BNB’s record-breaking rally has reignited activity across its ecosystem, from meme coins inspired by CZ to infrastructure tokens gaining real traction. As traders chase quick profits, smart money is pivoting toward projects like Best Wallet: a growing Web3 ecosystem building real-world crypto infrastructure.

BNB has officially entered its next bull phase, breaking above $1,300 for the first time in its history. The surge has triggered an explosion of activity across the BNB Chain, where speculative tokens – particularly meme coins inspired by Binance’s founder Changpeng “CZ” Zhao – have gone viral.

Meme mania is back in full swing. Dozens of tokens built around CZ’s image or catchphrases have soared by triple and quadruple digits in just days. The standout performer, simply called 4, references CZ’s famous “rule number four” – his mantra to ignore fear, uncertainty and doubt (FUD) and “keep building”. Within a week of launch, 4 rocketed to a $243 million market cap and nearly $80 million in 24-hour trading volume.

Other viral projects include Paul (PALU), inspired by one of CZ’s own X posts and 客服小何, meaning “Binance Life” in Chinese. Both have outperformed even the most active Solana meme coins, with price increases of 2,246% and 415% respectively.

The meme wave has lifted BNB’s network metrics dramatically. Blockchain analytics from Bubblemaps show over 100,000 on-chain traders piling into the latest crop of BNB-based tokens, with roughly 70% in profit and dozens now showing seven-figure gains.

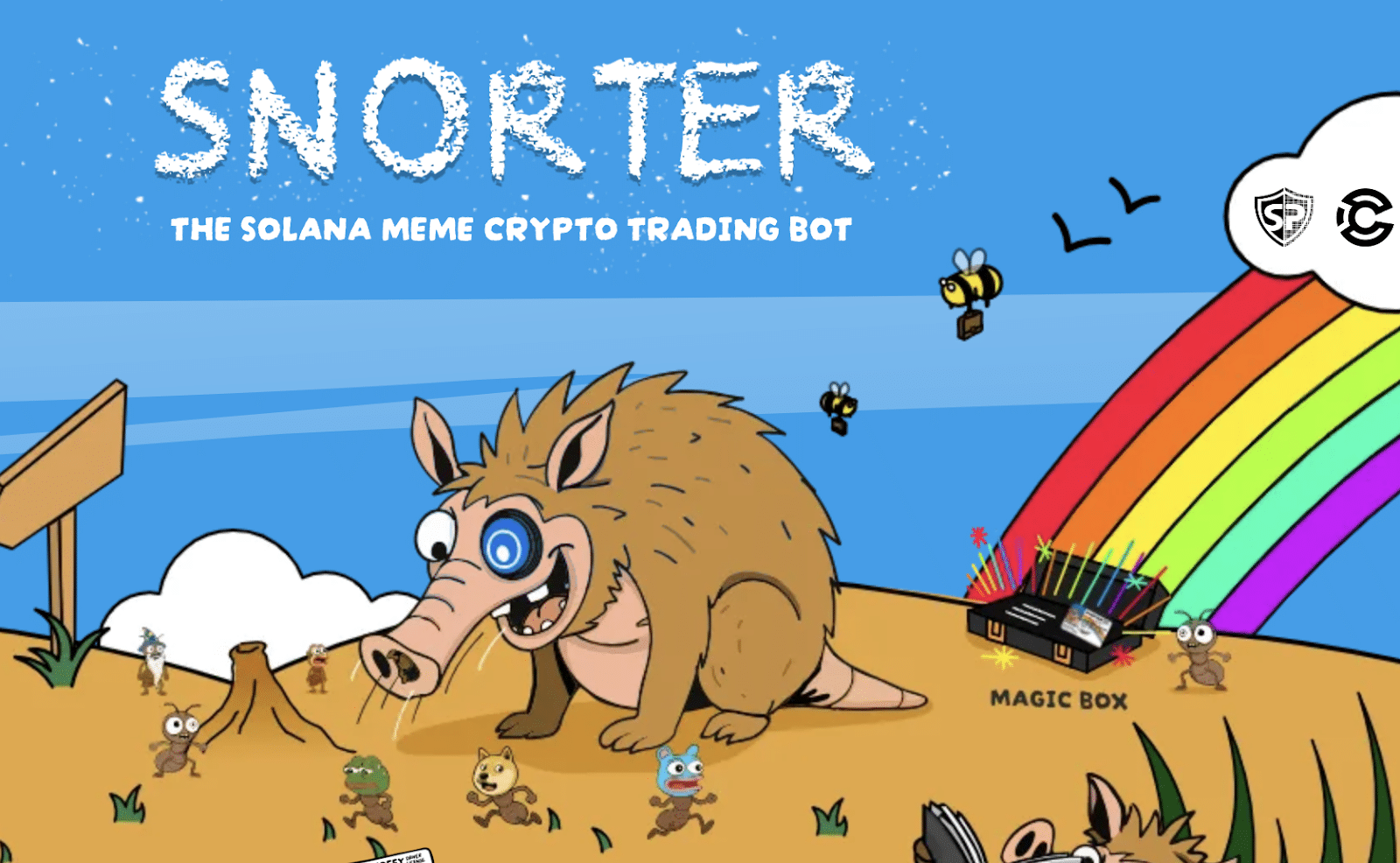

The trend echoes Solana’s meme season earlier in the year, except this time, it’s happening on Binance’s home turf. The majority of top-trending tokens on DEXScreener are now BNB-based, underscoring how meme liquidity is rotating toward the Binance ecosystem.

