As markets turn bullish after the Fed’s rate cuts, GameFi innovation is back in the spotlight, and Pepenode (PEPENODE) is leading the charge. With its Burn-to-Earn model blending deflationary mechanics, community rewards, and real yield, this fast-rising token is reshaping how players and investors engage with crypto gaming.

As the U.S. Federal Reserve cuts interest rates to a three-year low and President Trump announces a new trade deal with China, global markets are shifting toward optimism, and risk assets are the first to benefit. Crypto analysts say these macro shifts mark the start of a fresh risk-on cycle, one that could benefit emerging tokens and the GameFi sector in particular.

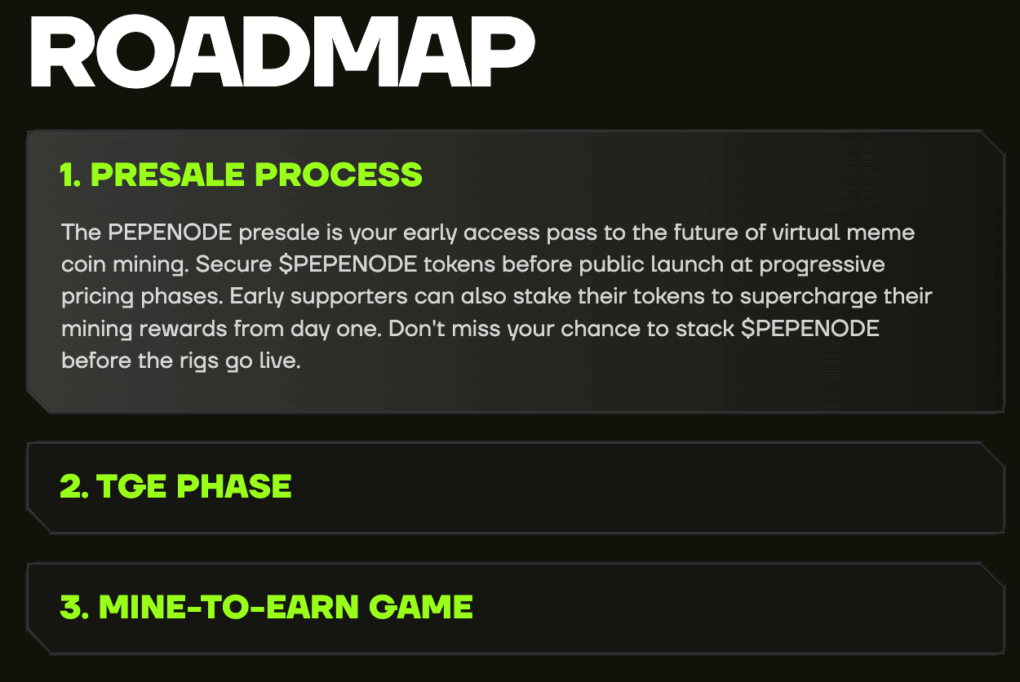

While institutional investors remain parked in Bitcoin and Ethereum, a growing share of retail traders are turning toward innovative, smaller-cap projects that blend entertainment and earning potential. Among the most talked about this week is Pepenode ($PEPENODE) – a meme-fueled GameFi project that’s already crossed $2 million in presale funding, positioning itself as one of the standout launches of 2025.

However, what’s driving the excitement isn’t just the presale success. It’s Pepenode’s Burn-to-Earn mechanic – a supply model that could change how reward systems work across the GameFi landscape.

A Perfect Storm for GameFi Growth

The macro environment couldn’t be more favorable for risk-taking. With interest rates falling, liquidity rising, and optimism returning to markets, speculative capital is flowing back into digital assets. Historically, every major GameFi rally has followed periods of monetary easing and an increase in investor appetite for high-risk, high-reward opportunities.

In the same way, 2021 saw Axie Infinity spark a play-to-earn boom; 2025 could see a resurgence in gaming-based ecosystems, but this time, driven by more sustainable tokenomics. That’s where Pepenode stands out.

Its Mine-to-Earn framework gamifies the concept of crypto mining, allowing players to simulate building virtual mining rigs and earn PEPENODE tokens as they progress. The hook, however, lies in how Pepenode flips the old inflationary model on its head.

From Inflation to Deflation: How Pepenode’s Burn-to-Earn System Works

One of the biggest weaknesses in early GameFi systems was the issue of inflation. Projects minted new tokens endlessly to fund rewards, diluting holders and collapsing price floors once user growth slowed. Pepenode’s developers designed a more elegant solution: engineered scarcity.

Here’s how it works: every time a player purchases Miner Nodes or upgrades equipment inside the Pepenode ecosystem, 70% of the tokens used are permanently burned. Instead of expanding the supply, player activity continuously reduces it – turning participation into a deflationary force that benefits long-term holders.

This Burn-to-Earn mechanic ensures that as the game grows, so does scarcity. It’s a self-reinforcing loop: the more players engage, the fewer tokens remain in circulation, which can potentially support both ecosystem stability and token value.

It’s a striking contrast to legacy meme coins that relied purely on hype. In Pepenode’s design, community participation fuels economic value – a principle that’s redefining the GameFi playbook for 2025.

