Bitcoin’s rebound above $114K coincides with growing whale interest in Bitcoin Hyper, a new Layer-2 scaling solution aiming to solve Bitcoin’s speed and fee problem. Could this be the hidden driver of the next crypto cycle?

The start of October brought a cocktail of political and market volatility. For the first time in six years, the U.S. federal government entered a shutdown after Congress failed to agree on a budget deal. The stalemate sent ripples through global markets, raising risk-off sentiment and triggering $300 million in crypto liquidations over the past 48 hours.

Despite these pressures, Bitcoin has remained relatively steady, holding around $114,627 at the time of writing. Ethereum traded at $4,148 and XRP hovered near $2.86. The resilience of Bitcoin compared to struggling altcoins has positioned it once again as the anchor of the digital asset market.

Institutional interest is also keeping Bitcoin buoyant. On September 30, spot Bitcoin ETFs recorded $430 million in net inflows, with no redemptions across the 12 listed products. Ethereum ETFs followed suit, securing $127 million in inflows.

Japanese investment firm Metaplanet disclosed that it now holds 30,823 BTC – worth $3.33 billion – at an average entry of $107,912. Its gains of nearly 500% year-to-date highlight the confidence among large players even as retail sentiment remains cautious.

Seasonality could also play a role. Historically, October and November have been two of Bitcoin’s strongest months, averaging 19% and 43% gains respectively. Traders refer to this as the “Uptober” effect – a trend that could help BTC regain momentum despite macro headwinds.

Whales Search for the Next Growth Story

Yet the real intrigue isn’t just in Bitcoin’s resilience, but in where whale capital is flowing next. Beyond ETFs and large institutional allocations, some of the biggest bets are being placed on Bitcoin Hyper ($HYPER), a new Layer-2 project designed to overhaul Bitcoin’s scalability limits.

While Bitcoin remains the benchmark store of value, its limitations as a transaction network are well-known. At peak congestion, fees spiked above $120 during the Runes protocol launch in April 2024, pricing out everyday users. By comparison, Solana and other high-performance blockchains process thousands of transactions per second at negligible cost.

This gap has left Bitcoin’s Layer-2 ecosystem trailing behind Ethereum. Data shows that Bitcoin L2s collectively hold just $8.4 billion in total value locked (TVL), compared with Ethereum’s $88 billion. For whales seeking long-term upside, the next credible scaling solution for Bitcoin is a prize worth betting on and Bitcoin Hyper appears to fit the bill.

Why Bitcoin Hyper Stands Out

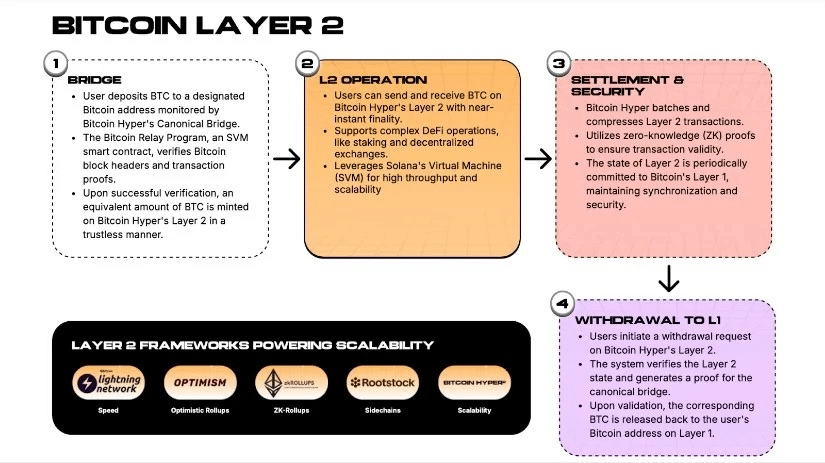

Bitcoin Hyper isn’t just recycling older approaches like sidechains or zk-rollups with minimal innovation. Instead, it proposes a hybrid model that integrates Solana’s Virtual Machine (SVM) with Bitcoin settlement. This allows developers to deploy Solana-based apps while still anchoring finality to Bitcoin’s Proof-of-Work security.

Transactions are bundled using zero-knowledge proofs and settled back onto Bitcoin’s base layer, ensuring scalability without sacrificing security. The canonical bridge design also makes it possible to move wrapped Bitcoin into Hyper’s ecosystem for use in DeFi, NFTs, or even meme coins, then move it back seamlessly.

For whales, the attraction to Bitcoin Hyper comes down to a mix of utility and timing. $HYPER is not positioned as a purely speculative token; it plays an active role within the ecosystem, powering gas fees, staking mechanisms, governance decisions and seamless cross-chain transactions.

At the same time, it offers something few projects can claim: first-mover advantage. Bitcoin Hyper is among the earliest attempts to merge Solana-grade performance with Bitcoin settlement, creating a unique blend of speed and security that stands out in the crowded Layer-2 landscape.

Presale Momentum Reflects Growing Interest

Bitcoin Hyper’s presale recently passed $19 million, attracting daily inflows of more than $250,000. Large allocations have been reported, with whale purchases of $161,000, $100,000 and $74,000 highlighting confidence at scale.

At a current presale price of $0.013005 per token, $HYPER is positioned at an entry point far below its potential future listing price. Importantly, staking is already live, with yields of around 60% APY – an incentive that has accelerated uptake among both retail and institutional-style investors.

Industry analysts are also beginning to take notice. Outlets such as 99Bitcoins have suggested that HYPER could be among the rare presales capable of delivering 100x returns if adoption scales post-launch. While projections of that magnitude remain speculative, the strong presale traction indicates that sentiment is moving in HYPER’s favour.

Could Bitcoin Hyper Ride a Q4 Rally?

Bitcoin’s historical seasonality offers another reason whales may be positioning early. The fourth quarter has been a consistent period of gains, with average Q4 rallies over the past decade reaching 85%. Notable runs include 57% in 2023 and 48% in 2024.

Layer-2 tokens often outperform during such periods as capital rotates out of Bitcoin and into smaller-cap opportunities. If Bitcoin reclaims bullish momentum later this year, wrapped BTC flows into DeFi ecosystems could expand – with Bitcoin Hyper offering one of the newest avenues for this liquidity.

This scenario creates a reinforcing loop: Bitcoin strength lifts sentiment, Layer-2 adoption rises and projects like HYPER benefit disproportionately from the surge in activity.

INVEST IN BITCOIN HYPER AND RIDE THE BTC WAVE

Bitcoin’s rebound above $114,000 has restored some confidence to a market grappling with political deadlock and macro volatility. Yet the bigger story may lie beneath the surface. While institutions continue to build Bitcoin positions, whales are also seeking exposure to new narratives and Bitcoin Hyper represents one of the most ambitious attempts yet to reimagine Bitcoin as more than a store of value.

HYPER’s presale crossing $19.5 million suggests deep-pocketed investors believe it could unlock use cases ranging from DeFi to NFTs, powered by Solana-grade performance but secured by Bitcoin’s foundation.

If history holds true and Bitcoin enters a strong Q4 rally, Bitcoin Hyper could find itself in the slipstream – not just as another token, but as a potential Layer-2 catalyst for Bitcoin’s next phase of growth.

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Cryptocurrency investments are highly volatile and carry significant risk. Always conduct your own research before investing.