Once seen purely as “digital gold,” Bitcoin’s next evolution is arriving through Bitcoin Hyper, a high-speed Layer 2 built to make the original blockchain useful for payments, apps, and DeFi – not just holding.

For centuries, investors have sought assets that exist outside government control. Gold filled that role – a physical store of value, trusted across generations and borders. Bitcoin inherited that legacy, marketed as the digital version of what gold had long represented: independence, scarcity, and protection against inflation. In the words of one financial strategist, “I can see Bitcoin becoming the 21st century’s digital gold.”

Yet, the comparison has its limits. Gold’s value lies in its physicality and relative stability, while Bitcoin remains highly volatile. The biggest question? Whether the cryptocurrency can ever become a dependable store of value, given its sharp price swings and sensitivity to speculation. Bitcoin’s price can move 10% in a day; gold rarely shifts more than 2%. This volatility is both its greatest risk and its greatest strength – volatility fuels opportunity, and that’s precisely where Bitcoin Hyper steps in.

Why Bitcoin and Gold May Be Alike, But Not the Same

A growing body of research explores the connection between gold and Bitcoin – not just as assets, but as commodities produced through mining. Gold miners physically extract ore from the earth; Bitcoin miners solve mathematical puzzles using electricity and computing power. Both industries rely on scarcity, competition, and energy consumption to determine value.

However, studies highlight 20 key differences between the two. Gold mining has massive physical barriers to entry, demanding costly machinery and geological expertise. Bitcoin mining, by contrast, is flexible and global – miners can relocate operations to regions with cheaper electricity or scale down production instantly during downturns. This fluidity makes Bitcoin mining less complex and less capital-intensive, but also more exposed to price volatility.

The data support the divergence. Research shows Bitcoin miners’ stock returns are twice as volatile as those of gold miners, yet their exposure to the underlying commodity’s price is lower. Gold miners’ revenues hinge on the metal’s spot price, while Bitcoin miners can pause operations quickly when electricity costs rise or rewards fall. This elasticity gives Bitcoin an advantage that gold never had – a digital asset that can evolve faster than any physical commodity.

That evolution is happening now.

Bitcoin Hyper: The Layer That Changes Everything

While Bitcoin remains the world’s most recognised store of value, its use as a medium of exchange has lagged behind. The network processes only around seven transactions per second – a fraction of what’s needed for mainstream adoption. Enter Bitcoin Hyper ($HYPER), the project that aims to make Bitcoin not just valuable but usable.

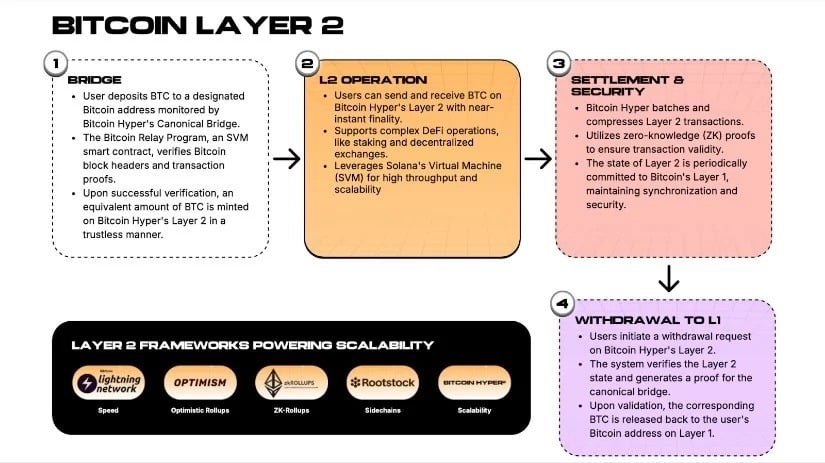

Bitcoin Hyper isn’t a fork or a gimmick. It’s a Layer 2 protocol purpose-built to supercharge Bitcoin’s performance, combining its unmatched security with the speed of Solana’s technology stack. Using the Solana Virtual Machine (SVM), Bitcoin Hyper executes transactions at lightning pace while anchoring final settlements to Bitcoin’s blockchain. The result is a system that maintains Bitcoin’s decentralisation but allows sub-second transaction speeds, low gas fees, and seamless cross-chain interoperability.

This Layer 2 design transforms Bitcoin into a live ecosystem rather than a static store of wealth. Payments, trading, and decentralised applications can all run directly on the Hyper network. Developers can build DAOs, DeFi protocols, or even meme coins using Bitcoin’s base security as a foundation – something that, until now, simply wasn’t possible.

By connecting Bitcoin, Ethereum, Solana, and other major networks, Bitcoin Hyper bridges previously isolated ecosystems, allowing liquidity and applications to flow freely between them. In that sense, it represents not just an upgrade to Bitcoin but a structural shift in how the asset integrates into the wider crypto economy.

