As global banks and financial giants embrace stablecoin payments to modernise cross-border settlements, the line between traditional and digital finance continues to blur. With projects like Best Wallet enabling seamless fiat-to-crypto access, the next stage of adoption may already be underway.

A structural shift is underway in the global financial system. What began as a niche crypto experiment – stablecoins pegged to the U.S. dollar – has evolved into a trillion-dollar movement attracting the attention of banks, regulators and governments worldwide.

According to Standard Chartered, the adoption of dollar-backed stablecoins could pull as much as $1 trillion from emerging market banks in the next few years. The report notes that nearly 99% of stablecoins are linked to the U.S. dollar, effectively functioning as decentralised digital bank accounts that appeal to users in economies prone to inflation or currency crises.

The shift is driven by a simple motivation: security. “Return of capital matters more than return on capital,” the bank’s report stated, suggesting that for citizens in high-risk economies like Egypt, Turkey and Kenya, stability trumps yield.

By 2028, Standard Chartered estimates that global stablecoin holdings could surge from around $173 billion to $1.22 trillion, underscoring a massive behavioural shift toward digital finance.

But this transformation isn’t limited to retail adoption – it’s now reaching the upper echelons of global banking.

Global Banks Enter the Stablecoin Payments Race

Nine major European banks – including ING, UniCredit, Danske Bank, SEB and CaixaBank – announced a joint initiative to launch a MiCAR-compliant euro-denominated stablecoin by 2026. This digital payment instrument will provide 24/7 cross-border settlements at low cost, built on blockchain infrastructure regulated by the Dutch Central Bank.

The group’s goal is to offer a trusted European alternative to U.S.-dominated stablecoins like USDT and USDC, while establishing a unified payment standard for the region.

Floris Lugt, Digital Assets Lead at ING, described the move as “imperative for banks to adopt the same digital standards”, emphasising that programmable stablecoin payments could revolutionise everything from supply chains to securities settlements.

Meanwhile, across the Atlantic, a similar movement is gaining traction. The Wall Street Journal reported that U.S. banking giants – J.P. Morgan, Citigroup, Bank of America and Wells Fargo – are in talks to form a consortium for a U.S. bank-backed stablecoin. This initiative could be accelerated by the GENIUS Act, a proposed law that would set a unified framework for stablecoin issuance by both banks and fintechs.

The convergence of these efforts signals one thing: stablecoin payments are no longer an experimental concept. They’re becoming the next frontier in mainstream banking.

Why Stablecoin Payments Are the New Competitive Edge

Stablecoins offer banks a fast, low-cost way to process payments and settle transactions without relying on outdated infrastructure. Instead of waiting days for cross-border transfers to clear, blockchain-based settlements can occur in seconds.

That efficiency is increasingly hard to ignore. Banks recognise that if they don’t modernise, fintechs and crypto-native firms will capture their market share. This is why partnerships between traditional finance and blockchain projects are accelerating.

Examples include the R3–Solana Foundation collaboration, which will bridge regulated real-world assets onto public blockchain networks. This move, according to Solana Foundation President Lily Liu, “signifies that the future of capital markets will be built on public infrastructure.”

Similarly, Bullish’s partnership with Deutsche Bank represents another milestone in merging TradFi with crypto.

Deutsche Bank and Bullish Partnership: A Sign of What’s Next

In a landmark collaboration, Deutsche Bank has partnered with global digital asset platform Bullish to enable seamless fiat-to-crypto integration. Under the agreement, Deutsche Bank will handle Bullish’s real-time corporate banking services – including fiat deposits, withdrawals and reconciliation tools – creating a smooth bridge between traditional banking and decentralised finance.

For institutional clients, this means a major pain point is eliminated: moving money between banks and crypto exchanges no longer involves complex third-party intermediaries. The partnership, overseen by regulators such as BaFin in Germany and the Securities and Futures Commission (SFC) in Hong Kong, demonstrates how regulated digital asset infrastructure is becoming an institutional standard.

As Kilian Thalhammer, Head of Merchant Solutions at Deutsche Bank, stated, “Our collaboration with Bullish reflects our ambition to act as a Global Hausbank for the emerging digital economy.”

This kind of partnership doesn’t just benefit institutions – it opens the door for consumers, too and this is where Best Wallet enters the picture.

