With Bitcoin and Ethereum under pressure, big players are wiring hundreds of millions into custodians, while smaller traders rotate into high-risk meme coin presales. Maxi Doge has become a focal point of that retail flow, raising over $4 million as the market crash reshapes risk appetite.

The latest market crash has pushed many retail investors to the sidelines, but on-chain data shows that large players are responding very differently. Anchorage Digital, a regulated US crypto custodian, has received 4,094 BTC in recent hours from Coinbase, Cumberland, Galaxy Digital, and Wintermute – an inflow worth roughly $405 million. These movements suggest that while the broader market panics, institutions are leaning into the downturn and treating volatility as an opportunity to accumulate.

Ethereum is seeing a parallel pattern. A whale wallet known as #66kETHBorrow added another 16,937 ETH to its holdings, taking its total position to 422,175 ETH – worth around $1.34 billion. With Ethereum priced at $3,013.60, traders are watching to see whether such large-scale buying will anchor price stability or simply precede another selloff.

The contrast between institutional behavior and retail panic suggests that a deeper conviction exists at the top of the market. While smaller investors typically retreat during sharp downturns, whale and institutional wallets often see these moments as opportunities to accumulate core assets at compressed valuations.

Bear Trap or Bottom? Analysts Split on the Next Move

Despite these sizable inflows, there is a question of whether the market is forming a base or setting up a bear trap. Some market watchers argue that repeated tests of Bitcoin’s support levels, alongside visible demand from custodial players, are reminiscent of prior bottoming phases in major market cycles. Liquidity remains thin, macro uncertainty remains elevated, and any breakdown of current structures could trigger another capitulation event.

While large inflows are encouraging, they do not guarantee immediate recovery. Market volatility can remain elevated even when institutions are net buyers.

Retail Capital Rotates Toward High-Risk Meme Coin Bets

While high-value investors are focusing on accumulating Bitcoin and Ethereum, retail traders are moving in a very different direction. Instead of trying to catch a falling knife in blue-chip assets, many smaller speculators are turning to early-stage presales – especially within the meme coin category – in search of more asymmetric upside.

Historically, the meme coin sector thrives during turbulent periods precisely because it offers volatility on steroids. If traders believe the majors may take weeks or months to recover, they often gravitate toward lower-cap tokens that can move dramatically even in bearish conditions. That dynamic explains why Maxi Doge, a newly launched Dogecoin-themed project, has already raised more than $4 million while wider market sentiment remains fragile.

Retail flows into presales reflect a belief that if the majors aren’t offering rapid upside, smaller projects might.

What Is Maxi Doge and Why Is It Raising Millions in a Downturn?

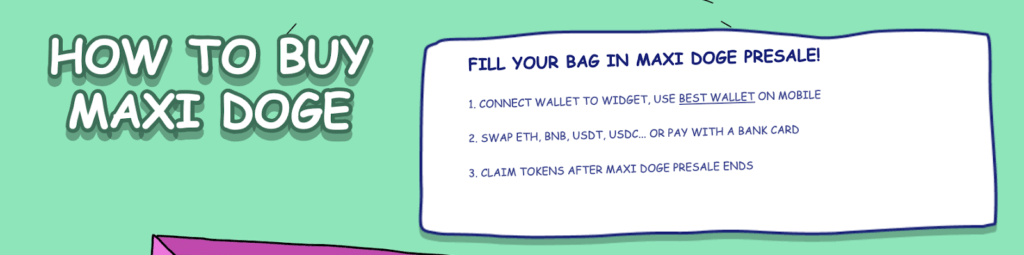

Maxi Doge positions itself as a new-school meme coin that blends Dogecoin-style branding with trading-focused features to sustain user engagement. It is currently in presale, with the MAXI token priced at $0.0002685 and scheduled to increase in upcoming rounds. The strong fundraising suggests the market sees Maxi Doge as more than a passing meme; it has attracted enough capital to build and sustain its ecosystem.

A core part of its appeal lies in its planned futures integrations, allowing traders to access leveraged positions on MAXI eventually – an unusual feature for a meme token. This not only broadens the project’s speculative use cases but also aligns it with more advanced trading strategies typically reserved for larger assets.

Meanwhile, staking rewards currently sit at 76% APY, a mechanism designed to incentivise early participation and moderate immediate post-launch volatility. Weekly trading competitions offering MAXI and USDT rewards aim to sustain engagement and keep the community active beyond the initial hype phase. Together, these components help explain why Maxi Doge has quickly surged past $4 million in presale funding despite an ongoing market crash.

Dogecoin’s Outperformance Adds Fuel to the Maxi Doge Narrative

The recent outperformance of Dogecoin adds a layer of relevance to the Maxi Doge story. While Bitcoin has been flat over the past week, DOGE has gained more than 7%, outperforming most of its peers in the top 10. The only token to outperform Dogecoin this week is XRP, largely because of its imminent ETF launch.

DOGE itself has at least three ETF applications in review at the SEC, suggesting institutional interest may soon expand into the meme coin sector. If any of these products are approved, it could trigger a broader uptick in liquidity and visibility for Dogecoin.

This phenomenon could create a halo effect around related meme tokens. Investors who missed earlier Dogecoin rallies may look to lower-cap alternatives to capture higher beta exposure. Maxi Doge, with its smaller market cap, strong presale demand, and blend of utility and meme appeal, is well-positioned to capitalize on this rotation. If Dogecoin enters a new momentum phase, tokens like MAXI could benefit disproportionately.

How the Crash Is Reshaping Risk – Institutions vs. Meme Coin Speculators

The current market crash has again highlighted the divergent risk appetites across the crypto ecosystem. Institutions and whales appear to be playing a long-term strategy by accumulating blue-chip assets at discounted levels. Their outlook is framed around adoption, portfolio resiliency, and macro exposure.

Retail participants, however, are increasingly treating the downturn as an excuse to seek out higher-risk projects with extreme upside potential. Early presales like Maxi Doge offer that appeal: low entry prices, viral branding, and mechanisms that promise dynamic movement once trading goes live.

Both approaches carry their own risks. Institutions may still be early in their accumulation if the downturn intensifies, while retail presale buyers face structural, technical, and liquidity risks. Yet the simultaneous activity from both groups indicates that the market is far from inactive; rather, it is undergoing a redistribution of capital and risk preferences as volatility reshapes investor behavior.

Risks, Timelines, and What Investors Should Watch Next

Whether this market crash represents a temporary shake-out or the start of a deeper correction will depend on several factors. Bitcoin must hold or reclaim its support zone to avoid broader contagion, while Ethereum must defend $3,000. The persistence of institutional inflows will also signal whether big players believe the current dip is a long-term opportunity.

For Maxi Doge, much depends on the completion of its presale rounds, the details of its initial exchange listings, and progress on futures integrations. The evolution of staking yields and community engagement metrics will also shape how sustainable its early momentum turns out to be.

FIND OUT MORE ABOUT MAXI DOGE’S TOKENOMICS BEFORE JOINING THE PRESALE

As always, meme coin presales should be treated as high-risk, speculative investments. Independent research, diversified positioning, and disciplined strategy remain essential in such market environments.

Disclaimer: Cryptocurrencies are volatile and high-risk. This content is for informational purposes only and is not financial advice.