Solana’s booming DeFi sector signals rising demand for new scalable infrastructure and Solaxy could be the project to meet it.

Solana’s momentum in decentralised finance is accelerating. The network's total value locked (TVL) recently surpassed $10.9 billion, placing Solana ahead of the entire Ethereum Layer-2 ecosystem. Its 30-day fee revenue jumped by 109% to $43.4 million, while meme coin activity and institutional partnerships support bullish sentiment. This sets the stage for an optimistic Solana price prediction – yet, the pressure on the main chain highlights a growing need for scalable solutions.

That need is now being answered on two fronts. Nasdaq-listed DeFi Development Corp. (DFDV) is expanding its footprint in Solana by teaming up with Bonk (BONK), one of Solana’s most valuable meme coins. The companies have announced a joint Solana validator node, combining treasury capital and community power to help decentralise the network further.

Meanwhile, Solaxy, a new Layer-2 solution, is gaining traction in presale and aims to offload Solana’s rising transaction volume, giving developers and meme coin traders the performance they need.

Institutional Support Builds Solana’s Credibility

DFDV’s commitment to Solana continues to deepen. After purchasing 172,670 SOL this week at an average price of $136.81, the firm now holds nearly 600,000 SOL – valued at over $105 million. That treasury development and the validator deal with Bonk helped push DFDV’s stock up 74% in a single day to reach a new all-time high.

The validator partnership isn’t just about staking rewards—it reflects a broader movement to build out decentralised infrastructure. Bonk will reinvest a portion of validator earnings into token burns, while DFDV manages operations and continues to accumulate Solana. This rare alignment of incentives marks a new model for how institutional players and meme coins can work together in the Solana ecosystem.

Despite this optimism, some technical indicators point to caution. Solana’s price dipped to $165, approaching a critical support level. Should it break below that threshold, analysts warn of a potential fall to $141. However, with so many on-chain fundamentals flashing green, especially around DeFi activity and validator growth, any pullback may be temporary—particularly if new solutions can relieve network stress.

Solaxy Brings Scalable Solutions to Solana’s Growing Ecosystem

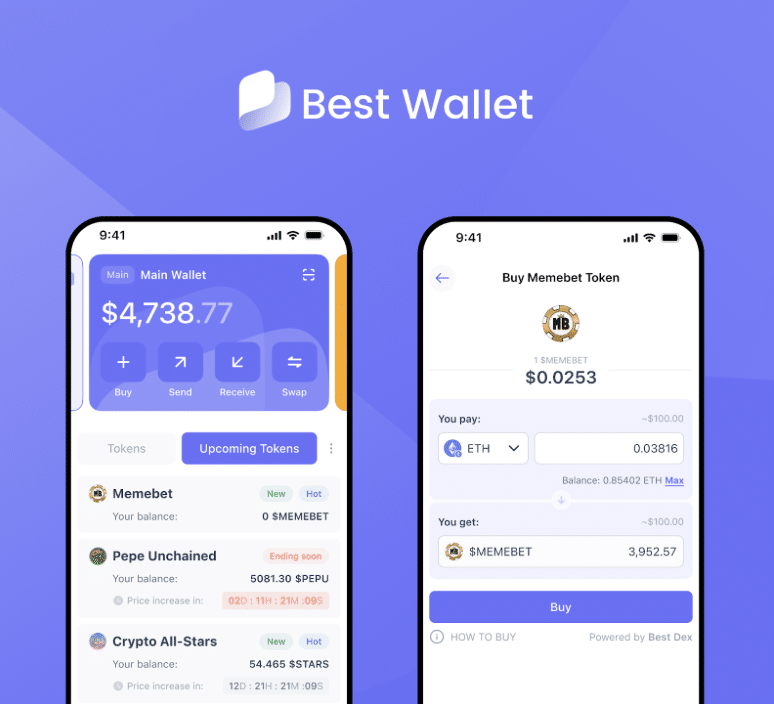

This is where Solaxy enters the picture. Designed as a Layer-2 for Solana, the project is still in presale but has already raised over $37.7 million and is expected to cross the $40 million mark shortly. Unlike typical Layer-2s built on Ethereum, Solaxy uses a roll-up system tailored to Solana’s architecture. It bundles transactions off-chain before anchoring them to the main chain, dramatically reducing congestion and failed transactions.

That performance boost is timely. Solana’s DeFi volumes are surging and meme coin activity is pushing transaction limits. With new protocols like pump.fun driving user engagement, demand for cheaper, faster and scalable infrastructure is only increasing.

Solaxy’s hybrid model further enhances its efficiency. Integrating Ethereum’s liquidity ensures deep pools for trading and staking. Investors can already stake SOLX for a projected 107% APY. At the same time, developers can explore tools like Solaxy’s testnet Block Explorer and its just-launched Bridge for interoperability between Solana Devnet and the Solaxy Testnet. Full cross-chain compatibility is on the roadmap, and IDE and WIKI modules are also being developed.

As a Layer-2 solution purpose-built for Solana, Solaxy could significantly improve the network’s scalability without compromising its low fees and high throughput. This positions it as a core infrastructure upgrade that benefits retail users and institutional investors.

Why Scalable Solutions Like Solaxy May Influence Solana Price Prediction

The future trajectory of Solana’s price will likely depend on its ability to maintain performance under pressure. With DeFi usage climbing, meme coins multiplying and institutional involvement deepening, network congestion is a real concern. Scalable solutions such as Solaxy aren’t just complementary – they’re essential.

Solaxy’s success could directly reinforce Solana’s valuation. Allowing dApps to run more smoothly and meme coins to avoid transaction failures supports more use cases and revenue-generating activity. If it continues, that feedback loop may help push SOL back toward its all-time high of $295 and beyond.

Investors already expect big things. Some analysts forecast a return to $200 for SOL as early as June, fuelled by DeFi activity, validator growth and potential ETF speculation. Add in Solaxy’s infrastructure support and a strong case emerges for a sustained rally – especially if broader crypto market conditions remain favourable.

FIND OUT MORE ABOUT SOLANA’S LAYER 2 SOLUTION: SOLAXY

Solaxy’s tokenomics and roadmap also reinforce its potential. Future projections suggest a price target of $0.032 by 2025 and even higher figures for 2026, so early presale participants are positioning themselves for long-term gains. With regulatory clarity improving in the US, projects like Solaxy that deliver real utility could see fast institutional adoption.

The Road Ahead: SOL’s Performance Depends on Layer-2 Innovation

Solana has proven itself to be a major player in the Layer-1 arena, but as the ecosystem grows, so must the tools that support it. Validator expansion, meme coin engagement and DeFi momentum are all vital, but they must be matched by backend innovation to avoid performance bottlenecks.

Solaxy could become a foundational piece of that puzzle. By providing scalable solutions during a critical phase of Solana’s growth, it strengthens the entire network. If that keeps transaction costs low, reliability high, and performance consistent, Solana may continue to attract developers, traders, and capital at scale.

With $37.7 million already committed and the next presale stage imminent, Solaxy’s progress will be one to watch closely—not just for what it brings to the table now but also for how it may shape Solana’s future.

Disclaimer: This article is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Cryptocurrency investments are highly volatile and carry significant risk.