Tether’s push for a $500 billion valuation underscores the growing influence of stablecoins in global markets, but as competition heats up, platforms like Best Wallet are positioning themselves to capture the next wave of adoption through accessibility, utility and multi-chain innovation.

Tether Holdings SA, issuer of the world’s largest stablecoin, is preparing a fundraising round that could reshape the crypto landscape. According to early reports, the El Salvador-based firm is seeking between $15 billion and $20 billion in exchange for approximately 3% of its equity.

If successful, the raise would value the company at around $500 billion – putting it in the same league as OpenAI and SpaceX.

The proposal involves new equity rather than existing investors offloading shares, with Cantor Fitzgerald acting as lead adviser. While numbers may shift as discussions continue, even the possibility of Tether commanding such a valuation highlights how central stablecoins have become to the broader crypto and financial ecosystem.

Tether’s USDT remains the market leader, with a value of $172 billion, far surpassing Circle’s USDC at $74 billion. The company has achieved extraordinary profitability by investing reserves in US Treasuries and cash equivalents, reporting $4.9 billion in second-quarter profits. Its margins are said to be close to 99%, a figure that has drawn as much scepticism as it has admiration.

Despite earlier clashes with regulators, Tether is preparing a strategic return to the US, aided by President Donald Trump’s pro-crypto policies. It has already announced a plan for a US-regulated stablecoin, appointing former White House official Bo Hines to oversee operations.

