As Senator Cynthia Lummis introduces a groundbreaking bill to let digital assets count toward mortgage eligibility, all eyes are on Best Wallet – whose crypto-first ecosystem may become the go-to platform for next-gen homebuyers and retail investors alike.

Crypto is making its way into the American housing market and fast. Senator Cynthia Lummis (R-Wyo.) has introduced the 21st Century Mortgage Act, a bill designed to modernise federal mortgage underwriting by allowing digital assets like Bitcoin to count in a borrower's financial profile.

Under current rules, home loan applicants often have to liquidate their crypto into fiat to qualify. Lummis’s proposal, however, would prohibit that requirement, effectively recognizing cryptocurrencies like BTC and ETH as legitimate collateral in mortgage decisions by Fannie Mae and Freddie Mac.

This comes in response to data showing that just 36.6% of Americans under 35 own homes – a generation that also leads crypto adoption. In fact, 21% of US adults now hold crypto and two-thirds of them are under 45.

It’s not just the US catching on. In Australia, fintech firm Block Earner just won a legal case allowing them to offer Bitcoin-backed mortgages. The global trend toward integrating crypto into traditional finance is undeniable and may be the start of a broader realignment.

Best Wallet: Positioned to Capitalise on the Crypto-Finance Convergence

With crypto potentially becoming a recognized asset in mortgage eligibility, platforms that bridge real-world financial use with digital assets stand to benefit enormously. That’s where Best Wallet comes in.

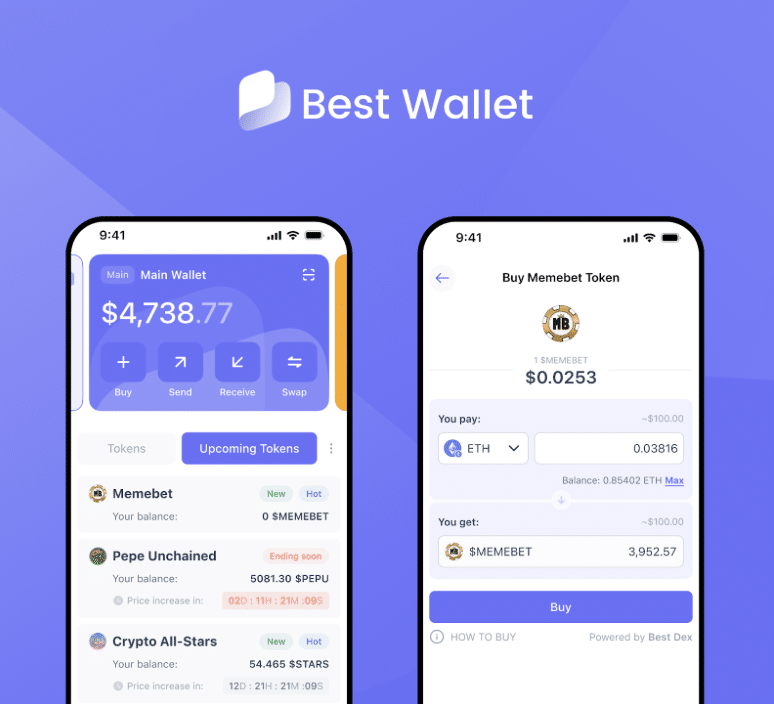

Best Wallet isn’t just a non-custodial crypto wallet – it’s an all-in-one Web3 platform designed for seamless asset management, trading and real-world application. With support for over 100 fiat currencies, the platform makes it easy for users to onboard into crypto. This is perfect for new buyers who may now be incentivised to accumulate Bitcoin as part of their path to homeownership.

Best Wallet doesn’t stop at onramps. Through its automated Dollar Cost Averaging (DCA) tool, users can schedule consistent Bitcoin purchases to smooth volatility and build long-term holdings. It’s a low-stress, disciplined way to stack sats – just in time for a future where BTC on your balance sheet might help buy your first house.

$BEST Token’s Utility Ties Directly to New Financial Realities

As digital assets enter traditional systems, utility tokens with real-world functions will gain in relevance. $BEST, the native token of Best Wallet, is engineered with just that in mind.

Holders of $BEST gain access to gas-free transactions across chains, enjoy discounted fees for token swaps, unlock higher staking rewards with a current yield of 94%. They can get early access to token presales inside the app. They can also benefit from cashback bonuses through the upcoming Best Card, a crypto-linked debit card.

These features aren’t theoretical – Best Wallet has already attracted over 250,000 monthly active users and has raised more than $14.3 million in its ongoing presale. As the user base grows and demand for crypto-as-collateral increases, $BEST could evolve from a utility token into a core asset for crypto-native finance.

TradFi Meets Web3: Best Wallet’s Unique Edge

What makes Best Wallet stand out in a crowded crypto app landscape is integration and safety.

Unlike browser-based wallets that often suffer from phishing risks, Best Wallet is mobile-only, dramatically reducing exposure to common exploits. The app also includes an advanced security infrastructure based on multi-party computation (MPC), real-time scam filtering to protect user assets and a built-in token launchpad that surfaces high-potential projects before they go viral.

For users looking to diversify beyond Bitcoin, Best Wallet offers a standout feature: Upcoming Tokens. This curated discovery engine highlights emerging coins before exchange listings. Past picks include Pepe Unchained, which surged 700%, Catslap with returns exceeding 7,000% and Wall Street Pepe, which has jumped nearly 35% in just two weeks.

This dual strategy – steady BTC accumulation and high-alpha altcoin plays – makes Best Wallet unique in its ability to serve both cautious long-term investors and high-risk traders.

From Mortgage Eligibility to Mainstream Adoption

The financial system is changing. Senator Lummis’s crypto mortgage bill signals a historic inflection point: digital assets are no longer fringe – they're starting to count.

That change ripples out. If more lenders recognize crypto holdings as financial assets, there will be a surge in demand for secure, compliant, multi-functional wallets that can document, store and even grow these holdings.

Best Wallet sits at the center of this movement. Whether you're saving to buy a home with Bitcoin or scanning for the next breakout altcoin, the app offers a real financial toolkit for the modern crypto user.

In the context of a regulatory landscape that’s increasingly open to digital assets, $BEST isn’t just a speculative bet – it’s a gateway token to participating in that new reality.

How to Join the $BEST Ecosystem

Best Wallet’s presale is currently active, with tokens available at just $0.025405. You can purchase directly through the app using ETH, USDT, or even a credit card. Once acquired, you can stake $BEST for 94% APY and start unlocking platform features immediately.

As crypto moves from speculation to infrastructure – from meme coins to mortgage applications – the projects that focus on real-world integration will lead the charge.

If the 21st Century Mortgage Act becomes law, owning crypto could open doors to homeownership and owning $BEST could open doors to an entire financial ecosystem built on that premise.

INVEST IN $BEST AS THE WORLD ACCEPTS CRYPTO INNOVATIONS

Crypto is no longer just about trading – it’s becoming part of the everyday economy. Best Wallet isn’t riding the wave. It’s building the bridge.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research before investing in cryptocurrencies.