Security, Transparency, and Market Confidence

For any new GameFi or altcoin project, credibility starts with code integrity. Pepenode’s smart contract has undergone a full third-party audit by Coinsult, with no issues found. This audit not only reassures investors but sets Pepenode apart from the dozens of unaudited meme and gaming projects that populate the crypto presale landscape.

The presale itself has also demonstrated resilience. Raising $2 million despite muted broader conditions signals firm investor conviction. This mirrors early-stage patterns from successful GameFi projects that started small and scaled fast once exchange listings went live.

Independent analyst Borch Crypto even predicted that Pepenode could deliver “50x upside potential” post-launch – though, as always, speculative projections should be viewed with caution.

The New Market Rotation: Risk-On and Ready for Pepenode

Crypto capital flows in 2025 reveal a clear pattern: after heavy inflows into Bitcoin and Ethereum through spot ETFs, investors are diversifying toward smaller, faster-moving assets. Analysts describe this as the “risk rotation phase” – when capital shifts from established assets into the GameFi and meme coin sectors that typically outperform during expansionary cycles.

This is why Pepenode’s timing appears ideal. As Fed rate cuts release liquidity, projects that combine strong narratives with transparent mechanics attract the most speculative inflows. Pepenode’s hybrid of meme culture and utility-driven gameplay fits that brief perfectly.

The project’s visibility has also been amplified by coverage from Cointelegraph, CoinDesk, and CryptoTimes24, which have each highlighted Pepenode’s early fundraising success and staking features. Public attention from reputable crypto outlets tends to accelerate retail participation – an effect seen in prior cycles with tokens like PEPE and Floki Inu.

On-Chain Signals: Tracking Pepenode’s Early Momentum

Traders looking for objective confirmation can turn to on-chain data to gauge Pepenode’s growth. Metrics such as holder count, burn rate and staking participation reveal whether community interest is turning into real network activity.

Already, Pepenode’s staking pool has gained early traction, with high advertised APYs of up to 642% for early participants. These rates are expected to decline as more tokens are staked, aligning with standard deflationary principles.

Moreover, presale tier tracking shows a consistent upward price movement – a sign that demand is strong enough to support dynamic pricing without the need for discount incentives. In other words, Pepenode isn’t relying on aggressive marketing gimmicks to drive participation; it’s earning traction through structural design and scarcity.

How to Participate in the Pepenode Ecosystem

For those exploring GameFi opportunities, getting involved with Pepenode follows a straightforward process.

· Presale Access: Tokens can be purchased directly through the project’s official website at pepenode.io, with support for ETH, BNB, USDT, and fiat payment options.

· Verification: Always double-check contract addresses through official project channels or audit listings to avoid phishing pages.

· Wallet Integration: Use Web3-compatible wallets like MetaMask or Best Wallet for secure transactions. The latter even lists Pepenode in its “Upcoming Tokens” section for easier tracking.

· Staking & Gameplay: Once tokens are claimed post-presale, players can begin participating in the Mine-to-Earn simulator, purchasing Miner Nodes, and earning through gameplay.

As always, investors should review Pepenode’s whitepaper and confirm liquidity lock details before committing significant capital.

Pepenode and the Evolution of GameFi Tokenomics

The rise of GameFi marked a fusion of two powerful digital movements: blockchain ownership and interactive engagement. Still, while earlier GameFi experiments faltered under inflationary stress, Pepenode represents a refined model – one where playing the game strengthens the economy instead of draining it.

Its Burn-to-Earn design ties token scarcity directly to community participation, aligning incentives between players and holders. Every Miner Node purchase not only upgrades gameplay but also reduces total supply, creating a dynamic that balances fun with financial logic.

By turning deflation into a feature, Pepenode could set a precedent for future GameFi ecosystems – particularly those seeking to move beyond short-term speculation.

Responsible Speculation in a New Market Cycle

While the GameFi narrative is resurgent, it’s important to remember that presales carry significant risk. Investors should allocate only small portions of their portfolios to early-stage tokens and ensure they diversify across various sectors.

Red flags include unaudited code, unclear tokenomics, anonymous teams, or missing liquidity lock documentation. Pepenode’s audit and public presale structure mitigate some of these risks, but volatility remains inherent to the space.

Long-term success will depend on whether the project can sustain engagement after its initial exchange listing and if its in-game economy can attract repeat participation without overshooting the supply-demand balance.

Pepenode’s Burn-to-Earn Model Could Reshape GameFi

As the crypto market enters a renewed expansion phase powered by rate cuts and rising liquidity, traders are rediscovering their appetite for innovation. Pepenode stands at the intersection of meme culture and meaningful on-chain design – a GameFi project that rewards participation while combating inflation through token burns.

Its audited smart contract, deflationary mechanics, and strategic gameplay offer a blueprint for what the next generation of GameFi tokens could look like: sustainable, secure, and community-driven.

MINE-TO-EARN WITH PEPENODE NOW

Whether Pepenode becomes a long-term market leader remains to be seen, but one thing is clear – it’s not just playing the game; it’s changing the rules.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are volatile and speculative. Always conduct independent research, review project whitepapers, and verify information through official channels before making any investment decisions.