposits, or by investing capital in businesses as silent partners.

In the digital economy, the menu has expanded: peer-to-peer lending, creator royalties and – in crypto – staking, liquidity provision, and, historically, mining.

Mining on proof-of-work chains became a byword for passive returns during previous cycles. Still, in recent years, the barrier to entry soared: expensive rigs, long payback periods, volatile electricity costs, and technical hassle.

In that context, it’s unsurprising that projects are experimenting with software-first ways to capture the “mining” feel without the server roo,m and one of the more talked-about attempts is Pepenode.

Pepenode’s Mine-to-Earn Idea, in Plain English

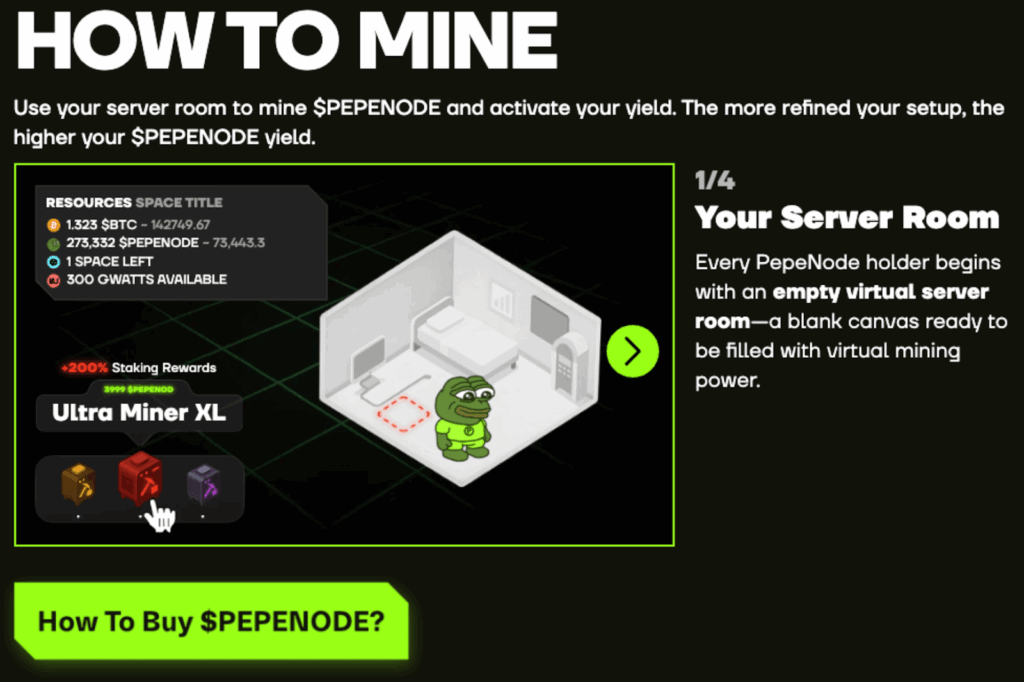

Pepenode pitches a virtual alternative to physical mining: build an on-screen “server room,” assemble digital Miner Nodes and earn rewards denominated in $PEPENODE – with the potential for bonus payouts in familiar meme-coin names like PEPE and FARTCOIN.

The mechanics intentionally mirror a real rig: dashboards, hashrate, energy variables and rolling rewards. The difference is the absence of GPUs, warehouse heat, and utility bills.

Crucially, all of this is slated to come to Ethereum after the presale and TGE. To participate, users need the native token, $PEPENODE, which serves as the in-platform currency for acquiring nodes, upgrading the facility, and exchanging components.

The structure is intentionally game-like: you start with an empty room, add nodes with different properties and experiment with combinations to optimise output – closer to Clash-of-Clans strategy than command-line mining ops.

Two design choices stand out for a passive-income lens. First, the project’s deflationary burn trims supply – up to 70% of tokens spent on upgrades can be permanently removed from circulation.

Second, there’s staking: early participants are being offered staking yields reportedly at 740% APY at the time of writing, with the caveat that such rates are dynamic and typically compress as pools grow.

Where the Numbers Sit Today

According to the project’s own disclosures, the presale has raised over $ 1.7 M so far, with $PEPENODE priced at approximately $0.0010918 at the moment. The team frames early entry as strategically advantageous because nodes purchased earlier are intended to carry higher mining capacity, improving the base you’re compounding from. That logic underpins the “start sooner, optimise longer” ethos running through the game.

For would-be participants, setup is intentionally straightforward: acquire $PEPENODE, connect a compatible wallet, allocate capital toward nodes and then manage upgrades through the dashboard.

The loop is designed to produce two streams: ongoing $PEPENODE rewards from virtual mining and the chance of periodic airdrops in other meme assets for top performers. For users simply seeking set-and-forget exposure, staking offers a more hands-off path than micromanaging rigs.

Does Mine-to-Earn Qualify as “Best Passive Income”?

It depends on what you value. The best passive income tends to balance three key factors: the durability of the payoff, the transparency of the mechanism, and the risk relative to the reward.

