Bitcoin is showing one of its calmest trading phases in history and that has investors wondering whether it’s the silence before the next storm. As accumulation builds among institutional players, a new project called Bitcoin Hyper is gaining traction for attempting what few have done successfully: bringing Solana-like speed and scalability to Bitcoin.

Bitcoin’s price recently climbed above $126,000 for the first time before slipping in a brief correction. Despite the minor retreat, this phase could prove pivotal. According to leading analysts tracking Bitcoin price prediction trends, BTC is entering a rare period of historic stability that has often preceded major price surges.

On-chain analytics platform Alphractal reports that Bitcoin’s 180-day volatility has fallen to its lowest level on record, suggesting traders are witnessing one of the most subdued market conditions in BTC’s history. Volatility compression of this kind has historically signalled the build-up to large directional moves – either upward breakouts or sharp retracements.

Crypto analyst Mr. Wall Street believes the latest pullback represents consolidation, not exhaustion. After BTC surged 16% from $108,000 to $126,000 in ten days, he argues that the asset is coiling for another push higher rather than forming a cycle top. Supporting this view, institutional inflows remain strong.

Recent reports show BlackRock purchased $1.2 billion in Bitcoin this week and an additional $3.3 billion the week prior. These figures indicate aggressive accumulation by large entities – a dynamic that tends to squeeze short sellers and provide structural support for higher prices.

Technically, Mr. Wall Street expects BTC to retest its 4-hour EMA200 before resuming its upward trend, mirroring the setup seen ahead of April’s breakout. From a macro perspective, weaker US economic data and a more dovish Federal Reserve are adding fuel to the bullish narrative. With interest rates expected to decline further, analysts anticipate renewed appetite for risk assets like Bitcoin.

Bulls Regain Momentum as Bears Retreat

Beyond spot markets, Bitcoin’s derivatives data also paints a constructive picture. The net taker volume – a measure of buy versus sell orders across major futures platforms – has rebounded from a negative $400 million to neutral levels. This shift implies that bearish sentiment is fading fast.

A similar reversal in derivatives activity occurred in April 2025, just before Bitcoin’s rally toward six-figure territory. If that pattern repeats, the next few weeks could mark the transition from consolidation to breakout.

This mix of technical stability, institutional accumulation and balanced derivatives exposure suggests that the market is in a classic “calm before the storm” setup – one that often leads to explosive upside once volatility returns.

Why Innovation Matters During Bitcoin’s Consolidation

During quieter market phases, innovation within the ecosystem often accelerates. Historically, every major Bitcoin consolidation has coincided with the birth of new infrastructure – from exchanges and payment processors to Lightning Network adoption. Now, a new wave of Layer-2 innovation is emerging, seeking to push Bitcoin beyond its role as a store of value.

One of the most notable projects in this new frontier is Bitcoin Hyper ($HYPER), a Layer-2 blockchain designed to scale BTC while preserving its underlying security. With its $22.6 million presale already oversubscribed, Bitcoin Hyper is positioning itself as a leading contender in Bitcoin’s evolving infrastructure landscape.

Bitcoin Hyper’s Blueprint for a Faster, Smarter BTC

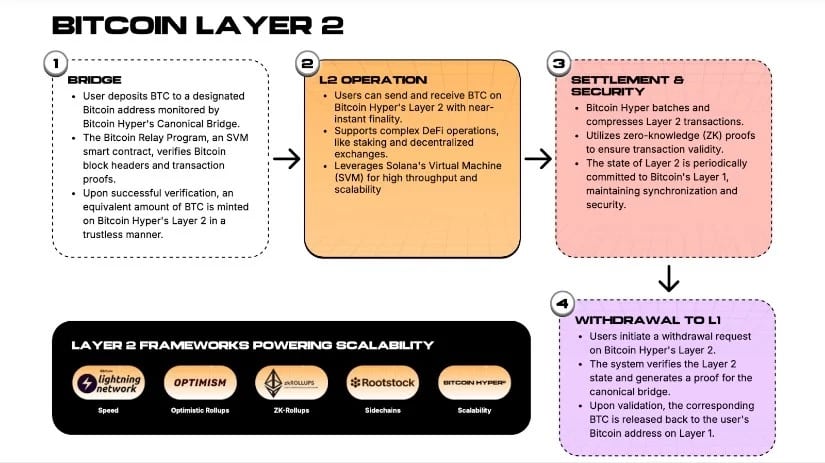

At its core, Bitcoin Hyper aims to bring Solana-like performance to the Bitcoin ecosystem. It leverages zk-rollup technology – a proven scalability solution popularised on Ethereum – to bundle thousands of transactions off-chain before settling them as a single, secure batch on the Bitcoin mainnet. This drastically reduces congestion and gas fees.