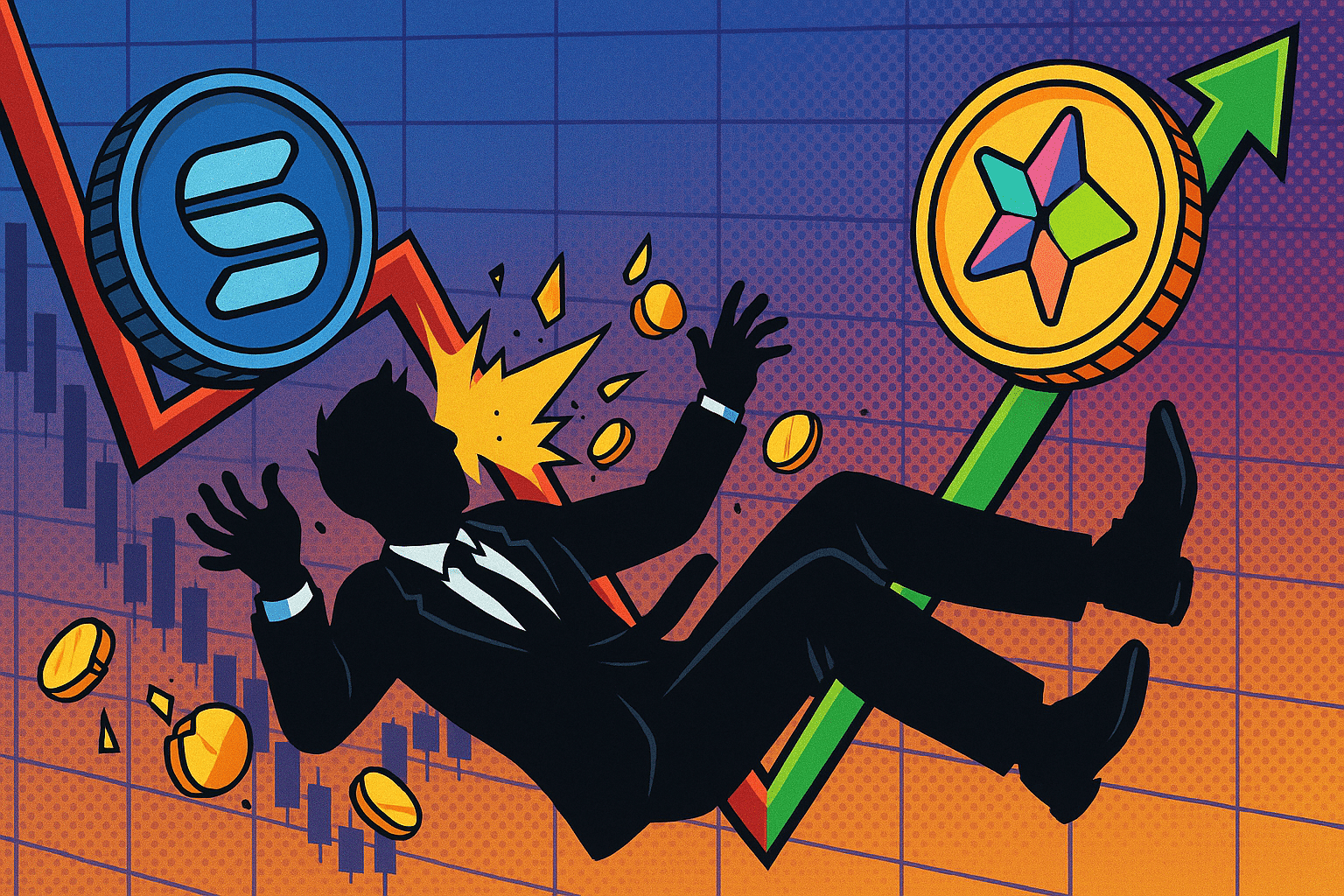

With rivals like Circle scaling and new entrants seeking to capture market share, Tether’s $500B bid isn’t just about capital – it’s about cementing its dominance in the stablecoin wars.

Stablecoins at a Crossroads

The importance of Tether’s potential rise goes beyond valuation. Stablecoins are increasingly viewed as the glue between traditional finance and decentralised systems, offering fiat-like stability with blockchain speed.

But questions linger. Falling US interest rates could reduce the profit margins that have fuelled Tether’s growth. Meanwhile, regulatory scrutiny is intensifying, particularly around reserve transparency and systemic risk. The race is no longer just about scale, but also trust, usability, and integration with broader financial services.

This is where complementary players like Best Wallet enter the picture, carving out opportunities in the adoption layer by simplifying how people interact with digital assets.

