Bitcoin is consolidating just below its new all-time high, with traders targeting $150,000 after a short cooldown. While BTC takes a breather, crypto whales are quietly buying into Bitcoin Hyper – a next-generation Layer-2 network merging Solana’s speed with Bitcoin’s unmatched security.

Bitcoin’s first full week of Uptober begins with a plot twist markets have seen before: a weekend all-time high followed by a measured pause. Spot BTC is hovering around $121,000 after what one trader called a “classic weekend squeeze and retrace”, with a small CME gap already addressed and a larger one lingering near $110,000.

Near term, technicians are watching $123,000 as a pivot; a durable reclaim would strengthen the case for the next leg toward the now-popular $150,000 target. Equally important, bulls don’t want to see the trend lose the $117,000–$118,000 shelf that underpinned the latest breakout.

Momentum traders are eyeing a routine check-in at the four-hour 50-period EMA (recently near $119,250 and rising). A shallow dip into that band, followed by buyers stepping back in, would fit the “higher highs, higher lows” template that typically precedes continued upside.

On higher time frames, several analysts argue a period of acceptance above prior resistance is healthy: blasting through every ceiling “in one go” is rarely how durable bull runs unfold.

Neutral Range, Macro Noise

If the chart hints at consolidation, some modelling tools agree. An AI-driven forecast drawing on hundreds of on-chain features calls for BTC to oscillate between roughly $108,000 support and $123,000 resistance, with a bias to the upper half of the range.

The takeaway: the remainder of October may look less like a straight-line “Uptober” surge and more like a re-accumulation window before any sustained attempt at price discovery.

Macro adds its own uncertainty. A US government shutdown has delayed key data, shifting focus to scheduled remarks from Federal Reserve officials in the coming days. Markets are already handicapping the October and December meetings while risk assets broadly continue to “climb the wall of worry”. Crypto sentiment sits in clear “greed,” but not yet “extreme” territory, a posture that leaves room for both shakeouts and squeezes without breaking the broader uptrend.

Capital Rotation: From Benchmark to Betas and into Infrastructure

Historically, when BTC cools after an all-time high, flows search for relative value. That rotation is visible across altcoins and, notably, inside the expanding orbit of Bitcoin-centric infrastructure narratives.

One beneficiary is Bitcoin Hyper, a proposed high-throughput Layer-2 (L2) network that executes using Solana-style parallelism while anchoring settlement to Bitcoin’s base chain.

Here is where crypto whales enter the frame. While BTC ranges, large addresses have been steadily amassing HYPER during the project’s presale. Funding climbed from $18.8 million on September 29 to $22 million by Monday – a $3.3 million jump in a week – with the current tranche priced near $0.013075 per token and a round timer measured in hours. The cadence of stepwise price increases and hard caps has turned the raise into a live sentiment gauge for big-ticket demand.

The Footprints are Hard to Miss

Transaction records underpin the narrative. One wallet acquired 24.6 million HYPER ($327,000). Two others together picked up 25.65 million ($333,000). Over the weekend, a single buy of 42.2 million ($560,000) printed, followed by a Monday top-up of 20 million ($273,000) from the same whale address as totals crossed $21.6 million. Individually, these are sizable entries; collectively, they suggest deep-pocketed players are laddering into exposure while liquidity is still thin and slippage manageable.

The timing also matters. Whether BTC quickly reclaims $123,000 or revisits the $118,000–$119,000 zone first, consolidation periods often coincide with thesis-driven positioning.

For whales, the thesis here is straightforward: if the next advance in Bitcoin price pulls in another wave of users, base-layer constraints – minute-scale block times and single-digit transactions per second – will clash with demand again. A parallel execution environment that settles back to Bitcoin is a bet on future throughput, not just on price.

What Bitcoin Hyper is Proposing

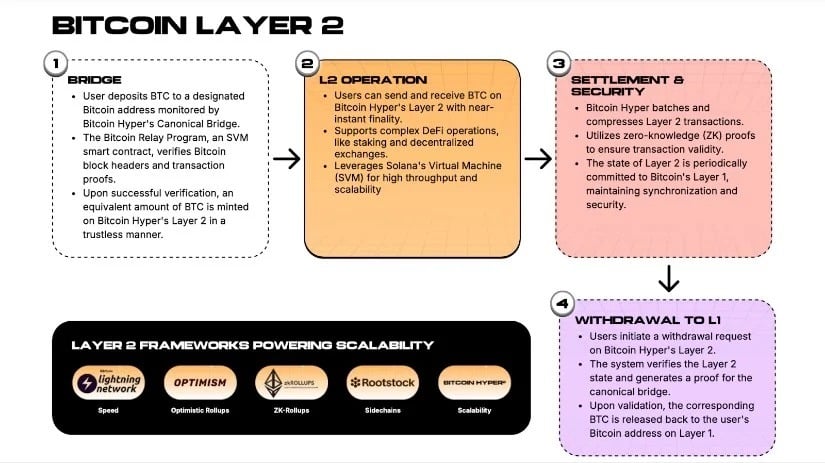

Bitcoin Hyper’s architecture tries to balance the blockchain trilemma. Execution would run on the Solana Virtual Machine (SVM), which processes transactions in parallel to achieve high throughput. Settlement remains on the Bitcoin base chain, preserving decentralisation and security.

A canonical bridge links the two: BTC sent to the bridge is held on Layer-1 while a corresponding wrapped asset circulates on the Layer-2 for use across decentralised finance, gaming and potential real-world-asset applications. Redemption works in reverse; wrapped BTC is burned on L2 and the original BTC is released from custody on L1.

