Binance and on-chain data show retail investors are driving Bitcoin’s range while institutions sit back. Rate cuts add a constructive backdrop, but the search for utility is intensifying. Enter Bitcoin Hyper – a Bitcoin Layer-2 that blends Solana-style throughput with Bitcoin settlement and a growing candidate for the best crypto to buy now.

Bitcoin’s grip around $117,500 is increasingly a story of many small hands rather than a few large ones. Binance flow dashboards and CryptoQuant distributions point to a market propped up by smaller tickets: inflows in the 0–0.001 BTC cohort have approached 97,000 BTC, while the 0.001–0.01 BTC band sits near 719,000 BTC.

In contrast, the usually market-moving 100+ BTC prints have been subdued. The implication is straightforward: broad-based retail participation is providing liquidity and dampening sudden air-pockets that are often triggered by whale selling.

That foundation coincides with a macro turn. The Federal Reserve has delivered its first rate cut of 2025, a 25 bp step that may not shock the system but does tilt conditions in favour of risk assets.

A consistent policy message and steady ETF inflows can keep depth healthy and let market breadth improve rather than fade. If labour and inflation prints behave, further easing remains on the table and history suggests those windows have mattered. After March 2020’s cuts, Bitcoin quadrupled by year-end as liquidity and narrative combined.

The current twist is who is leading. With institutions quieter, retail is dictating the tape. That creates a curious mix of resilience and fragility: resilience because distributed demand reduces single-seller shock; fragility because sentiment-driven cohorts can reverse quickly if a headline or basis wobble spooks them.

Against that backdrop, the question animating desks is less “will Bitcoin tick $120k?” and more “where does fresh beta come from if the top asset chops?”

From rate cuts to rails: the case for Bitcoin utility

Post-cut periods typically send investors hunting for assets with asymmetric upside and clear product-market fit. Ethereum and Solana have long been favoured for DeFi and programmability, but a credible path to make Bitcoin faster and more versatile would be a category reset.

That is the wedge Bitcoin Hyper is trying to drive into the market and why it is increasingly cited in scans for the best crypto to buy now that isn’t simply a momentum echo.

The pitch is clean: keep Bitcoin’s settlement guarantees while moving execution to a high-throughput Layer-2. Bitcoin Hyper proposes an execution layer powered by the Solana Virtual Machine (SVM), then rolls up state and periodically anchors it to Bitcoin Layer-1.

In practice, that means parallelised processing, thousands of transactions per second and very low fees – without editing Bitcoin’s base rules. The design aims to preserve neutrality and finality on L1 while solving the throughput and programmability gaps off-chain.

Architecture in plain English

Think of Bitcoin Hyper as a fast-lane that sits above the motorway. Users move BTC into a canonical bridge on Layer-1, which locks the coins and mints a 1:1 wrapped balance (WBTC) on the Layer-2. Transactions – swaps, payments, dApp calls – happen at SVM speed. Periodically, commitments of the L2 state are posted to Bitcoin, so anyone can verify the rollup’s integrity. When users are done, they burn the wrapped balance on L2 and unlock native BTC back on L1.

Two pieces make that credible. First, the rollup discipline: batching and committing state roots back to Bitcoin to inherit its security, rather than relying on an off-chain honour system. Second, the SVM choice: developers can port Solana dApps with minimal surgery, seeding an ecosystem without waiting years for greenfield builds.

If delivered, that turns BTC from store-of-value only into a medium that can support DeFi rails, NFTs, gaming and day-to-day payments, all while settling to the chain that institutions already trust.

