A $19 billion liquidation wiped out leveraged bets and sent crypto markets into freefall, but the turmoil may have done more to reset than ruin. As panic selling met thin liquidity, Bitcoin briefly dipped below $110,000 before rebounding – a violent purge that exposed fragility yet hinted at resilience beneath the chaos.

The largest single-day washout in crypto history has a way of clarifying things. More than $19 billion in leveraged positions were forcibly closed last Friday as panic selling, thin weekend liquidity and systemic feedback loops cascaded across exchanges.

Bitcoin briefly slipped below $110,000 before rebounding; ether fell more than 12% at the lows; and altcoins saw even steeper drawdowns, with HYPE (-54%), DOGE (-62%) and AVAX (-70%) plunging before paring losses. For many investors, the headline was simple: crypto crash – again.

Yet beneath the headline, options flows and on-chain behavior point to a more nuanced reset. Data desks flagged heavy put buying in both BTC and ETH, with traders clustering around $115,000 and $95,000 BTC strikes for late-October expiries and layering downside hedges into year-end on ether.

That tilt implies caution, not capitulation. At the same time, on-chain analysts observed that bitcoin investor flows held up better than expected relative to equities during the drawdown, while capital in altcoins appeared to rotate into BTC rather than exit the ecosystem entirely. In short: leverage was purged, risk was repriced and the market lived to fight another day.

Macro noise certainly amplified the shock. Tariff threats against China rattled global risk assets just as a pricing glitch on a major venue distorted collateral valuations, accelerating liquidations across interconnected books.

The result was a feedback loop that looked less like a classic “fundamentals” sell-off and more like a fragile microstructure stress test. By Sunday, rhetoric had softened and prices stabilised, but the signal was clear: this phase will reward assets with real user loops and defensible utility.

From Survival to Signal: What Long-Term Investors Will Watch Next

Post-wipeout playbooks typically hinge on three pillars. First, whether bitcoin can reclaim and hold key resistance levels to re-anchor risk. Second, whether derivatives positioning normalises as hedges roll off. Third, where incremental activity shows up on-chain – does capital trickle back into high-beta altcoins and if so, which narratives prove sticky?

Historically, that last question has driven the next cohort of outperformers. In prior cycles, sectors with clear product-market fit – stablecoin rails, early DeFi, or high-throughput chains – caught bid first.

In this cycle, an unexpected entrant is finding traction: a Pepenode-led “mine-to-earn” wrinkle on the meme coin narrative that tries to fuse gamified engagement with transparent mechanics and deflationary design. If bitcoin consolidates and rotation resumes, projects that convert speculation into repeatable in-app behaviors may screen better as top altcoin candidates than pure “number go up” plays.

Pepenode’s Pitch: Virtual Mining, Real Incentives

Pepenode positions itself as a gamified, virtual mining platform built on Ethereum. Instead of buying ASICs and paying power bills, participants assemble a digital server room, purchase and upgrade miner nodes and combine node types to improve simulated hash power. Rewards accrue in PEPENODE and, for top performers, in other meme tokens such as PEPE and FARTCOIN. The twist is accessibility: no hardware, no noise, no kilowatts – just a browser, a wallet and a ruleset.

The architecture is straightforward. During the current presale, participants acquire PEPENODE and can immediately stake tokens – team communications have referenced live APYs around 707%. These sort of dynamic rates typically compress as total value locked rises.

Early adopters are slated to access more powerful tiered nodes once the game transitions from off-chain logic to on-chain execution at the Token Generation Event (TGE). A leaderboard and bonus system are intended to drive competition, while a 2% referral share of mined rewards nudges organic growth.

Two mechanics deserve particular attention in a post-crypto crash market that is newly sensitive to token supply. First, Pepenode says about 70% of tokens spent on nodes and upgrades are burned. That is a heavy deflationary throttle which, if activity proves resilient, concentrates future demand on a shrinking float.

Second, the presale runs on progressively rising pricing, aligning early-stage incentives with the project’s “build-and-earn” loop. Neither guarantees performance, but both are designed to translate gameplay into token-level scarcity – an explicit attempt to move beyond one-and-done hype.

