Global payment giants Stripe and SWIFT are pushing blockchain and AI deeper into finance, with new stablecoin issuance tools and cross-border payment rails, but while institutions and enterprises focus on infrastructure, the question remains: can consumer-first wallets like Best Wallet bridge these innovations to everyday users?

At its annual Stripe Tour New York showcase, Stripe announced more than 40 new products designed to merge frontier technologies like stablecoins and AI with mainstream commerce. Among the highlights was Open Issuance, a platform that allows businesses to launch their own stablecoins with just a few lines of code.

The significance lies in control.

Until now, most businesses building with stablecoins have been tied to external issuers, meaning they don’t capture yield on deposits or control redemption costs. Stripe’s solution, built on infrastructure acquired from Bridge, lets companies mint, burn and customise reserves for their own coins. Liquidity is backed by partners like BlackRock and Fidelity, while interoperability is built into the framework.

Stripe’s president Will Gaybrick framed the move as a transition from experiment to adoption: “With the advent of stablecoins and AI, we’re at the dawn of a new online economy and we’re relentlessly focused on channeling its many opportunities to help our customers grow.”

The company also doubled down on AI commerce, unveiling the Agentic Commerce Protocol (ACP) in partnership with OpenAI. The protocol, already powering Instant Checkout inside ChatGPT, allows merchants to sell through AI agents while retaining brand control. Stripe positioned this as a step toward “agentic commerce,” where AI doesn’t just recommend but transacts on a user’s behalf.

Together, these updates suggest Stripe is preparing businesses for a world where AI agents and programmable money converge, giving enterprises new ways to generate revenue and reduce friction.

SWIFT’s Blockchain Ledger: Banks Enter the Race

On the other side of the payments spectrum, SWIFT – the backbone of interbank transactions – announced its own blockchain project at the Sibos conference in Frankfurt.

Working with Consensys and more than 30 global banks, SWIFT is developing a blockchain-based ledger for tokenised payments. The aim is interoperability between distributed ledger technology (DLT) and the fiat infrastructure that still dominates cross-border trade.

The first use case focuses on 24-hour cross-border payments, with smart contracts enforcing transaction rules in real time. NatWest, HSBC, Deutsche Bank, Emirates NBD and Banco Santander are among the institutions involved, underscoring how seriously the sector views tokenisation.

HSBC’s head of global payments, Manish Kohli, described the initiative as “driven by a common ambition: to make cross-border payments faster, smarter and always available.” NatWest executives echoed that the ledger provides the foundational infrastructure needed for real-time settlement across borders.

While fintech analyst Chris Skinner pointed out that SWIFT’s project follows the same path as Visa and Mastercard’s tokenisation work, the difference is scope. With over 11,000 institutions already on SWIFT’s rails, the potential scale of adoption is enormous.

This signals a clear trend: institutions are standardizing around blockchain payments, not just in crypto but in the very fabric of traditional finance.

Institutional Rails Meet Retail Front Ends

Both Stripe and SWIFT are building the rails of tomorrow’s financial system, but rails don’t guarantee adoption. For most users, what matters isn’t how a transaction moves across ledgers but how easily they can buy, store and use assets. That’s where consumer-facing wallets like Best Wallet enter the picture.

Best Wallet has been quietly building a platform that mirrors many of the innovations Stripe and SWIFT are aiming for but from the retail side. It allows users to buy, store and swap tokens across chains, integrates with dApps and even has a built-in decentralised exchange (DEX) for direct token trading.

Unlike Stripe’s institutional focus, Best Wallet’s value proposition is simplicity: sign up with an email in under a minute and start transacting without custodians or identity checks.

Best Wallet Review: Bridging Web3 for Consumers

What sets Best Wallet apart is its effort to centralise multi-chain asset management in a user-friendly interface. Ethereum, BNB, Polygon and Solana are supported, alongside real-time profit/loss tracking and market sentiment tools. Users can create multiple wallets, swap assets and even access trending token data without leaving the app.

For security, the wallet layers biometric authentication, 2FA, passcodes and spam token filters. In a world where over $2 billion was lost to hacks in 2024, these features matter for retail trust.

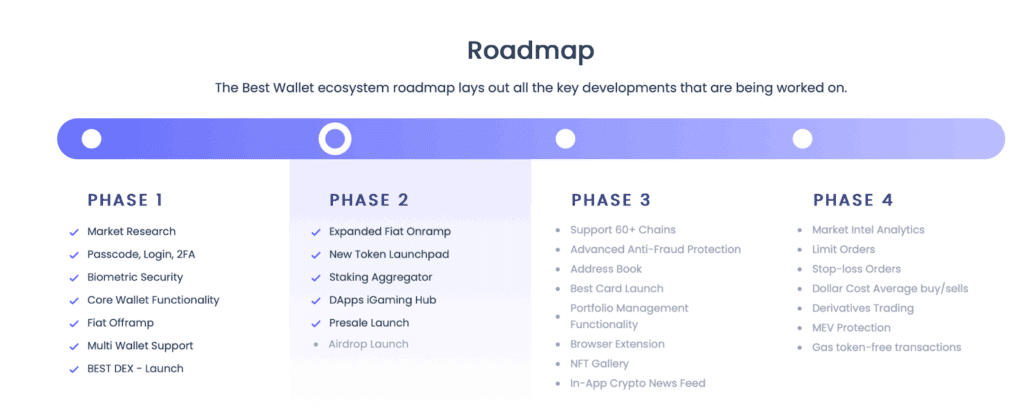

The upcoming roadmap includes a staking aggregator, NFT gallery, in-app news feeds and even gasless transactions, showing that Best Wallet is targeting both beginners and seasoned traders who want advanced features without institutional complexity.

Compared against incumbents like MetaMask or Coinbase Wallet, Best Wallet leans on usability and cross-chain access. It doesn’t require browser extensions or heavy KYC onboarding – making it more approachable for the mainstream retail crowd Stripe and SWIFT ultimately need to reach.

The Retail Question: Can Wallets Outpace Rails?

The contrast between Stripe, SWIFT and Best Wallet underscores a key tension in blockchain payments. Enterprises and banks are focused on infrastructure standardisation – stablecoin issuance, tokenised ledgers, compliance layers – while consumer wallets are experimenting with front-end usability that makes crypto practical for day-to-day users.

If institutions succeed without consumer adoption, blockchain risks becoming an invisible backend technology, powering finance without empowering individuals. On the flip side, if wallets like Best Wallet attract mass users without institutional rails, liquidity and interoperability bottlenecks will persist.

The real breakthrough will come when these worlds converge. Imagine AI agents transacting seamlessly across SWIFT’s blockchain rails, businesses launching their own stablecoins via Stripe and retail users accessing all of it through Best Wallet’s interface. That is the vision of blockchain payments at scale.

Who Really Wins?

The Stripe-SWIFT moment shows how seriously the financial world now takes blockchain payments. Both companies are betting that programmable money and tokenised assets will define the future of commerce. Yet neither directly answers how retail users will interact with this new system.

That’s where wallets like Best Wallet may emerge as the real winners for retail, not by competing with banks or enterprises but by translating their infrastructure into usable, secure and accessible experiences.

SECURE YOUR CRYPTOASSETTS WITH BEST WALLET NOW

As stablecoins gain traction and tokenised payments scale globally, the winners will be those platforms that combine institutional credibility with retail usability. Stripe and SWIFT may control the pipes, but wallets will decide what flows through them.

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Cryptocurrency investments are highly volatile and carry significant risk. Always conduct your own research before investing.