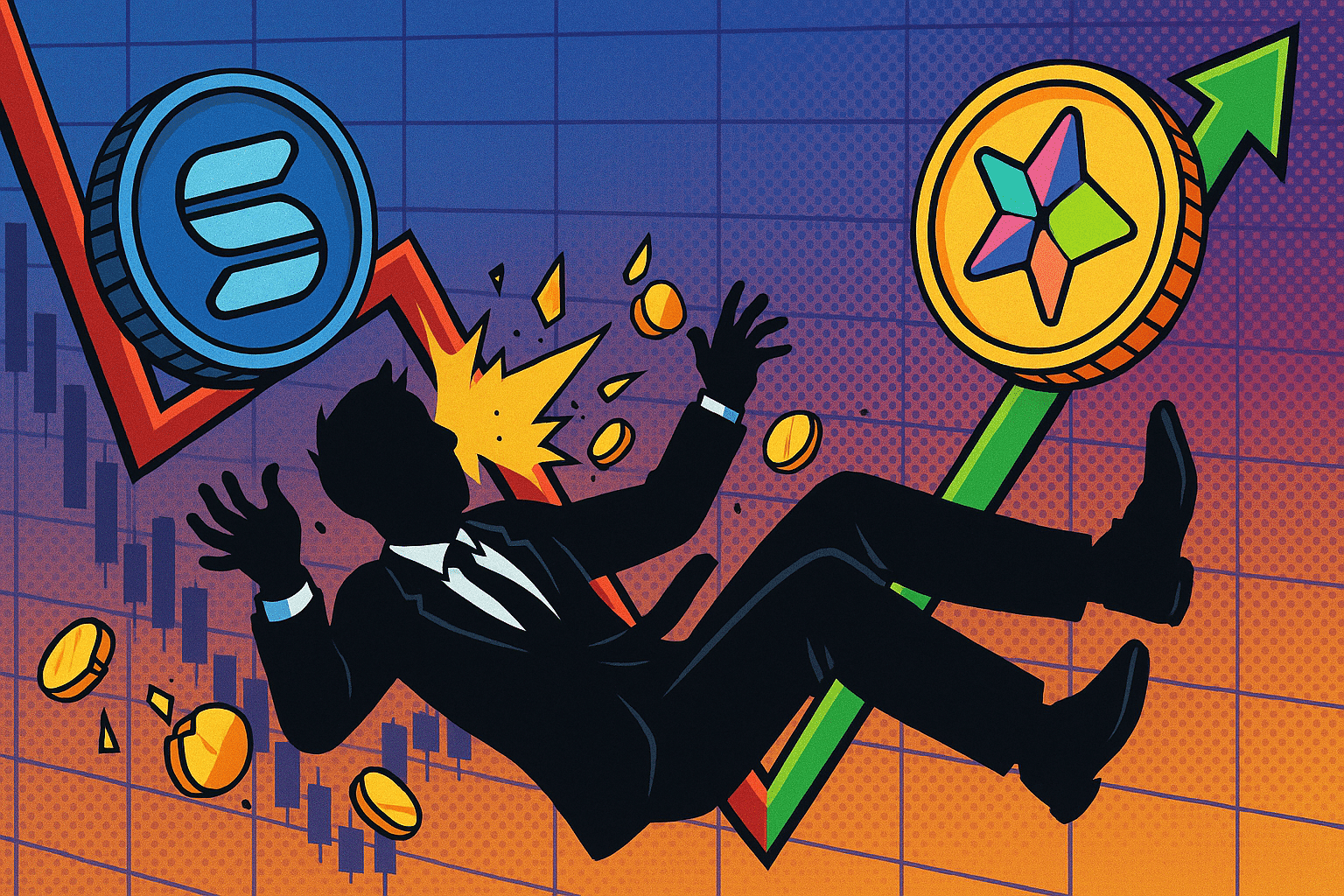

As SOL reclaims the $200 zone and long-range Solana price prediction models point toward fresh highs in 2025, we examine whether a surge in on-chain activity could supercharge trading tools – especially Snorter’s Telegram bot and what that means for Snorter’s adoption.

Solana’s price has clawed back the psychologically important $200 handle, trading around $207 after a failed push to $250 and a swift reset to the $190–$200 support area.

On a trailing view, the network has posted outsized on-chain revenue in 2025 and remains a top venue for DeFi, NFTs and retail-driven microcaps. The technicals, however, are mixed: the 14-day RSI sits in the low-40s, MACD momentum has flashed selling pressure on both daily and 4-hour frames and short-term moving averages have turned defensive even as longer-term EMAs (50/100/200) continue to trend higher.

