The crypto market is entering a new rotation cycle. Following the Federal Reserve’s latest rate cut, investors appear to be rebalancing away from established assets, such as Ethereum, and into new, high-performance infrastructure projects, like Bitcoin Hyper.

Ethereum, long regarded as the backbone of smart contracts in Web3, has seen a sharp decline in US institutional demand. Meanwhile, market momentum is shifting toward projects that blend scalability, transparency, and real-world utility – characteristics that Bitcoin Hyper’s Layer-2 network appears to embody.

This new capital rotation marks more than a passing shift in sentiment; it could redefine which tokens are considered the best crypto to buy now heading into 2026.

Institutional Appetite for Ethereum Weakens After the Fed’s Rate Cut

Recent data from CryptoQuant paints a clear picture: institutional demand for Ethereum is cooling. ETF inflows have slowed to their weakest levels since April, and the Coinbase premium for ETH has hovered near zero – a signal of declining US buying pressure.

Analysts attribute this slowdown to a combination of macro and market-specific factors. The Grayscale ETHE arbitrage trade, which initially drove much of the early ETF inflow, has closed. At the same time, investors have been re-evaluating risk in light of persistent inflation, high bond yields, and Fed Chair Jerome Powell’s cautious tone on future rate policy.

“The early wave of Ethereum ETF inflows was driven less by conviction and more by reallocation mechanics,” explained Bitget Wallet’s research analyst Lacie Zhang. “With the arbitrage window closed and relative underperformance against Bitcoin, Ethereum inflows naturally cooled.”

Ethereum’s CME futures basis has also dropped to a three-month low, suggesting less appetite for leveraged exposure. According to Brickken’s market analyst Enmanuel Cardozo, “Institutional players have shifted from aggressive positioning to risk management mode, not a full exit.”

Despite the pullback, on-chain data still shows limited distribution among long-term holders. This suggests that while US institutions have stepped back, the broader market is simply rotating – seeking new opportunities rather than exiting crypto altogether.

Capital Rotation and the Hunt for the Best Crypto to Buy Now

Each tightening and loosening cycle from the Fed reshuffles investor priorities, and this rate cut has sparked a new wave of repositioning. Traders are now looking toward projects that combine scalability with credible use cases.

While Ethereum continues to dominate in terms of ecosystem depth, it’s the new Layer-2 networks that are attracting fresh liquidity. These projects promise faster transactions, lower costs, and integration with Bitcoin’s base-layer security – features that appeal to both developers and institutions looking for sustainable, utility-driven growth.

This context has led to growing attention toward Bitcoin Hyper, a Bitcoin Layer-2 project positioned at the intersection of speed, decentralisation, and DeFi connectivity.

Bitcoin Hyper: A Layer-2 Solution Built for Real-World Utility

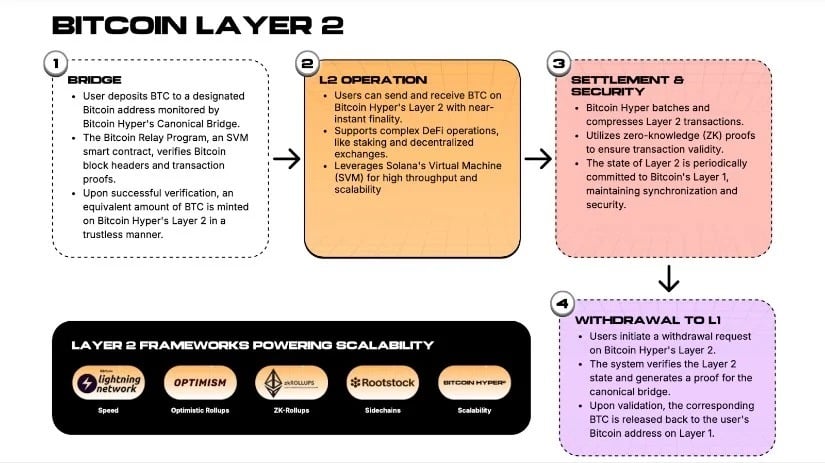

Bitcoin Hyper has been described as an “infrastructure play” rather than a speculative token. Its developers are tackling one of Bitcoin’s core limitations: scalability. The network aims to deliver sub-second finality and thousands of transactions per second while leveraging Bitcoin’s underlying security model.