Pepenode’s mine-to-earn blueprint addresses the usability gaps in traditional mining by removing hardware, power, and maintenance from the equation. It’s capital-light, borders on no-code, and abstracts away the operational friction that derailed small miners.

On the other hand, crypto-native income streams inherently carry market risk. Token prices move. Yields change. Game economies evolve. Pepenode’s proposition is explicit about this reality by leaning into engagement: success is not purely “passive”; it’s interactive. You can stake and sit back, but the project’s design also rewards those who tinker – rebalancing nodes, timing upgrades, and hunting leaderboard bonuses.

For some investors, that hybrid — part passive, part active— may be a feature, not a bug. It offers a clear pathway: stake if you want less involvement, build and optimise if you want to chase higher output.

How the System Tries to Sustain Itself

Pepenode’s architecture is designed with long-term sustainability in mind, weaving together incentives that aim to keep users engaged and the ecosystem active. Rather than relying solely on token price appreciation, the platform channels demand directly into its in-game mechanics.

Every upgrade within the system burns up to 70% of the tokens used, gradually reducing supply and introducing a steady element of scarcity alongside ongoing utility. If player activity remains strong, this feedback loop could create a self-sustaining cycle where participation supports value rather than draining it.

Another critical component is the inclusion of multi-asset rewards. Beyond earning the native $PEPENODE token, top performers can also receive airdrops of popular meme coins such as PEPE and FARTCOIN.

This multi-token reward structure keeps engagement high and adds a competitive edge, motivating players to refine their strategies and optimise their mining rigs. It’s an extra layer of incentive that can help maintain enthusiasm even as market sentiment fluctuates—a crucial advantage in the volatile world of meme coins.

Finally, Pepenode introduces staking as a way to stabilise the ecosystem. With early yields advertised at around 740% APY, holders have a strong reason to keep their tokens staked rather than selling immediately on the open market.

In theory, this mechanism helps ease short-term selling pressure and encourages longer-term participation. Of course, such high APYs rarely last forever, as returns typically decrease once more tokens are locked in.

Taken together, these mechanisms do not eliminate risk – volatility remains an unavoidable part of any crypto project, but they do represent an effort to align user incentives with the network’s broader goals.

In essence, Pepenode’s design tries to ensure that the same activities that make the game enjoyable also help reinforce the economic health of the platform itself.

What Participation Looks Like in Practice

For readers mapping this to a personal passive-income plan, the path is linear:

You’d acquire $PEPENODE, set up a compatible wallet, and decide between staking or building. If staking, you’re effectively choosing yield exposure with fewer moving parts. If building, you step into the game layer: purchase nodes, place them in your server room, iterate on configurations, and consider upgrades as you learn which combinations maximise your virtual hashrate relative to costs.

Because the platform tracks hashrate, energy, and rewards in real time, feedback is quick. That’s part of the draw: you aren’t compiling code or flashing firmware – you’re tuning a dashboard. The “earn” side arrives via ongoing $PEPENODE rewards, with the possibility of landing meme-coin bonuses if your rig ranks near the top.

Importantly, none of this requires GPUs, a dedicated warehouse, or industrial electricity. Accessibility – anyone with a wallet – may be Pepenode’s most enormous wedge.

The Risks to Keep in View

A balanced look must acknowledge the obvious: Pepenode operates in a volatile, meme-driven niche. Price action can be violent in both directions. The model also relies on community growth – a feature common to most social tokens.

If participation fades, the in-game economy can stall. While the presale momentum – $1.7M+ raised and headline staking APYs are eye-catching, the sustainability of yields and gameplay incentives will only be proven in live conditions post-TGE.

There’s also the distinction between passive and hands-off. Staking is passive mainly; optimising rigs is closer to an active strategy, albeit within a gamified wrapper. Prospective users should pick the lane that matches their time budget and risk tolerance.

Where Pepenode Fits in a Passive-Income Stack

For readers already holding dividend stocks, treasuries, or real-estate cash flows, Pepenode is a speculative satellite, not a core bond ladder. Its appeal comes from accessibility (no hardware required), flexibility (stake or build), and a deflationary model that links engagement to scarcity.

For those seeking unique passive income in crypto and willing to take early-stage risks, Pepenode’s mine-to-earn design stands out in the crowded meme-coin space.

Crypto Mining as Passive Income?

Pepenode reframes crypto “mining” as a virtual, strategy-driven game that pays out in $PEPENODE and may layer in meme-coin bonuses for top performers. With $1.7M+ raised in its presale, a token price near $0.0010918, and staking yields currently advertised at 740% APY, the project is engineering both passive and interactive paths to participation.

Whether it becomes the best passive income idea for you depends on your appetite for token volatility and preference for staking versus game optimisation.

MINE-TO-EARN NOW WITH PEPENODE

What’s clear is that Pepenode is attempting to turn the costs and complexity of old-school mining into a software-first experience – one that trades GPUs and power bills for dashboards and on-chain incentives. For some, that trade-off could be exactly the point.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile. Always do your own research before investing.