As Bitcoin’s Layer-2 race heats up, investors are pouring millions into Bitcoin Hyper – a new network blending Bitcoin’s security with Solana’s speed. With nearly $25 million raised, it could mark the next big leap in crypto scalability.

After years of muted enthusiasm for early-stage token raises, the crypto market’s appetite for presales is back. Data from RootData’s 2025 financing report shows that over $16 billion has already been raised this year, marking a strong comeback for private rounds and token launches.

Unlike the speculative ICO rush of 2017, this new wave of funding is more calculated. Investors are backing projects with genuine technical merit and well-structured tokenomics and among the most talked-about developments right now is Bitcoin Hyper ($HYPER) – a Bitcoin Layer 2 project that has already attracted nearly $25 million in presale funds, signaling renewed confidence in the future of Bitcoin scalability.

Bitcoin Hyper’s Vision: A Faster, Smarter Bitcoin

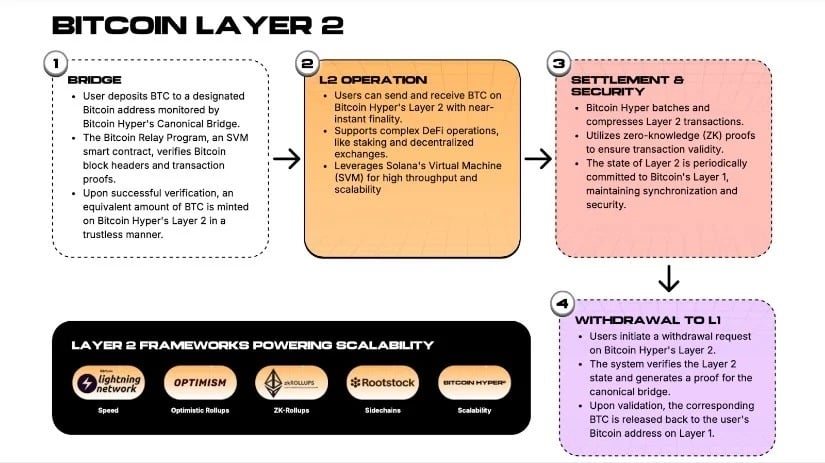

Bitcoin Hyper’s pitch is simple but bold – fix Bitcoin’s transaction bottlenecks and high fees without compromising on decentralisation or security. The project uses zk-rollups and Solana’s Virtual Machine (SVM) to unlock the kind of performance Bitcoin has never seen before.

Through zk-rollups, Bitcoin Hyper compresses thousands of individual transactions into a single cryptographic proof, dramatically increasing throughput. While Bitcoin’s main chain averages 3–7 transactions per second (TPS), Bitcoin Hyper’s infrastructure can process thousands, with near-instant finality.

By integrating SVM, developers can port Solana-based code directly onto the Bitcoin Hyper network. This parallel processing capability means dApps can execute transactions simultaneously – something previously impossible on Bitcoin.

A trustless canonical bridge ensures full synchronisation with the Bitcoin base layer, maintaining the network’s security guarantees while expanding its functionality. In short, Bitcoin Hyper doesn’t reinvent Bitcoin – it supercharges it.

Presale Momentum and Whale Accumulation

Momentum is building fast. The HYPER presale has already passed $23.8 million and is on track to hit $25 million in the coming days. Each token is currently priced at $0.013115, available via crypto or fiat using wallets like Best Wallet.

Whale activity is another indicator of strong conviction. On-chain data shows multiple six-figure buys, including transactions worth $379,900, $274,000 and $196,600. These aren’t speculative micro-buys – they’re coordinated moves from early adopters and institutional investors.

According to prominent analyst Crypto Tech Gaming, this accumulation mirrors early trends seen in the Ethereum Layer 2 boom, suggesting that “smart money” may already be positioning for the next major cycle of Bitcoin innovation.

The Market Context: Bitcoin Layer 2s Take Center Stage

The broader Bitcoin Layer 2 narrative has gained serious traction in 2025. While Ethereum’s Layer 2s dominate total value locked (TVL), Bitcoin’s scalability solutions – like Lightning Network, Stacks and Rootstock – are starting to attract fresh liquidity.