Architecturally, Bitcoin Hyper combines Bitcoin’s base-layer trust with a Solana-inspired execution environment known as the Solana Virtual Machine (SVM). This design allows developers familiar with Solana’s tools to build directly on Bitcoin Hyper, effectively bridging two of the largest blockchain ecosystems.

The project’s presale, which has raised approximately $25.2 million, has garnered significant media coverage. This is an early validation of its market positioning – particularly as it enters a macro environment where liquidity is expected to increase following rate cuts.

Transparency is another key factor driving interest. Bitcoin Hyper’s team publishes frequent development updates, maintains a detailed roadmap, and has released audit results to verify the integrity of its smart contracts.

Why Investors Are Watching Bitcoin Hyper After the Rate Cut

Macroeconomic dynamics are shifting in ways that typically benefit crypto. Lower interest rates generally increase liquidity, supporting risk assets such as Bitcoin and emerging altcoins. Historically, Bitcoin’s strength often triggers capital spillover into smaller-cap tokens, especially those offering staking yields and governance rights.

Bitcoin Hyper’s tokenomics align closely with these investor interests. The project features a capped supply with deflationary burn mechanics and built-in staking, offering rewards to long-term holders. Governance rights ensure that tokenholders have a voice in network evolution, further aligning incentives between users and the protocol.

These structural elements are what make Bitcoin Hyper stand out in conversations about the best crypto to buy now. Instead of relying on speculative hype, it offers measurable signals of progress: consistent roadmap delivery, verifiable audits, and clear adoption metrics.

From Ethereum to Bitcoin Hyper: Understanding the Rotation

The current investor rotation from Ethereum toward newer infrastructure projects, such as Bitcoin Hyper, doesn’t signify a rejection of Ethereum’s long-term potential. Instead, it reflects a repricing of opportunity.

Ethereum’s scaling challenges remain a focal point, and many institutions are adopting a wait-and-see approach until the network demonstrates more sustainable revenue and lower transaction costs. Meanwhile, Bitcoin Hyper represents the inverse trade – an opportunity to capitalise on Bitcoin’s security while tapping into scalable DeFi applications.

As Cardozo from Brickken noted, “When institutions step back, innovation steps in.” That sentiment captures the transition perfectly. As capital shifts from established assets to earlier-stage infrastructure plays, the next bull market leaders are likely being built right now.

Market Indicators to Watch

Several measurable indicators will determine whether Bitcoin Hyper’s momentum can sustain beyond the presale stage. Exchange listings and liquidity provision will be early tests of execution. Developer activity – particularly any migration from Solana or Ethereum – will offer clues about adoption.

Transaction throughput, staking participation, and token burn rates will also provide real-world performance metrics. Transparent delivery against these benchmarks could strengthen Bitcoin Hyper’s reputation as one of the more credible entrants among 2025’s Layer-2 cohort.

Of course, presales remain speculative by nature. Investors should monitor progress rather than chase hype. Verified audits, consistent updates, and active governance participation will matter far more than short-term price action.

A Broader Realignment in Crypto

The current cycle feels less like a crash and more like a recalibration. The cooling of Ethereum demand coincides with a maturing market that’s starting to reward fundamentals over narrative.

Bitcoin Hyper’s emergence signals a shift in investor focus. Infrastructure, scalability, and transparent tokenomics are the new currency of credibility. The most successful projects in this environment will be those that deliver real-world utility rather than rely on speculative momentum.

If rate cuts continue to ease liquidity conditions, capital is likely to flow into these new networks first, just as it did during earlier expansions in 2020 and 2021.

INVEST IN BITCOIN’S FUTURE WITH BITCOIN HYPER

The post-rate-cut market is creating a new investment hierarchy. Ethereum’s slowdown doesn’t spell weakness – it simply shows where capital is flowing next. The next leg of growth may be built on Bitcoin’s foundation but executed by innovative Layer-2 networks like Bitcoin Hyper.

For investors scanning the market for the best crypto to buy now, that rotation narrative is crucial. Projects that combine scalability, real-world integration, and transparent governance could define the next generation of crypto value creation.

As always, due diligence is key, but if history is any guide, the smart money tends to move early – often before the headlines catch up.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry high risk and volatility. Always conduct your own research before purchasing tokens or participating in presales.