As Bitcoin weathers fresh volatility, investors are pivoting to Bitcoin Hyper – a high-speed Layer-2 built on Bitcoin’s security – with its presale rocketing past $23.6 million and positioning it as one of 2025’s most talked-about crypto plays.

The broader crypto market has spent the week navigating one of its more volatile stretches in recent memory. After the October 10 flash crash wiped out nearly $19 billion in leveraged positions, sentiment turned defensive. A single trader who had accurately timed that plunge is now back with an even larger short position against Bitcoin – a move that’s left traders bracing for another possible swing.

Bitcoin has since steadied near $112,000, but macro pressure persists. President Trump’s renewed tariff threats against China triggered a flight from risk assets, knocking Bitcoin down over 15% from its highs. Ether and meme coins posted even sharper declines. For some, it was another reminder of how fragile crypto’s leverage-driven momentum can be.

Yet, amid the liquidations and risk-off rotation, a different signal is emerging. While Bitcoin struggles to reclaim its recent highs, capital is quietly flowing into a project built on top of it – one that aims to solve the blockchain’s most persistent bottleneck.

That project is Bitcoin Hyper and it’s just passed $23.5 million raised in its presale – a milestone that stands out in a week defined by selling.

Bitcoin Hyper: A Layer-2 Solution With Solana-Level Speed

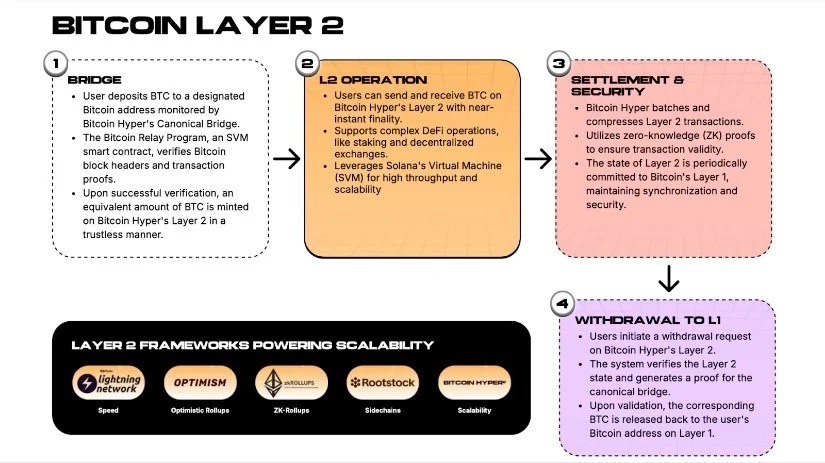

Bitcoin Hyper’s appeal lies in its architecture. The project is a Layer-2 network designed to fuse Bitcoin’s security with the Solana Virtual Machine (SVM) – bringing high-speed throughput and low-cost transactions to an ecosystem that has long been criticised for its scalability limits.

While Bitcoin itself still processes between 3 and 7 transactions per second, Bitcoin Hyper aims to elevate that to thousands per second without compromising on-chain integrity. It’s effectively an attempt to bring Solana’s performance to the Bitcoin world.

In practical terms, that means developers could build DeFi, gaming, or payment applications on Bitcoin Hyper that settle securely back to the Bitcoin blockchain. It’s a structural upgrade that, if successful, could transform BTC from a passive store of value into an actively used network asset – a leap similar to what Ethereum achieved with Layer-2 rollups like Arbitrum and Optimism.

The presale, now entering Stage 4, offers tokens at $0.013115 per HYPER, ahead of its expected DEX listing. On-chain data shows rising whale participation, including a single buy worth over $32,000, signaling confidence from high-net-worth participants despite broader market caution.

Traders Are Splitting

The most striking dynamic in recent days is the divergence between bearish traders and long-term builders. The same entity that profited $191 million from the October 10 crash is now shorting Bitcoin again with a $392 million position. Meanwhile, new capital continues to move toward Bitcoin Hyper, a Layer-2 infrastructure project built precisely to strengthen Bitcoin’s long-term value proposition.

This contrast highlights a fundamental divide in the market. While leveraged speculators bet on price declines, developers and investors are positioning for structural evolution. Bitcoin Hyper’s growing presale inflows – more than $4.5 million in just two weeks – show that builders are using this drawdown to double down on innovation.

Whales, too, seem to agree. One investor recently allocated $833,000 into HYPER, while smaller contributions have kept daily inflows steady above $500,000. Staking activity has already surpassed 1 billion HYPER tokens, locking in a 50% APY and signaling that many investors see this as more than a short-term trade.

