As Bitcoin’s price fluctuates near record highs, whales are turning their attention to Bitcoin Hyper – a new Layer-2 project built to scale the Bitcoin network and revive the meme coin market narrative.

The Bitcoin price has cooled slightly after touching $126,198, pausing what has been one of the strongest rallies of the year. Bitcoin surged above $125,000 before encountering short-term resistance, consolidating around $123,000 at the time of writing.

Trading data shows Bitcoin remains above $124,000 and the 100-hour simple moving average. A bullish trend line continues to form with support near $124,200, while resistance sits around $125,500.

If the price clears that zone, a move towards $126,500 or even $128,000 is possible. However, a failure to hold above the $124,200 line could trigger a short-term decline toward the $122,500 or $121,200 levels.

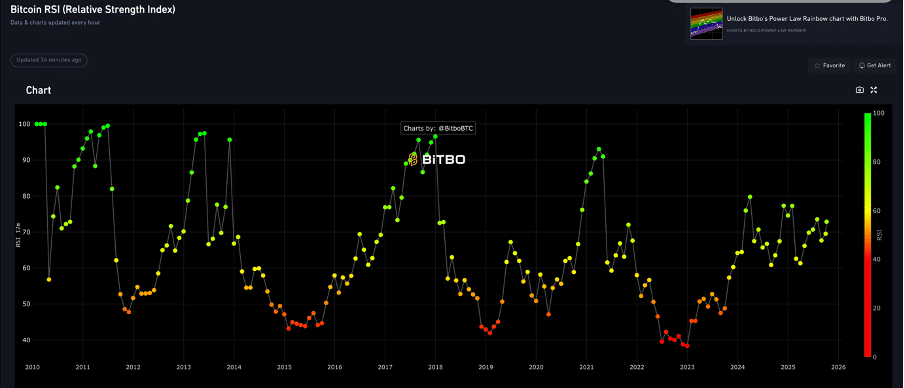

Despite the pullback, technical indicators still lean positive. The hourly MACD has gained momentum in the bullish zone, while the RSI remains above 50 – both suggesting the uptrend remains intact. Major support rests at $124,200, while key resistance lies near $125,500 and $126,500.

Source: Bitbo

Market watchers note that Bitcoin’s consolidation above $120,000 represents remarkable resilience following a month-long rally. After briefly dipping under $110,000 in late September, Bitcoin’s recovery has been swift and decisive, driven by optimism around spot ETF inflows and declining bond yields.

Yet with the price now hovering near its previous all-time high, attention is shifting to what comes next and for many investors, that may be Bitcoin Hyper, the project whales are quietly accumulating.

Bitcoin Hyper: The Layer-2 That’s Catching Whale Attention

While Bitcoin continues to lead the market, its scalability issues are once again in focus. As activity spikes, so do transaction fees, with users paying increasingly high costs to move funds on-chain. Compared to networks like Solana or Ethereum, Bitcoin’s limited capacity – around seven to ten transactions per second – leaves little room for mass adoption.

