Bitcoin reclaimed the $112K area after a shaky September, but volatility hasn’t left the room. In the shadow of those swings, Bitcoin Hyper’s fast-rising presale and Layer-2 design are drawing attention from investors looking for utility and upside – before Q4 closes.

After a tense stretch hovering near $109K, BTC has bounced roughly 2.3% to peek back above $111K. The move fits a familiar “Uptober” pattern, but it doesn’t extinguish the macro jitters that have whipsawed prices for weeks.

Reasons are split: a brewing supply squeeze – low exchange balances and thinner OTC flow – as fuel for a run; geopolitical headlines and shifting rate expectations can still cap rallies or trigger sharp reversals.

That split screen – tentative strength, stubborn volatility – has many traders reassessing the best crypto to buy into year-end. One name repeatedly surfacing in those conversations is Bitcoin Hyper, a presale project pitching a Bitcoin-anchored, high-throughput Layer-2 capable of handling smart contracts and dApps. With more than $18.8 million already committed, the market is paying attention.

Bitcoin Hyper’s Pitch: Utility-Centric Bitcoin

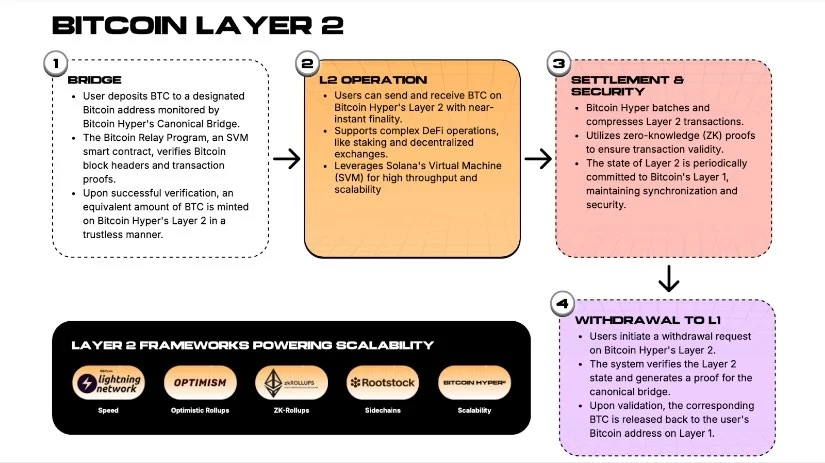

Bitcoin Hyper bills itself as a way to nudge the Bitcoin universe beyond “digital gold.” The idea: keep Bitcoin as the settlement bedrock while moving fast activity – payments, DeFi, gaming, even meme coin speculation – onto a Layer-2 designed for speed and programmability. In practice, that means a canonical bridge to lock BTC on L1 and mobilise a wrapped representation within a high-throughput execution layer.

The team’s public materials outline a familiar stack for anyone who’s built on modern chains: a Solana Virtual Machine (SVM) environment for sub-second confirmations and low fees; a bridge architecture to maintain ties to the base chain; and a rollup-style approach to anchor activity back to Bitcoin for security. The aim isn’t to replace Bitcoin’s role as hard money – it’s to make that hard money useful in day-to-day applications.

Crucially, that utility stance hasn’t abandoned crypto’s cultural edge. The project adopts a tongue-in-cheek, meme-driven aesthetic – a “superhero Pepe” frontman that speaks to the retail crowd even as the technical thesis targets developers and power users.

Why Presales Matter and Why This One Is on the Radar

Crypto presales are the industry’s version of early-stage crowdfunding: a project sells its native token at a discount to seed development and bootstrap community. The upside is obvious – get in early and ride the long tail if the product finds product-market fit. The risks are, too – execution missteps, token supply overhangs, or market cycles can undercut returns.

Against that backdrop, Bitcoin Hyper ($HYPER) has emerged as one of the busier presales this month. The team reports daily inflows that have pushed the raise beyond $18 million, even as broader markets have chopped. The current tranche price hovers around $0.012995, with a stage-based model that ratchets higher over time – an incentive for early participants that also forces the project to keep shipping as the bar rises.

For investors trying to identify the best crypto to buy before year-end, the presale structure isn’t the whole story – it’s the Layer-2 thesis plus momentum that’s pulling capital in.

Inside the HYPER Presale and Token Design

Under the hood, $HYPER sports a total supply of 21 billion tokens – a nod to Bitcoin’s 21M cap, scaled for network usage. Public materials point to a balanced allocation that reserves funds for development, liquidity, ecosystem grants and marketing. Two independent firms – Coinsult and SpyWolf – have reviewed the smart-contract code, with no major issues flagged in their reports.