What Makes Bitcoin Hyper Different

There’s no shortage of Bitcoin-linked projects that have promised scalability or DeFi integration. Yet, Bitcoin Hyper’s design stands out for its pragmatic engineering and market timing.

1. Solana Virtual Machine (SVM) Integration:

By running on the SVM, Bitcoin Hyper inherits Solana’s speed – giving developers access to parallel transaction execution and near-zero fees.

2. Bitcoin Security Layer:

Settlement on Bitcoin means Hyper inherits the trust and immutability of the world’s most secure chain, a rare hybrid of speed and safety.

3. DeFi and Real-World Utility:

Unlike meme-driven hype coins, Bitcoin Hyper has clear plans for hybrid apps – bridging Bitcoin liquidity with real-world finance, gaming and tokenised assets.

4. Deflationary Mechanics and Staking:

Early staking rewards at 50% APY are complemented by a deflationary model designed to limit token supply post-TGE.

5. Cross-Chain Compatibility:

The Solana architecture opens future interoperability across EVM and non-EVM ecosystems, potentially expanding demand for the HYPER token.

For these reasons, analysts like Borch Crypto and 99Bitcoins have both cited Bitcoin Hyper as one of 2025’s most credible contenders for the “top crypto to buy” list – not for its marketing, but for its mission to turn Bitcoin’s passivity into productivity.

A Market Realignment in Real Time

The October crash exposed the crypto market’s dependency on leverage, but it also catalysed a flight toward fundamentals. As weaker assets bled liquidity, stronger narratives – those tied to tangible upgrades and scalability breakthroughs – began to capture attention.

Bitcoin Hyper embodies that shift. It’s not a direct competitor to Bitcoin, but an extension of it, aiming to make BTC more useful across decentralised applications. If even a small portion of Bitcoin’s $2 trillion market cap begins circulating through such an ecosystem, the network effects could be immense.

This structural demand is what separates Bitcoin Hyper from short-term speculative tokens. By creating a functional Layer-2 economy, it channels liquidity back into Bitcoin rather than siphoning it away.

That idea – utility as a new demand driver – is gaining momentum as investors search for sustainable returns beyond leverage.

Smart Money Is Moving and Retail Is Following

In crypto, the term “smart money” often refers to the early capital that identifies and accumulates before the crowd notices. Recent blockchain data shows that pattern forming around Bitcoin Hyper.

The influx of whale addresses, coupled with staking lock-ups, suggests conviction from entities with long-term horizons. Retail investors are following suit, drawn by the blend of Bitcoin familiarity and Solana-style performance.

The project’s presale dashboard reflects this shift in sentiment. Each new stage has sold out faster than projected, with Stage 3 reportedly ending 12 hours early. Community metrics are growing, too – over 15,000 followers on X and rapidly expanding Telegram activity show momentum that’s organic rather than purely paid.

A Layer-2 Thesis for the Next Market Cycle

Every crypto cycle introduces a new technological layer. The previous one was defined by DeFi and Layer-1 expansion. The current narrative is increasingly turning toward Bitcoin Layer-2 scaling, with protocols like Bitcoin Hyper leading the pack.

If Bitcoin’s next bull phase is to sustain higher valuations, it will likely depend on transaction utility – where tokens, payments and smart contracts can coexist under Bitcoin’s security umbrella. Bitcoin Hyper aims to be the infrastructure that enables that future.

As the presale nears its final stages and the listing window approaches, the project’s trajectory will depend on delivery: launching the mainnet, maintaining security standards and attracting developers. Still, its early traction and growing capital inflows suggest it has already carved out a strong narrative foundation.

From Flash Crash to Foundational Growth

The October market crash may have erased billions, but it also reset expectations. In its wake, traders are re-evaluating what constitutes a top crypto to buy – not just by price momentum, but by what each project builds.

Bitcoin Hyper’s surge past $23.5 million in its presale shows that investors are rewarding tangible innovation. As shorts pile onto Bitcoin’s spot price, long-term capital is quietly backing the Layer-2 that could redefine its future.

FIND OUT MORE ABOUT THE BITCOIN’S LAYER 2 STILL IN ITS PRESALE STAGE: BITCOIN HYPER

If the next bull run is to be built on stronger foundations, projects like Bitcoin Hyper – bridging Bitcoin’s security with Solana’s scalability – may prove to be the blueprint.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are speculative and carry risk. Always conduct your own research before making investment decisions.