The Technology Behind the Hyper Layer

At the heart of Bitcoin Hyper’s architecture lies its Canonical Bridge, a cross-chain mechanism that allows assets and data to move between blockchains in real time. This bridge means users can trade, stake, or lend using Bitcoin-backed assets without leaving the ecosystem – all while maintaining transparency and auditability.

The project’s choice of the Solana Virtual Machine is equally significant. SVM is one of the fastest blockchain engines ever built, processing thousands of transactions per second with minimal energy use. By leveraging this technology, Bitcoin Hyper avoids the congestion and high fees that have long frustrated Bitcoin users, while preserving its immutable settlement layer for security and trust.

This approach unlocks new functionality. Developers gain access to the same tools and smart-contract capabilities found on Ethereum and Solana, but with Bitcoin’s liquidity. That opens the door for everything from NFT markets to automated lending platforms – all backed by Bitcoin’s credibility as a hard asset.

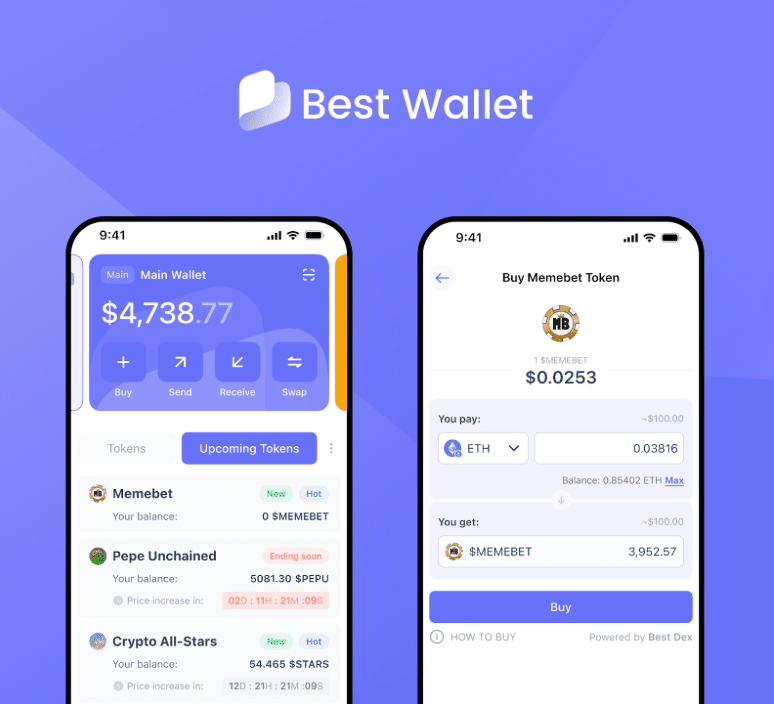

Every part of the Hyper ecosystem runs on $HYPER, the native token that powers transactions, staking, and governance. Holding $HYPER gives users a voice in protocol upgrades and early access to new launches, creating an incentive structure built around participation rather than speculation.

Why Bitcoin Hyper is the Best Crypto to Buy Now

The timing of Bitcoin Hyper’s emergence aligns with a broader institutional shift. Across Europe, regulatory frameworks like the EU’s MiCA are clarifying rules for crypto adoption, giving legitimacy to projects with real-world applications. Meanwhile, companies such as Aifinyo AG in Germany are building corporate treasuries backed by Bitcoin, signalling that institutional players are preparing for Bitcoin’s utility era.

Investors have taken notice. Bitcoin Hyper’s presale has already raised more than $24.5 million, with tokens priced at around $0.013155. Beyond the numbers, the project has been audited and verified, demonstrating the kind of transparency often missing from early-stage ventures. For many, it represents a natural next step – a scalable infrastructure project for a maturing Bitcoin economy.

Bitcoin Hyper also embodies the spirit of crypto culture. It doesn’t shy away from the community-driven energy that fuels adoption. Its vision combines technological rigour with the memes, narratives, and creativity that make crypto more than just a market – a movement.

From Digital Gold to Digital Utility

For over a decade, Bitcoin has been praised as “digital gold,” a hedge against inflation and a symbol of financial independence, but Bitcoin’s next phase isn’t about holding – it’s about building. Bitcoin Hyper takes the original network’s scarcity and transforms it into a platform for growth, innovation, and interoperability.

The comparison with gold may still hold philosophically, but Bitcoin’s trajectory is beginning to diverge. Where gold remains static, Bitcoin is now dynamic. Where gold sits in vaults, Bitcoin can flow across decentralised systems, and where gold’s value depends on trust and tradition, Bitcoin’s value is increasingly determined by technology and network activity.

EXPLORE BITCOIN HYPER’S OFFICIAL SITE TO LEARN MORE ITS ROLE IN BITCOIN’S EVOLUTION

Bitcoin Hyper marks the moment when “digital gold” becomes digital infrastructure – a foundation upon which the future of decentralised finance can stand, pushing it to be the best crypto to buy now.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are volatile and speculative. Always conduct your own research or consult a licensed financial advisor before making investment decisions.