With Thailand approving sweeping crypto tax exemptions through 2029, local traders and DAOs now face a new priority – protecting their digital assets. In a post-tax world, secure wallets like Best Wallet are no longer optional their infrastructure.

Thailand’s Ministry of Finance has just passed one of the most consequential crypto reforms in Southeast Asia to date. Effective January 2025 through the end of 2029, capital gains derived from the sale of digital assets will be exempt from personal income tax for residents.

The reform, passed by the Thai cabinet on June 17, is a clear signal that the country aims to position itself as a digital asset hub and is willing to make regulatory concessions to achieve this goal.

“This tax adjustment will enhance the growth of Thailand’s digital asset market, related businesses and token-based fundraising,” said Deputy Minister Julapun Amornvivat.

The exemption eliminates the previous 15% withholding tax on cryptocurrency profits, providing immediate benefits to individual investors. Exchanges operating in Thailand, such as Bitkub and regional arms of Binance and KuCoin, are expected to benefit from renewed trading activity as tax concerns ease.

However, with these regulatory carrots come new sticks. Thailand’s Revenue Department is preparing to implement the Crypto-Asset Reporting Framework (CARF), which will allow for global information exchange between jurisdictions. In other words, while tax burdens are being lifted, scrutiny over wallet activity and transaction history is about to increase, especially for individuals or teams moving large sums on-chain.

Regulatory Tailwinds Sweep Across Southeast Asia

Thailand isn’t acting in isolation. Its tax reform follows closely on the heels of Vietnam’s crypto legislation. On June 14, the Vietnamese National Assembly passed the Law on Digital Technology Industry, officially classifying cryptocurrencies and placing them under regulatory oversight. That law, set to take effect in 2026, paves the way for broader token adoption and innovation within Vietnam’s borders.

This regulatory pivot signals something bigger: Southeast Asia is preparing for mainstream crypto adoption and, in doing so, it’s creating a new standard for digital asset management. With fewer tax hurdles but tighter compliance and reporting standards, how traders store, move, and secure their assets is becoming a core issue, not a technical afterthought.

Why Secure Wallets Are Now Central to Crypto Operations

As Thailand opens its gates to tax-free capital gains, a significant operational shift is underway. Institutional players, DAOs, and even independent traders will need to rethink wallet infrastructure – not just for storage, but for operational readiness in a tax-transparent landscape.

This is where secure wallets, such as Best Wallet, come into play.

