Bitcoin is clawing back momentum after weeks of turbulence, but as institutional inflows slow, the market is eyeing fresh catalysts. Could Bitcoin Hyper’s Layer-2 unlock the next phase of BTC’s growth?

Bitcoin extended its recovery, now trading above $111,031. This follows a 3% rise last week, a modest rebound after three weeks of decline from July’s all-time high of $124,474.

Sentiment has been bolstered by fresh inflows into US Bitcoin exchange-traded funds (ETFs). Spot ETFs saw $368.25 million in inflows on Monday, breaking a two-day outflow streak. If sustained, such flows could act as a short-term floor for BTC, offering breathing room in a historically volatile month.

Traders, however, remain cautious. With US Nonfarm Payrolls revisions due this week, along with fresh Producer Price Index (PPI) and Consumer Price Index (CPI) data, macroeconomic headwinds still loom. Federal Reserve Chair Jerome Powell has hinted at a policy pivot, with markets now pricing in a strong chance of multiple interest-rate cuts before year-end.

Technically, Bitcoin price prediction models show mixed signals. A daily close above the 50-day EMA at $112,00 would reinforce bullish control, with upside potential toward $116,000. Indicators such as the Relative Strength Index (RSI) edging above 50 and a bullish MACD crossover point to strengthening momentum.

Still, analysts warn that September has historically been Bitcoin’s weakest month, often marked by dips before stronger autumn rallies.

This fragile recovery underscores the importance of structural catalysts. While ETFs and macro data shape short-term moves, many traders argue that Bitcoin’s long-term supercycle narrative now depends on expanding its utility and that’s where Bitcoin Hyper enters the conversation.

Institutional Flows Slow, Leaving Bitcoin in Search of Utility

Despite strong ETF launches earlier in 2025, institutional appetite has cooled. Strategy, one of the largest corporate holders, added just 1,200 BTC in August. Other firms averaged fewer than 350 BTC each. At the same time, ETF flows fell sharply in late July, with over $1 billion exiting funds during the week of August 18.

This weakening institutional demand has left Bitcoin rangebound around $111,000, down 0.6% over two weeks and nearly 5% across the past month. Analysts note that while Bitcoin remains the premier store of digital value, it lacks the industrial and cultural utility that underpins gold.

Gold can be worn, exchanged and embedded in industry. Bitcoin, by contrast, remains almost exclusively an investment vehicle. That raises a key question for the next Bitcoin price prediction cycle: Can BTC evolve from “digital gold” into a programmable, utility-rich asset?

Enter Bitcoin Hyper, a Layer-2 solution that promises to bridge the gap.

Bitcoin Hyper’s Layer-2: Bridging Security and Scalability

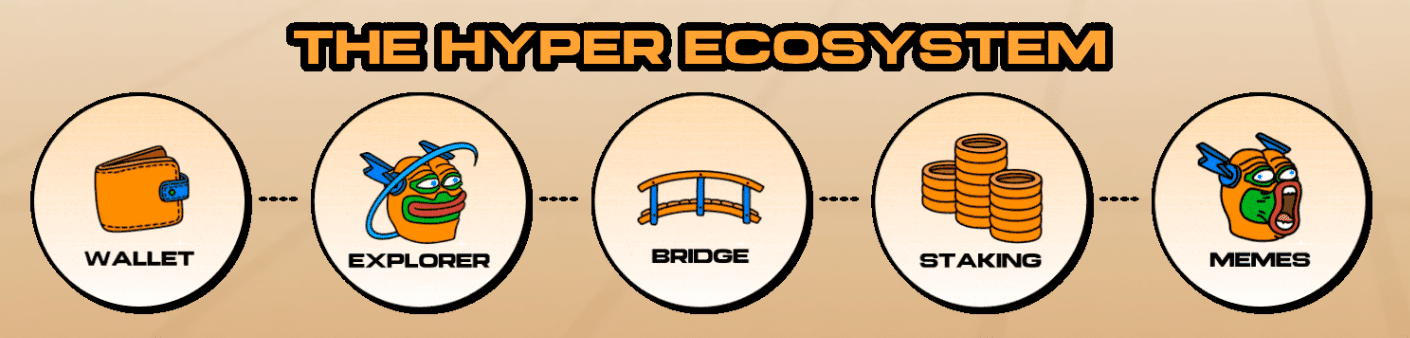

Bitcoin Hyper ($HYPER) has emerged as one of the most ambitious Layer-2 projects of 2025, raising over $14.7 million in presale funding. Its mission is simple: to transform Bitcoin from a passive store of value into a dynamic financial engine.