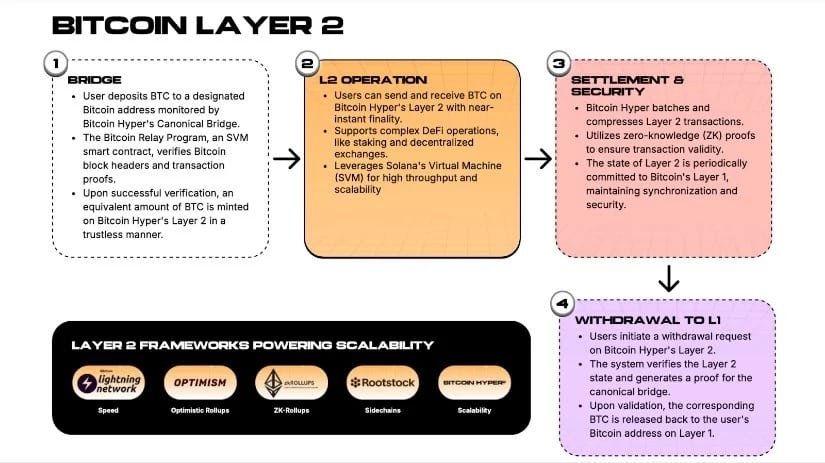

This is where Bitcoin Hyper ($HYPER) enters the picture. Built as a high-speed Layer-2 (L2) for Bitcoin, Bitcoin Hyper integrates the Solana Virtual Machine (SVM) to bring smart contract functionality and parallel processing to the Bitcoin ecosystem. In simple terms, it’s designed to make Bitcoin faster, cheaper and more compatible with Web3 applications.

The Layer-2 acts as an off-chain processing layer, powered by Solana’s technology, which collects and processes transactions before committing them back to the main Bitcoin chain for secure settlement. This approach keeps the base layer decentralised and secure while offloading the heavy computation that slows it down.

For retail and institutional investors alike, Bitcoin Hyper represents a bridge between the security of Bitcoin and the scalability of Solana – a fusion that could redefine the blockchain’s utility.

Why Bitcoin’s Scalability Matters

Bitcoin’s security is one of its greatest strengths, but it comes with trade-offs. Each transaction must be verified and added to a block by miners, a process that takes roughly ten minutes per block. With a fixed block size, the network can only handle a limited number of transactions at once, resulting in higher fees and slower confirmations during periods of congestion.

The so-called “scalability trilemma” – balancing security, decentralisation and speed – has long been Bitcoin’s challenge. While Lightning Network offers one form of scaling, it operates off-chain and remains complex for mainstream users.

Bitcoin Hyper aims to solve this by keeping settlement tied to Bitcoin’s secure Layer-1 while enabling high-speed DeFi and Web3 applications through its Solana-based L2. The Canonical Bridge mechanism allows Bitcoin holders to convert their BTC into wrapped tokens ($wBTC) usable across decentralised platforms, then seamlessly convert them back when needed.

For example, sending BTC to the Canonical Bridge locks the tokens on-chain, minting an equivalent amount of $wBTC on the Hyper network. These tokens can then interact with DeFi protocols or trading dApps, offering liquidity, staking, or other rewards – all while maintaining full backing by the original BTC.

This hybrid model could make Bitcoin more versatile than ever, allowing it to participate directly in decentralised finance without sacrificing security.

