Solana’s native token, SOL, is again in the spotlight following a wave of renewed bullish sentiment. The asset surged nearly 25% between May 6 and May 10, triggered by Bitcoin’s rally past $100,000 and an uptick in altcoin market momentum. Beyond macro conditions, Solana’s network fundamentals are pointing to something more enduring.

Over the past month, Solana’s total value locked (TVL) has climbed to $10.9 billion, overtaking the combined Ethereum layer-2 ecosystem – a milestone that signals growing developer and investor confidence in the blockchain’s infrastructure. This places Solana second only to Ethereum in TVL among all networks, with protocols like Raydium, Jito and Marinade leading the surge.

In parallel, Solana’s 30-day fee revenue hit $43.3 million, a 109% increase from the previous month. For a network often lauded for its ultra-low fees, this spike in revenue suggests users are engaging more frequently – and at higher volumes – across decentralised applications (DApps) and DeFi protocols.

The result is rising demand for the SOL token, with about 65% of its supply staked and derivative markets reflecting a healthy appetite for leverage. The current 8% annualised funding rate for perpetual futures underscores sustained bullish sentiment, even with SOL still trading below its all-time high of $295.

Traders Eye $200 SOL as Ecosystem Catalysts Stack Up

Market optimism is also gaining traction on social media. Influencers with large followings, such as Teo Mercer and Cozy the Caller, are calling for a return to the $200 price zone, a level last touched in mid-February. With SOL trading just over $180, that milestone represents a modest 17% climb from current levels—a realistic move, particularly in light of current volumes and open interest metrics.

Trading activity reflects growing conviction. SOL’s open interest now stands at $3.5 billion, the highest in over two months, while spot trading volume surged to nearly $6 billion in the past 24 hours alone. Meanwhile, daily transactions, DEX usage, and stablecoin issuance on Solana are accelerating, with over $13 billion in stablecoins circulating on the network.

Launching platforms like 1inch aggregator and continued meme coin trading frenzy on Solana-native protocols such as pump.fun further drives user engagement. While Ethereum’s L2s aim to bring scale to its ecosystem, Solana’s core chain handles increased demand with high throughput, but questions around long-term scalability persist.

Why Solana’s Growth Brings Layer 2 Needs into Focus

Despite Solana’s architecture being designed for speed and cost-efficiency, rapid user activity and transaction volume increase concerns about congestion and sustainability. These are the same dynamics that drove Ethereum to embrace its multi-layer model. Solana, by contrast, has primarily functioned as a monolithic chain—until now.

With the network consistently nearing capacity during high-traffic periods, projects are beginning to explore Solana-specific Layer 2 solutions. These aren’t just theoretical; one has already emerged as a standout.