The real breakthrough, however, comes from Bitcoin Hyper’s use of the Solana Virtual Machine (SVM). Capable of handling up to 65,000 transactions per second, the SVM gives Bitcoin Hyper the throughput needed for real-world use cases like decentralised finance (DeFi), gaming and NFT marketplaces.

For comparison, the Bitcoin base layer processes around 3 to 7 transactions per second. By combining zk-rollups and parallel execution through the SVM, Bitcoin Hyper could transform BTC from a slow-moving settlement layer into a high-speed, multi-application platform.

Developers familiar with Rust – the language used for Solana – will be able to build directly on Bitcoin Hyper, reducing barriers to entry and accelerating app deployment. The network’s design ensures that all Layer-2 activity remains anchored to Bitcoin’s base-chain security, preserving decentralisation while enabling exponential scale.

Inside the HYPER Token Model

The $HYPER token powers every transaction within the Bitcoin Hyper network. With a fixed supply of 21 billion tokens, it mirrors Bitcoin’s scarcity ethos while serving three critical functions: gas payments, staking and governance.

Holders can stake their HYPER to help validate transactions and earn rewards – currently projected at around 52% APY. This system incentivises network security and participation without relying solely on speculative hype. The token also grants governance rights, allowing holders to vote on proposals and upgrades as the ecosystem evolves.

Bitcoin Hyper’s presale, priced around $0.013085 per token, has already surpassed the $22.6 million milestone. On-chain data shows significant whale accumulation, with large addresses steadily adding HYPER positions ahead of its planned listings.

The team intends to list the token first on a decentralised exchange such as Uniswap, followed by Tier-1 centralised exchange (CEX) listings later this quarter. If executed successfully, that could open liquidity to millions of new retail and institutional participants.

Could Bitcoin Hyper Lead the Next Bull Run?

Every major bull market in crypto has been defined by a clear narrative. In 2017, it was the rise of ICOs; in 2021, it was DeFi and NFTs. As the 2025 cycle matures, the story could be Bitcoin’s transformation from static asset to active ecosystem.

Projects like Bitcoin Hyper embody that transition. By building programmable scalability directly on Bitcoin’s foundation, it could reignite developer interest and attract new capital – similar to how Ethereum’s Layer-2s turbocharged its ecosystem.

The timing couldn’t be more fitting. Bitcoin’s historic lull, combined with a wave of institutional accumulation, suggests the market is preparing for its next chapter. If Bitcoin price predictions above $150,000 prove accurate, investors may soon begin looking for complementary assets that scale with BTC’s success.

Bitcoin Hyper could be one of those catalysts – a project that bridges Bitcoin’s security with the speed and functionality required for mainstream adoption.

Building Momentum Beneath the Surface

The data shows a clear picture: BTC is calm, but not complacent. With volatility collapsing, institutional accumulation rising and innovation accelerating, the stage is set for the next phase of the crypto bull run.

If history repeats itself, Bitcoin’s quiet consolidation will give way to a powerful breakout and when it does, the ecosystem surrounding it – led by projects like Bitcoin Hyper – may be where some of the most significant gains occur.

FIND OUT MORE ABOUT BITCOIN’S LAYER 2, BITCOIN HYPER

While short-term corrections are inevitable, the long-term Bitcoin price prediction narrative remains anchored in growth, scalability and innovation. As the line between traditional finance and blockchain technology continues to blur, Bitcoin’s future may depend not just on its price, but on how projects like Bitcoin Hyper help it evolve into something far greater than digital gold.

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Cryptocurrency markets are volatile and unpredictable. Always conduct your own research before making investment decisions.