Against that push-pull, medium- and long-term Solana price prediction ranges are still expansive. Base cases for 2025 cluster around an average near $408 with upside skews toward $432–$452 if momentum reasserts.

Out in 2028, scenario bands widen toward $792–$933 on the back of mainstream dApp adoption, while decade-end projections in 2031 stretch beyond the four-figure mark, with some models entertaining peaks near $2,160.

None of that negates path risk in the near term – network congestion bouts and cross-chain competition remain real, but it does frame a thesis investors have leaned into repeatedly: high throughput plus low fees equals fertile trading soil.

Microstructure Matters: Why Bots Thrive When Blockspace is Cheap

What pushes SOL’s day-to-day price is a blend of macro liquidity and chain-specific flow. On Solana, the latter has a distinct flavour. Sub-second finality and thousands of transactions per second encourage rapid issuance of small-cap tokens and frenetic speculative cycles.

When blockspace stays affordable, market makers and retail alike can ladder bids, rotate quickly and feed a high-frequency, event-driven ecosystem. That environment has historically favored automation – especially Telegram-based tools that sit where retail already congregates.

It’s here that Snorter enters the picture: a Solana-native Telegram bot designed to spot new liquidity, filter scams, route orders fast and minimize slippage. If SOL sustains activity above the $200 band and pushes toward the mid-$400s in 2025, order-flow intensity on the chain should increase.

In prior cycles, that has lifted both infrastructure tokens and the tools retail uses to navigate them. The question for would-be “next 1000x” hunters isn’t whether bots matter (they do), but which bot captures durable mindshare as competition tightens.

Price Road Map: Levels, Sentiment and the 2025–2031 Arc

Short-term, SOL has been rejected twice near $250, with resistance building around $205–$215 on intraday frames and support coalescing at $192–$200. A decisive reclaim and hold above the $215 shelf would strengthen the bull case toward $240 and reopen the $250 test; failure to defend $200 risks a drift to the high-$180s. The 50-day SMA near $206 remains a pivot; the 200-day SMA around $165 continues to slope higher and underpins the longer-term uptrend.

From a cyclical standpoint, the consensus Solana price prediction for 2025 imagines an average in the low-$400s with peaks around $452. By 2028, models that assume continued developer growth and mainstream dApp usage see fresh highs near $933 and by 2031, multi-thousand targets appear under bullish adoption curves.

Those are directional guideposts, not guarantees, but they contextualise why traders still chase Solana beta on weakness and why ancillary plays tied to Solana’s order flow keep attracting capital.

Snorter’s Pitch: Solana-First Design Meets Early-Signal Hunting

Most Telegram trading bots started on Ethereum, then bolted Solana support onto an EVM-first footprint. Snorter flips that script. Built as a Solana-native tool, it is engineered to capitalise on Solana’s fast blocks without relying on gas bidding wars or slower L1 settlement.

Its core loop blends mempool and liquidity monitoring with contract checks, tax handling and rug-pull heuristics, attempting to surface candidates before retail attention turns them into crowded exits.

The bot’s token, $SNORT, underwrites access and incentives. The team has tied utility to lower maximum fees (capped at 0.85% per trade), governance over feature evolution and staking mechanics designed to keep users inside the ecosystem. Copy-trading and limit-order modules aim to offer hands-off and rules-based options, while the real-time sniping engine is built for traders who want to set criteria and let automation do the first pass.

Snorter’s presale has passed $4.17 million with three weeks left on the clock and a notional price point around $0.1065. That momentum doesn’t prove product-market fit, but it does indicate that a share of the market believes Telegram is still where retail coordination lives and that a Solana-first bot can carve space alongside cross-chain incumbents.