From a user-benefit perspective, the token is slated to power gas fees, staking, governance and bridge operations – i.e., the core levers that make the network run. Combine that with the project’s stated plan to move from presale to launch in the near term and you get a clearer picture of why there’s traction: an explicit path from fundraising to a live Layer-2 where BTC can be mobilised, not just stored.

None of this guarantees a smooth listing or faultless rollout, but in a market scanning for catalysts, a funded, audited, roadmap-driven presale is a concrete signal.

Can a Layer-2 Shift BTC From Store of Value to Utility?

The broader question is whether a Bitcoin-anchored Layer-2 can unlock enough activity to matter. Ethereum’s explosion of DeFi and NFTs was catalysed by the arrival of smart contracts and later supercharged by Layer-2s. Bitcoin never got that same execution layer at scale, so its demand profile has stayed concentrated in savings, treasuries and ETF flows.

Bitcoin Hyper’s bet is that if you pair Bitcoin’s trust with SVM-level throughput, developers will bring familiar playbooks – DEXs, lending markets, on-chain games – into a BTC-centric world. Fees under a penny and sub-second finality make that plausible. A bridge that keeps accounting reconciled to Bitcoin’s base chain keeps the security story intact. If even a small slice of dormant BTC gets mobilised into these use cases, it could be meaningful for both the network and the token that fuels it.

That’s the upside scenario animating a lot of the “best crypto to buy now” chatter around Bitcoin Hyper. It’s less about speculative branding and more about whether a high-speed execution lane can expand Bitcoin’s addressable market.

What Analysts Are Saying About Bitcoin Hyper

Several analysts have started to highlight Bitcoin Hyper as one of the most compelling early-stage projects in the market right now. Their optimism is largely tied to how the token blends meme appeal with genuine technical ambition.

For example, Crypto Ape has argued that Bitcoin’s recent momentum is being fueled by “Uptober FOMO,” pointing out that OTC desks are running dry and exchange reserves are hitting record lows. In his view, this supply shock could drive BTC prices higher in October, but he also notes that volatility remains a constant risk. For investors seeking exposure with greater upside potential, he sees Bitcoin Hyper as an attractive alternative because of its utility-driven focus.

Elsewhere, sites like Bitcoinist have also reviewed the project positively. They emphasise that while Bitcoin Hyper is branded as a meme coin, its roadmap shows more substance than hype. By building a multichain, utility-centric ecosystem with smart contract capabilities, the project is being framed as a serious attempt to unlock Bitcoin’s usability rather than simply riding the meme cycle.

Meanwhile, content creators and market commentators on YouTube and X have joined in, praising the project’s steady presale momentum – which is bringing in roughly $200,000 per day – as evidence of strong retail conviction.

Some have gone further, suggesting that if the team executes its plans and delivers a smooth mainnet launch, Bitcoin Hyper could realistically deliver 100x returns in the coming cycle.

Taken together, these perspectives paint a consistent picture: while the broader market remains volatile, analysts see Bitcoin Hyper’s blend of memetic appeal and real utility as the reason it stands out and why many are calling it one of the best crypto to buy now.

How Bitcoin Hyper Fits a Year-End Playbook

Q4 often rewards projects that can couple a narrative with working code. If BTC continues to stall and chop into November, traders typically rotate into stories with clearer catalysts. That’s where Bitcoin Hyper slots in: a funded Layer-2 aiming to convert BTC from a passive asset into programmable capital.

For investors compiling a year-end shortlist of the best crypto to buy, that combination – utility thesis, presale traction and impending milestones – explains why HYPER is appearing alongside more familiar names. It’s not a replacement for BTC, but a bet that a faster execution lane can compound Bitcoin’s relevance.

Momentum Meets a Make-or-Break Launch Window

Bitcoin’s bounce back above $111K tells us sentiment can turn quickly, but the volatility that pushed it down is still in play. In that environment, Bitcoin Hyper offers a different angle: keep BTC as settlement gold and move everyday activity to a Layer-2 designed for speed and smart contracts.

With $18.8M+ raised, a stage-based presale around $0.012975, audits in hand and a roadmap pointing to near-term network rollout, the project has earned a legitimate look from traders hunting for the best crypto to buy before year-end. The upside case is straightforward: mobilise a sliver of dormant BTC into low-fee, high-speed apps and let usage drive token demand.

The risk case is equally clear: delivering secure bridges and a reliable SVM-based execution layer is hard and market conditions can shift fast. As always, sizing, diversification and discipline matter.

INVEST IN BITCOIN HYPER TO BE PART OF BITCOIN’S FUTURE

For now, the market has cast its early vote with capital. Whether Bitcoin Hyper can convert that into sustained network activity and justify the attention – will be one of Q4’s more interesting tests.

Disclaimer: This article is for informational purposes only and should not be taken as financial or investment advice. Cryptocurrency investments carry significant risk and readers should conduct their own research and consult a licensed financial advisor before making any decisions.