However, each existing L2 comes with trade-offs. Lightning excels for microtransactions but fails at complex operations like DeFi. Stacks improves speed but struggles with liquidity. Rootstock adds programmability, but its federated bridge design introduces custodial risks.

Bitcoin Hyper is designed to address these weaknesses simultaneously. Its zk-rollup architecture keeps security trustless and decentralised, while the SVM engine provides the high throughput required for modern dApp ecosystems.

If it succeeds, it could transform Bitcoin from a “store of value” into a fully programmable, high-performance DeFi platform.

Why Bitcoin Needs Hyper-Speed Scaling

The scalability challenge facing Bitcoin isn’t new, but the numbers make it impossible to ignore. According to Chainspect data, Bitcoin’s average throughput is just 7 TPS, compared to Solana’s 857.6 TPS. The theoretical ceiling for Solana is 65,000 TPS, while Bitcoin’s hard cap sits around 13.2 TPS.

Block times are another major bottleneck. Bitcoin finalises transactions roughly every 13 minutes, while Solana achieves finality in under 0.4 seconds. This isn’t just inconvenient – it’s a dealbreaker for developers trying to build scalable dApps or on-chain financial systems.

Bitcoin Hyper bridges this gap. By running transactions off-chain through zk-rollups and syncing back via the canonical bridge, it maintains Bitcoin’s security while drastically improving performance. In practice, that means faster DeFi trades, NFT mints and cross-chain swaps, all without relying on centralised custodians.

How Bitcoin Hyper’s Architecture Works

Bitcoin Hyper’s dual-layer design ensures that security and speed coexist:

· Deposit & Verification: Users send BTC to a verified deposit address, triggering a smart contract that confirms the transaction through Bitcoin’s blocks.

· Layer-2 Mirroring: A corresponding amount of BTC is mirrored 1:1 on the Hyper Layer-2.

· Fast Transactions: Users can now send, stake, or trade their BTC instantly within the L2 ecosystem.

· Final Settlement: Periodically, batches of transactions are validated via zero-knowledge proofs and written back to the Bitcoin main chain.

This approach allows Bitcoin to remain the settlement layer – while Bitcoin Hyper handles high-speed execution and scalability.

Whale Confidence and Analyst Projections

Institutional investors are watching closely. Several six-figure wallet movements indicate that early accumulation is underway. These patterns often precede major market catalysts, as seen during the rise of Polygon, Arbitrum and Optimism.

If Bitcoin Hyper maintains its current adoption rate, it could emerge as the dominant Bitcoin Layer 2 by mid-2026. Analyst predictions project a potential launch valuation of $0.0583, with long-term targets surpassing $1 if institutional liquidity deepens.

Beyond price speculation, what’s drawing attention is utility. Bitcoin Hyper’s staking program offers up to 49% APY and its token serves multiple roles (gas, governance and launchpad access), ensuring sustained ecosystem demand.

Why This Matters for the Broader Crypto Market

The rise of Bitcoin Hyper reflects a deeper shift in the crypto landscape. As monetary easing resumes and liquidity returns, investors are no longer chasing meme tokens; they’re looking for infrastructure projects with staying power.

Bitcoin Hyper’s combination of scalability, composability and decentralisation positions it to lead the next evolution of Bitcoin’s ecosystem. By merging Solana’s performance with Bitcoin’s trust model, it represents a hybrid architecture that could redefine the future of blockchain interoperability.

INVEST IN BITCOIN’S FUTURE WITH BITCOIN HYPER

With presale funding nearing $25 million, whale wallets moving in and zk-rollup technology offering a genuine scaling breakthrough, Bitcoin Hyper stands out as one of the most ambitious projects in the Bitcoin Layer 2 sector.

If the network delivers on its promise to make Bitcoin faster, cheaper and more developer-friendly, it could trigger the next major wave of innovation and potentially one of the most significant crypto breakouts of 2025.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are volatile and speculative. Always conduct your own research before investing.