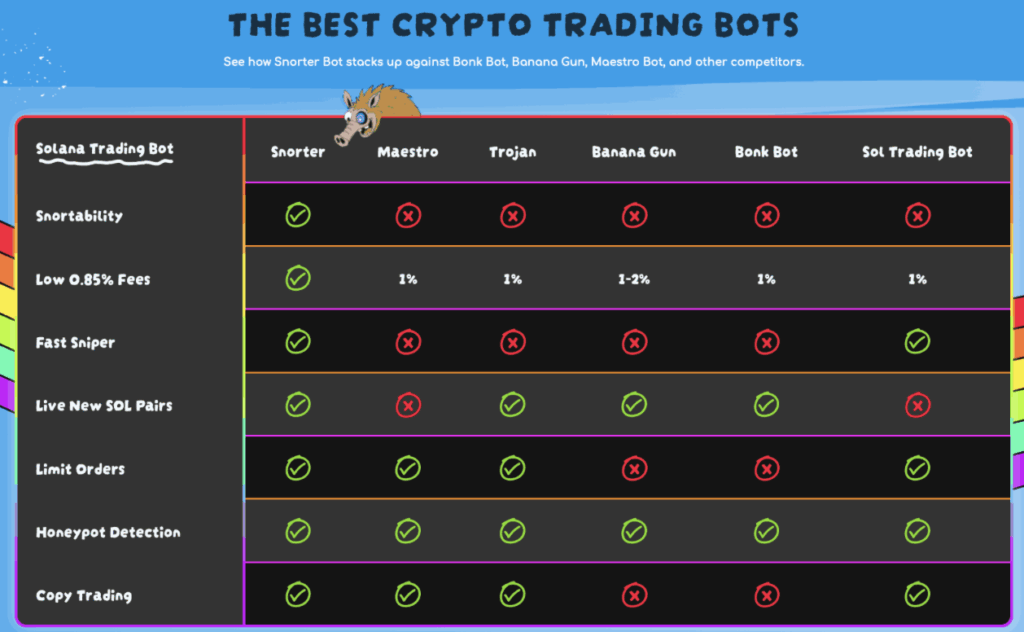

Competitive field: Maestro, Banana Gun, Trojan, Bonk Bot and the “Native” Question

Snorter won’t launch into a vacuum. Maestro and Banana Gun have strong brand recall from Ethereum and have expanded to Solana, though their infra and power users remain EVM-weighted.

On the Solana side, Trojan and Bonk Bot have proven that speed plus a good keyboard UI can capture flow, particularly during meme-coin surges and pre-liquidity scrambles.

Where Snorter argues differentiation is twofold. First, native token economics are front-and-center from day one on Solana, rather than as an afterthought imported from another chain.

Second, the early-detection stack emphasises both Solana and Ethereum mempools, filtering through contract verification and anti-rug checks before surfacing trades. If that workflow consistently front-runs retail chatter while avoiding obvious traps, Snorter can earn trust rapidly. If it misfires – flagging noise, missing threats, or clogging with failed transactions – users will rotate to alternatives just as fast.

Linking Narratives: What a Healthy SOL Does for a Telegram Bot

If SOL consolidates above $200 and trends toward the $400s in 2025, that typically correlates with more listings, more experiments and more retail risk-taking on Solana. Each of those adds events for bots to detect and route.

A favourable Solana price prediction isn’t just a tailwind for SOL holders – it’s a structural boost for tools like Snorter that monetise activity, not just direction.

Conversely, if volatility compresses or the chain runs into persistent congestion, the addressable opportunity narrows, fee caps matter less and differentiation shifts from raw speed to reliability and discovery quality.

In other words, Snorter’s upside is entwined with Solana’s throughput story. The more often the network can sustain sub-second finality at scale, the more meaningful any “be first” edge becomes for a Telegram bot that lives on that rail.

Risk lens: Execution, Security and the Realities of Automation

Two caveats deserve attention. First, presale traction is not the same as audited, battle-tested code. Bots sit close to user funds and smart-contract or routing bugs can be costly. Snorter’s public materials highlight contract verification and rug-pull checks for the tokens it surfaces; users will also want clarity on the bot’s own security posture, key management and fee logic.

Second, automation cuts both ways. Early entries can turn into early exits if liquidity fades or if tax and trading-restriction edge cases aren’t handled correctly. No bot eliminates risk; at best, it improves the signal-to-noise ratio and reduces mechanical slippage.

A Two-Track Trade

For investors focused on SOL, the base case remains intact: strong developer momentum, deep retail participation and a credible path – backed by several models – to the low-$400s average in 2025 with upside toward $452 in an extension.

For traders eyeing tools that could scale with that activity, Snorter is a live experiment in Solana-first automation. Its success will depend less on hype and more on whether it consistently detects real opportunities early, routes orders cleanly and keeps fees low without sacrificing reliability.

SNIPE CRYPTO EFFICIENTLY WITH SNORTER BOT

If the next leg of the Solana cycle materialises, a native Telegram bot tied to the chain’s tempo could find product-market fit quickly. Whether Snorter becomes that default will be decided in chat windows and transaction logs – not in presale dashboards.

For now, the market has given both stories room: a resilient Solana price prediction arc on one side and a Solana-centric trading stack on the other, each capable of amplifying the other if execution meets expectation.

Disclaimer: This article is for information only and is not financial advice. Digital assets and presales are volatile and risky. Always conduct your own research before committing capital.