Two consequences follow if adoption takes hold. First, more BTC could be parked in the bridge, tightening circulating supply on the base chain. Second, wrapped BTC would become an actively used medium across L2 applications, creating utility-driven demand for BTC rather than purely speculative hoarding. Even a fractional share of Bitcoin’s supply entering that loop would represent significant value as spot price grinds toward the next psychological levels.

Token Mechanics and Incentives

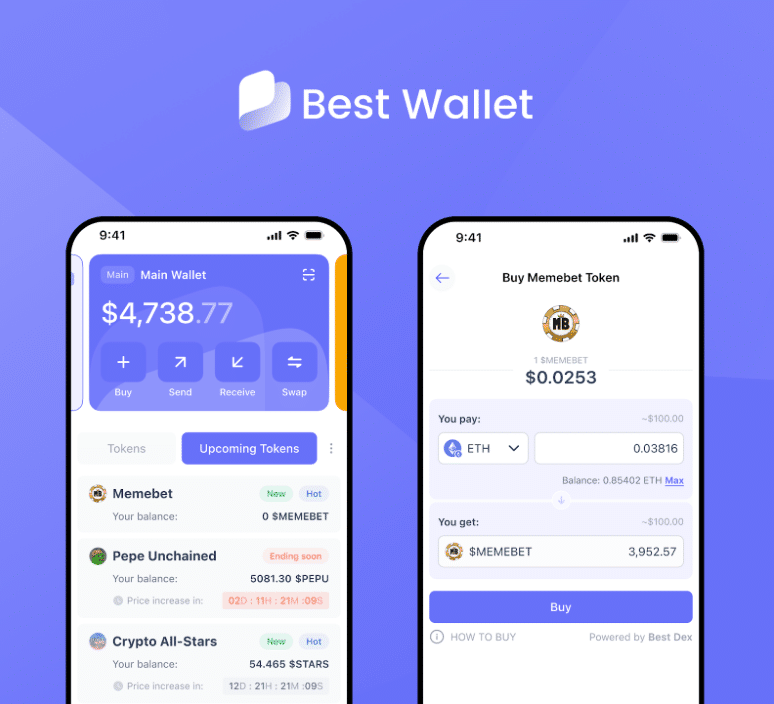

$HYPER is the network’s native asset for fees, staking and governance – the economic spine that would keep validators and operators aligned if activity scales. During the presale, staking has gone live with APYs cited in the low-to-mid fifties and nearly a billion tokens committed, indicating that early participants are opting to lock tokens for yield while the network tooling and ecosystem build out.

For developers, the pitch is familiarity and speed. Rust-based SDKs and Solana-style APIs should shorten the learning curve for teams used to SVM semantics, potentially accelerating the arrival of the first wave of L2 apps. If that happens, throughput is not just a headline number; it becomes a practical requirement for order books, AMMs and game loops that buckle under sequential execution.

How the Stories Intersect: BTC Range and Whale Bids

Set side by side, the BTC range and the whale accumulation in HYPER read like two chapters of the same tape. Bitcoin’s weekend high, followed by a drift toward key moving averages, invites a slow reset of sentiment and positioning.

In that lull, crypto whales are choosing to express a directional view on utility – not just on BTC price. The presale structure, with round caps and price steps, gives them an immediate way to size that view without waiting for secondary listings.

That doesn’t make the outcome a foregone conclusion. Delivery risk is real for any early-stage network. Timelines can slip. Toolchains can bite. Narratives can lose oxygen if BTC chops sideways for longer than expected.

Still, the pattern of large, repeated buys through multiple milestones suggests some holders are comfortable with those risks at today’s valuations. They appear willing to keep averaging as long as the raise continues to clear new totals.

What Success Would Look Like and Why BTC Holders Care

If Bitcoin Hyper executes on its roadmap, success would be visible on two fronts.

On-chain, you would expect to see steadily rising L2 transactions, developer deployments and wrapped BTC in flight, all settling to Bitcoin. Off-chain, you would expect to see builder migration from SVM-compatible ecosystems, not because of grants alone but because the combination of speed and Bitcoin settlement expands the addressable user base.

For BTC holders, that matters. It reframes part of a portfolio from passive exposure to an asset that can circulate in a Bitcoin-secured environment without abandoning Bitcoin’s guarantees. In a best-case scenario, some percentage of supply earns yield or facilitates activity on L2 while long-term conviction about the base asset remains intact.

The Week Ahead: Levels and Milestones

Zooming back to the here and now, the near-term checklist is crisp. For BTC, watch the $123,000 reclaim and the four-hour 50 EMA retest around $119,000–$120,000; a controlled visit that holds would keep the march toward $150,000 on track. Monitor the $117,000–$118,000 shelf – losing it would complicate the picture and risk a wider range between $112,000 and $124,000.

For Bitcoin Hyper, the immediate markers are mechanical: whether the current round closes on the sub-day timer or at the $22.4 million cap and whether the weekly tally pushes through $23 million on the same drumbeat of large entries. With HYPER priced around $0.013075 and the previous step at $0.013065, the presale’s incremental increases are small individually but meaningful in aggregate as a proxy for demand.

Bitcoin’s Base Becomes a Launchpad

Uptober gave Bitcoin a new all-time high and, just as importantly, the space to consolidate above prior resistance. In that space, crypto whales are not standing still. They are deploying into Bitcoin Hyper, a Layer-2 thesis that links Solana-style execution with Bitcoin settlement in an attempt to turn BTC from a passive store of value into an actively used asset across a faster rail.

BE PART OF BITCOIN’S FUTURE WITH BITCOIN HYPER

Whether the presale clips $23 million this week or BTC tags the four-hour EMA first, the through-line is the same: price and utility are starting to converge. If Bitcoin’s next leg higher coincides with workable Bitcoin-secured throughput, the rails whales are funding today may be the ones a broader cohort runs on tomorrow.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile. Always do your own research before investing.