Bitcoin is holding firm above key support levels despite recent volatility, with analysts forecasting a continuation of its long-term uptrend. As liquidity becomes the new market driver, projects like Bitcoin Hyper – a Solana-powered Layer-2 solution – are emerging as potential leaders in the next crypto boom.

After weeks of choppy trading, Bitcoin (BTC) remains resilient, consolidating above the $102,000 level – a crucial threshold that analysts say is keeping the bull market intact. As of October 17, BTC trades near $109,000, only slightly off its recent highs and still up more than 70% year-to-date.

This strength comes amid growing expectations that the Federal Reserve’s monetary easing could extend well into 2025. In September, the Fed implemented its first rate cut of the current cycle, lowering the benchmark rate to 4.0%–4.25%, with markets now pricing in further reductions to around 3.5% by year-end.

Lower interest rates historically boost appetite for risk assets like Bitcoin and this time is no different. ETF inflows from firms such as BlackRock, Fidelity and Grayscale continue to pour in, with institutional holdings now representing a meaningful portion of Bitcoin’s circulating supply.

The result? A growing belief that liquidity – not halving cycles – is the dominant force driving Bitcoin’s long-term price trajectory.

The Liquidity Era: Rethinking the Bitcoin Price Prediction Model

For more than a decade, Bitcoin’s price predictions have been tied to the four-year halving cycle, where block rewards are cut in half roughly every four years. This model historically coincided with major bull runs, but analysts argue that the dynamic is shifting.

Crypto strategist @TedPillows recently wrote on X that “the $BTC 4-year cycle is most likely over,” pointing to the impact of global liquidity and monetary policy instead. His accompanying chart showed how each cycle since 2012 has gradually lengthened, suggesting Bitcoin’s next peak may not occur until mid-2026.

This theory aligns with the broader macro backdrop. As liquidity returns to markets through central bank easing, risk assets could experience extended bullish periods rather than sharp boom-and-bust cycles.

That shift is also reflected in technical analysis. Bitcoin’s Elliott Wave structure appears to show the fourth wave of consolidation nearing completion, with a potential fifth-wave breakout targeting $200,000 or higher in the next 18 months.

Some institutions remain conservative – Standard Chartered sees BTC between $130,000 and $150,000 by 2026 – while Fundstrat projects a move to $200,000–$250,000. Others, using liquidity-driven models, envision targets as high as $300,000–$500,000 if macro easing continues.

Either way, the overarching Bitcoin price prediction remains bullish, supported by liquidity expansion and sustained institutional participation.

The Missing Link: Bitcoin’s Scalability Problem

While the macro setup looks strong, Bitcoin’s technological limitations are increasingly visible. Despite its dominance, Bitcoin remains painfully slow, processing around 5 transactions per second (TPS) compared to Solana’s 857 TPS.

Even more striking: Solana’s theoretical capacity reaches 65,000 TPS, while Bitcoin tops out at around 7 TPS. With block times averaging 13 minutes and transaction finality taking over an hour, Bitcoin simply cannot handle modern financial applications at scale.

This “speed deficit” has long been Bitcoin’s Achilles’ heel. Layer-2 solutions like the Lightning Network have improved micropayments but remain limited in scope and adoption. For Bitcoin to thrive in a liquidity-driven world of real-time DeFi, NFTs and on-chain settlement, it needs a structural upgrade.

That’s where Bitcoin Hyper ($HYPER) enters the picture.

