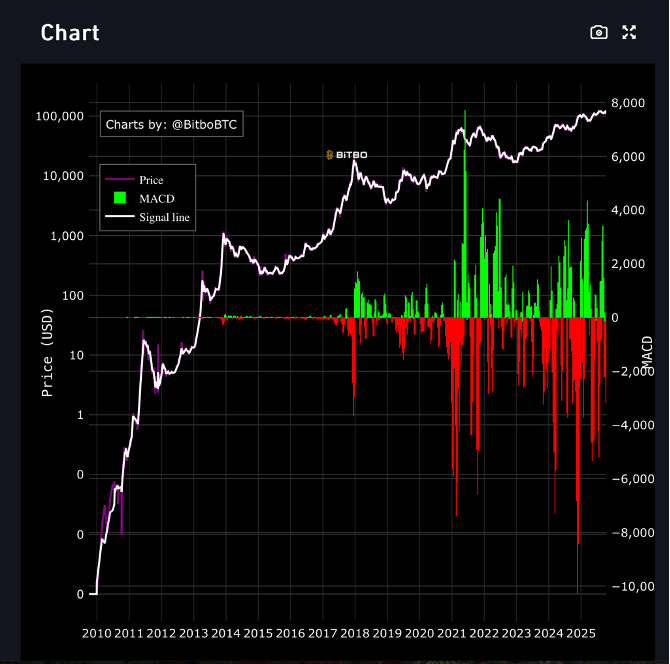

Bitcoin is retesting the golden cross, a technical formation that has historically preceded massive rallies, but as traders await confirmation of a breakout, one new Layer-2 project – Bitcoin Hyper – may offer the infrastructure boost needed to propel BTC to new highs.

After weeks of turbulence, Bitcoin (BTC) is once again at a pivotal point. The leading cryptocurrency has returned to test its golden cross, where the 50-day moving average climbs above the 200-day moving average – a formation that has preceded some of Bitcoin’s most powerful rallies.

According to analyst Mister Crypto, maintaining support above this crossover could open the door to a fresh surge toward $160,000 by late October 2025. “If we can hold above, BTC price will absolutely explode,” he noted on X.

The signal carries historical weight. In both 2019 and 2021, Bitcoin’s golden crosses preceded price surges exceeding 1,000%, often following short consolidation phases. Technical strategist Cas Abbé adds that Bitcoin typically dips 10%–15% before resuming its climb, reminding traders that “the golden cross is a trend confirmation, not an immediate buy signal.”

However, not all analysts are convinced. Some, like FX_Professor, warn that golden crosses “often lag price movement,” serving as confirmation rather than prediction. Still, the majority agree that the underlying momentum – fueled by ETF inflows and bullish on-chain data – remains strong.

Institutional Flows and Macro Factors Shape the Outlook

Bitcoin’s rebound comes amid renewed institutional engagement. Spot ETF inflows continue to climb, reinforcing demand from both retail and professional investors. As of press time, BTC traded around $114,000, up nearly 2% in 24 hours.

But global macro headwinds remain a wildcard. Escalating US–China trade tensions, fresh tariffs on tech imports and ongoing interest-rate uncertainty have kept risk appetite fragile. When the US announced new tariffs last week, Bitcoin briefly plunged below $110,000, triggering billions in leveraged liquidations.

Despite these shocks, Bitcoin’s recovery suggests resilience.

Bitcoin Price Prediction: Why $160K Is Still on the Table

With Bitcoin now stabilizing above key support, momentum indicators like the MACD are turning upward. The combination of technical strength, institutional accumulation and market rotation toward BTC over altcoins has analysts maintaining a bullish long-term outlook.

Previous golden cross formations – particularly in 2020 – signaled multi-month rallies that took BTC from $10K to over $60K. If history rhymes, the current setup could push Bitcoin toward $160K before the year’s end.

Yet for this scenario to unfold, Bitcoin needs both robust infrastructure and scalable transaction throughput. This is where Bitcoin Hyper enters the conversation – a Layer-2 project designed to make Bitcoin faster, cheaper and more adaptable for modern Web3 use.

Bitcoin Hyper: The Layer-2 Powering Bitcoin’s Next Chapter

At the core of the latest Bitcoin price prediction discussions is a question of capability: can Bitcoin handle the next phase of adoption? For years, its limited scalability has restricted its use for global payments and decentralised apps.

Bitcoin Hyper aims to change that. Built as an ultra-fast Layer-2 network for Bitcoin, it allows users to transact BTC at lightning speeds while introducing smart-contract functionality similar to Ethereum or Solana.

This upgrade could revive Bitcoin’s original purpose – enabling low-cost, peer-to-peer payments – while expanding its utility across DeFi, NFTs and gaming. The result: a faster, programmable Bitcoin ecosystem that finally merges decentralization with usability.