From Presale to Product: What the Roadmap Implies

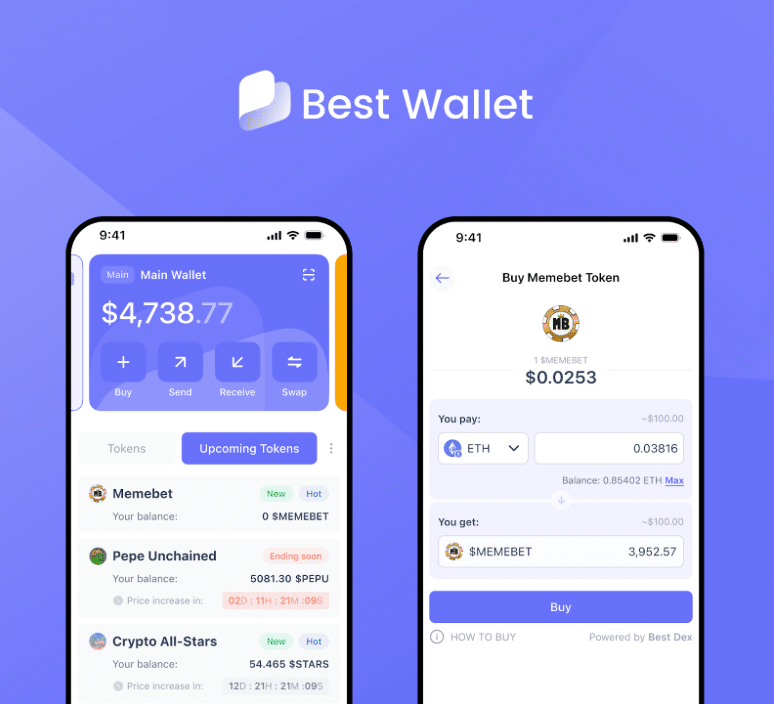

Pepenode’s near-term roadmap centers on three milestones. The first is the presale phase, where the token is sold at incrementally higher prices and staking is live. The second is the TGE, which unlocks tokens for use and ushers in the on-chain migration of the mining logic – important for transparency and verifiability. The third is exchange availability, with decentralised and centralised listings flagged as goals after the TGE to provide liquidity and discovery.

Within the game itself, the progression arc leans on experimentation. Nodes carry unique properties, combinations interact and facility upgrades (the “server room”) increase efficiency. That creates a search space where players can test layouts for higher output, a familiar loop from mobile strategy games ported into a tokenised context. If the loop is engaging enough to retain users beyond the novelty window, the burn mechanic tied to upgrades becomes more meaningful; if not, it risks being a paper feature.

The project is explicit that it is still in presale. That status cuts both ways. On one hand, it is early – uncertainty is high and execution risk is real. On the other hand, the entry price is low by design, the presale reportedly has raised over $1.8 million to date and the current quoted price of $0.0011005 sets a reference point for any future listing. For some investors – particularly those seeking asymmetric outcomes after a market crash – that mix is precisely the appeal.

Token Design Under the Microscope After the Crash

After a deleveraging event of this magnitude, token mechanics matter more. Investors will ask a few blunt questions of any would-be top altcoin. Where does demand come from when the news cycle is quiet? What locks users in beyond early incentives? How quickly can emissions or yields normalise to sustainable levels? And can the team ship the on-chain transition – and iterate – without breaking trust?

Pepenode’s answers, at least on paper, are deliberate. Demand is intended to be circular: gameplay requires token spend; spend triggers a burn; burn amplifies scarcity; scarcity, in theory, supports price and further gameplay. Lock-in is meant to come from combinatorial optimisation and competitive rewards. Yields are variable and likely to taper as staking participation grows and the on-chain migration is positioned as a step-function upgrade to transparency rather than a brand-new code path.

None of that eliminates risk. Presales, by definition, sit at the riskiest end of the spectrum. The staking APYs quoted are eye-catching and will almost certainly compress and while a deflationary engine is attractive, it is only as durable as the activity that feeds it.

Still, in a week when many altcoins were reminded that narrative alone isn’t a moat, Pepenode’s attempt to tie narrative to repeated in-app decisions is precisely the kind of structure long-term allocators will scrutinise.

How the Crash Reframes the Altcoin Opportunity

The immediate aftermath of the crypto crash is a study in contrasts. Options desks are pricing more downside risk into near-dated maturities. Bitcoin is still wrestling with resistance levels that would unlock a new high this year. Yet leverage has been flushed, positioning is cleaner and the path is clearer for assets that can convert attention into usage.

That is where Pepenode could fit. If bitcoin stabilises and capital rotates back down the risk curve, “engage-to-earn” structures that emphasise game loops, measurable progression and supply sinks may be better positioned than meme coins that rely solely on social momentum. Pepenode’s ERC-20 base means it inherits Ethereum’s tooling and wallet familiarity, while its planned on-chain mining logic should make performance and payouts auditable – traits that matter more after investors have been reminded how fast trust can evaporate.

From Crash to Construction

Markets don’t reward hope; they reward persistence. The current reset is likely to keep volatility elevated while macro and microstructure cross-currents resolve. In that window, assets that combine a clear product loop with thoughtful token design have a chance to separate from the pack.

Pepenode is attempting exactly that – building a virtual mining ecosystem that turns token spend into a deflationary flywheel and stakes its claim as a top altcoin candidate for the next phase.

EARN BY MINING WITH PEPENODE NOW

It is still early. Execution, not a presale counter, will decide whether the project earns durable shelf space in portfolios rebuilding after the crypto crash, but among this cycle’s experiments, Pepenode’s blend of game mechanics, on-chain verifiability and explicit scarcity gives it a thesis investors can actually test – one upgrade, one node combination and one burn at a time.

Disclaimer: This article is for information purposes only and does not constitute financial advice. Crypto assets are volatile and risky. Do your own research and never invest more than you can afford to lose.