As Zhao himself joked on X: “BNB meme szn! I didn’t expect this at all. People keep asking me to predict the future. Keep building!”

But while retail enthusiasm drives BNB Chain’s speculative boom, long-term investors are quietly watching something deeper unfold – the rise of infrastructure tokens that may underpin the next leg of crypto’s growth.

From Memes to Mechanisms: BNB’s Broader Infrastructure Connection

BNB’s connection to Binance goes beyond speculation. As the native token of one of the world’s largest exchanges, BNB underpins both custodial and non-custodial wallet systems – including Binance’s integrated Web3 wallet and a fast-growing ecosystem of decentralised applications.

This infrastructure-first foundation gives BNB a unique position in crypto markets: it benefits from speculation, but it’s ultimately tied to real, revenue-generating use cases.

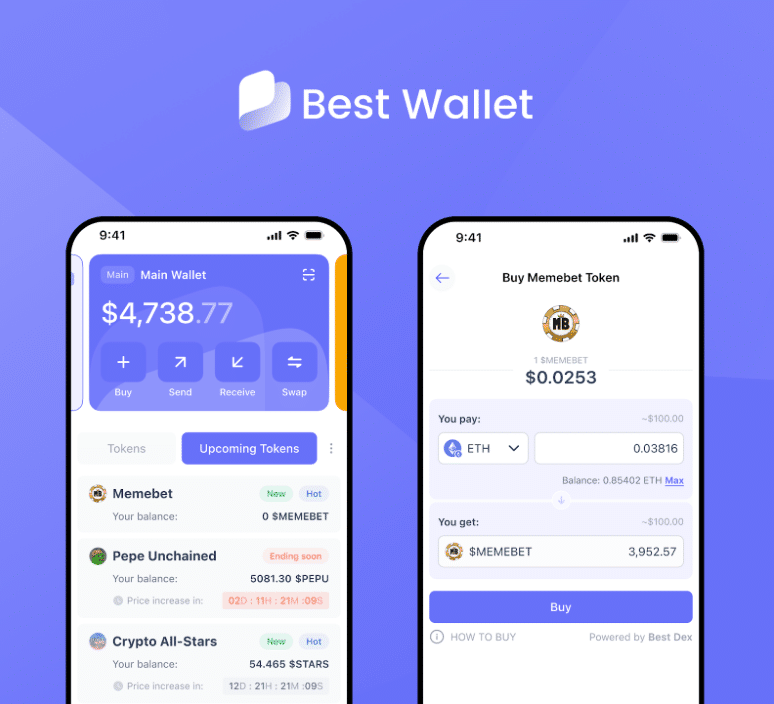

A similar narrative is now forming around Best Wallet ($BEST): another infrastructure project gaining momentum as investors look for long-term exposure to Web3 adoption rather than short-lived meme rallies.

Why Best Wallet Is Emerging as the Next Infrastructure Play

As meme coins capture headlines, institutional and retail investors alike are seeking projects with sustainable growth drivers. One of the strongest tailwinds right now is the ongoing expansion of the stablecoin economy – a $160 billion segment reshaping global finance.

Regulatory clarity has accelerated this shift. The US GENIUS Act, signed in July 2025, opened the door for more stablecoin issuers, including exchanges, fintech platforms and even traditional banks, but because stablecoins are pegged to fiat currencies, they don’t benefit directly from rising market valuations.

That’s why investors are turning their attention to crypto infrastructure tokens – assets that capture on-chain transaction growth, like Best Wallet’s $BEST token.

Stablecoins Drive On-Chain Growth, But Infrastructure Captures Value

Data from DeFiLlama shows Tether’s dominance has slipped from 86% in mid-2020 to just under 59%. While Circle’s USDC now commands nearly 25% of the market. Meanwhile, new issuers and fintech startups are flooding the space, drawn by the profitability of holding stablecoin reserves.

As Castle Island’s Nic Carter explained, “If an exchange holds $500 million in USDT, Tether earns around $35 million a year on that float and the exchange gets nothing.” This realisation has sparked a wave of new stablecoin projects and an appetite for the infrastructure powering them.

Enter Best Wallet – a next-generation, non-custodial wallet built for exactly this moment.