Whale Confidence Builds Around $HYPER

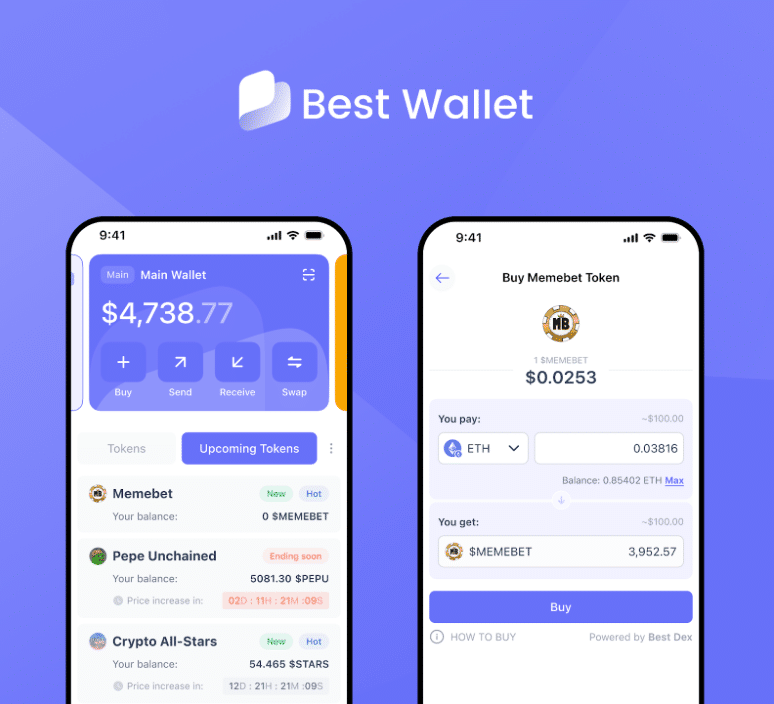

Whale movements often serve as a bellwether for emerging trends and in recent weeks, they’ve turned their attention toward Bitcoin Hyper. Reports of $196,600 and $145,000 whale buys have added momentum to an already fast-moving presale that has now surpassed $21.7 million.

These large transactions reflect growing belief in Bitcoin Hyper’s long-term potential as the Bitcoin ecosystem modernises. The timing couldn’t be better: with Bitcoin’s rally stalling just below $125,000, many expect an “altcoin rotation” – a period when capital shifts from BTC into newer, smaller projects with higher upside.

Historically, such cycles begin shortly after Bitcoin sets new highs and given Bitcoin Hyper’s role as a scalability solution directly tied to BTC, whales appear to be positioning early.

The $HYPER Token and Its Growing Ecosystem

The native token $HYPER underpins the entire Bitcoin Hyper ecosystem. Beyond being a governance and utility asset, it powers staking, transaction fee reductions and early access to new decentralised applications built on the network.

Half of the token supply is allocated toward development and treasury growth, ensuring steady ecosystem expansion. Holders benefit from staking rewards, currently at a 53% annual percentage yield (APY), alongside participation rights in project governance through the Hyper DAO.

Importantly, $HYPER also acts as a reward mechanism for developers building new tools and applications on the Bitcoin Hyper Layer-2. This incentive structure mirrors early-stage Ethereum and Solana models, where builders directly benefited from network growth.

With the presale nearing completion and the current price fixed at $0.013065 – set to increase in just 30 hours – Bitcoin Hyper is drawing attention as one of the most dynamic early-stage crypto opportunities of the year.

Why Whales See It as the Best Meme Coin to Buy

Despite its advanced technology, Bitcoin Hyper has gained surprising traction among the meme coin crowd – not for jokes or hype, but for its narrative strength. In a market where meme tokens often dominate headlines, Bitcoin Hyper stands out by merging meme-level community enthusiasm with genuine technical innovation.

Whales are referring to it as the best meme coin to buy not because it’s a parody, but because it embodies the same retail energy that fuels meme rallies – combined with real utility. The project taps into Bitcoin’s cultural dominance while promising faster, cheaper and smarter blockchain infrastructure.

This blend of meme-driven virality and tangible progress has proven powerful before. Just as Dogecoin once became the mascot of crypto’s retail rebellion, Bitcoin Hyper could become the face of Bitcoin’s technological revival.

Bitcoin Rally Could Spark New Wave

If Bitcoin holds above $124,000 and breaks $126,500 resistance, it could retest its all-time highs and trigger a new wave of risk-on appetite across the market. Historically, such rallies have led to significant inflows into Layer-2 projects and meme tokens, with early movers reaping the largest gains.

Analysts predict that if the Bitcoin price sustains its momentum into Q4, Bitcoin Hyper’s valuation could soar. Conservative estimates suggest a move to $0.03 by the end of 2025, while more optimistic scenarios place it closer to $0.20 – representing a 15x increase.

FIND OUT MORE ABOUT BITCOIN HYPER BEFORE IT SPIKES

Regardless of price targets, one fact is becoming clear: the next wave of crypto growth will favour projects that enhance Bitcoin rather than compete with it. Bitcoin Hyper sits at that intersection, positioning itself as a hybrid meme-tech project that could redefine how the world interacts with the original cryptocurrency.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are volatile and investors should conduct their own research before making investment decisions.