Solaxy: The Layer 2 Contender Tailored to Solana’s Scaling Needs

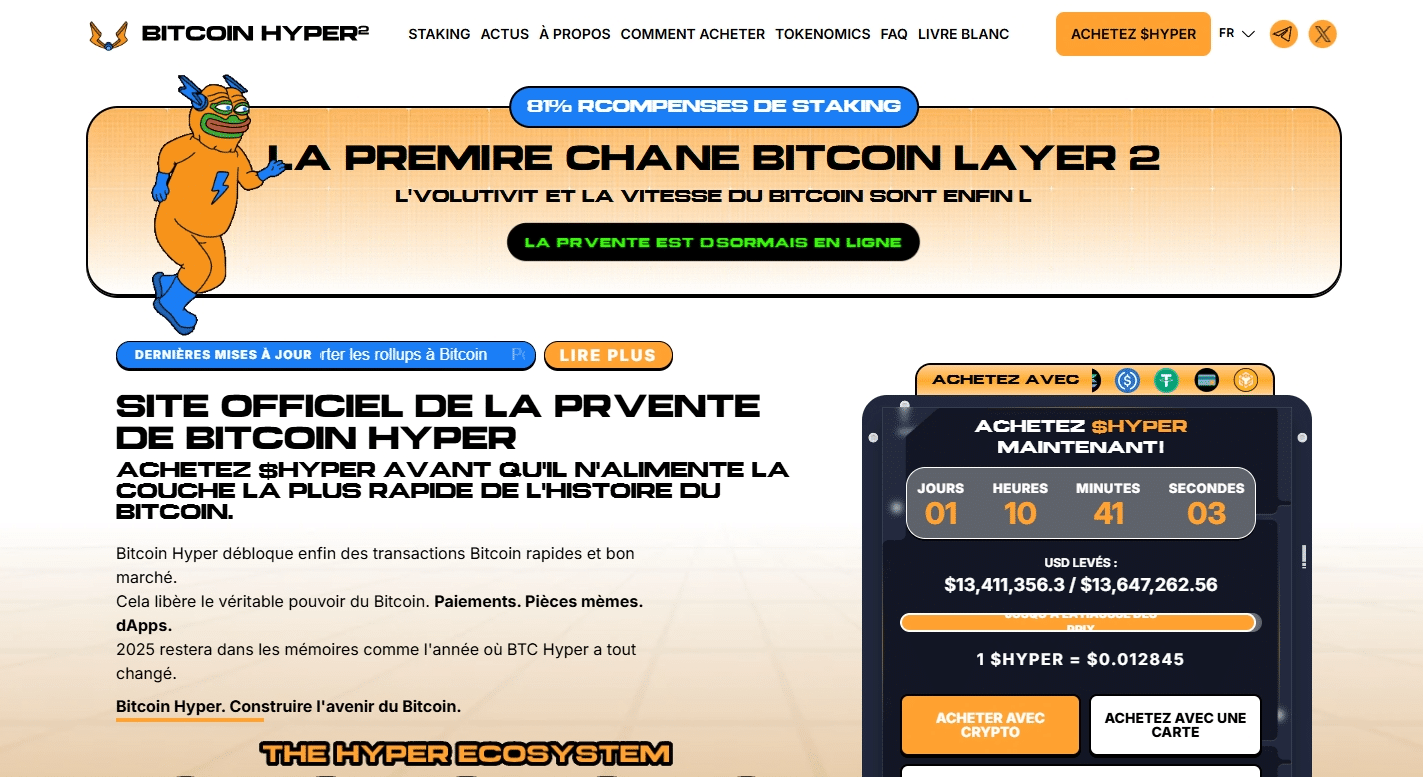

Solaxy is a new Layer 2 solution designed specifically for the Solana blockchain. Still in presale, the project has already raised nearly $35.5 million and is generating interest across the developer and investor communities. Much of that enthusiasm stems from its clear focus: delivering scalability without compromising the core advantages that make Solana attractive in the first place – speed, low fees and accessibility.

Rather than replicating Ethereum’s Layer 2 designs, Solaxy adapts the concept to fit Solana’s architecture. It processes transactions off-chain before settling them to Solana’s base layer, effectively reducing the main net load while maintaining security and finality. This is especially relevant at a time when meme coins, NFT drops, and new DApps are pushing Solana’s throughput limits.

The project’s native token, SOLX, plays a central role in its ecosystem – serving as the gas token, governance mechanism and staking asset. Early buyers in the presale can acquire SOLX at $0.001724, with expectations of a significant revaluation upon exchange listing.

Comparing Ecosystem Growth with Market Infrastructure

Solana’s growth in recent months illustrates what happens when transaction efficiency meets real user adoption, but it also shows the potential limits of single-layer scaling strategies. The rise of Layer 2 projects like Solaxy underscores the market’s desire to future-proof network performance, particularly as more capital and activity move on-chain.

Solaxy’s proposition is timely. Its emergence comes when Solana’s TVL surpasses rival chains and L2s, yet signs of network strain are beginning to surface. As such, Solaxy isn’t positioning itself in competition with Solana – it’s offering an extension that enables the core network to handle more complex and high-volume workloads.

EXPLORE THE SOLAXY PRESALE TO LEARN MORE ABOUT LAYER 2 SCALABILITY

If successful, this model could accelerate the migration of institutional capital and large-scale retail projects to Solana by alleviating bottlenecks that deter high-frequency users. It also provides an infrastructure layer for emerging sectors like decentralised gaming, social media apps, and AI-integrated DApps—verticals that require both speed and scalability.

The Road Ahead for SOL and Solaxy

While much of the short-term price action in SOL depends on macro conditions and crypto market sentiment, the long-term narrative is increasingly infrastructure-focused. In the same way Ethereum benefitted from expanding Layer 2 solutions like Arbitrum and Optimism, Solana’s next phase may depend on projects like Solaxy delivering targeted scalability.

Whether SOL reaches $200 in the coming weeks will depend on continued user activity, potential ETF developments, and broader altcoin momentum. If the network continues to gain traction, Solaxy could become a key enabler of sustainable growth, offering a scaling alternative built to match the pace of Solana’s rising demand.

Disclaimer: This article is for informational purposes only. Cryptocurrency investments carry risk and are subject to market volatility. Always do your research before investing.