Solana is drawing record institutional inflows as Bitcoin and Ethereum leak capital. With $210–$220 resistance in play and ETF buzz rising, traders are eyeing Snorter – a Solana Telegram bot token that hunts meme coin trades at sub-second speed, risks included.

When CoinShares tallied flows last week, Solana stood alone. Roughly $291 million moved into SOL-focused products while the broader market saw $812 million in outflows, including heavy redemptions in Bitcoin and Ethereum. On price, SOL has been consolidating above $200, with technicians flagging a cluster of resistance around $210–$220 and an obvious magnet near $250 if momentum carries. The setup is classic: strong spot demand, clean technicals and a clear invalidation if bids fade under $200.

Macro and micro drivers are converging. A new Crypto.com–STSS treasury transaction exceeding $400 million in Solana reinforced the “institutions are here” narrative.

Meanwhile, traders are gaming potential spot SOL ETF decisions in October, which, if favorable, could push liquidity into on-chain markets. Add the Alpenglow upgrade discussion – aimed at improving finality and shrinking execution latency and you get why SOL sits on many Q4 “altcoins to watch” lists despite on-chain revenue and DEX volumes still looking mixed. If the resistance shelf clears and ETF headlines cooperate, a test of $245–$250 is plausible and a squeeze toward $300 cannot be ruled out.

This is the backdrop for capital rotation into smaller plays. Historically, when Solana strength persists, liquidity bleeds into meme coin experiments – especially those that live on Solana’s fast rails. That’s where Snorter enters the conversation.

The Spillover Effect: From SOL Inflows to On-Chain Velocity

Institutional inflows rarely stop at a base asset. When funds allocate to Solana, market makers provision liquidity, arb desks spin up strategies and retail looks for higher beta. Last cycle, that cocktail birthed a stream of meme coin breakouts. This cycle’s twist is the tooling: retail now has simpler paths to discover, filter and execute on-chain in real time.

If SOL can maintain its bid and volatility rises into ETF timelines, tools that compress discovery-to-execution time should benefit most. Snorter’s pitch sits precisely there: scan first, filter fast, execute sooner.

Meet Snorter: Solana-Native Scanning With Telegram Muscle

Snorter is a Solana-based trading bot tokenised via $SNORT, with the bot accessible directly inside Telegram. The design goal is straightforward: give everyday traders a whale-style playbook without whale-sized infrastructure.

Under the hood, Snorter monitors Solana transaction queues and validator feeds for early tells – new token mints, liquidity injections and emergent pools – often before they surface on public dashboards. It can also read pending activity on Ethereum to catch cross-chain narratives, but its execution edge is firmly on Solana.

Once a candidate is flagged, the system runs checks for liquidity depth, emerging volume, wallet concentration, contract safety and anti-rug signals, then prompts users to act. When they do, orders route through custom RPC endpoints engineered to cut latency compared with crowded public infrastructure, aiming for sub-second execution on DEXs.

The value proposition is not that Snorter guarantees wins – nothing does in a meme coin market. It’s that it narrows the gap between discovery and filled trade at a time when seconds can separate entries from exit liquidity. The Telegram interface keeps the workflow minimal, which matters in fast markets where switching tabs is a tax on execution.

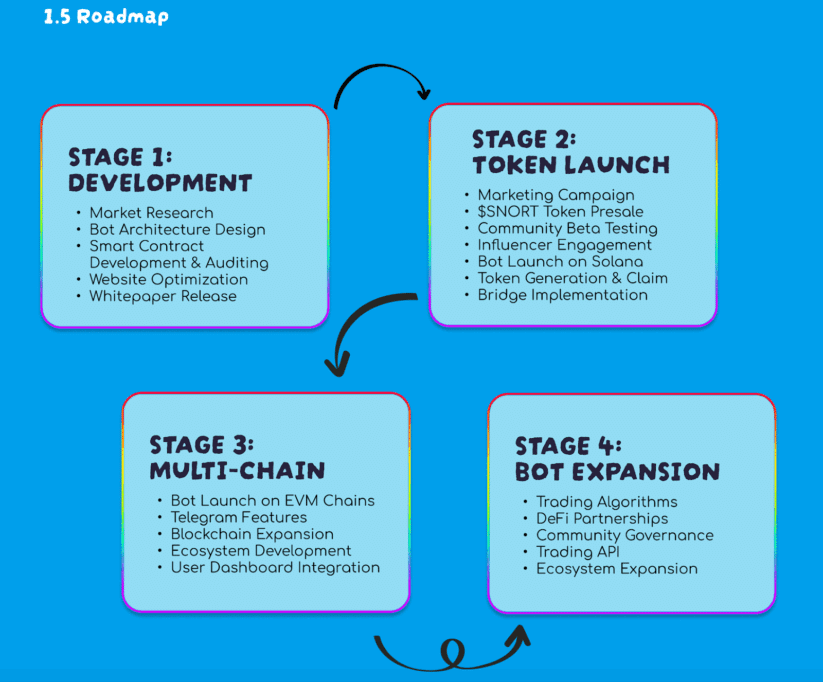

Token Mechanics and Roadmap – Useful, but Not a Silver Bullet

Per the project’s disclosures, $SNORT underpins the bot’s economics: reduced trading fees inside Telegram for holders, the ability to stake for rewards and the right to weigh in on product governance as features expand. The team earmarked a significant portion of supply – about 45% – for marketing and rewards, signaling a campaign-heavy growth strategy across influencers, listings and community programs.