What Makes Best Wallet Stand Out

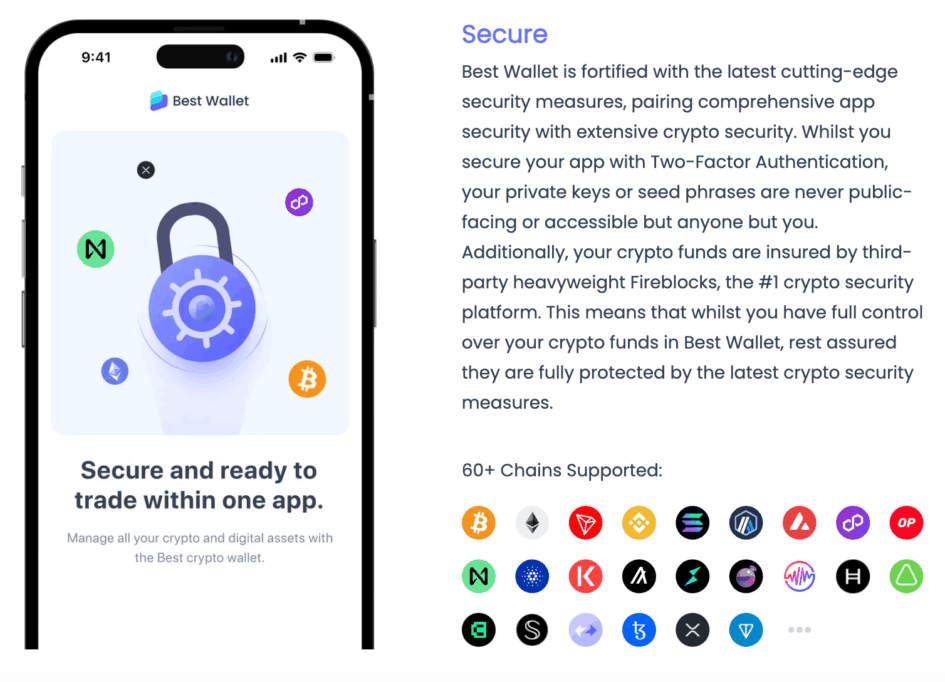

Best Wallet is designed as a multi-chain hub for crypto storage, payments and DeFi interactions. Unlike traditional wallets that simply store tokens, Best Wallet integrates a suite of tools for swapping, staking and even spending crypto in the real world.

The platform’s upcoming Best Card is a major example of this integration. It will allow users to make everyday purchases using stablecoins or cryptocurrencies – effectively turning digital assets into spendable money.

At the heart of this ecosystem lies the $BEST token, which powers all in-app transactions, from gas fees to staking rewards. The token also underpins the wallet’s planned governance model, where users will vote on new features and integrations.

So far, the presale for $BEST has exceeded $16.3 million, a milestone that mirrors early funding rounds seen in other breakout infrastructure projects. Analysts project a potential 101% increase in price by year-end and over 450% by 2026 if adoption continues to accelerate.

The Best Wallet app already has hundreds of thousands of users across Android and iOS and with features like Fireblocks-powered MPC security, it has built a reputation as one of the safest wallets in the space.

Infrastructure Tokens Lead the Next Phase of Uptober

BNB’s surge underscores one key truth about this market cycle: infrastructure still drives everything. Meme coins can create explosive short-term returns, but the rails that support real adoption – wallets, bridges and L2s – are what keep the ecosystem running.

As BNB breaks into uncharted price territory, traders are increasingly searching for the “next BNB” – a token that blends functionality, adoption and upside. Projects like Best Wallet fit that mold, sitting at the intersection of utility and growth.

The current environment of strong liquidity, rising retail participation and new regulatory frameworks creates ideal conditions for infrastructure projects to thrive.

What Comes Next

If BNB continues to hold above $1,200 support, the next leg could take it toward $1,500, extending the meme-driven rally through Uptober, but even if short-term volatility hits, infrastructure tokens like Best Wallet may benefit from sustained user growth as capital rotates from speculation to utility.

The parallel between BNB’s ecosystem and Best Wallet’s emerging footprint is striking: both connect to large-scale crypto infrastructure that goes beyond trading hype. As stablecoin adoption rises and decentralised finance matures, the demand for secure, interoperable wallets will only grow.

Speculation Fuels the Next Wave of Utility

BNB’s record-breaking run and meme coin explosion mark the latest chapter in crypto’s cyclical nature – where speculative frenzy and fundamental innovation move in tandem. Beneath the surface of viral tokens and on-chain chaos, the quiet accumulation in infrastructure plays like Best Wallet signals where long-term value may be forming.

SECURE ALL CRYPTO WITH BEST WALLET

Just as BNB transformed from an exchange token into a multi-chain powerhouse, Best Wallet could emerge as a central hub for how people actually use crypto – bridging the gap between DeFi, stablecoins and everyday payments.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile. Always do your own research before investing.