Token economics and incentives

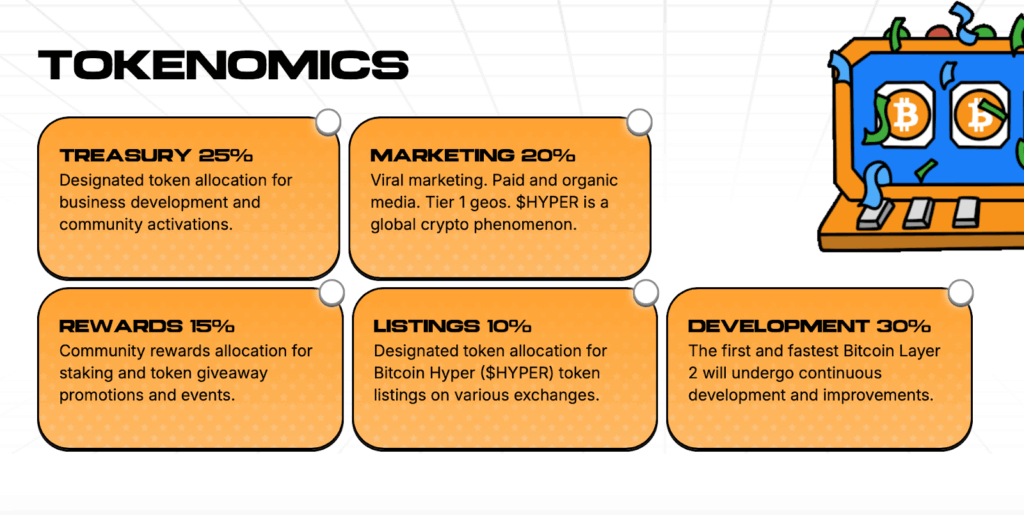

The $HYPER token sits at the centre of this plan. It is slated for gas, governance and staking; developer grants lean on it; and fees and rewards accrue to the token economy rather than living off pure BTC throughput. That alignment matters because it gives users a reason to hold and gives builders a reason to deploy – beyond speculative churn.

Presale mechanics indicate the market is paying attention. Funding has pushed past $16.8 million, with price steps mapped toward a stated listing level of roughly $0.012975. Staking yields (currently cited around 68% APY) are designed to lock float before mainnet liquidity arrives. Meanwhile, visible on-chain buy tickets – such as a pair of 8 ETH-sized allocations executed in close succession – suggest whales are nibbling at an early discount while volatility remains contained.

None of this absolves risk. Presale schedules can slip; staking APRs compress as participation scales; and any Layer-2 that touches Bitcoin inherits a high bar for security audits and bridge design. The framing here is not promotional, but analytical: the ingredients line up with what risk-seeking retail is hunting for in a post-cut tape.

Why the timing could be fortuitous

Markets don’t move on tech abstracts; they move on catalysts and cash. On catalysts, the macro path is clearer: Polymarket participants favour multiple cuts before 2026; ETF flows have normalised from launch spikes but remain net supportive; and the dollar’s direction will steer cross-border participation. On cash, the leadership baton is with smaller tickets and those cohorts typically chase utility narratives once the top-two assets feel “expensive.”

All of that steers attention toward Bitcoin-adjacent beta that still feels early. In previous cycles, that role fell to sidechains or wrapped-Bitcoin applications on other L1s. A credible Bitcoin-anchored rollup with SVM compatibility updates the playbook: it keeps settlement home, accelerates execution and invites a ready-made developer base. If rate cuts extend risk windows through Q4 and into 2026, a Layer-2 that puts BTC to work could sit squarely in the slipstream.

The sceptic’s checklist

Balanced coverage demands the obvious questions. Can a brand-new L2 safely operate a canonical bridge at Bitcoin scale? How frequently will state roots be posted and what are the fraud-proof or validity-proof mechanics around disputes? Does SVM compatibility fragment from EVM-dominant tooling, or does it capture a distinct developer constituency that is already comfortable on Solana? And on token design: do gas and governance demand create organic sinks for HYPER, or does value only accrete if activity surges?

Investors vetting candidates for the best crypto to buy now should ask those questions loudly. The upside in L2s is tied to throughput and trust; the downside, when bridges misfire, is uncompromising.

What would success look like?

In the near term, success isn’t a headline; it’s a sequence. A transparent, audited bridge goes live. Early dApps – ideally a payments rail, a simple DEX and a Bitcoin-collateralised lending market – demonstrate low fees and fast finality.

State commitments land on Bitcoin predictably. Staking participation holds even as APRs trend down. Builders port at least a handful of SVM apps without drama. Only then does an exchange listing matter, because only then is there something to use.

If that sequence plays out, Bitcoin Hyper could do more than catch a rotation. It could turn BTC’s vast, idle liquidity into working capital for an app layer that has historically lived elsewhere. In that world, HYPER isn’t just a presale ticket; it’s the coordination token for a throughput upgrade that Bitcoin users can feel.

PLUG INTO HYPER SPEED – BEFORE THE FAST LANE FILLS

Retail flows have steadied Bitcoin while institutions bide their time. Rate cuts have warmed the water without boiling the pot. In that environment, assets with believable utility and asymmetric timing stand out. Bitcoin Hyper fits the brief: a rollup that borrows Solana’s execution model, anchors to Bitcoin’s settlement and invites developers to ship without starting from zero.

It won’t be the only contender and it won’t be immune to the hazards that come with bridges and new chains, but on today’s facts, it’s a defensible inclusion on any shortlist for the best crypto to buy now.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and carry significant risk. Always do your own research before investing.