Bitcoin Hyper: A Layer-2 Leap Forward

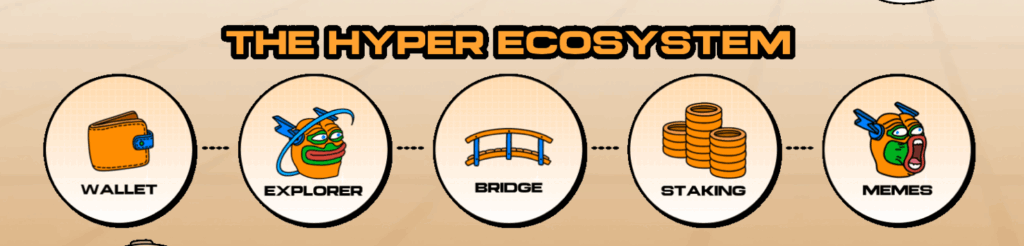

Bitcoin Hyper aims to bring Solana’s speed and Bitcoin’s security together in one ecosystem. Built using the Solana Virtual Machine (SVM), it’s the first Layer-2 network designed specifically for Bitcoin that enables sub-second transactions and near-zero fees.

The system operates through a Canonical Bridge that directly connects to Bitcoin’s base chain. When users deposit BTC into the bridge, the network validates and mirrors those tokens one-to-one on the Hyper Layer-2. This ensures decentralisation, transparency and full auditability – without relying on custodians or wrapped tokens.

Unlike other sidechains, Bitcoin Hyper stays fully synchronised with the Bitcoin ledger while providing the flexibility of a high-throughput environment. Developers can deploy dApps, DeFi platforms and NFTs that settle back to Bitcoin’s main chain, effectively turning BTC into an active financial network instead of a static store of value.

For users, it means the ability to send, stake and trade BTC instantly – something that’s long been impossible on the native chain.

Whale Interest and Investor Momentum

The market appears to be taking notice. Bitcoin Hyper’s presale has already raised over $23.9 million, with several notable whale transactions recorded on-chain. Among them are buys worth $379,900, $274,000 and $196,600, showing growing institutional-scale confidence in the project.

Each $HYPER token is currently priced at $0.013125, with analysts forecasting potential post-launch valuations reaching $1.20 if adoption follows the trajectory of other major Layer-2 ecosystems. Early participants can also earn up to 49% APY through staking, alongside access to governance features, airdrops and a native launchpad for future Bitcoin-based projects.

This combination of yield incentives and functional scalability is drawing comparisons to early-stage Ethereum Layer-2 rollouts like Arbitrum and Optimism – both of which delivered substantial returns following their launches.

While Bitcoin price predictions continue to dominate headlines, many investors now see Bitcoin Hyper as a way to capture the upside of that trend through infrastructure exposure.

A Bridge Between Two Worlds

The long-standing divide between Bitcoin maximalists and DeFi innovators may finally be narrowing. Bitcoin Hyper represents an architectural bridge – allowing Bitcoin to remain the secure foundation it’s always been, while adding the performance and interoperability it’s always lacked.

By leveraging SVM architecture, Bitcoin Hyper essentially gives Bitcoin a “Solana-like body with a Bitcoin brain.” Developers gain access to existing Solana tooling and users gain cross-chain liquidity across ecosystems like Ethereum and Solana, all without compromising Bitcoin’s decentralisation.

If successful, Bitcoin Hyper could become the core infrastructure powering decentralised finance on Bitcoin – a transformation that aligns perfectly with the macro narrative of liquidity-driven growth and digital asset adoption.

Why Bitcoin Hyper Could Lead the Next Boom

As Uptober momentum carries into Q4, Bitcoin’s price stability above $100,000 suggests a foundation for a broader rally. With liquidity expanding, ETFs driving institutional inflows and central banks turning dovish, the environment appears ripe for another leg higher.

But this time, the catalysts may come from infrastructure, not speculation. Bitcoin Hyper stands out as one of the first projects to give Bitcoin both the speed of Solana and the security of its base layer, a combination that could unlock unprecedented scalability.

JOIN BITCOIN’S FUTURE WITH BITCOIN HYPER NOW

If Bitcoin’s next bull phase truly extends into 2026 – as liquidity models predict – then Layer-2 solutions like Bitcoin Hyper may not just benefit from the rally; they could define it.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and may not be suitable for all investors. Always perform independent research before participating in presales or digital asset purchases.