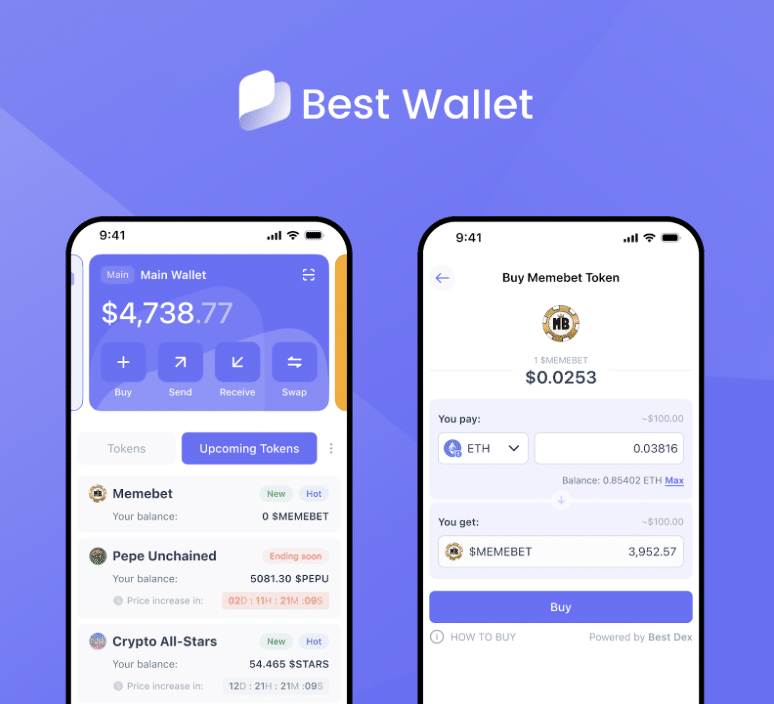

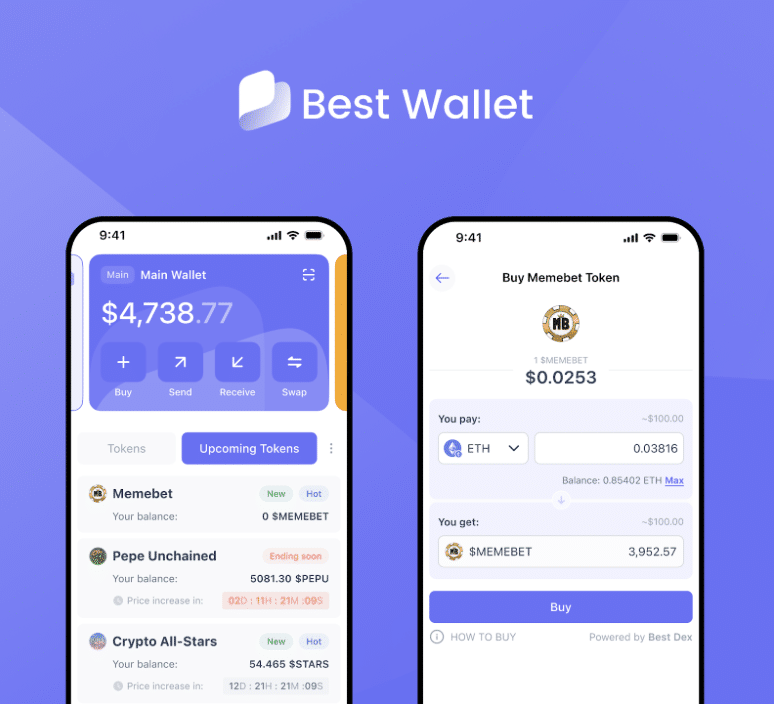

Best Wallet isn’t simply another mobile crypto app. It’s a cross-chain treasury management tool tailored for Web3-native teams and crypto businesses. With support for over 50 blockchains – including Ethereum, Arbitrum, BNB Chain, and Polygon – it allows teams to allocate capital, pay contributors, and participate in presales without relying on centralised exchanges or exposing assets to custodial risk.

For Thailand-based operators, this solves a specific pain point: local exchanges enforce strict KYC rules that prevent foreign residents from opening accounts. With Best Wallet, users retain complete control and privacy while still participating in Thailand’s newly incentivised market.

From Tax-Free Gains to Operational Readiness

The Thai tax reforms change the financial equation, but they don’t change the need for secure infrastructure. They raise the stakes. Without the ability to offset losses against capital gains taxes, crypto investors and teams in Thailand now have more to lose from mismanaging their wallets or falling victim to breaches.

Best Wallet mitigates these risks with a suite of mobile-first security features. These include biometric login, passcode protection, and optional two-factor authentication. Importantly, it remains fully non-custodial and KYC-free, providing a critical edge for teams and individuals navigating global transaction flows in an increasingly transparent environment.

With transaction data soon to be shared between jurisdictions under CARF, the onus is now on users to not only manage funds wisely but to do so in a way that balances privacy with operational clarity.

Crypto Operations Are Going Mobile and Thailand’s Law Accelerates That Trend

A significant implication of Thailand’s decision is that capital is about to move faster and more freely than before. DAOs, token treasuries, and Web3 startups will need wallet solutions that support that velocity. Browser extensions and cold wallets, while secure, lack the agility that today’s crypto teams require.

Best Wallet meets this demand with its enterprise roadmap. While current tools focus on individual access and multi-wallet setups, the team is actively developing features such as multi-sig approvals and shared team access – two critical components for scaling trustless financial operations. That roadmap makes it a future-proof option as the crypto business in Thailand (and the wider region) matures.

The wallet also integrates a decentralised exchange aggregator, enabling instant token swaps across supported chains. For crypto-native companies managing diverse treasuries, that means fewer steps, lower fees, and less exposure to volatile gas costs.

Tokenised Bonds and the Road Ahead

Thailand’s tax reform wasn’t the only digital asset headline this quarter. In May, the country announced a pilot initiative to issue tokenised government bonds, dubbed G-tokens, worth $150 million. Issued via ICO portals, these instruments blend traditional finance with blockchain’s real-time settlement potential.

This marks a significant shift from symbolic crypto friendliness to structural integration. It also means that crypto-native wallets, capable of interfacing with DeFi protocols and tokenized financial instruments, are now indispensable.

LEARN MORE ABOUT BEST WALLET TO SECURE YOUR CRYPTO

Best Wallet already supports dApp access, allowing users to interact with launchpads, decentralized governance platforms, and, increasingly, tokenized real-world assets – all from a single interface. As Thailand begins to experiment with on-chain fundraising and token-based debt instruments, this functionality will only become more relevant.

Tax Relief Without Risk Mitigation Is Incomplete

Thailand’s crypto tax exemption is a landmark decision, but it’s only part of the equation. The policy removes a key barrier to growth, but the responsibility of managing assets securely still falls on users and teams.

In a region leaning into digital asset adoption, wallets are no longer just tools – they’re the foundation of financial sovereignty.

As regulations evolve and capital flows shift, the need for secure, mobile-first, cross-chain wallet infrastructure will only grow. Best Wallet isn’t just a useful app – it’s a necessary response to the new reality unfolding across Southeast Asia.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile and regulatory policies are subject to change. Always conduct your research before making financial decisions.