That’s aggressive and it reflects the competitive landscape where rival bots fight for mindshare and volume.

Momentum has been notable. The presale has raised over $4.2 million, including several whale allocations that crossed six figures. Current pricing hovers near $0.1065–$0.1067, with dynamic staking advertised north of 113% APY.

The team frames this as a bootstrapping phase; as staking participation grows, yields are expected to normalise. For now, the setup rewards early commitment but also amplifies standard smart-contract and platform risks you see across new protocols.

It’s also worth underscoring what $SNORT is not. It is not a claim on protocol revenue, it is not a guaranteed dividend stream and it is not a shield against market drawdowns. Its value accrues – if it does – via utility (fee reductions, access), network effects (more traders, more alerts, more volume) and brand.

In a crowded bot category featuring names like Trojan, Banana Gun and Maestro, differentiation must show up in fills, filters and safety, not slogans.

Where Snorter Could Fit if SOL Breaks Higher

If Solana clears the $210–$220 pocket and runs at $245–$250, two things typically happen. First, attention floods into Solana-native narratives. Second, meme coin velocity jumps as traders chase laggards and farm new mints.

In that tape, a scanner-plus-sniper that can surface pools early and fire orders quickly is positioned to capture value even if only a handful of alerts per week translate to workable trades.

Snorter’s edge is its Solana-first architecture. Execution on Solana is a speed game; bots that bolt Solana onto Ethereum-centric stacks often inherit avoidable latency. If Snorter’s custom endpoints and routing logic consistently beat public RPC congestion during rushes – launchpad frenzies, ETF headline spikes, or social-driven waves – users will notice in their fills.

The fee structure matters too: holders see trading fees drop to about 0.85%, which is competitive in the bot wars and can compound to meaningful savings for active accounts.

Mind the Risks: Liquidity, False Positives and Market Structure

No tool, Snorter included, can neutralise meme coin risk. Liquidity can vanish. Contract audits miss things. Copy-trading concentrates exits at the same time. Even a perfect alert can fail if a pool is botted to oblivion by the time you click. There’s also a behavioural risk: bots can encourage overtrading, which magnifies slippage and fees in chop.

From a project standpoint, staking yields in triple digits are by nature transitory and contingent on emissions and participation. As supply unlocks or governance evolves, yields will likely compress. While whales joining a presale can be a confidence signal, their exits later can pressure price if liquidity is thin.

None of this is unique to Snorter; it’s the fabric of early-stage crypto. It does, however, argue for position sizing, a plan for failed alerts and disciplined use of the bot’s limit orders and risk controls rather than pure market-buy aggression.

Why This Narrative Resonates Now

The ingredients for a Q4 meme rotation are back on the table. Solana has the strongest institutional bid of any large-cap right now, technicals are aligned for a break if volume materialises and ETF decisions could crowd the trade further. When base-layer momentum returns, retail typically hunts meme coin torque. In that environment, Snorter aligns with the market’s demand for speed, filters and execution simplicity.

That doesn’t make $SNORT a foregone winner. It does make the thesis legible: if Solana continues to attract capital and on-chain activity escalates, the tools that help traders navigate the firehose stand to gain mindshare. Should Snorter consistently deliver earlier alerts, cleaner filters and better execution than public paths, its token can accrue utility value without resorting to the kind of hype that burns traders in the long run.

JOIN THE SNORTER PRESALE BEFORE IT ENDS

Solana’s $291 million of weekly inflows, potential ETF catalysts and a roadmap aimed at faster finality are pulling liquidity back on-chain. If that continues, a renewed meme coin phase is plausible.

Snorter is engineered for precisely that: surfacing candidates from validator feeds, filtering for quality and firing transactions at sub-second speeds inside Telegram.

The opportunity is obvious; so are the risks. For traders, the practical question isn’t whether a bot can promise gains – it can’t, but whether it can reduce the time to a good decision and increase the odds of a clean fill when Solana volatility returns.

If the answer is “yes” often enough, Snorter could become a default companion for the next Solana meme coin wave. Proceed with discipline, size conservatively and remember that the best edge is still a plan you can execute – fast.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always do your own research (DYOR) before investing in cryptocurrencies.