How Bitcoin Hyper Works

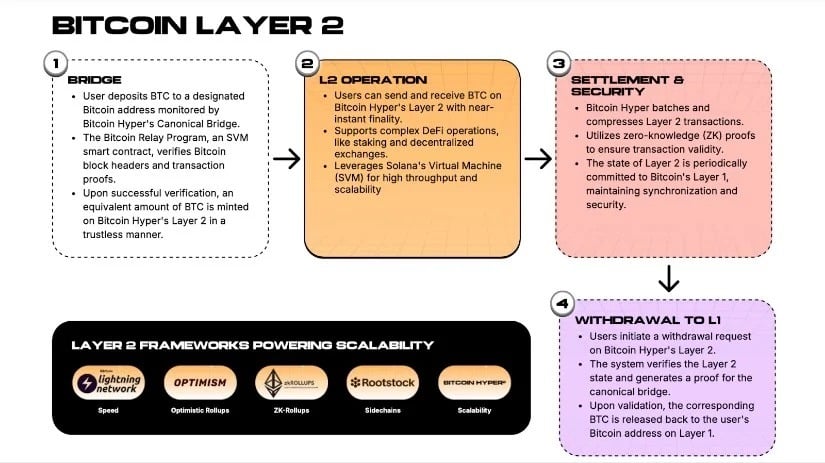

Bitcoin Hyper’s innovation lies in its Bitcoin Relay Program, a Solana-based smart contract system that enables BTC holders to bridge assets seamlessly between Bitcoin’s main chain and the Hyper Layer-2.

When a user deposits BTC, it’s locked on the mainnet and an equivalent amount is minted on Bitcoin Hyper. When they withdraw, the Layer-2 tokens are burned and their BTC is released. The process is trustless and fully decentralized, leveraging Bitcoin’s proof-of-work security with Layer-2 efficiency.

Audits by Coinsult and Spywolf confirm the security of Bitcoin Hyper’s contracts, giving investors confidence in the system’s integrity.

Beyond security, the network offers 53% staking APY, incentivizing early adopters to support network validation and governance.

From Payments to DeFi: The Expanding Bitcoin Hyper Ecosystem

Bitcoin Hyper doesn’t stop at faster BTC transactions. Its design makes it compatible with Web3 applications, enabling developers to deploy DeFi platforms, meme coins and play-to-earn games – all powered by Bitcoin.

This marks a strategic evolution: rather than competing with Ethereum or Solana, Bitcoin Hyper positions Bitcoin as their cross-chain rival, combining BTC’s liquidity and credibility with next-generation transaction speed.

This could trigger a new wave of adoption. As stablecoin payments grow and Bitcoin reclaims relevance in the global remittance sector, a fast, programmable Layer-2 like Bitcoin Hyper could become a vital pillar of crypto infrastructure.

Could $HYPER Be the Hidden Catalyst?

The $HYPER token fuels Bitcoin Hyper’s ecosystem, functioning as gas, staking collateral and a governance asset. As activity on the Layer-2 expands, demand for $HYPER could increase significantly – a dynamic that mirrors how ETH powers Ethereum.

Crypto commentators such as Borch Crypto and Creed have described Bitcoin Hyper as one of the most promising developments since Ordinals, estimating that $HYPER could rally up to 100x once it lists on exchanges.

This optimism reflects the broader sentiment that scalability solutions, rather than pure speculation, will drive the next major Bitcoin rally. If Bitcoin Hyper delivers on its roadmap, it could become a key component in Bitcoin’s transition from passive store of value to active transactional layer.

Bitcoin’s Road to $160K and Beyond

The combination of technical and structural factors paints a bullish medium-term picture for Bitcoin. Holding above the golden cross would validate the uptrend, while projects like Bitcoin Hyper could accelerate real-world utility – a fundamental catalyst for sustainable growth.

If Bitcoin Hyper successfully integrates with the main network and gains traction among developers, it could amplify transaction throughput and unlock an entirely new era of BTC-based innovation.

While Bitcoin’s current rebound remains subject to macro conditions, analysts agree that the next leg higher will require both confidence and capability. Bitcoin Hyper may provide the infrastructure needed for that next leap.

INVEST IN BITCOIN BEFORE THE NEXT PRICE JUMP

Bitcoin’s market rebound and the reemergence of the golden cross have reignited optimism among traders and institutions alike. With forecasts pointing toward $160,000, the long-term trajectory hinges not only on technicals but also on infrastructure – and that’s where Bitcoin Hyper comes in.

By transforming Bitcoin into a fast, smart contract-enabled network, Bitcoin Hyper could be the missing link that sustains the next major rally. Whether this happens in months or over multiple cycles, the groundwork for a more scalable Bitcoin ecosystem is now being laid.

As Bitcoin strengthens its position as digital gold, Bitcoin Hyper could be the innovation that ensures it remains equally relevant as digital infrastructure.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are volatile and investments carry risk. Always conduct your own research and consult a licensed financial advisor before making any investment decisions.