Best Wallet: A Gateway to the New Financial System

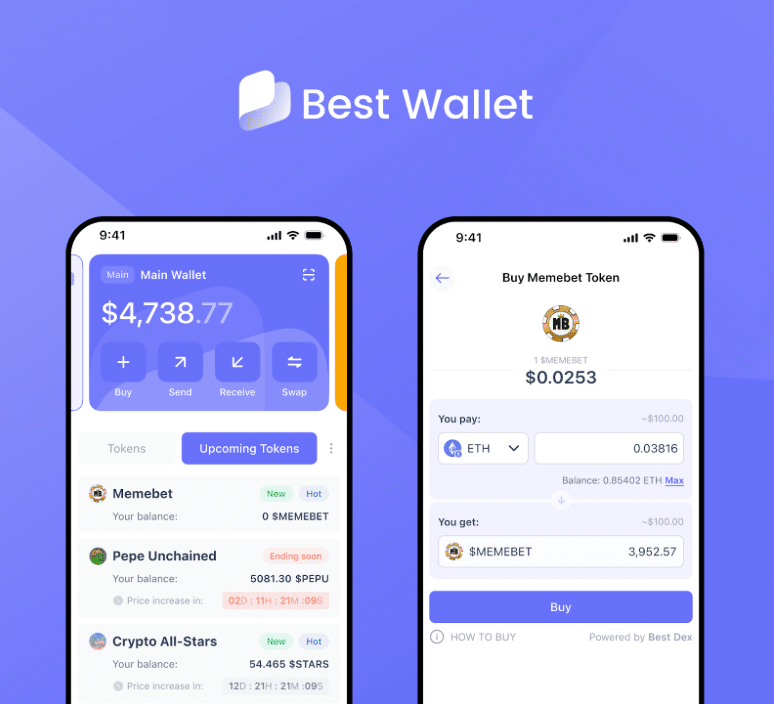

As banks move toward stablecoin adoption, tools that connect traditional and decentralised finance are becoming essential. Best Wallet stands out as one of the leading non-custodial wallets positioned to facilitate this transition.

Available on iOS and Android, Best Wallet allows users to buy and sell crypto instantly using debit or credit cards – offering seamless fiat on- and off-ramps that mirror the kind of convenience banks are racing to provide.

It supports over 1,000 cryptocurrencies across networks like Bitcoin, Ethereum and BNB Chain, with plans to expand to more than 60 chains. Security remains a core feature, with biometric logins, two-factor authentication and upcoming anti-fraud and MEV protection designed to safeguard user assets.

The platform also integrates a cross-chain swap aggregator connecting over 330 decentralised exchanges and 30 bridges, ensuring optimal trade execution across ecosystems.

But what truly sets Best Wallet apart is its broader ecosystem – powered by the $BEST token.

$BEST: Fueling Adoption Through Utility

The $BEST token lies at the heart of Best Wallet’s ecosystem. It powers governance, staking and fee reductions within the app, while also supporting development and marketing initiatives that expand user adoption.

Currently priced at $0.025765, the token has already raised more than $16.4 million in its presale. Holders can stake $BEST for an attractive 80% APY, reflecting early demand and long-term growth expectations.

A significant portion of $BEST’s supply – 25% for development and 35% for marketing – ensures sustainable growth and continuous innovation.

Best Wallet’s roadmap also includes the launch of Best Card, a crypto debit card that will allow users to spend digital assets anywhere traditional cards are accepted, earning cashback in crypto. This blend of everyday utility and blockchain integration places Best Wallet squarely at the center of the stablecoin-driven payment revolution.

The Broader Implications: Banking, Blockchain and Beyond

The adoption of stablecoin payments by global banks marks a pivotal turning point. What was once a challenge to the banking system is now becoming its next engine of growth.

As banks, fintechs and crypto projects converge, the tools connecting them – like Best Wallet – will become critical infrastructure. Whether through regulated banking partnerships like Deutsche Bank’s or decentralised wallets that empower individual users, the end goal is the same: a faster, more efficient and more inclusive financial network.

JOIN THE STABLECOIN REVOLUTION WITH BEST WALLET

With emerging markets leading the adoption curve and developed economies now following, the race to modernise money is accelerating. Best Wallet and its $BEST token could prove to be among the first platforms to truly bridge this global transition.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are speculative and carry significant risk. Readers should conduct independent research and consult a financial professional before investing.