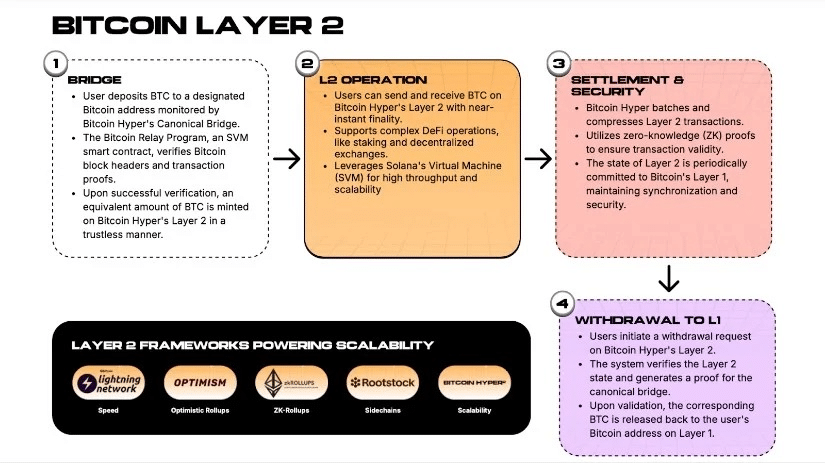

The project leverages the Solana Virtual Machine (SVM) as its execution layer. This allows developers to port Solana-based decentralized applications directly onto Bitcoin Hyper, offering the same speed and low transaction costs Solana is known for while anchoring activity to Bitcoin’s unparalleled security.

The Canonical Bridge is central to this design. BTC locked on the base chain is mirrored as wrapped BTC on Hyper, enabling it to be deployed across decentralized finance (DeFi), NFTs, gaming and tokenized assets. When users want to redeem their original Bitcoin, the wrapped version is burned, ensuring the Layer-1 chain remains the ultimate settlement layer.

This hybrid approach addresses what Ethereum co-founder Vitalik Buterin famously called the blockchain trilemma: balancing scalability, security and decentralization. By combining Solana’s performance with Bitcoin’s security, Hyper may be one of the first Layer-2s capable of solving all three at once.

Why Bitcoin Hyper Matters for Price Predictions

For Bitcoin’s long-term price trajectory, utility may become just as important as institutional flows. Bitcoin Hyper offers a pathway for BTC to capture activity currently dominated by Ethereum and Solana.

Consider Solana’s DeFi ecosystem, which currently locks in over $11 billion in assets. If even a fraction of that activity migrates to Hyper, the result would be billions in transaction volume tied directly to Bitcoin. Add in NFTs, tokenised real-world assets and gaming applications and the multiplier effect becomes significant.

This potential has turned Bitcoin Hyper into a focal point for retail investors, many of whom see HYPER tokens as a leveraged bet on BTC’s evolving role. While Bitcoin dominance has levelled off, presale demand for Hyper has surged, reflecting a belief that utility-driven growth could drive the next phase of the supercycle.

The Bitcoin price prediction debate often centers on whether BTC can sustain valuations above $100K. Hyper reframes the question: What if Bitcoin’s price no longer depends solely on passive accumulation, but on active, utility-driven demand?

Short-Term Uncertainty, Long-Term Opportunity

None of this eliminates short-term risks. September remains a historically weak month for Bitcoin and ETF flows can be fickle. On-chain indicators show stabilization, but volumes are still light and options markets suggest persistent demand for downside protection.

Yet, the emergence of Bitcoin Hyper underscores a shift in market psychology. For the first time in years, the most compelling Bitcoin narrative isn’t just “digital gold.” It’s programmable, scalable Bitcoin – an asset that can support DeFi, NFTs and cross-chain liquidity while maintaining the security that made it valuable in the first place.

That’s why traders are watching Hyper’s presale so closely. While Bitcoin may dip below $100K in the short term, the Layer-2 story could provide the catalyst for its next major rally.

The Next Supercycle Catalyst?

Bitcoin’s recovery above $111,000 has offered temporary relief, but September remains fraught with risk. ETF inflows, labor market data and macroeconomic trends will dictate short-term moves and the Bitcoin price prediction models remain split between $100K support and $116K resistance.

For the long term, the spotlight is shifting. Bitcoin Hyper’s Layer-2 design could deliver the missing ingredient: real-world utility. By fusing Solana’s speed with Bitcoin’s trust layer, Hyper could transform BTC into more than a reserve asset – it could become the foundation for an active, global financial ecosystem.

DON’T MISS THE L2 OF BITCOIN – FAST TRANSACTIONS, SMART CONTRACTS

For now, Bitcoin’s story is still being written, but if $Hyper delivers on its promise, future price predictions may not just ask whether BTC can hold six figures. They may ask how high utility can push it.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and carry significant risk. Always conduct your own research and consult a licensed financial adviser before making any investment decisions.