Best Wallet: Building the Adoption Layer

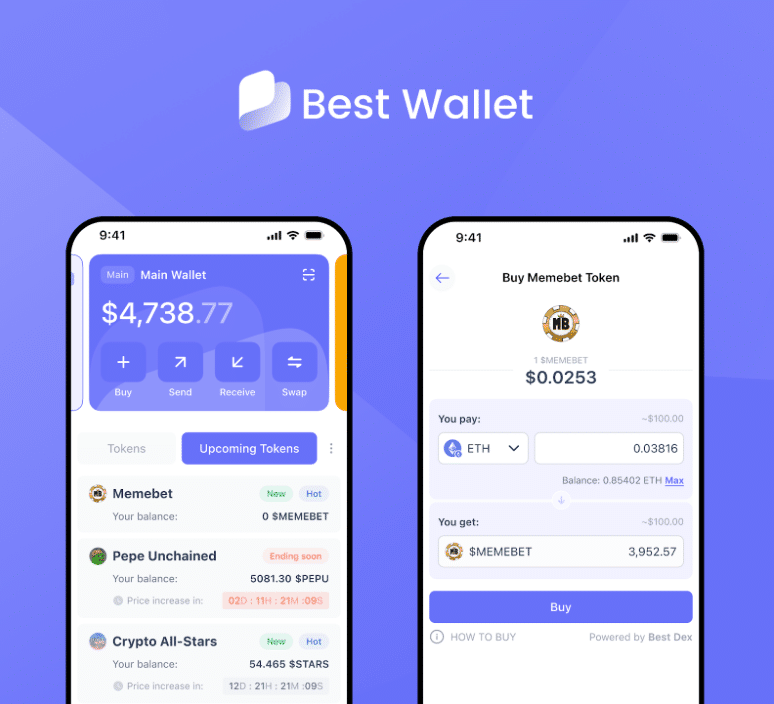

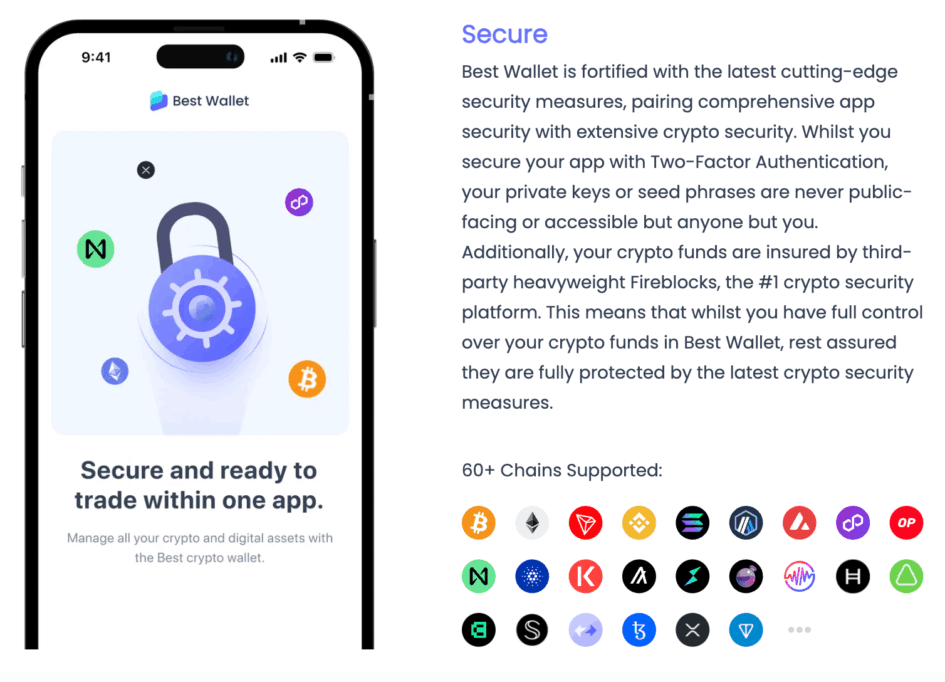

Unlike Tether, which dominates through sheer scale, Best Wallet is tackling a different problem – accessibility. In a market that often overwhelms newcomers with multiple wallets, seed phrases, and confusing user flows, Best Wallet has positioned itself as a mobile-first hub where users can buy, store and manage assets across 60+ supported chains.

Its ecosystem is built around simplicity. Whether trading Bitcoin, Solana, Ethereum, or Base, users can manage their holdings within a single interface. Crypto presales are integrated directly into the app through a vetted marketplace, providing exposure to new tokens before they are listed on exchanges.

Security is another focal point. Instead of relying on traditional seed phrases, Best Wallet deploys Fireblocks MPC-CMP technology, providing enterprise-grade protection for private keys. For added resilience, encrypted cloud backups enable users to recover their assets even if they lose their device.

$BEST Token: Utility and Governance in One

The Best Wallet ecosystem is underpinned by its native token, $BEST, which has already raised over $16.1 million in its presale. At $0.025695 per token, $BEST is designed to provide real, ongoing benefits to holders.

Transaction fees are reduced when swapping assets within the app’s integrated decentralised exchanges. Staking rewards are boosted through an upcoming aggregator, rewarding long-term participation. Governance is community-driven: token holders can vote on new blockchains to support or shape the platform’s roadmap.

In this way, $BEST functions as both a utility and governance token and as the user base grows, its importance within the Best Wallet ecosystem could deepen.

The Stablecoin Wars and Adoption Platforms

What connects Tether’s $500 billion ambition with Best Wallet’s growing ecosystem is the broader narrative of stablecoins and their growing adoption. Stablecoins like USDT may dominate liquidity and institutional flows, but platforms like Best Wallet ensure that retail users have the tools to participate meaningfully.

Where Tether is focused on scale, returns and regulatory positioning, Best Wallet is focused on everyday usability – from simplified presale participation to reducing transaction friction. In many ways, they address two halves of the same equation: stablecoins as financial infrastructure and wallets as the adoption layer that makes them usable.

Why the Timing Matters

The timing of these developments is critical. Tether’s proposed valuation comes just as interest rates begin to shift and as regulators sharpen their focus on the systemic importance of stablecoins. For Best Wallet, its presale and product rollouts coincide with renewed retail appetite for presales and cross-chain trading.

If Tether solidifies itself as a $500 billion behemoth, demand for straightforward, multi-chain wallets is likely to increase. That creates fertile ground for Best Wallet to scale alongside the stablecoin giants, ensuring that mass adoption isn’t just about liquidity pools but about user experience.

Two Sides of the Same Story

The $500B Tether raise represents a watershed moment for stablecoins. It signals not only the extraordinary profitability of the model but also the intensifying battle for dominance in a sector that bridges traditional finance and decentralised markets.

At the same time, adoption platforms like Best Wallet are proving equally vital. By making crypto simpler, safer, and more engaging, Best Wallet is positioning itself as a complementary force in the ecosystem – one that could thrive as stablecoins like Tether continue to expand their reach.

FIND OUT MORE ABOUT BEST WALLET AND JOIN THE $BEST PRESALE

In the end, stablecoins may win the liquidity wars, but wallets will decide whether mainstream adoption sticks, and in that race, Best Wallet is already shaping up to be a frontrunner.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and carry risks. Always do your own research before investing.